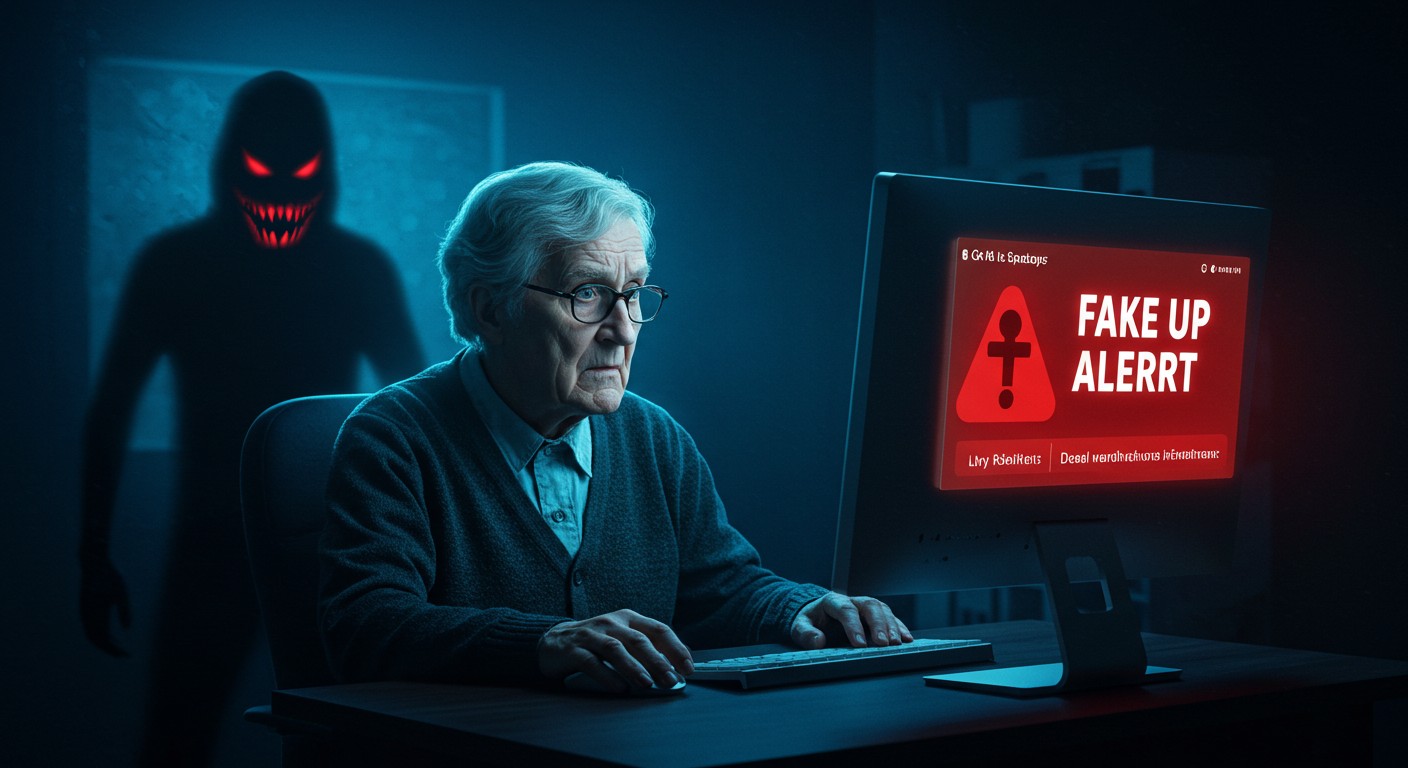

Have you ever watched a loved one struggle with a computer, unsure whether to click that suspicious pop-up? It’s a sinking feeling, knowing they might be one click away from trouble. In today’s digital world, scammers are getting craftier, preying on those least equipped to spot their tricks—our elderly family members. I’ve seen it firsthand: a relative nearly lost thousands to a fake “Microsoft” alert. It’s not just a tech issue; it’s personal. Protecting our elders from online scams isn’t just about teaching them to avoid shady links—it’s about understanding the emotional and financial toll these schemes take.

The Growing Threat of Online Scams Targeting Elders

The internet is a double-edged sword. It connects us, but it also opens doors for scammers. Elderly individuals, often less familiar with digital nuances, are prime targets for fraudsters using tactics like fraudulent pop-up alerts. These scams aren’t just annoying—they’re devastating, with losses often reaching into the millions. According to recent reports, criminals exploit trust, posing as tech giants or even government officials to manipulate their victims.

Why are elders so vulnerable? For one, many grew up in an era where trust was the default, not suspicion. Combine that with limited tech know-how, and you’ve got a perfect storm. Scammers know this and design their schemes to exploit it, using fear and urgency to push victims into hasty decisions.

How Scammers Operate: The Pop-Up Trap

Picture this: you’re browsing the web when a flashing pop-up screams, “Your computer is hacked! Call this number now!” For many elders, this is terrifying. These pop-ups often mimic legitimate warnings from companies like Microsoft, complete with official-looking logos. Once the victim calls, the scammer spins a web of lies—maybe their bank account is “compromised” or there’s a “federal warrant” out for them. The goal? Get cash, fast.

Real security warnings never ask you to call a phone number or share personal details.

– Cybersecurity expert

The tactics are chillingly effective. Scammers may instruct victims to withdraw large sums from their accounts, claiming it’s for “safety” or even “home repairs” to avoid suspicion at the bank. In some cases, they send someone to the victim’s home, posing as a federal agent to collect the money. It’s bold, calculated, and heartless.

The Emotional and Financial Toll

Beyond the money, these scams hit hard emotionally. Imagine the shame of realizing you’ve been duped or the fear of losing your life savings. For elders, who may already feel isolated, this can be crushing. I’ve spoken with folks who’ve seen their grandparents withdraw into themselves after falling for a scam, afraid to trust anyone—even family.

Financially, the damage can be catastrophic. Some victims lose hundreds of thousands, wiping out retirement funds or savings meant for healthcare. The ripple effects touch entire families, forcing tough conversations about money and independence.

Why Online Dating Ties In

You might wonder why this topic fits under Online Dating. Scammers often exploit the same vulnerabilities that make elders targets in the digital dating world—trust, loneliness, and a desire for connection. Just as fake profiles on dating sites lure victims with promises of love, pop-up scams prey on their need for security. The tactics are eerily similar: build trust, create urgency, and strike.

In my experience, elders exploring online dating are especially at risk. They’re already navigating unfamiliar digital spaces, making them more likely to trust a seemingly legitimate alert. Understanding these parallels can help us protect them across the board.

Spotting the Red Flags

So, how do you spot a scam before it’s too late? It starts with knowing the signs. Here are some key red flags to watch for:

- Unsolicited Pop-Ups: Legitimate companies don’t send random warnings demanding immediate action.

- Requests for Secrecy: Scammers often tell victims to keep quiet, even from family or banks.

- Impersonation: Be wary of anyone claiming to be a federal agent or tech support without proof.

- Urgent Demands: Scams thrive on pressure—real companies give you time to think.

If something feels off, it probably is. Encourage your loved ones to pause and verify before acting.

Practical Steps to Stay Safe

Protecting elders from scams isn’t just about spotting danger—it’s about building a safety net. Here’s a game plan to keep them secure:

- Install Reliable Security Software: Use trusted antivirus programs to block malicious pop-ups.

- Educate, Don’t Lecture: Gently explain the risks of clicking unknown links or sharing personal info.

- Limit Remote Access: Never allow strangers to control their computer remotely.

- Verify Identities: If someone claims to be from a company or agency, call the official number to confirm.

- Stay Connected: Regular check-ins can help spot unusual behavior early.

Perhaps the most effective step is fostering open communication. Encourage your loved ones to talk about anything suspicious—they shouldn’t feel embarrassed to ask for help.

| Scam Type | Common Tactic | Protection Tip |

| Pop-Up Scam | Fake tech alerts | Ignore and close pop-ups |

| Impersonation | Pretending to be officials | Verify with official contacts |

| Bank Fraud | Urging cash withdrawals | Consult family or bank first |

The Bigger Picture: Building Digital Confidence

Protecting elders isn’t just about avoiding scams—it’s about empowering them to navigate the digital world with confidence. I’ve found that teaching basic tech skills, like recognizing legitimate websites or updating software, can make a huge difference. It’s like giving them a shield against the chaos of the internet.

Community programs can also help. Many local libraries offer free tech workshops for seniors, covering everything from email safety to spotting fake alerts. These small steps build resilience, letting elders enjoy the benefits of technology without fear.

Empowering seniors with digital literacy is like teaching them to lock their doors—it’s essential for safety.

– Tech educator

What to Do If They Fall Victim

Despite our best efforts, scams can still happen. If your loved one falls victim, don’t panic—act quickly. Report the scam to local authorities and contact their bank to freeze accounts if needed. Emotional support is just as crucial; reassure them that they’re not alone and that help is available.

It’s also worth reaching out to organizations like the Federal Trade Commission, which offers resources for scam victims. The sooner you act, the better the chances of minimizing damage.

A Call to Action

We can’t eliminate scams entirely, but we can arm our elders with knowledge and support. It starts with a conversation—maybe over coffee, maybe during a family dinner. Ask them about their online habits, share a story about a scam you’ve heard, and gently guide them toward safer practices. It’s not just about protecting their wallets; it’s about preserving their trust and independence in a world that’s increasingly digital.

In my view, the most rewarding part of this is seeing an elder regain confidence online. Whether it’s helping them spot a fake pop-up or teaching them to video chat safely, these moments strengthen family bonds and build a safer digital future. So, what’s the next step you’ll take to protect your loved ones?

This article barely scratches the surface of online safety, but it’s a start. Scammers evolve, but so can our defenses. By staying vigilant and fostering open dialogue, we can keep our elders safe and connected in the digital age. Let’s make it a priority—because they deserve it.