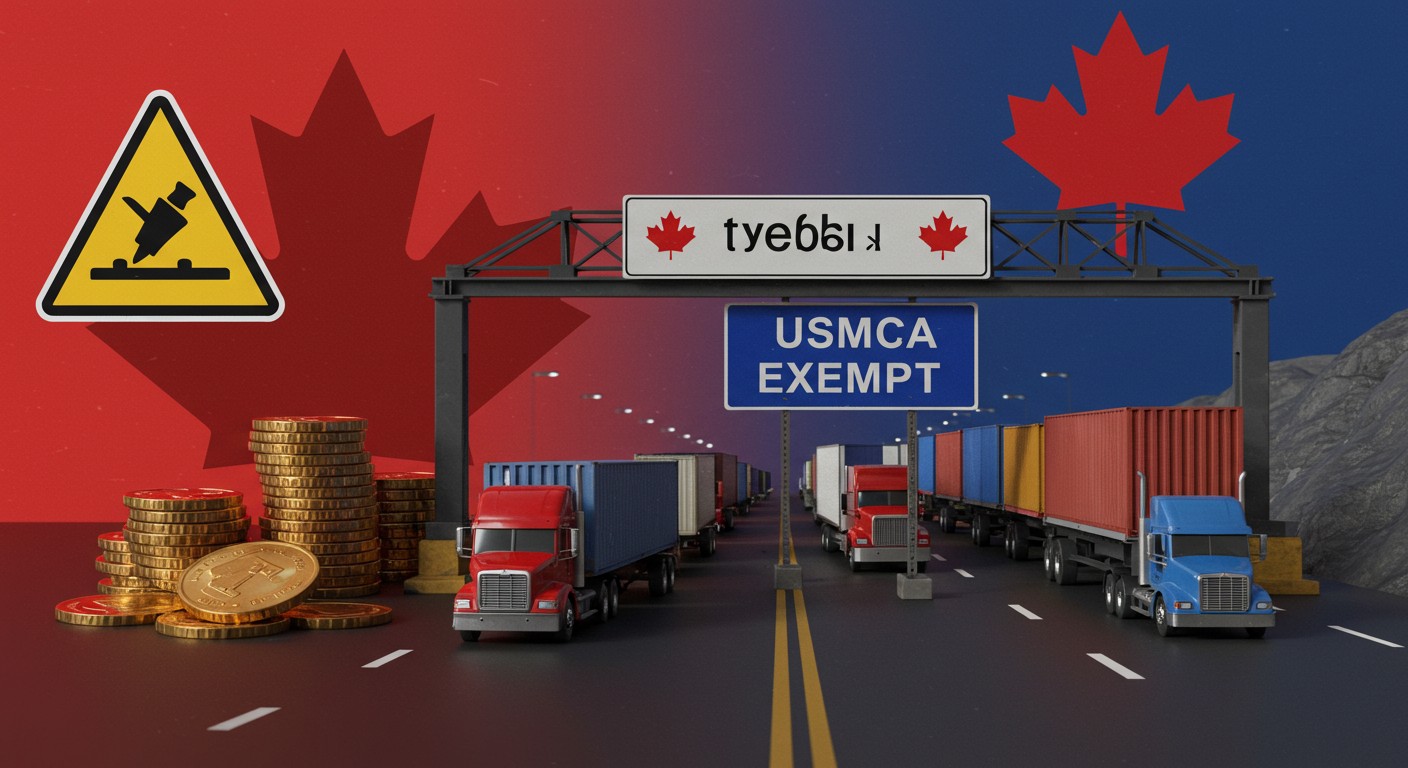

Have you ever wondered what happens when a single policy shift ripples across borders, shaking up economies and markets? The recent announcement of a 35% tariff on certain Canadian goods entering the US has sparked heated discussions. Yet, the exemption of USMCA goods offers a sigh of relief for many industries. Let’s dive into this complex trade move, unpack its implications, and explore what it means for the future of US-Canada relations.

Navigating the New Tariff Landscape

The United States and Canada share one of the world’s most interconnected economies. From auto parts to energy, goods flow seamlessly across their border, largely thanks to the United States-Mexico-Canada Agreement (USMCA). Recently, however, a new tariff proposal has stirred the waters. A 35% levy on select Canadian imports is set to begin, driven by concerns over trade imbalances and the fentanyl crisis. But here’s the kicker: USMCA-protected goods remain untouched, preserving a critical lifeline for both nations.

This decision isn’t just about numbers—it’s a bold statement. It reflects a broader strategy to address trade deficits while maintaining the delicate balance of a long-standing partnership. In my view, it’s a high-stakes chess move, one that could either strengthen or strain cross-border ties. Let’s break it down.

Why the Tariff Hike?

The decision to impose a 35% tariff stems from a mix of economic and social pressures. The US has long pointed to trade imbalances with Canada, particularly in sectors like dairy, where Canadian tariffs on US products can reach 400%. According to trade analysts, these barriers have frustrated American farmers, limiting their access to Canadian markets. The new tariff appears to be a retaliatory measure, signaling that the US is ready to play hardball.

Trade policies are never just about economics; they’re about leverage and priorities.

– Economic policy expert

Another driving force is the fentanyl crisis. The US has urged Canada to tighten border controls to curb the flow of illicit drugs. The tariff announcement includes a clause suggesting flexibility if Canada steps up its efforts. It’s a carrot-and-stick approach—cooperation could lead to adjustments, but inaction might escalate tensions.

What’s fascinating is how this move balances punishment with pragmatism. By exempting USMCA goods, the US avoids disrupting tightly integrated supply chains, like those in the auto industry. It’s a calculated step, but is it enough to avoid broader fallout? Only time will tell.

USMCA: The Safety Net

The USMCA is the cornerstone of North American trade, replacing the older NAFTA agreement. It ensures that most goods—think cars, agricultural products, and manufactured items—move tariff-free across the US, Canada, and Mexico. The decision to keep these goods exempt from the new 35% tariff is a lifeline for industries that rely on cross-border trade.

Consider the auto sector, where parts crisscross the border multiple times before a vehicle is complete. A blanket tariff would have been catastrophic, potentially driving up costs and disrupting production. By preserving USMCA exemptions, the US maintains economic stability while still flexing its muscle on non-exempt goods.

- Auto industry: Protected by USMCA, ensuring stable supply chains.

- Energy imports: Subject to a lower 10% tariff, balancing cost and access.

- Metals: Already facing 50% tariffs, now under increased scrutiny.

In my experience, trade policies often seem like abstract numbers, but their real-world impact is tangible. A friend in the auto industry recently shared how even minor tariff changes can ripple through supply chains, affecting everything from production schedules to worker hours. The USMCA exemption is a saving grace here, but the broader tariff hike still raises eyebrows.

Market Reactions: A Rollercoaster Ride

When news of the tariff broke, markets reacted swiftly. US stock futures dipped briefly, reflecting investor jitters about trade disruptions. However, the clarification that USMCA goods would remain exempt helped calm the storm. The Canadian dollar, however, wasn’t as lucky, leading losses among major currencies.

Here’s a quick snapshot of the market’s response:

| Market | Reaction | Reason |

| US Stock Futures | Brief Decline, Partial Recovery | USMCA Exemption Clarified |

| Canadian Dollar | Significant Drop | Fear of Trade Disruptions |

| Global Currencies | Mixed, Risk-Sensitive Weakened | Uncertainty in Trade Outlook |

Perhaps the most interesting aspect is how markets seem to be riding two waves: optimism about US economic policies and caution about global trade tensions. The stock market’s resilience suggests confidence in the USMCA’s protective role, but the Canadian dollar’s slide hints at deeper concerns. Are investors overreacting, or is this a sign of bigger challenges ahead?

Canada’s Response: Fighting Back

Canada isn’t sitting idly by. Officials have vowed to push back against the tariffs, particularly the proposed 50% levy on copper imports. Industry leaders have called the tariffs unfair, arguing they could harm both economies. One Canadian official stated:

We’ll fight these tariffs with everything we’ve got. Trade is a two-way street.

– Canadian industry spokesperson

Recent talks between the two nations have been tense. A brief halt in negotiations followed Canada’s attempt to impose a digital services tax, which was quickly abandoned under US pressure. This back-and-forth highlights the delicate dance of diplomacy. Canada’s challenge now is to address US concerns—particularly on fentanyl—while protecting its economic interests.

I’ve always found trade disputes to be like a tug-of-war: both sides pull hard, but neither wants the rope to snap. Canada’s swift response shows it’s ready to negotiate, but it won’t roll over easily. The question is whether cooler heads will prevail or if this escalates further.

What’s at Stake for Both Sides?

The stakes are high for both the US and Canada. For the US, the tariffs are a tool to address trade deficits and push for stronger border security. But they risk alienating a key ally and disrupting markets. For Canada, the tariffs threaten economic growth, particularly in sectors like metals and dairy, which are already under pressure.

Here’s a breakdown of the potential impacts:

- Economic Growth: Higher tariffs could slow trade, impacting GDP on both sides.

- Consumer Prices: Non-exempt goods may become pricier, hitting consumers’ wallets.

- Diplomatic Relations: Tensions could strain US-Canada cooperation on other issues.

The fentanyl issue adds another layer of complexity. It’s not just about trade—it’s about lives. The US is pushing for action, and Canada’s response could shape the trajectory of this policy. If Canada steps up, we might see a softening of the tariffs. If not, the trade war could intensify.

Looking Ahead: A Balancing Act

As the August 1 deadline approaches, all eyes are on how this policy will unfold. The USMCA exemption is a smart move, preserving key industries while allowing the US to flex its economic muscle. But the broader tariff strategy raises questions about long-term impacts. Will it lead to meaningful change, or is it a risky gamble?

In my opinion, trade policies like this are a double-edged sword. They can drive change but also create unintended consequences. The markets’ initial wobble shows that investors are watching closely, and Canada’s response will be critical. For now, the USMCA offers stability, but the road ahead could be bumpy.

Trade wars are easy to start but hard to end. The real challenge is finding balance.

– Global trade analyst

So, what’s next? Will Canada and the US find common ground, or are we in for a prolonged standoff? The answers lie in the delicate interplay of policy, economics, and diplomacy. One thing’s for sure: this story is far from over.

The tariff announcement is a reminder that global trade is never static. It’s a living, breathing system, shaped by politics, economics, and human priorities. As we watch this unfold, it’s worth asking: How will these changes affect the goods we buy, the prices we pay, and the relationships between nations? Stay tuned—this is one trade story you won’t want to miss.