Have you ever stopped to think about what powers the AI tools we use every day? It’s not just clever code or cutting-edge chips—it’s raw, unyielding energy. The artificial intelligence revolution, sparked by innovations like ChatGPT, has unleashed a tidal wave of demand for electricity, and companies like GE Vernova are stepping up to meet it. I’ve always found it fascinating how the backbone of tech revolutions often lies in something as grounded as power generation. Let’s dive into how GE Vernova, a titan in the energy sector, is fueling the AI boom with its gas turbines and navigating the high-stakes race to keep the digital world humming.

The AI Energy Crisis: A New Frontier

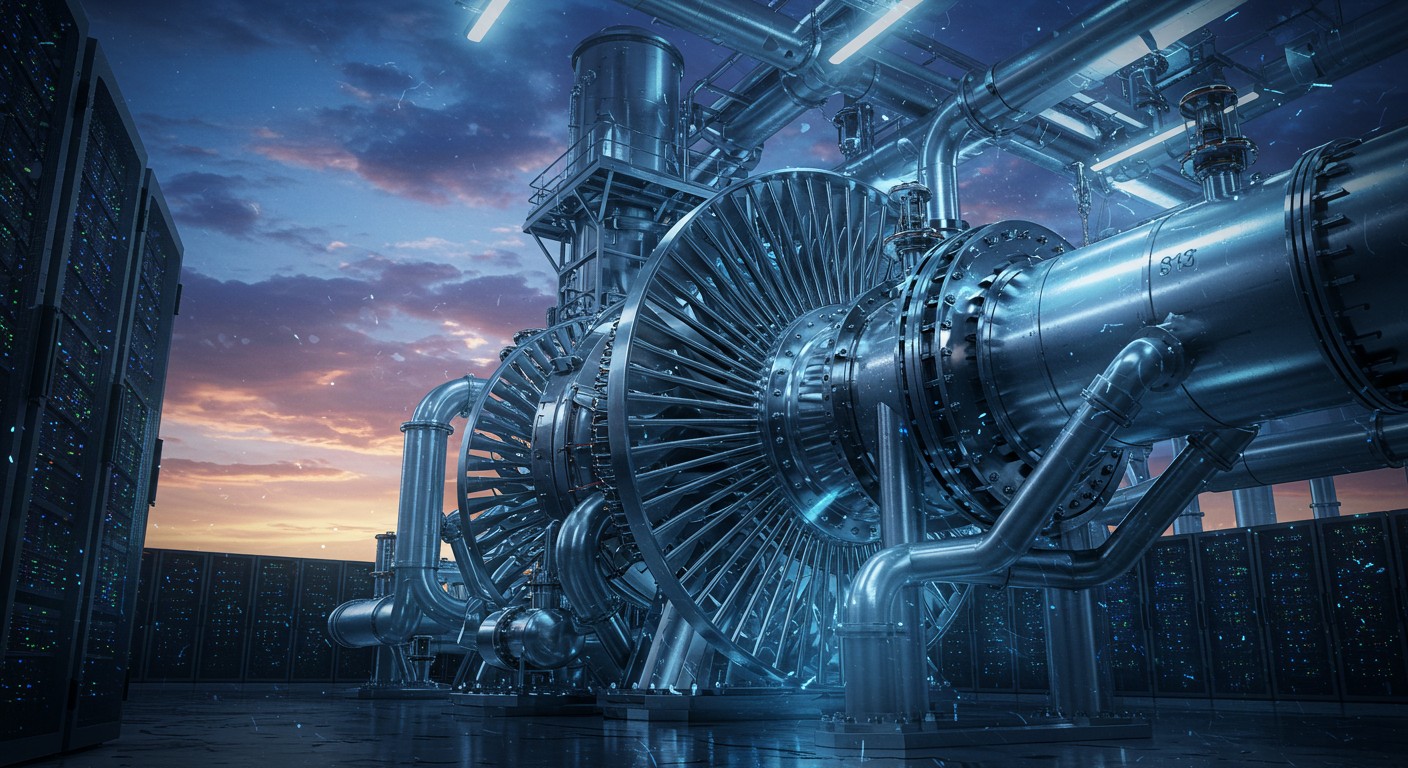

The rise of generative AI has flipped the script on what we thought we knew about energy consumption. Data centers, those sprawling hubs of servers that drive AI applications, are energy hogs. They require immense power to process the complex algorithms behind machine learning models. A few years ago, the tech world was scrambling for Nvidia’s graphics processing units (GPUs). Now, the bottleneck isn’t chips—it’s electricity. And that’s where GE Vernova comes in, not with a whisper but with the roar of massive gas turbines.

The AI boom has created an unprecedented demand for power, and companies like GE Vernova are at the center of it all.

– Industry analyst

These turbines, essentially giant engines that burn natural gas to produce electricity, are the workhorses of modern power plants. They’re not your average backyard generator; they’re complex, meticulously engineered machines that can power entire cities. But with great power comes great responsibility—and a few headaches. The demand for these turbines is so intense that manufacturers are struggling to keep up, and GE Vernova is no exception.

Why Gas Turbines Are the Unsung Heroes

Picture this: a data center humming with thousands of servers, each one crunching numbers for AI models that generate text, images, or predictions. That kind of computing power doesn’t run on hopes and dreams—it needs electricity, and lots of it. Gas turbines are the go-to solution because they’re reliable and can ramp up quickly to meet sudden spikes in demand. Unlike solar or wind, which depend on weather, gas turbines deliver consistent power, making them ideal for the always-on world of AI.

According to energy experts, the U.S. is seeing a 2.5% annual growth in electricity demand through 2035, a sharp jump from the flat growth of the past decade. Tech giants like Amazon and Microsoft are pouring billions into building data centers, and they’re turning to companies like GE Vernova to keep the lights on. It’s no wonder orders for gas turbines are at a record-breaking pace for 2025. But here’s the catch: building these turbines isn’t like churning out smartphones. It’s a slow, intricate process, and supplies are tight.

GE Vernova’s Meteoric Rise

GE Vernova’s stock has been on a tear, doubling in value this year alone and hovering around $662 per share. I can’t help but marvel at how a company rooted in industrial manufacturing has become a darling of the AI era. Their recent earnings report was nothing short of spectacular, with gas turbine orders nearly tripling and overall power segment orders up 44%. The company’s backlog of orders and future slot reservations has climbed to 55 gigawatts, with projections to hit 60 gigawatts by year-end. For context, that’s enough to power dozens of Hoover Dams.

This is an era of accelerated electrification, and we’re seeing unprecedented investment in power infrastructure.

– Energy sector executive

But it’s not just about numbers. GE Vernova is riding a wave of investor enthusiasm because it’s positioned at the intersection of two megatrends: AI and electrification. The company’s CEO has described their turbines as “largely sold out” through 2027, with orders already spilling into 2028. If you’re wondering why, it’s because every new data center needs a reliable power source, and GE Vernova is one of the few players with the scale to deliver.

The Supply Crunch: Can They Keep Up?

Here’s where things get tricky. The demand for gas turbines is so fierce that GE Vernova and its competitors, like Siemens Energy, are struggling to keep pace. These machines are massive—think of them as the size of a small house—and building one can take years. Customers placing orders today might not see delivery until 2028 or beyond. That’s a long wait when tech companies are racing to launch the next big AI model.

- High demand: AI data centers are driving a surge in electricity needs.

- Limited supply: Gas turbines are complex and time-consuming to manufacture.

- Price hikes: Tight supply has pushed turbine prices higher, boosting GE Vernova’s margins.

I’ve always thought it’s a bit ironic that the cutting-edge world of AI relies on industrial giants like GE Vernova. But this mismatch between supply and demand is creating a financial windfall for the company. Still, there’s a lingering question: can they scale up without overcommitting? The energy industry has scars from the early 2000s, when a gas turbine boom went bust after market shifts and financial troubles at companies like Enron. No one wants a repeat of that fiasco.

Balancing Act: Scaling Without Stumbling

GE Vernova is walking a tightrope. On one hand, they need to ramp up production to meet the AI-driven demand. On the other, they can’t afford to overbuild and get stuck with excess inventory if the AI hype cools off. It’s a classic case of risk versus reward. Energy experts point out that expanding manufacturing capacity isn’t as simple as flipping a switch. These turbines require specialized facilities, skilled labor, and long lead times for parts.

To their credit, GE Vernova isn’t sitting still. They’ve committed $600 million over the next two years to expand their U.S. factories, with half of that earmarked for gas turbine production. This investment will create over 850 jobs and boost capacity, but it’s a measured approach. I can’t help but respect their caution—after all, the energy industry is littered with stories of companies that bet big and lost. Still, some analysts argue they could afford to be more aggressive, given the “ironclad” nature of their orders.

| Investment Area | Amount | Impact |

| Gas Turbine Expansion | $300 million | Increased production capacity |

| Factory Upgrades | $300 million | 850 new jobs, modernized facilities |

Beyond Heavy-Duty Turbines: Creative Solutions

While heavy-duty gas turbines are the stars of the show, GE Vernova is also exploring alternatives to ease the supply crunch. Enter aeroderivative turbines, which are smaller, faster to deploy, and preassembled. They’re not as efficient for massive data centers, but they’re a lifesaver for smaller utilities or projects with tight timelines. For example, a Missouri utility recently ordered three of these units to meet local power needs.

GE Vernova also made a savvy move by acquiring a combustion parts business, bringing critical manufacturing in-house. This gives them more control over their supply chain, which is a game-changer in an era of tight supplies. It’s the kind of strategic thinking that makes me optimistic about their ability to stay ahead of the curve.

By controlling more of our supply chain, we can better meet the growing energy demands of the AI era.

– Energy industry insider

The Bigger Picture: AI and the Future of Energy

The AI boom is more than a tech trend—it’s a fundamental shift in how we consume energy. For decades, electricity demand in the U.S. was stagnant, but AI has changed the game. Data centers are popping up like mushrooms after rain, and each one needs a reliable power source. While renewables like solar and wind are part of the solution, their limitations mean natural gas will play a starring role for now.

GE Vernova’s competitors, like Siemens Energy and Mitsubishi Power, are also ramping up, but GE Vernova’s early moves give it a head start. Their $600 million investment and strategic acquisitions position them as a leader in this space. Still, I can’t shake the feeling that the industry as a whole needs to think bigger. What happens if AI demand keeps growing at this breakneck pace? Will we see new innovations in power generation to complement gas turbines?

Lessons from the Past, Eyes on the Future

The energy industry’s cautious approach stems from hard-learned lessons. In the early 2000s, a similar frenzy for gas turbines ended in a bust when market dynamics shifted. Manufacturers were left with canceled orders and warehouses full of unsold equipment. Today’s leaders, including GE Vernova, are determined not to repeat that mistake. They’re balancing growth with prudence, ensuring they don’t overcommit to a trend that might fizzle out.

- Learn from history: The 2000s boom-bust cycle taught manufacturers to be cautious.

- Invest strategically: GE Vernova’s $600 million commitment is significant but measured.

- Innovate: Aeroderivative turbines and supply chain control are creative solutions.

Perhaps the most intriguing aspect of this story is how it highlights the interconnectedness of technology and energy. AI might be the future, but it’s built on the foundation of industrial giants like GE Vernova. As an observer, I find it thrilling to see how these two worlds collide, creating opportunities and challenges in equal measure.

What’s Next for GE Vernova?

GE Vernova is in a stellar position, but the road ahead isn’t without bumps. The company’s stock price reflects investor confidence, but maintaining that momentum requires delivering on promises. Expanding production, managing supply chain constraints, and staying ahead of competitors will be critical. I’d love to see them push the envelope a bit more—maybe invest even heavier in capacity or explore new technologies to complement their turbines.

For now, GE Vernova is the linchpin in the AI energy race, and they’re playing their cards well. Their ability to balance caution with ambition will determine whether they remain the go-to name in power generation. One thing’s for sure: as long as AI continues to reshape our world, companies like GE Vernova will be the ones keeping the lights on.

The future of AI depends on the power we generate today.

So, what does this all mean for investors, tech enthusiasts, or anyone curious about the AI revolution? It’s a reminder that even the most futuristic technologies rely on the nuts and bolts of industry. GE Vernova’s story is a testament to the power of innovation—not just in code, but in the machines that make it all possible. As we look to the future, one question lingers: can the energy sector keep up with AI’s insatiable hunger for power? Only time will tell.