Have you ever felt like the world’s economy is a game of trust, where one wrong move could tip the scales? I’ve been mulling over this lately, especially with all the chatter about tariffs and national production making headlines. It’s like watching a high-stakes chess match where every piece matters—only this time, the pieces are markets, policies, and our collective confidence in what’s next.

The Dance of Trust and Tariffs

Economic trust isn’t just a buzzword; it’s the glue holding markets together. When policies like tariffs come into play, they can either strengthen or shake that foundation. Recently, discussions around tariffs have sparked debates about their real impact. Are they a tool for protecting local industries, or do they risk unsettling global trade? Let’s dive into this complex dance and unpack what’s at stake.

Why Tariffs Stir the Pot

Tariffs, at their core, are taxes slapped on imported goods. They’re designed to make foreign products pricier, nudging businesses and consumers toward homegrown options. Sounds simple, right? But here’s where it gets tricky: tariffs can ripple through economies in ways we don’t always see coming. They affect prices, supply chains, and even investor confidence.

Tariffs can be a double-edged sword—protecting local jobs but raising costs for consumers.

– Economic analyst

I’ve noticed that markets often shrug off tariff news initially, almost like they’re daring policymakers to follow through. Take recent proposals for hefty tariffs—some as high as 50% on certain countries. The stock market barely flinched. Why? Perhaps it’s because investors have been through this before and expect a last-minute pivot. Or maybe they believe the economic fallout won’t be as bad as feared. Either way, it’s a gamble.

- Tariff mitigation: Companies often pre-order goods to dodge tariff hikes, delaying the sting.

- Negotiation tactics: Suppliers and businesses haggle over who absorbs the extra costs.

- Market complacency: Investors bet on policy reversals, keeping markets steady.

National Production: A Beacon of Stability

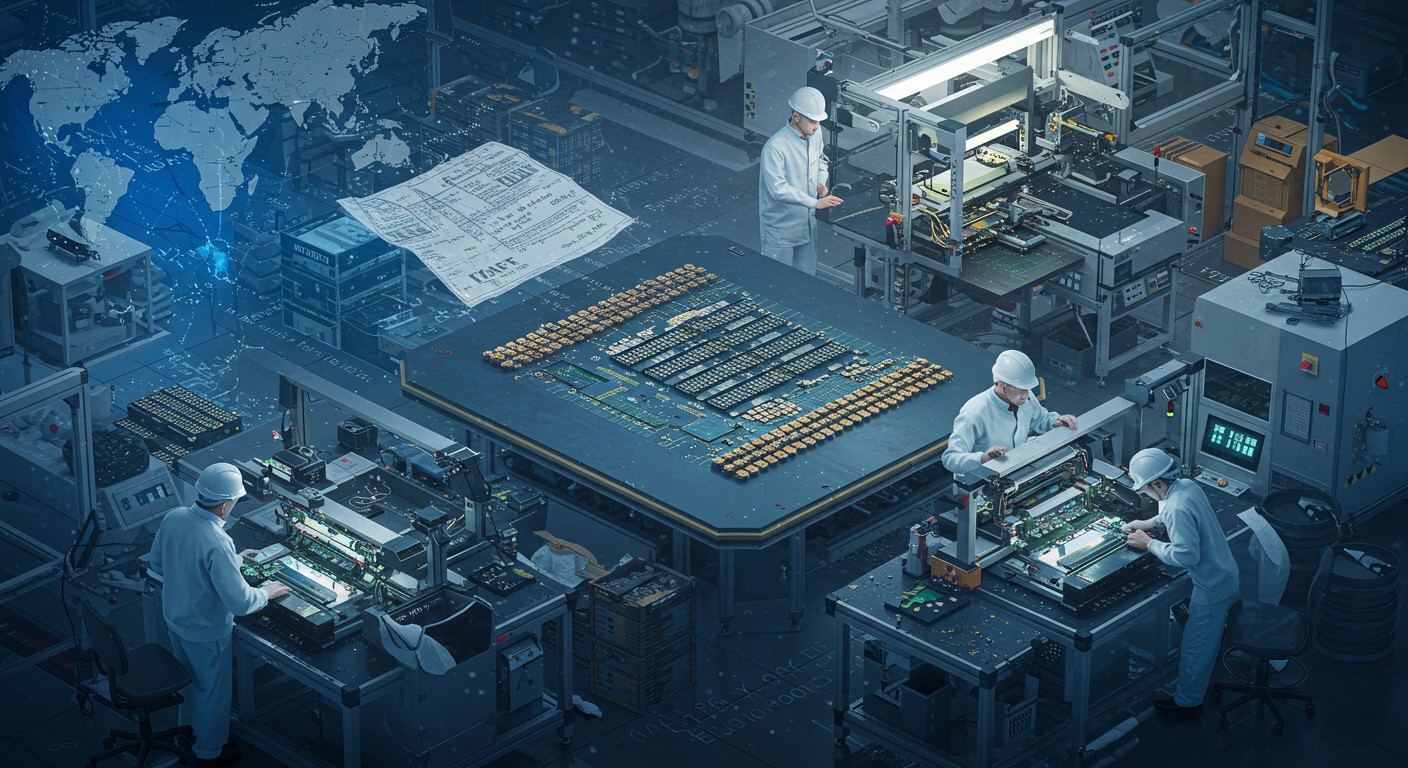

Amid the tariff talk, there’s a brighter story unfolding—one that’s less about barriers and more about building. The push for national production is gaining steam, especially in industries critical to security, like semiconductors and pharmaceuticals. It’s not just about making stuff at home; it’s about creating a resilient economy that doesn’t buckle under global pressures.

Think about it: when a country invests in its own production—say, chip manufacturing or refining raw materials—it’s like planting a seed for long-term growth. Recent government initiatives, like those funneling funds into domestic manufacturing, show this isn’t just talk. These moves align with tax incentives, like accelerated depreciation, that make it easier for businesses to invest in new facilities.

Investing in domestic production isn’t a handout; it’s a strategy for self-reliance.

In my view, this focus on self-sufficiency could be a game-changer. It’s not just about economics—it’s about national pride and security. Imagine the boost to local communities when factories hum with activity, creating jobs and reducing reliance on shaky global supply chains. It’s a vision that feels both practical and inspiring.

The Market’s Trust Game

Markets are funny creatures. They thrive on trust but can be skittish when uncertainty creeps in. Right now, they seem oddly calm about tariff threats. Is it because they’ve been burned before and learned to wait it out? Or are they banking on other economic wins, like the surge in AI investments or defense spending, to offset any tariff-related hiccups?

Here’s a stat that caught my eye: the effective tariff rate could climb from around 14% to much higher if new policies kick in soon. That’s not pocket change—it could mean higher prices for everything from electronics to groceries. Yet, markets keep chugging along, buoyed by strategies like pre-ordering goods or companies absorbing costs to avoid price hikes.

| Economic Factor | Impact of Tariffs | Mitigation Strategy |

| Consumer Prices | Increase due to higher import costs | Companies absorb costs |

| Supply Chains | Disruption in global sourcing | Pre-ordering goods |

| Market Confidence | Potential dips in stock indices | Betting on policy reversals |

Perhaps the most interesting aspect is how markets interpret silence. When tariff threats don’t materialize, it’s like a collective sigh of relief. But what happens if they do stick this time? A 5% market pullback isn’t out of the question, especially as deadlines loom without clear resolutions.

Strategies to Stay Ahead

So, how do you navigate this economic rollercoaster? Whether you’re an investor, a business owner, or just someone trying to make sense of it all, there are ways to stay grounded. Here’s what I’ve found works when trust in the economy feels wobbly.

- Focus on domestic winners: Invest in industries tied to national production, like tech or manufacturing.

- Diversify globally: Spread your investments to cushion against tariff shocks.

- Stay informed: Keep an eye on policy shifts to anticipate market moves.

It’s also worth noting that crypto markets could see a boost from this uncertainty. When traditional markets wobble, digital assets often become a safe haven for those looking to hedge their bets. I’m no crypto guru, but the buzz around it suggests it’s worth watching.

The Human Side of Economic Trust

Beyond the numbers, there’s a human element to all this. Economic policies don’t just affect stock tickers—they impact jobs, communities, and how we view our future. When I think about tariffs, I can’t help but picture the workers in a factory, wondering if their jobs will stay secure. Or the small business owner deciding whether to pass on higher costs to customers.

Building trust in the economy means balancing these human stories with big-picture goals. Policies that boost national production can create jobs and pride, but tariffs that hit too hard might squeeze the very people they’re meant to help. It’s a tightrope walk, and I’m not sure anyone’s nailed the perfect balance yet.

Economic trust is built when policies empower people, not just profits.

– Financial strategist

Looking Ahead: What’s Next?

As we inch closer to key policy deadlines, the question isn’t just whether tariffs will stick—it’s whether the market’s trust will hold. If the focus stays on national production and strategic investments, we could see a stronger, more resilient economy. But if tariffs dominate the conversation, we might be in for a bumpy ride.

In my experience, markets hate surprises, but they love clarity. If policymakers can signal their intentions—whether it’s doubling down on domestic manufacturing or easing off on trade barriers—investors will adjust. Until then, it’s a waiting game, and I’m keeping my eyes peeled for the next move.

Economic Resilience Formula: 50% Strategic Investments 30% Policy Clarity 20% Market Adaptability

So, where do we go from here? I’d argue it’s about finding balance—supporting local industries without alienating global partners. It’s about trusting that the economy can weather these storms, as long as we play our cards right. What do you think—can we avoid being fooled twice by the same economic tricks?