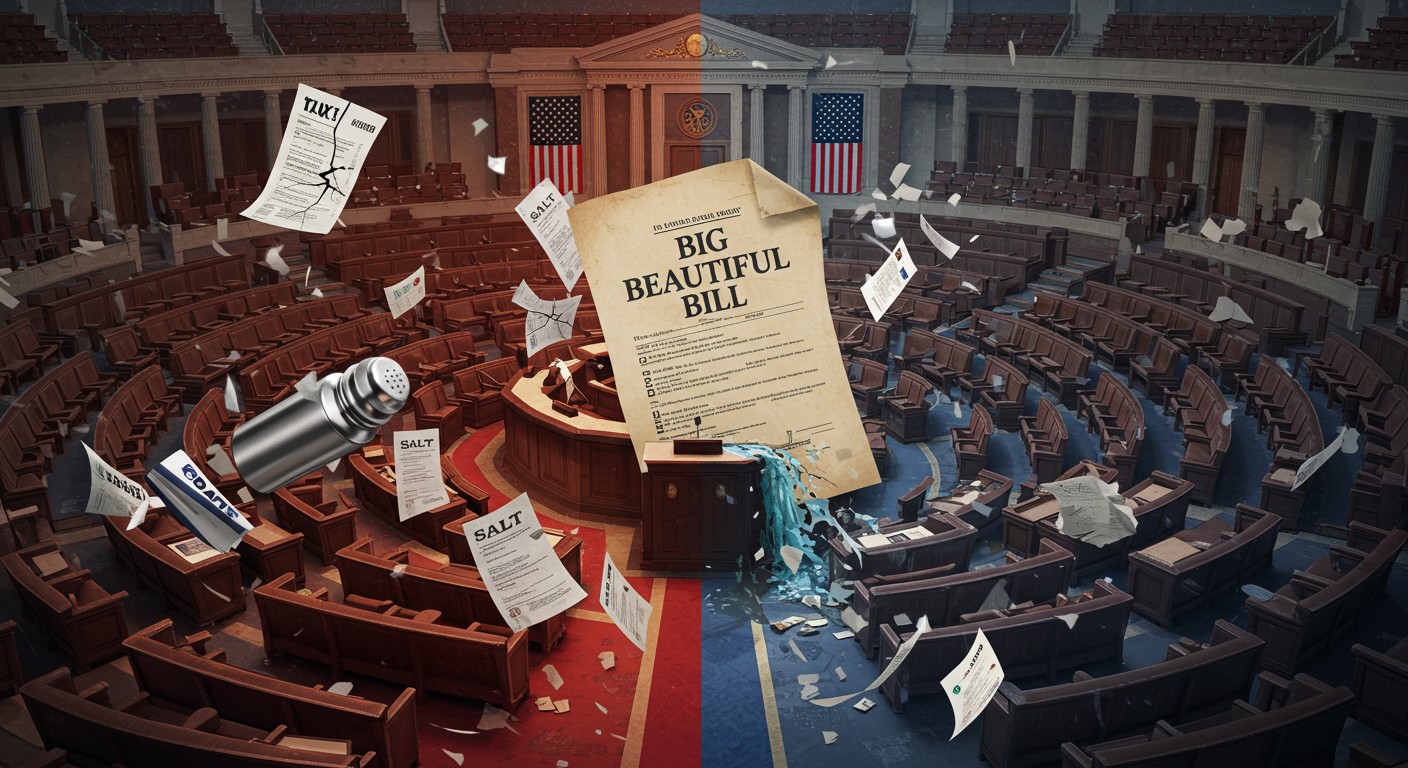

Have you ever wondered what happens when political promises collide with the gritty reality of lawmaking? I’ve been following the twists and turns of Washington’s latest legislative saga, and let me tell you, it’s like watching a high-stakes chess match where every move could reshape your wallet, your healthcare, or even your energy bill. The Senate’s freshly unveiled tax and spending package—affectionately dubbed the “Big Beautiful Bill”—is stirring up a storm, setting the stage for a heated showdown with the House. Let’s dive into what this bill means, why it’s causing such a ruckus, and how it might affect you.

A Legislative Tug-of-War

The Senate dropped its version of the “Big Beautiful Bill” like a bombshell, and it’s packed with changes that don’t quite align with the House’s vision. From tax cuts to Medicaid reforms and even green energy tweaks, this bill is a sprawling beast of policy. What’s fascinating—and a bit nerve-wracking—is how it reveals deep divides within the Republican party. With a razor-thin majority in the House and a Senate itching to flex its muscle, negotiations are about to get messy. Here’s a closer look at the key battlegrounds.

Tax Cuts: Permanent, but Not as Bold

One of the bill’s cornerstones is making the 2017 tax cuts permanent. You know, those changes that reshaped federal tax brackets, bumped up the standard deduction, and ditched personal exemptions? The Senate wants to lock those in for good, no expiration dates. But here’s where it gets interesting: they’re not going as far as the House. For instance, the child tax credit gets a boost to $2,200 per kid—decent, but it falls short of the House’s more generous $2,500 proposal. Why the restraint? I suspect the Senate’s trying to balance ambition with fiscal caution, but it’s a risky move that might leave some families feeling shortchanged.

Tax policy is always a balancing act—too generous, and you blow a hole in the budget; too stingy, and you lose voter support.

– Economic policy analyst

The Senate also introduces some new deductions, but they come with strings attached. Tipped workers, overtime earners, and car owners get targeted breaks, but they’re temporary and capped. For example, tips are deductible up to $25,000, but only through 2028. It’s a nod to campaign promises, sure, but the time limit feels like a tease. Why not go all-in? Perhaps the Senate’s worried about the long-term cost, but it’s hard not to wonder if these half-measures will satisfy anyone.

- Tips: Deductible up to $25,000 through 2028

- Overtime Pay: Deductible up to $12,500 (or $25,000 for joint filers) through 2028

- Auto Loan Interest: Deductible up to $10,000 through 2028

Medicaid: A Deep Cut with Controversy

Now, let’s talk about the real lightning rod: Medicaid. The Senate’s bill takes a much sharper knife to Medicaid funding than the House’s version, especially for states that expanded the program under the Affordable Care Act. The provider tax rate, a critical funding tool for state Medicaid programs, would drop from 6% to 3.5% by 2031, starting in 2027. This only applies to expansion states, while non-expansion states get a pass on new provider taxes but can keep existing ones. Nursing homes and care facilities dodge the cuts, but hospitals? Not so lucky.

Rural-state Republicans are already sounding alarms. I can’t help but sympathize—hospitals in these areas are often hanging on by a thread. Slashing their funding could mean fewer beds, longer wait times, or even closures. The Senate’s also pushing for tougher work requirements for Medicaid recipients. Adults with kids over 14 would need to clock 80 hours a month of work, school, or community service. The House was softer, exempting all parents of dependent kids. This difference alone could spark a fierce debate when the two chambers sit down to hash things out.

| Policy Area | Senate Proposal | House Proposal |

| Provider Tax Rate | 3.5% by 2031 (expansion states) | Maintains existing arrangements |

| Work Requirements | 80 hours/month for parents (kids over 14) | Exempts parents of dependent children |

| Hospital Payments | Eliminates some state-directed payments | Protects existing payments |

Green Energy: A Partial Rollback

The Senate’s take on green energy tax credits is another point of divergence. While the House went hard on scaling back the 2022 Inflation Reduction Act, the Senate’s approach is a bit gentler. Projects starting in 2025 get full credits, but the benefits taper off: 60% in 2026, 20% in 2027, and nothing after 2028. Unlike the House, the Senate doesn’t demand projects produce electricity by 2028, and it throws a bone to hydro, nuclear, and geothermal projects starting before 2034. It’s a compromise that might appease some environmentalists, but it’s still a rollback. I wonder if this middle ground will satisfy anyone or just leave both sides grumpy.

Energy policy is a tightrope—balance innovation with cost, and you might just keep everyone happy.

– Energy policy expert

The Senate’s less aggressive stance could be a strategic play to avoid alienating moderates, but it risks diluting the GOP’s push to unwind green initiatives. It’s a classic case of trying to please everyone and potentially pleasing no one.

SALT: The Deduction That Won’t Budge

Here’s where things get really spicy: the SALT deduction. The Senate wants to keep the $10,000 cap on state and local tax deductions permanent, a far cry from the House’s deal to bump it to $40,000 for households earning under $500,000. This was a hard-fought compromise for blue-state Republicans, and they’re not taking the Senate’s stance lying down. One House member called the proposal “dead on arrival,” and I can’t blame them. For folks in high-tax states, that $10,000 cap feels like a slap in the face. The Senate’s digging in, but this could be the hill where negotiations stall.

SALT Deduction Comparison: Senate: Permanent $10,000 cap House: $40,000 cap for incomes under $500,000

In my experience, tax policy fights like this one often come down to regional priorities. Blue-state Republicans are under pressure from their constituents, while the Senate’s more concerned with keeping the bill lean. Who blinks first? That’s the million-dollar question.

Debt Ceiling: A $5 Trillion Gamble

If you thought SALT was contentious, buckle up for the debt ceiling. The Senate’s proposing a $5 trillion increase, topping the House’s $4 trillion plan. Fiscal conservatives are already up in arms, and I can’t say I’m surprised. Borrowing that much is like signing a blank check for future headaches. The Senate argues it’s necessary to keep the government running, but critics see it as a reckless move that could haunt the economy down the line.

Raising the debt ceiling is never popular, but sometimes it’s the only way to keep the lights on.

– Budget analyst

The backlash is real, and it’s not just from the usual suspects. Even within the GOP, there’s a growing unease about the long-term implications. Will this be the issue that fractures party unity? It’s hard to say, but the stakes couldn’t be higher.

What’s Next for the Big Beautiful Bill?

With the Senate’s bill now out in the open, the real work begins: reconciling it with the House’s version. The differences—Medicaid cuts, SALT caps, debt ceiling hikes—are more than just details; they’re ideological fault lines. Republicans have a narrow window to deliver on their promises before the political calendar gets messy. I’ve seen legislative battles like this before, and they rarely end cleanly. Will the GOP find a way to bridge the gap, or are we headed for a public showdown that could dent their momentum?

- Negotiations Intensify: Expect heated talks as the House and Senate duke it out over key provisions.

- Public Pressure Mounts: Constituents in high-tax and rural states will make their voices heard.

- Deadline Looms: Time’s ticking to finalize the bill before political distractions take over.

Perhaps the most intriguing aspect is how this bill reflects broader tensions within the Republican party. It’s not just about policy—it’s about priorities, power, and what it means to govern in a divided nation. For now, all eyes are on Congress. Stay tuned, because this one’s going to be a wild ride.