Have you ever gazed at the night sky, wondering what it takes to touch the stars? For me, it’s always been a mix of awe and curiosity about the companies bold enough to venture into space. One such trailblazer, a Texas-based rocket maker, is stepping into the spotlight with plans to go public, signaling a new chapter in the space race. This isn’t just about rockets or lunar landers—it’s about a company betting big on the future of space exploration and inviting investors to join the ride.

Why Firefly Aerospace’s IPO Matters

The decision to list on the Nasdaq under the ticker FLY isn’t just a corporate milestone; it’s a bold statement in a reviving IPO market. After a brutal 2022, where soaring inflation and rising interest rates scared investors away from riskier bets, 2025 is shaping up to be a comeback year. Companies like this rocket maker are seizing the moment, and I can’t help but feel a spark of excitement about what this means for the space industry. Perhaps the most intriguing part? This move comes hot on the heels of a lunar landing that’s turned heads across the globe.

A Stellar Track Record in Space

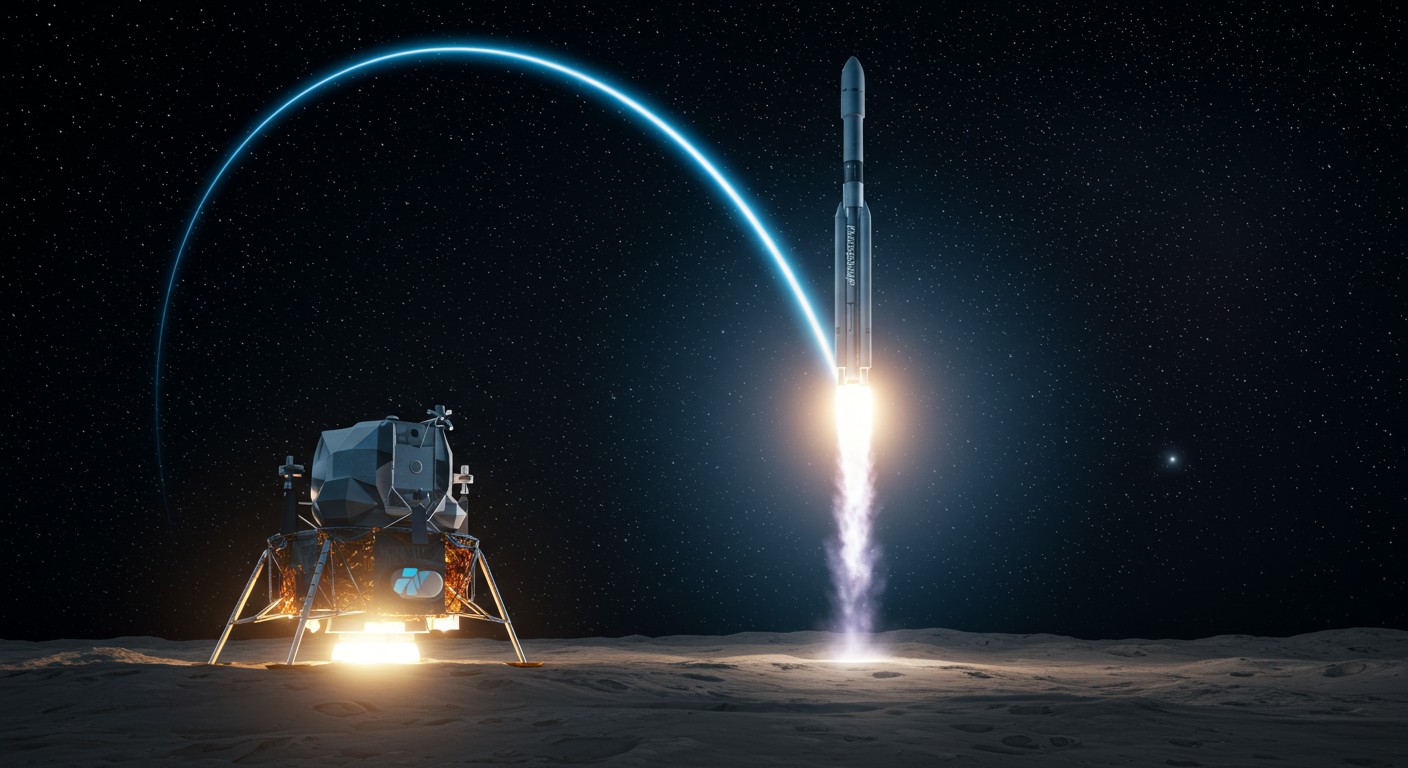

Let’s talk about what makes this company stand out. They’re not just building rockets—they’re crafting space tugs and lunar landers that push the boundaries of what’s possible. Earlier this year, their Blue Ghost lander touched down on the moon, a feat that’s no small potatoes in the aerospace world. It’s the kind of achievement that screams ambition and capability, making them a serious player in the space transportation game.

“Landing on the moon is a monumental step, not just for us but for the entire space industry.”

– Aerospace industry expert

This success isn’t just a one-hit wonder. Their Alpha rockets, designed for satellite launches, have earned praise for their reliability and efficiency. In my view, it’s this blend of innovation and proven results that makes their IPO so compelling. Investors aren’t just buying into a company—they’re betting on a vision to make space more accessible.

The Numbers Behind the Launch

Now, let’s get to the nitty-gritty. Financials matter, and this company’s numbers tell a story of growth with a side of caution. By the end of March, their revenue had skyrocketed to $55.9 million, a massive leap from $8.3 million the previous year. That’s over sixfold growth, folks! But, like any company pushing the envelope, they’re not without challenges. A net loss of $60.1 million, up from $52.8 million a year ago, shows they’re investing heavily in their future.

| Metric | Current Year | Previous Year |

| Revenue | $55.9M | $8.3M |

| Net Loss | $60.1M | $52.8M |

| Backlog | $1.1B | N/A |

What’s particularly exciting is their $1.1 billion backlog. This isn’t just a number—it’s a signal of strong demand for their services. From satellite launches to lunar missions, clients are lining up, and that’s a promising sign for anyone eyeing this stock.

Navigating a Reviving IPO Market

The timing of this IPO feels like a calculated move. After the 2022 market crash, where high interest rates and inflation crushed investor confidence, 2025 is showing signs of life. Recent deals, like those involving crypto firms and AI ventures, suggest the market is warming up to bold ideas. But it’s not all smooth sailing—global uncertainties, like new tariff policies, have made some companies hit pause. So, why is this rocket maker charging forward? I’d wager it’s because they see a window of opportunity in a market hungry for innovation.

“The IPO market is like a rocket launch—you need the right conditions to take off successfully.”

– Financial analyst

The involvement of heavyweights like Goldman Sachs and JPMorgan as lead underwriters adds credibility. These aren’t just names—they’re a vote of confidence in the company’s potential to soar. For investors, this could be a chance to get in on the ground floor of a space revolution.

What’s Next for the Space Industry?

The space industry is no longer a sci-fi fantasy—it’s a multi-billion-dollar market. Companies like this one are at the forefront, building the infrastructure for everything from satellite networks to lunar exploration. But what does this mean for investors? Here’s a quick breakdown:

- Growth Potential: The space sector is projected to hit $1 trillion by 2040, driven by satellite services and exploration.

- Risk Factors: High R&D costs and regulatory hurdles can weigh on profitability.

- Competitive Edge: Proven lunar landings and a hefty backlog set this company apart.

In my experience, investing in industries like this feels like betting on the future. Sure, there’s risk—who doesn’t love a bit of thrill? But the potential to be part of something as groundbreaking as space exploration is hard to ignore.

Is This the Next SpaceX?

It’s tempting to draw comparisons to industry giants, but let’s be real—this company is carving its own path. Their focus on small satellite launches and lunar missions positions them in a unique niche. Unlike larger players, they’re nimble, with a knack for innovation that’s already paying off. Their Alpha rocket is a workhorse for satellite launches, and their lunar lander has proven they can play with the big dogs.

Space Industry Breakdown: 50% Satellite Services 30% Launch Services 20% Exploration Missions

Could they become a household name? Maybe. The space race is heating up, and with a solid backlog and a successful moon landing under their belt, they’re off to a strong start. For me, the real question is whether they can keep up the momentum in a crowded field.

Why Investors Should Pay Attention

If you’re an investor, this IPO is worth a closer look. The space sector is buzzing with potential, and this company’s recent achievements make it a standout. Here’s why I think it’s a compelling opportunity:

- Proven Success: A lunar landing isn’t just a headline—it’s proof they can deliver.

- Revenue Growth: Sixfold revenue increase shows they’re scaling fast.

- Market Timing: The IPO market’s revival offers a prime window for bold bets.

That said, it’s not all starry skies. The net loss is a reminder that space is an expensive game. Investors will need to weigh the potential rewards against the risks of a still-maturing industry.

Final Thoughts: A Launch Worth Watching

As someone who’s always been fascinated by the stars, I find this IPO thrilling. It’s not just about a company going public—it’s about the future of space exploration and the chance for investors to be part of it. The road ahead won’t be easy, but with a strong backlog, a lunar landing, and a reviving IPO market, this rocket maker is poised for liftoff. Will they soar to new heights? Only time will tell, but I’ll be watching closely.

“The space industry is about dreaming big and delivering bigger.”

– Space entrepreneur

So, what’s your take? Are you ready to bet on a company that’s literally reaching for the moon? Or is the risk too steep for your portfolio? Whatever you decide, this IPO is a reminder that the space race is far from over—it’s just getting started.