Have you ever wondered what powers the tiny chips driving your smartphone, laptop, or even the AI revolution? Deep in the Netherlands, behind layers of security, a machine the size of a double-decker bus is rewriting the rules of technology. This isn’t science fiction—it’s the reality of ASML’s High NA, a $400 million behemoth that’s pushing the boundaries of what’s possible in microchip manufacturing. I recently came across some fascinating details about this game-changer, and let me tell you, it’s a story worth diving into.

The world of semiconductors is a wild one, full of mind-bending physics and relentless innovation. At the heart of it all is ASML, a Dutch company that’s basically the unsung hero of the tech world. Their latest creation, the High NA (short for high numerical aperture), is not just a machine—it’s a revolution. It’s transforming how the most advanced chips are made, and I’m here to break it all down for you in a way that doesn’t require a PhD in engineering.

Why High NA Is a Big Deal

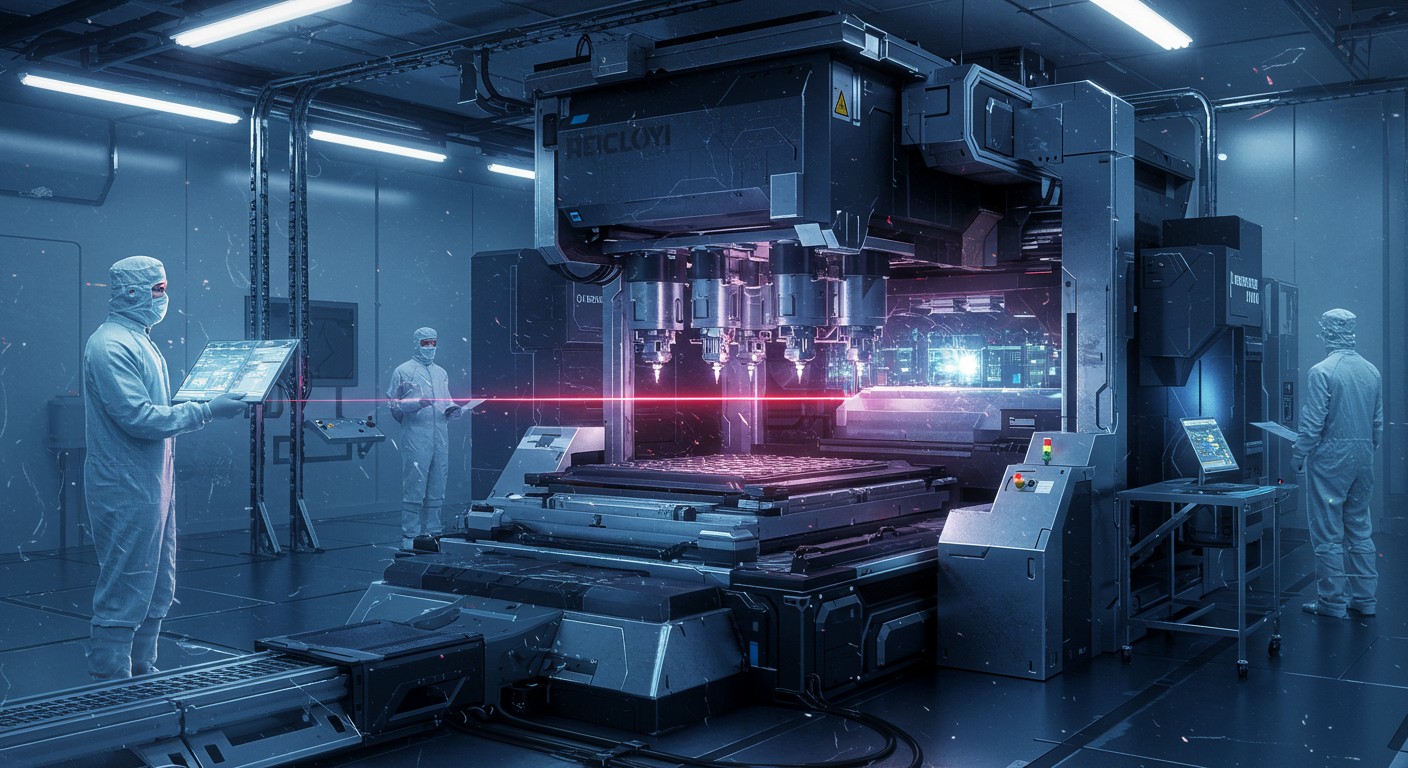

Let’s start with the basics. Chips are the brains of everything tech-related, from your gaming console to the servers running generative AI models. But making them? That’s where things get crazy. ASML’s High NA is the most advanced tool in the world for photolithography, the process that etches tiny circuit patterns onto silicon wafers. These patterns are so small—think five DNA strands wide—that even a speck of dust could ruin everything. That’s why High NA operates in a vacuum, and it’s why this machine costs more than a private jet.

What makes High NA special is its ability to project chip designs with insane precision. Compared to its predecessor, the EUV (Extreme Ultraviolet) machine, High NA uses a larger lens opening to capture more light, allowing it to print smaller, more intricate patterns in fewer steps. This isn’t just a tech upgrade—it’s a leap that could make chips faster, cheaper, and more efficient. And in a world obsessed with AI and speed, that’s a massive deal.

High NA is about shrinking designs and boosting efficiency. It’s a game-changer for chipmakers racing to keep up with demand.

– Semiconductor industry expert

The Birth of a Tech Titan

Building High NA wasn’t a walk in the park. ASML spent nearly a decade perfecting this beast, starting around 2016. Picture this: thousands of engineers across the U.S., Germany, and the Netherlands, piecing together four massive modules like a high-stakes Lego set. Each module is built in a different country—Connecticut, California, Germany, and the Netherlands—then shipped to ASML’s lab in Veldhoven for assembly and testing. Once approved, the whole thing gets disassembled again and shipped to customers in a logistical ballet that involves seven Boeing 747s or 25 trucks. Yeah, it’s that intense.

I find it mind-blowing how much coordination goes into just one machine. It’s not just about the tech—it’s about global teamwork on a scale most of us can’t even imagine. And the stakes? Huge. If High NA didn’t work, ASML’s massive investment could’ve tanked. But they pulled it off, and now companies like Intel, Samsung, and TSMC are reaping the rewards.

How High NA Works Its Magic

Okay, let’s get a bit nerdy—but I promise to keep it digestible. High NA is part of ASML’s EUV lithography family, which uses extreme ultraviolet light with a wavelength of just 13.5 nanometers. To put that in perspective, that’s smaller than the width of a virus. Creating this light is no small feat. ASML shoots molten tin droplets—50,000 per second—through a nozzle, then zaps each one with a laser to create a plasma hotter than the sun. Those tiny explosions emit EUV light, which bounces off ultra-flat mirrors (made by German optics company Zeiss) to project chip patterns onto silicon wafers.

The high numerical aperture part comes from the machine’s larger lens opening, which captures light at steeper angles. This lets High NA print tinier designs in one go, unlike older machines that need multiple steps (called multiple patterning). Fewer steps mean faster production, higher yields, and fewer defects. It’s like upgrading from a clunky typewriter to a lightning-fast laser printer.

- Smaller designs: High NA can etch patterns so tiny, you get more chips per wafer.

- Faster production: Fewer steps mean chips get made quicker.

- Higher yield: More usable chips per batch, cutting waste.

Who’s Using High NA?

Only the biggest players in the chip game can afford High NA’s $400 million price tag. Intel was the first to install one in its Oregon fab in 2024, and they’re already singing its praises. They’ve churned out 30,000 wafers with it, and the machine’s twice as reliable as its predecessors. Samsung’s also on board, reporting a 60% cut in cycle time—basically, their chips can do more, faster. TSMC, the world’s top chipmaker, is next in line, with plans to integrate High NA into its cutting-edge U.S. fab in Arizona.

Other players like Micron, SK Hynix, and Japan’s Rapidus are also eyeing High NA. Why? Because it’s the only way to keep up with the insane demand for chips powering everything from AI to 5G. ASML’s basically got a monopoly on EUV technology, and High NA is their crown jewel. As one industry analyst put it, they’ve “cornered the market” on advanced chipmaking tools.

High NA is a must-have for any chipmaker serious about staying competitive.

– Tech industry analyst

The Economics of High NA

At $400 million a pop, you might wonder why ASML doesn’t just jack up the price even more. Here’s the thing: they’re playing a long game. According to industry leaders, the goal is to keep chip production costs down, in line with Moore’s law—the idea that chip performance doubles every couple of years while costs drop. High NA’s efficiency—higher yields, fewer steps—makes chips cheaper to produce, which fuels demand for more tech and, in turn, more ASML machines. It’s a win-win, assuming you’ve got the cash to play.

But let’s be real: that price tag is wild. It’s not just the machine itself—High NA guzzles power like nobody’s business. That’s why ASML’s been working hard to cut energy use, reducing power per wafer exposure by over 60% since 2018. With AI models projected to consume massive amounts of energy by 2035, this focus on power efficiency is a big deal. It’s not just about making chips; it’s about making them sustainably.

| Feature | High NA Advantage | Impact |

| Resolution | Higher due to larger lens | Smaller chip designs |

| Production Speed | Fewer patterning steps | Faster chip output |

| Yield | Improved by single-step process | More usable chips |

| Power Efficiency | 60% less power per exposure | Lower operational costs |

The Global Chip Race

The chip industry is a global chessboard, and ASML’s High NA is a king piece. But it’s not without challenges. Take China, for example. They’re a huge market for ASML’s older DUV (Deep Ultraviolet) machines, which use less precise 193-nanometer light. In 2024, China accounted for nearly half of ASML’s sales, but U.S. export controls block them from getting EUV or High NA machines. Why? Geopolitics. The U.S. doesn’t want advanced tech falling into China’s hands, especially with the AI race heating up.

This restriction has sparked debates about whether China could develop its own EUV tech. Spoiler: it’s a long shot. Building something like High NA requires decades of expertise, thousands of suppliers, and a willingness to bet billions on risky R&D. ASML’s been at this since the 1990s, and even they barely made it work. For now, China’s stuck with DUV, which is fine for smartphones but can’t touch the cutting-edge chips High NA produces.

What’s Next for ASML?

ASML’s not resting on its laurels. They’re already dreaming up Hyper NA, the next evolution of their tech, slated for the early 2030s. It’ll push the numerical aperture even higher, making chips even smaller and more powerful. The designs are still in the draft stage, but industry insiders say it’s “not necessarily a difficult product.” That’s bold talk for a company that’s already redefined what’s possible.

In the meantime, ASML’s scaling up High NA production, aiming to ship at least five more machines this year and hit a capacity of 20 annually in a few years. They’re also investing in the U.S., building a training center in Arizona to teach engineers how to handle EUV and DUV systems. With plans to train 1,200 people a year, it’s a big step toward boosting America’s chipmaking independence.

The Bigger Picture

High NA isn’t just a machine—it’s a symbol of where technology’s headed. As chips get smaller and more powerful, they’re unlocking possibilities we couldn’t have imagined a decade ago. Think AI that can outsmart humans, 6G networks, or even quantum computing. But it’s also a reminder of how interconnected the world is. ASML relies on 800 global suppliers, and their machines power factories from Arizona to Taiwan. Tariffs, trade wars, or supply chain hiccups could throw a wrench in the whole operation.

Personally, I find it both thrilling and a little daunting to think about how much rides on these machines. One tiny chip can change the world, but one tiny mistake in production could cost millions. It’s a high-stakes game, and ASML’s playing it like a pro. So, what’s the takeaway? High NA is more than a pricey gadget—it’s the backbone of the tech we’ll all be using tomorrow.

So, next time you swipe through your phone or ask your AI assistant a question, spare a thought for the massive, mind-bogglingly complex machine that made it possible. High NA’s not just building chips—it’s building the future. And honestly, I can’t wait to see what’s next.