Ever wondered how much your state leans on the federal government’s wallet? I’ve always been fascinated by the invisible strings tying state budgets to Washington, D.C. Some states thrive on their own, while others rely heavily on federal dollars to keep things running. Let’s dive into the numbers and unravel which states depend most on Uncle Sam—and why it matters.

The Fiscal Tug-of-War: States and Federal Funds

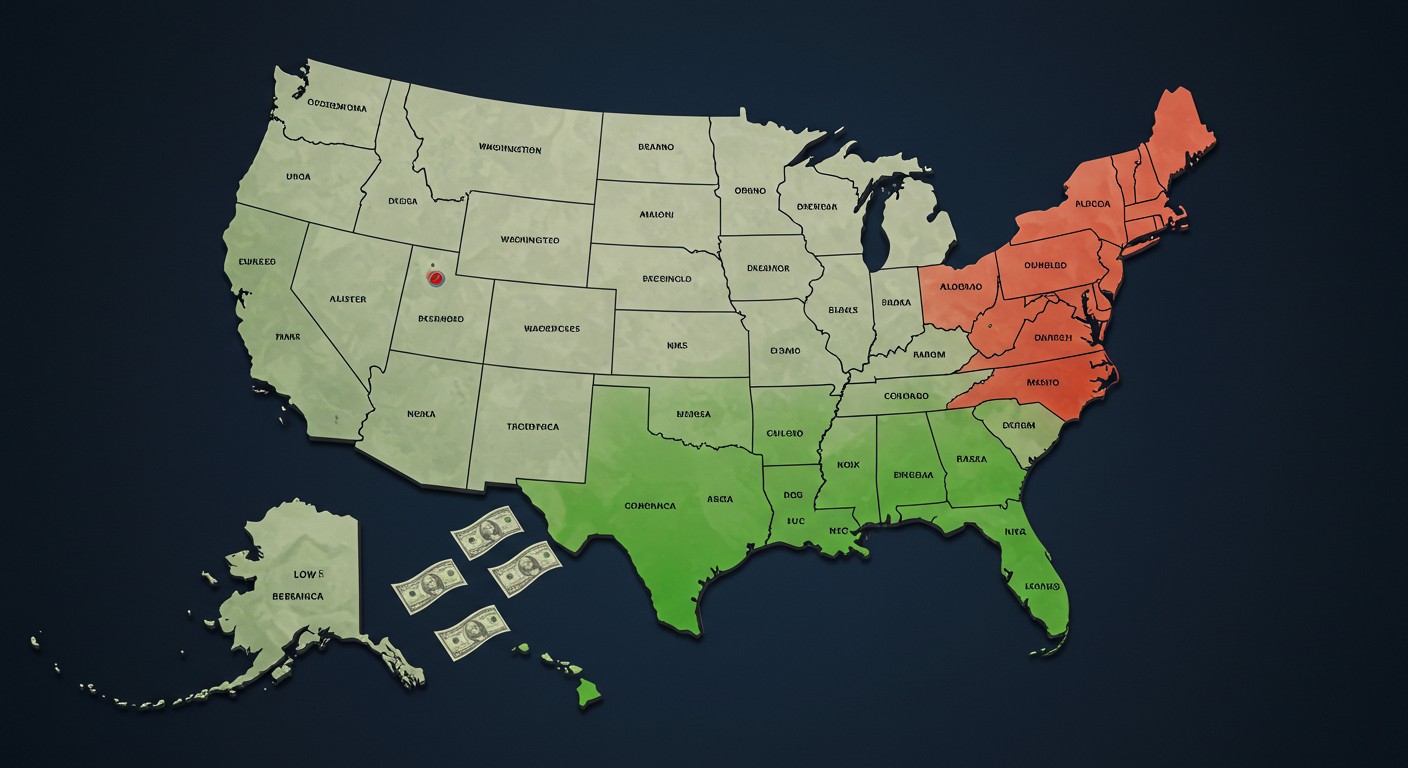

Every year, billions of dollars flow from the federal government to states through grants, contracts, and benefit programs. But not all states rely on these funds equally. Some get back far more than they send in taxes, while others subsidize the system. This dynamic sparks debates about tax fairness and economic redistribution. So, which states are the biggest beneficiaries, and what drives their dependency?

New Mexico: The Top Recipient

New Mexico stands out as the state most reliant on federal funds. For every dollar its residents send to Washington, they receive a whopping $3.42 in return. Nearly a third of the state’s budget—30.7%—comes from federal transfers. Why? It’s a mix of factors: a significant presence of military installations, federal land management, and a population with a high share of retirees drawing benefits.

“States like New Mexico benefit from federal investments in infrastructure and defense, which pump significant dollars into local economies.”

– Economic policy analyst

The state’s economy leans heavily on these inflows, making it a textbook case of federal dependency. But it’s not alone at the top.

Following Close Behind: Red States Dominate

West Virginia, Alaska, and Mississippi trail closely, each pulling in over $2.60 for every tax dollar sent. These states also rely on federal funds for more than a quarter of their revenues. West Virginia, for instance, covers 27% of its budget with federal dollars, driven by industries like energy extraction and a significant retiree population.

- West Virginia: $2.91 return per tax dollar, 27% federal revenue share.

- Alaska: $2.65 return, 29% from federal funds.

- Mississippi: $2.66 return, 25.9% federal share.

What’s striking is the political tilt. Seven of the top 10 dependent states lean Republican, including conservative strongholds like Alabama and Kentucky. This challenges the narrative that only blue states rely on federal aid. Perhaps the most interesting aspect is how economic structure, not ideology, drives these numbers.

The Outlier: District of Columbia

The District of Columbia is a unique case. While its return-on-taxes ratio is lower at $1.71, a massive 32.2% of its revenue comes from federal sources. As the nation’s administrative hub, D.C. naturally attracts federal contracts and grants. It’s less about dependency and more about its role in the federal ecosystem.

In my experience, D.C.’s numbers highlight how geography and function shape fiscal flows. It’s like the heart of a machine—pumping funds in and out, but not necessarily hoarding them.

What Drives Federal Dependency?

Why do some states rely so heavily on federal funds? It often boils down to a few key factors:

- Economic Structure: States with industries like energy or defense (think New Mexico’s military bases or Alaska’s oil) attract federal dollars.

- Demographics: Areas with more retirees or lower-income populations qualify for programs like Social Security or federal grants.

- Federal Presence: States with large federal land holdings or installations see higher inflows.

These factors create a feedback loop. States with limited tax bases lean on federal support, which in turn shapes their economies. It’s a bit like relying on a steady allowance to keep the household running.

The Donor States: Who’s Footing the Bill?

At the other end of the spectrum, states like New Jersey and Washington are the net donors. New Jersey, the least dependent, gets just 51 cents back for every tax dollar sent. Washington fares similarly, with a 59-cent return. These states, along with California, New York, and Minnesota, effectively subsidize others.

| State | Return on Taxes | % Federal Revenue |

| New Jersey | $0.51 | 17.2% |

| Washington | $0.59 | 16.5% |

| California | $0.73 | 14.5% |

These states have robust, diversified economies and higher household incomes, which boost tax contributions while reducing eligibility for federal aid. It’s like they’re the high earners in a family, covering the bills for everyone else.

“Donor states often have the economic muscle to stand on their own, but their contributions fuel services nationwide.”

– Fiscal policy expert

Red vs. Blue: A Partisan Perspective?

At first glance, the data suggests a partisan divide. Red states dominate the top of the dependency list, while blue states like California and New York are net donors. But it’s not that simple. Blue states like New Mexico and D.C. also rank high in dependency, proving that economic realities trump political ideology.

I find it intriguing how the narrative of “red states vs. blue states” falls apart here. It’s less about party lines and more about structural needs—think rural economies or federal infrastructure. Have you ever considered how your state’s economy shapes its reliance on federal funds?

The Bigger Picture: Tax Fairness Debates

The flow of federal dollars sparks heated debates about tax fairness. Donor states argue they’re unfairly burdened, subsidizing services for others. Meanwhile, recipient states point to their economic challenges—like lower incomes or federal land restrictions—that necessitate support.

Fiscal Balance Model: 50% Tax Contributions 30% Federal Grants 20% Economic Need

This tension is like a family budget meeting where everyone’s arguing over who pays for what. The reality? Both sides have valid points, but the system’s complexity makes easy answers elusive.

What Does This Mean for You?

Understanding your state’s federal dependency can shift how you view taxes and public services. If you’re in a donor state, you might feel the pinch of high taxes with less direct return. In a recipient state, federal funds might be propping up local schools or infrastructure. Either way, it’s a reminder of how interconnected our economy is.

- Check your state’s status: Are you in a donor or recipient state?

- Consider the implications: How do federal funds impact your local services?

- Engage in the debate: Is the current system fair, or does it need reform?

Personally, I think the system works like a balancing act—supporting states in need while relying on stronger ones to keep the engine running. But it’s worth asking: is this balance sustainable?

Looking Ahead: The Future of Federal Funding

As economic pressures shift—think aging populations or climate challenges—federal dependency could change. States like Texas or Florida, currently mid-tier, might see their reliance grow if economic or demographic trends shift. Meanwhile, donor states may push for reforms to ease their burden.

The key takeaway? Federal funding isn’t just about dollars—it’s about the economic and social fabric of the nation. Whether your state is a giver or a taker, these flows shape everything from roads to schools to healthcare.

“The federal funding system is a mirror of our economic diversity—complex, imperfect, but essential.”

– Public finance researcher

So, where does your state stand? And more importantly, what does it mean for the future of your community? These are questions worth pondering as we navigate the fiscal ties that bind us.