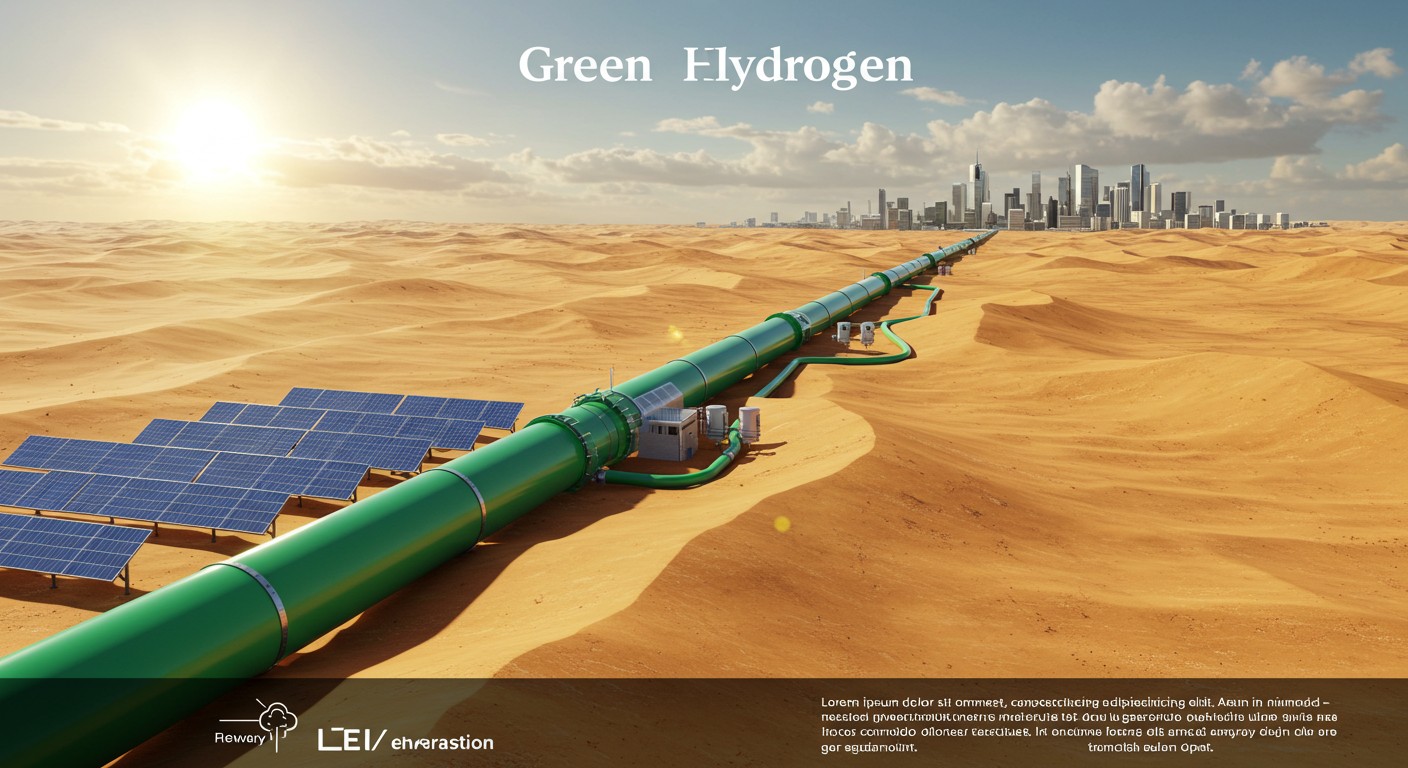

Picture this: a vast desert under a blazing sun, rows of solar panels soaking up endless rays, and a pipeline humming with the promise of a cleaner future. Sounds like a sci-fi dream, right? Yet, this could soon be reality as Africa steps up to fuel Europe’s bold green hydrogen ambitions. With Europe racing to decarbonize and Africa brimming with renewable potential, the stage is set for a groundbreaking energy partnership. But here’s the catch—can this vision overcome sky-high costs, unbuilt infrastructure, and shaky policies?

Africa’s Renewable Promise Meets Europe’s Energy Hunger

Europe’s got big plans. By 2030, the EU wants to import 10 million tonnes of green hydrogen to slash carbon emissions. Green hydrogen, produced using renewable energy to split water via electrolysis, is a clean fuel that could transform industries like steel, shipping, and energy. But producing it at scale? That’s tricky, especially in a continent where renewable infrastructure is stretched thin. Enter Africa, with its endless sunshine, sprawling deserts, and untapped wind resources.

North Africa, in particular, is catching Europe’s eye. Countries like Algeria and Tunisia boast some of the world’s best solar conditions. In theory, they could churn out green hydrogen cheaper than Europe ever could. The plan? Build massive solar farms, power electrolyzers, and ship the resulting hydrogen through pipelines to Europe. It’s a win-win: Africa gets investment and jobs, while Europe gets its clean fuel fix. But as I’ve learned digging into this, the real world loves throwing curveballs at grand ideas.

The SoutH2 Corridor: A Pipeline of Possibilities

At the heart of this vision lies the SoutH2 Corridor, a 3,300-kilometer pipeline network designed to ferry up to 4 million tonnes of hydrogen annually from North Africa to southern Germany. The project’s Italian H2 Backbone, a 1,900-km stretch mostly repurposed from existing gas pipelines, just scored a hefty $27.4 million from the EU. With completion eyed for 2030, it’s a bold bet on cross-continental energy sharing.

Connecting Africa’s renewable riches to Europe’s industrial hubs could redefine global energy flows.

– Energy policy analyst

The pipeline will link hydrogen plants in Algeria and Tunisia to Sicily, then onward to Austria and Germany. It’s ambitious, no doubt. When fully operational, it could supply over 40% of the EU’s hydrogen import target. But here’s where I raise an eyebrow—Algeria and Tunisia currently plan to supply just 330,000 tonnes by 2030. That’s a measly 8% of the pipeline’s capacity. What gives?

Why North Africa’s Hydrogen Dreams Face Hurdles

Let’s get real for a second. Building a green hydrogen industry from scratch is no walk in the park. Algeria and Tunisia have the solar potential, sure, but their hydrogen production sites are still on the drawing board. Large-scale output? Experts say that’s at least a decade away. And then there’s the policy gap—neither country has a clear export strategy for 2030. Without that, investors get jittery, and projects stall.

Cost is another buzzkill. A recent study in a leading science journal pegged North African green hydrogen at €4.2 to €4.9 per kilogram, depending on interest rates. Compare that to grey hydrogen (made from natural gas) at €1 to €2 per kilogram, and you see the problem. Europe’s markets might balk at those prices unless policies like subsidies or carbon tariffs level the playing field.

- Lack of infrastructure: No production plants yet, and pipelines need massive upgrades.

- High costs: Green hydrogen is pricier than fossil-based alternatives.

- Policy gaps: Export strategies are vague, scaring off investors.

Despite these hurdles, there’s something undeniably exciting about the potential. I can’t help but wonder: what if Africa nails this? The ripple effects could be huge, not just for Europe but for Africa’s own energy transition.

Beyond North Africa: The EU’s African Investments

North Africa isn’t the only player in this game. The EU is spreading its bets across the continent, pumping funds into green hydrogen projects in Kenya, Mauritania, Namibia, and South Africa. These investments often focus on green ammonia, a hydrogen derivative used in fertilizers and fuels. South Africa, in particular, is a rising star.

With $5.4 million from the EU’s Global Gateway strategy, South Africa is gearing up to become a green hydrogen heavyweight. Why? It’s got abundant renewables and 91% of the world’s platinum group metal reserves, crucial for electrolyzers. The EU’s not just throwing money at it—they’re offering technical know-how and aiming to spark private investment.

South Africa could lead the global green hydrogen race with the right support.

– EU energy official

This aligns with South Africa’s Just Energy Transition Partnership, a plan to ditch fossil fuels for renewables. It’s a model that could inspire other African nations, but scaling up won’t happen overnight. Building electrolyzers, training workers, and securing supply chains takes time—decades, even.

What’s Holding Africa Back—and How to Fix It

So, why isn’t Africa already a green hydrogen superpower? It’s not just about money. Policy support is critical. Europe’s got to step up with incentives like tax breaks or guaranteed purchase agreements to make African hydrogen competitive. And African governments need to get their act together—clear export plans, streamlined regulations, and investor-friendly policies are non-negotiable.

Then there’s the tech hurdle. Electrolysis is energy-intensive, and building enough renewable capacity to power it is a massive undertaking. Plus, transporting hydrogen over thousands of kilometers without leaks or losses? That’s a feat of engineering we’re still figuring out.

| Challenge | Impact | Possible Solution |

| High Production Costs | Limits market competitiveness | Subsidies, carbon pricing |

| Lack of Infrastructure | Delays production and export | Public-private partnerships |

| Weak Policies | Deters investment | Clear export strategies |

Fixing these won’t be easy, but the payoff could be transformative. Imagine African nations not just supplying Europe but powering their own clean energy revolutions. That’s the kind of future I’d bet on.

The Bigger Picture: A Global Energy Shift

Zoom out, and this isn’t just about hydrogen or pipelines. It’s about rewriting how the world shares energy. Africa’s role as a renewable powerhouse could shift global dynamics, reducing reliance on fossil fuels and empowering developing nations. But it’s a delicate balance—Africa must benefit as much as Europe, or the partnership risks feeling one-sided.

I find it fascinating how interconnected our energy future is. Europe’s decarbonization hinges on Africa’s renewables, which in turn depend on European cash and tech. It’s a reminder that no country can go it alone in the fight against climate change.

- Investment: Billions needed for plants, pipelines, and grids.

- Collaboration: Governments and companies must align.

- Innovation: New tech to cut costs and boost efficiency.

Will this work? I’m cautiously optimistic. The tech is there, the will is growing, but the clock’s ticking. By 2030, we’ll know if this pipeline dream is a game-changer or just hot air.

Final Thoughts: A Leap Worth Taking?

Here’s where I get a bit personal. I’ve always been drawn to stories of bold ideas—ones that seem impossible until they’re not. Africa powering Europe’s green hydrogen revolution feels like one of those. Sure, the costs are steep, the timelines tight, and the policies shaky. But the potential? It’s electric.

If Africa and Europe can pull this off, it’s not just about clean fuel. It’s about proving that global collaboration can tackle the biggest challenges of our time. So, can Africa fuel Europe’s green hydrogen dreams? Maybe. But it’ll take grit, cash, and a whole lot of ingenuity to get there.

What do you think—could this be the energy partnership that changes the world? Or are the hurdles too high? One thing’s for sure: the next decade will be a wild ride.