Have you ever wondered what it takes for a tech giant like Apple to pivot in a way that sends shockwaves through Wall Street? This week, the iPhone maker pulled off a move so bold it’s got investors buzzing and competitors scrambling. With a jaw-dropping $100 billion commitment to U.S. manufacturing and a strategic sidestep around new tariffs, Apple’s latest deal is more than just a headline—it’s a masterclass in navigating economic turbulence. Let’s dive into why this development is a big deal, not just for Apple but for the entire tech landscape.

A New Era for Apple and Tech Investments

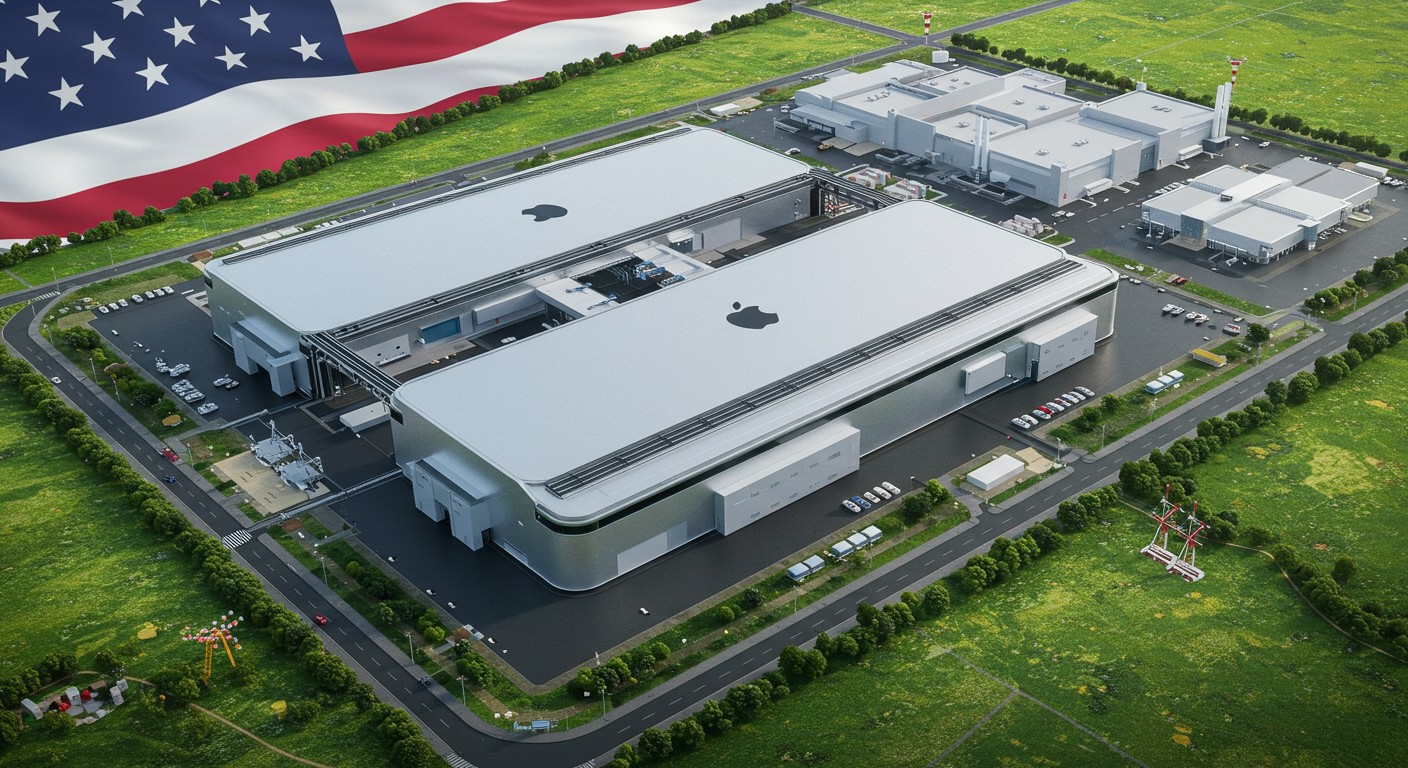

The tech sector has always been a rollercoaster, but Apple’s recent announcement feels like the moment the ride takes an unexpected twist. By committing to pour $100 billion into American companies and suppliers over the next four years, Apple is doubling down on its domestic presence. This isn’t just about shiny new factories—it’s a calculated move to shield itself from trade policies that could disrupt its global supply chain. And trust me, when a company like Apple makes a move this big, the ripple effects are felt far beyond Silicon Valley.

The Tariff Game-Changer

One of the most intriguing aspects of this story is how Apple dodged a potentially crippling blow. New trade policies, including a 100% tariff on imported semiconductors and chips, could’ve sent shockwaves through the tech world. But here’s the kicker: companies that commit to building in the U.S. are exempt. Apple, with its hefty investment in domestic production, including a $2.5 billion iPhone glass factory, just secured itself a golden ticket.

Companies that build in the U.S. won’t face the same tariff burdens, creating a massive incentive to bring manufacturing home.

– Economic policy analyst

This exemption isn’t just a win for Apple; it’s a signal to investors that the tech giant is playing chess while others are stuck in checkers. By aligning with domestic production goals, Apple’s not only dodging tariffs but also positioning itself as a leader in the push for U.S.-based manufacturing. It’s the kind of move that makes you wonder: how many other tech giants will follow suit?

Why Tech Stocks Are Buzzing

Apple’s announcement didn’t just lift its own stock—it sent a jolt through the entire tech sector. The Nasdaq Composite, a tech-heavy index, climbed 0.35% on the news, even as other major indexes dipped into the red. Apple’s stock itself surged by nearly 7%, clawing back losses from earlier tariff threats. This kind of movement isn’t just numbers on a screen; it’s a sign that investors see Apple as a safe bet in a stormy market.

- Stock surge: Apple’s shares jumped 6.78%, reflecting investor optimism.

- Market ripple: The tech sector saw gains, with Nasdaq outperforming other indexes.

- Investor confidence: Apple’s strategic pivot signals stability in uncertain times.

I’ve always believed that markets reward companies that adapt quickly, and Apple’s latest move is a textbook example. By investing heavily in the U.S., they’re not just dodging tariffs—they’re building a narrative of resilience that investors can’t ignore. It’s no wonder the tech sector is suddenly looking like the place to park your money.

What This Means for Apple’s Competitors

While Apple basks in the glow of its tariff exemption, competitors like Samsung are left wondering what’s next. Will they face the full brunt of a 100% tariff on imported chips, or will they negotiate a lower rate, as some speculate South Korea might? The uncertainty is palpable, and it’s creating a divide in the tech world between those who adapt and those who get left behind.

| Company | U.S. Manufacturing Commitment | Tariff Exposure |

| Apple | $100B over 4 years | Exempt |

| Samsung | Limited U.S. investment | Potentially 100% |

| Other Tech Giants | Varies | Uncertain |

The table above paints a clear picture: Apple’s proactive approach gives it a massive edge. Competitors now face a tough choice—invest in U.S. production or risk getting hammered by tariffs. In my experience, markets don’t wait for laggards, and companies slow to adapt could see their stock prices take a hit.

The Bigger Picture: U.S. Manufacturing Renaissance?

Apple’s $100 billion pledge isn’t just about iPhones; it’s part of a broader shift toward bringing manufacturing back to the U.S. This move aligns with a growing push for economic self-reliance, spurred by trade policies that favor domestic production. But is this the start of a manufacturing renaissance, or just a one-off win for Apple? That’s the million-dollar question—or, in this case, the $100 billion one.

Investing in U.S. manufacturing isn’t just good business—it’s a strategic necessity in today’s trade climate.

– Industry strategist

Perhaps the most fascinating aspect is how this could reshape the tech supply chain. By funneling $2.5 billion into a domestic glass factory, Apple is laying the groundwork for a more resilient supply chain. Other companies might take note, especially as tariffs make overseas production less viable. It’s a bold bet on the future, and one that could redefine how tech giants operate.

Why Apple Remains a Long-Term Winner

Let’s be real: Apple has a knack for coming out on top, no matter the odds. Whether it’s navigating trade wars or innovating new products, the company always seems to find a way. This latest deal is a testament to its leadership, particularly under CEO Tim Cook, who’s proven time and again that he knows how to create value.

- Strategic investments: Apple’s $100B commitment shows long-term vision.

- Market resilience: The stock’s 6.78% jump signals strong investor faith.

- Leadership edge: Tim Cook’s ability to navigate trade policies sets Apple apart.

I’ve always said that Apple isn’t a stock you trade—it’s one you own. This latest move only reinforces that belief. With tariffs no longer a looming threat and a massive investment in U.S. production, Apple is poised to keep leading the tech pack. Investors would be wise to take note.

What Investors Should Do Next

So, what’s the takeaway for investors? First, don’t sleep on the tech sector. Apple’s move has lit a fire under tech stocks, and the momentum could carry other players along. Second, keep an eye on competitors. Companies that don’t adapt to the new tariff reality could face rough waters, while those that follow Apple’s lead might offer fresh opportunities.

Investment Strategy Checklist: 1. Monitor tech sector trends 2. Evaluate tariff exposure 3. Prioritize U.S.-focused companies

In my opinion, the key is to stay nimble. Markets are unpredictable, but companies like Apple that can pivot quickly are the ones to bet on. Whether you’re a seasoned investor or just dipping your toes in, this is a moment to pay attention to the tech sector’s shifting tides.

Final Thoughts: A Market on the Move

Apple’s $100 billion investment and tariff exemption aren’t just a win for the company—they’re a signal that the tech sector is entering a new phase. From boosting investor confidence to reshaping supply chains, this deal has far-reaching implications. As someone who’s watched markets ebb and flow, I can’t help but feel excited about what’s next. Will this spark a broader manufacturing revival? Will competitors catch up? Only time will tell, but one thing’s for sure: Apple’s playing the long game, and it’s playing to win.

In a volatile market, companies that adapt swiftly are the ones that thrive.

– Financial advisor

For now, investors should keep their eyes peeled and their portfolios ready. The tech sector is buzzing, and Apple’s latest move just turned up the volume. Whether you’re in it for the long haul or looking for the next big opportunity, this is a story worth following.