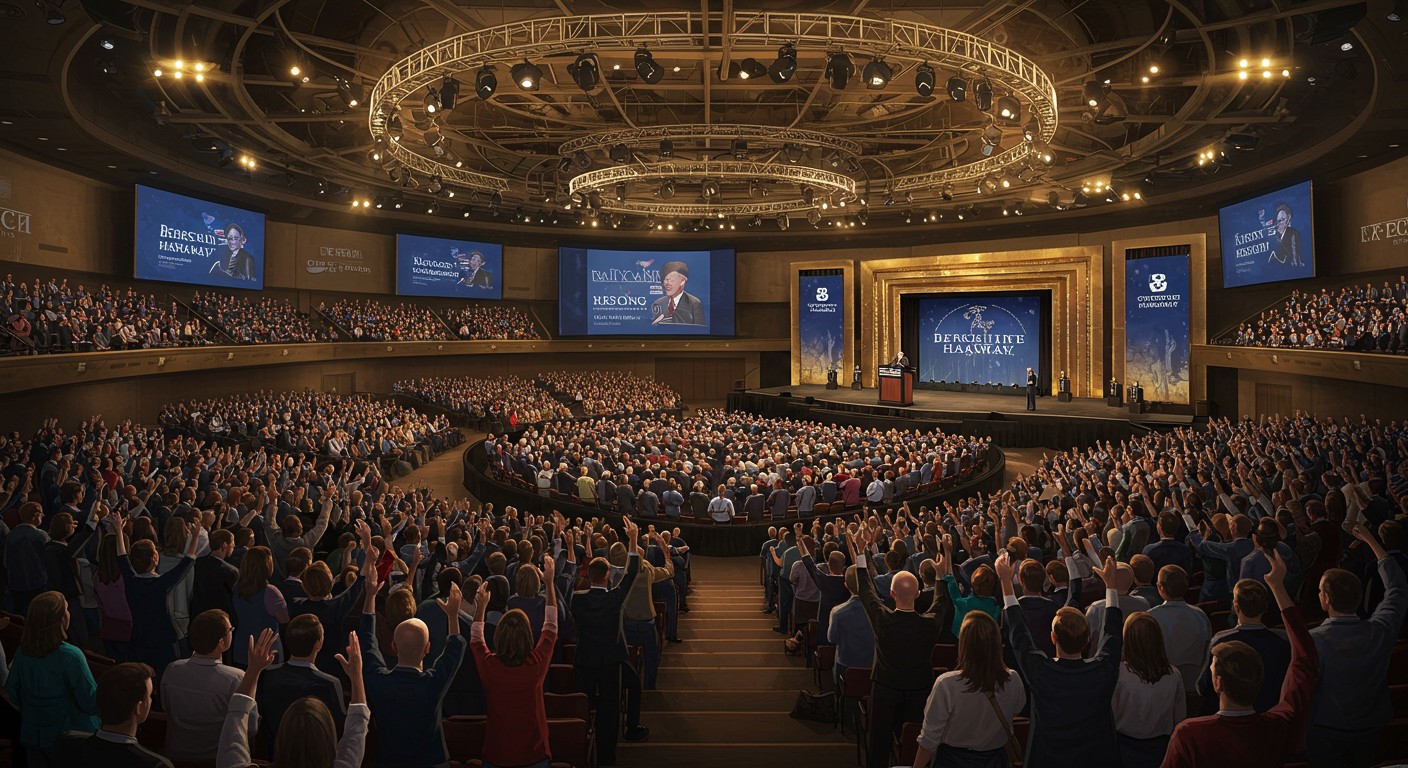

Picture this: thousands of investors, from Wall Street titans to everyday savers, converging on a modest Midwestern city for a weekend that feels more like a rock concert than a corporate gathering. That’s the magic of Warren Buffett’s Berkshire Hathaway annual meeting in Omaha, Nebraska. Dubbed the Woodstock for Capitalists, it’s a bucket-list experience for anyone serious about wealth-building. I’ve always found something electrifying about the idea of sitting in a room with like-minded folks, soaking up wisdom from one of the world’s greatest minds. Ready to find out why this event is unmissable and how you can be part of it?

A Festival of Financial Wisdom

The Berkshire Hathaway annual meeting isn’t your typical corporate snooze-fest. Forget scripted speeches and predictable votes. This is a lively, unfiltered celebration of value investing, where Warren Buffett and his team share insights that can shape your financial future. Held every May, it draws a global crowd eager to learn, network, and maybe snag a deal on Berkshire merchandise. But what makes it so special? Let’s dive into the heart of this iconic event.

The Star Attraction: Buffett’s Q&A Marathon

At the core of the Omaha extravaganza is a five-hour Q&A session that’s as candid as it gets. Warren Buffett, often joined by vice chairs Greg Abel and Ajit Jain, fields questions from shareholders and media with no preparation. That’s right—no pre-screened softballs here. Questions can range from Berkshire’s latest investments to Buffett’s thoughts on global economics or even his personal philosophy. It’s like getting a masterclass from a billionaire, free with your ticket.

We don’t get a clue about the questions, and that’s how we like it.

– Warren Buffett on the Q&A format

For many, this session is worth the trip alone. Attendees scribble notes, hoping to catch a nugget of wisdom that could transform their investment strategies. One year, Buffett might explain why he dumped an entire industry’s stocks; the next, he’s sharing life advice that resonates beyond the stock market. The unscripted nature keeps everyone on their toes, and frankly, it’s refreshing in a world of polished corporate PR.

More Than a Meeting: A Full Experience

The annual meeting is just one piece of a weekend packed with events. Berkshire transforms Omaha into a playground for investors, with activities that blend fun, networking, and commerce. Think of it as a financial festival where you’re not just learning but also connecting with others who share your passion for smart money moves.

- Shareholder Shopping: Exclusive discounts at Berkshire-owned businesses like See’s Candies or Nebraska Furniture Mart.

- 5K Run: The “Invest in Yourself” race, perfect for burning off those Omaha steaks.

- Exhibition Halls: Booths showcasing Berkshire subsidiaries, from insurance to railroads.

- Special Events: Cocktail parties, dinners, and even ping-pong matches with Buffett himself.

These extras create a sense of community. I’ve always thought there’s something special about bonding with strangers over a shared love of stocks and strategy. It’s not just about the knowledge—you leave feeling inspired, part of something bigger.

How to Get Your Seat in Omaha

So, how do you join the thousands flocking to Omaha? It’s easier than you might think, whether you’re a Berkshire shareholder or just curious. Here’s the breakdown:

- Own Berkshire Stock: Even one share of Class B stock (around $530 in May 2025) gets you up to four credentials. Request them through the annual report form.

- Buy a Pass: Non-shareholders can snag passes online, typically $20-$50, through resellers.

- Watch Online: Can’t make it? Tune into the live Q&A webcast, starting at 8:30 a.m. ET on May 3, 2025, via major financial networks.

Pro tip: Book accommodations early. Omaha’s hotels fill up fast, and you don’t want to be stuck commuting from the suburbs. Personally, I’d rather spend my energy soaking up Buffett’s insights than navigating traffic.

Legendary Moments That Define the Meeting

The Berkshire meeting has a knack for creating headlines and memories. Over the years, it’s delivered moments that ripple through the stock market and beyond. Here are a few that stand out:

- 2020 Airline Exit: Buffett shocked the crowd by revealing Berkshire had sold all its airline stocks amid pandemic uncertainty, a move that sent industry shares tumbling.

- Munger’s Bitcoin Jab: In 2021, the late Charlie Munger called Bitcoin “disgusting,” sparking debates that echoed across financial media.

- 2023 Tribute: Buffett honored his longtime partner Charlie Munger, who passed later that year, calling him the “architect” of Berkshire’s success.

- Lighthearted Fun: From Buffett playing ping-pong with Bill Gates to quirky shareholder skits, the meeting balances serious finance with a playful vibe.

These moments remind us why the meeting is more than a corporate obligation—it’s a stage for history-making announcements and personal reflections. They’re the stories you’ll tell years later, wishing you’d been there.

Why It’s a Bucket-List Experience

So, what’s the big deal? Why do people travel across continents for a shareholder meeting? For starters, it’s a chance to hear directly from Warren Buffett, a living legend whose investment strategies have made millionaires. But it’s more than that. The meeting embodies values like patience, discipline, and simplicity—qualities that feel almost rebellious in today’s fast-paced, disruption-obsessed markets.

It’s like a stadium of people who think like me. It’s refreshing.

– A certified financial planner on the meeting’s vibe

For me, the real magic lies in the community. You’re surrounded by people who geek out over portfolio management and long-term gains, not quick flips. It’s a reminder that wealth-building isn’t about chasing trends—it’s about sticking to principles. Plus, with Buffett in his 90s, there’s a sense of urgency. How many more meetings will he host? That alone makes it worth the trip.

What to Expect in 2025

The 2025 meeting promises to uphold its reputation. Buffett has already confirmed he’ll take random questions from attendees and curated ones from a financial journalist. Expect hot topics like Berkshire’s recent moves, the state of the economy, and maybe a few curveballs about AI or geopolitics. Greg Abel and Ajit Jain will add their perspectives, ensuring a well-rounded discussion.

| Event Component | Details | Why It Matters |

| Q&A Session | 5 hours, unscripted | Direct access to Buffett’s insights |

| Shareholder Events | Shopping, 5K, booths | Builds community, showcases Berkshire |

| Business Meeting | 20 minutes, post-Q&A | Efficient handling of corporate duties |

One thing’s certain: you’ll leave with ideas to chew on, whether you’re tweaking your portfolio management or rethinking your approach to risk. The meeting’s blend of hard-hitting finance and Midwestern charm is tough to beat.

Tips for Making the Most of It

Attending the Berkshire meeting is an investment in itself, so you’ll want to maximize the experience. Here’s how to do it right:

- Prepare Questions: If you’re a shareholder, craft a thoughtful question for the Q&A. You might get picked!

- Network Smart: Chat with attendees during events. You never know who you’ll meet—a fund manager, a blogger, or a future mentor.

- Take Notes: Buffett’s insights come fast. Jot down key points to revisit later.

- Explore Omaha: Check out local spots like the Old Market for a taste of the city’s charm.

I’d also suggest pacing yourself. The weekend is intense, and you’ll want energy for the Q&A. Maybe skip that third coffee before the 5K run—trust me on this one.

The Bigger Picture

Beyond the glitz and headlines, the Berkshire meeting is a celebration of financial wisdom. It’s a rare chance to step back from the noise of daily market swings and focus on what matters: long-term thinking, disciplined investing, and learning from mistakes. In a way, it’s a reminder that success doesn’t require a fancy degree or insider connections—just a willingness to learn and stay the course.

Perhaps the most compelling reason to attend is the perspective it offers. In an era of meme stocks and crypto frenzies, Buffett’s approach feels like a steady hand on the tiller. It’s not just about making money; it’s about building wealth with integrity. That’s a lesson worth traveling for, don’t you think?

So, whether you’re a seasoned investor or just starting out, the Berkshire Hathaway annual meeting is a chance to grow, connect, and maybe even laugh at Buffett’s dry humor. Mark your calendar for May 3, 2025, and start planning your Omaha adventure. Who knows? You might walk away with the insight that changes your financial future.