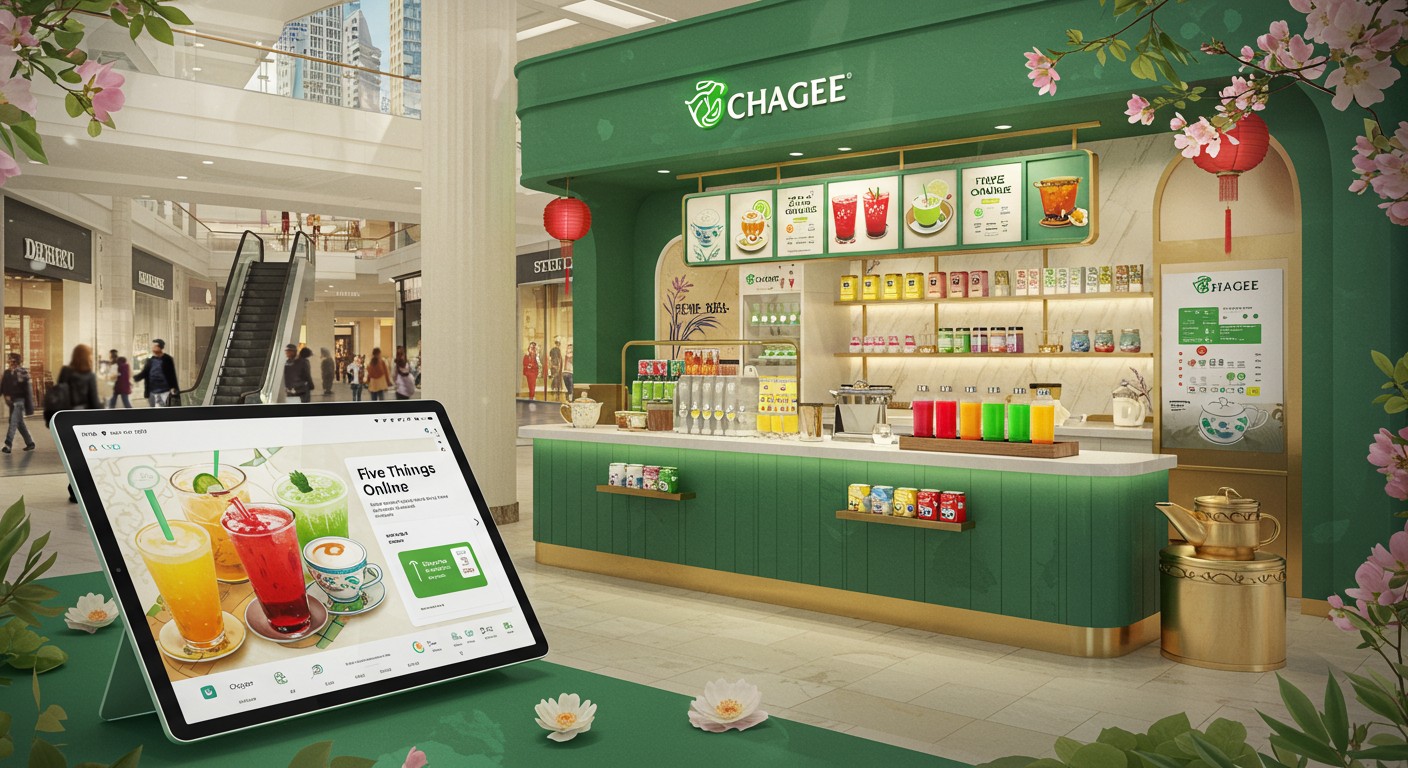

Imagine walking into a bustling mall in Los Angeles, the air buzzing with the hum of shoppers and the faint aroma of freshly brewed tea wafting from a sleek, modern storefront. That’s the scene Chagee, a Chinese tea chain, is painting as it sets its sights on the U.S. market. I’ve always been fascinated by how global brands adapt to new cultures, and Chagee’s story feels like a masterclass in ambition. With a recent report suggesting its stock could climb nearly 40%, this isn’t just about tea—it’s about a bold bet on growth, innovation, and a shifting consumer landscape.

Why Chagee’s U.S. Push Is a Game-Changer

Chagee isn’t your average tea shop. Founded in 2017 in Yunnan, China, it’s grown from a single store to over 6,600 teahouses worldwide by March 2025, a staggering 63.6% jump from the previous year. What’s driving this? A mix of premium branding, tech-driven operations, and a laser focus on health-conscious consumers. As coffee culture dominates the U.S., Chagee’s premium tea offerings—think jasmine green tea lattes and peach oolong frappes—offer a refreshing alternative. But can it really crack the American market? Let’s dive into what makes this expansion so intriguing.

A Booming Tea Market Awaits

The global tea market is no small fry. Experts estimate it’s worth over $467 billion, with projections to hit $602 billion by 2028. In the U.S., tea is gaining traction as a healthier, more affordable alternative to coffee, especially among younger consumers. Chagee’s premium positioning—focusing on raw-leaf fresh milk tea with zero trans fats and customizable sweetness—taps into this trend perfectly. I’ve noticed how Gen Z gravitates toward brands that feel authentic yet modern, and Chagee’s blend of traditional Chinese tea culture with a Starbucks-like vibe hits that sweet spot.

Tea is becoming the new coffee for health-conscious consumers seeking flavorful, low-calorie options.

– Beverage industry analyst

Chagee’s first U.S. store, set to open at Westfield Century City in Los Angeles, is a strategic move. Malls are hubs for trendsetters, and placing a flagship store there signals confidence. But it’s not just about one location. The company’s global footprint already spans Malaysia, Singapore, and Thailand, with plans to hit 100 countries. The U.S. is a natural next step, but it’s a competitive jungle—Starbucks and local chains like Peet’s won’t roll over easily.

The Power of the Franchise Model

One of Chagee’s secret weapons is its franchise model, which balances rapid expansion with tight control. Unlike some brands that let franchisees run wild, Chagee uses a system called Five Things Online to streamline operations. This digital platform handles everything from customer payments to supply chain logistics, ensuring consistency across its 6,250+ franchised stores. Only 160 are company-owned, but those act as testing grounds for new markets, reducing risk.

- Speedy service: Orders and payments are processed online, cutting wait times.

- Franchise support: Real-time guidance for store owners via digital tools.

- Supply chain efficiency: Automated inventory management keeps costs low.

This tech-driven approach isn’t just clever—it’s a lifeline in a market where efficiency is king. I’ve seen too many chains fumble expansion by neglecting oversight, but Chagee’s model feels like a well-oiled machine. It’s no wonder analysts are bullish, with some predicting a 40% stock upside based on this scalability.

Stock Performance: A Rocky Start, Bright Future

Chagee’s Nasdaq debut on April 17, 2025, was a wild ride. Shares, priced at $28, soared as high as 49% before settling at a 16% gain, valuing the company at $5.9 billion. Since then, the stock’s dipped over 10%, reflecting trade tensions and market volatility. But a recent 14% rebound after a strong Q1 report—showing 35.4% revenue growth to $467.5 million—has investors buzzing again.

Chagee’s Q1 results show it’s not just a tea company—it’s a growth machine with global ambitions.

– Financial market analyst

Analysts at a major investment bank recently slapped a $43.70 price target on Chagee, suggesting a 44% upside from its recent close. Why the optimism? It’s not just about tea sales. Chagee’s 20% market share in China’s premium tea segment and its ability to grow abroad without losing quality are big draws. Plus, its valuation looks attractive compared to competitors like Mixue, which trades at 29 times earnings versus Chagee’s 15.

| Metric | Chagee | Mixue |

| Valuation (2025) | $5.9B | $10B+ |

| Earnings Multiple | 15x | 29x |

| Store Count | 6,681 | 3,000+ |

Is the 40% upside realistic? I’d argue it’s within reach if Chagee nails its U.S. rollout. But trade tensions between the U.S. and China could throw a wrench in things—tariffs are already a headache for Chinese firms listing stateside.

Navigating U.S.-China Trade Tensions

Let’s not sugarcoat it: the U.S.-China trade war is a real hurdle. New tariffs, including a 10% hike in March 2025, have spooked investors. Some even speculate Chinese firms could be delisted from U.S. exchanges. Yet, Chagee’s pushing forward, banking on its global appeal and a consumer base that’s less fazed by geopolitics. Young Americans, especially Gen Z, are snapping up Chinese products on platforms like Taobao, signaling a cultural shift.

Chagee’s not blind to the risks. Its prospectus acknowledges tariffs could dent profits, but it emphasizes that cross-border trade isn’t its core business. Instead, it’s betting on local production and franchisees to keep costs down. This adaptability could be key to thriving in a tricky market.

What Sets Chagee Apart?

Chagee’s not just another bubble tea chain. While competitors like Mixue lean on low prices, Chagee’s premium branding—think $2.70 drinks with a lounge-like ambiance—sets it apart. Its menu, featuring jasmine green tea lattes and pu’er milk teas, appeals to health-conscious consumers wary of sugary drinks. Plus, its tech-forward approach, like the Nutritional Choice label showing calorie counts, adds a layer of transparency that resonates with today’s shoppers.

- Premium positioning: High-quality teas with a focus on health.

- Tech integration: Digital tools for efficiency and customer engagement.

- Cultural appeal: Blending Chinese heritage with modern aesthetics.

I can’t help but admire how Chagee’s turned tea into a lifestyle. It’s not just a drink—it’s an experience, like sipping history in a sleek, modern cup. That’s the kind of branding that could win over American consumers, but it’ll need to outshine established players.

Challenges on the Horizon

No expansion is without bumps. In Malaysia, Chagee faced backlash over a social media post tied to China’s South China Sea claims, a reminder that cultural missteps can sting. In the U.S., it’ll need to navigate a crowded beverage market where Starbucks reigns supreme. Can Chagee carve out a niche? I think its focus on health-conscious branding and tech could give it an edge, but it’s a tall order.

Then there’s the competition. Chains like Mixue and Guming are also eyeing global markets, and while Chagee’s premium focus differentiates it, low-price players could steal budget-conscious customers. Plus, maintaining quality across thousands of franchises is no small feat—slip-ups could tarnish its reputation.

Why Investors Are Excited

Despite the risks, investors are pouring in. Chagee raised $411 million in its IPO, with cornerstone investors like CDH Investment Management snapping up $205 million in shares. The company’s 2024 revenue nearly tripled to $1.7 billion, and Q1 2025 showed no signs of slowing. With 190 million registered members and a 38% GMV surge, Chagee’s numbers scream growth potential.

Chagee’s ability to scale while maintaining quality is what makes it a standout investment.

– Investment strategist

Analysts see Chagee as a bet on the global tea market, which is less saturated than coffee. Its low store closure rate (1.5%) and tech-driven efficiency make it a safer play than some peers. If it can replicate its China success in the U.S., that 40% stock upside might even be conservative.

The Road Ahead for Chagee

Chagee’s U.S. adventure is just beginning, but the stakes are high. Its Los Angeles store is a test case, and early buzz suggests it’s resonating with consumers. Social media posts rave about its smooth, not-too-sweet drinks and upscale vibe. If it can keep that momentum, more stores could follow, potentially transforming the U.S. tea scene.

But here’s the million-dollar question: Can Chagee become the next Starbucks? It’s a lofty goal, but its blend of premium products, tech, and cultural appeal gives it a shot. I’m rooting for it—not just as an investor but as someone who loves a good cup of tea. The next few years will tell if Chagee can brew up a storm in America.

Chagee’s story is more than a business case—it’s a cultural bridge. By bringing Chinese tea traditions to the U.S., it’s challenging coffee’s dominance and betting on a new kind of consumer. With a 40% stock upside on the table, it’s a narrative worth watching. Will it succeed? Only time will tell, but I’m grabbing a tea and staying tuned.