Have you ever stared at a crypto price chart, heart racing, wondering if you’re riding a rocket to riches or about to crash into a scam? The blockchain world is a wild ride—full of promise, but also littered with traps for the unwary. Recent chatter in the crypto space has stirred up some serious questions about trust, with accusations flying about certain projects treating their communities like pawns in a high-stakes game. Let’s peel back the curtain and dive into the murky waters of crypto trust, exploring what’s really going on and how you can protect yourself.

The Trust Crisis in Crypto

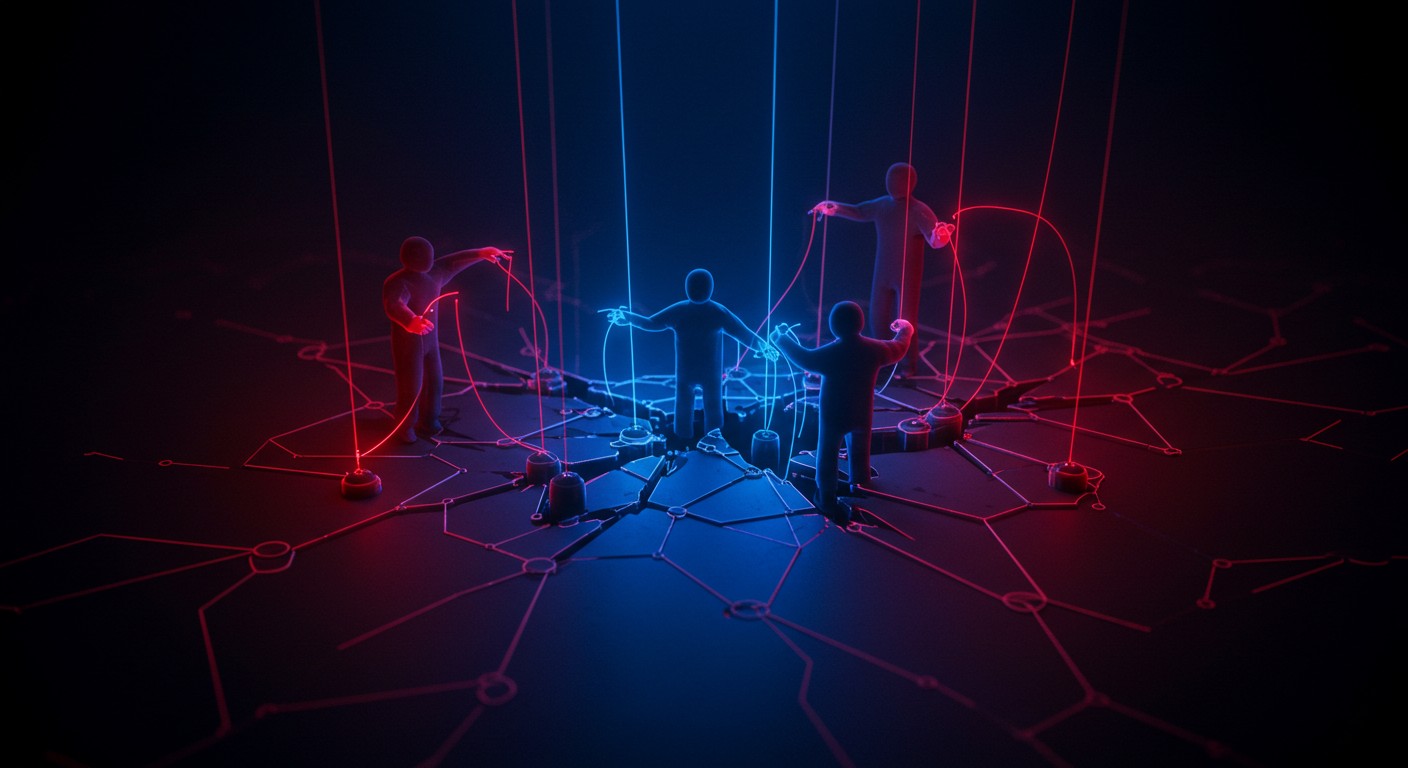

The crypto market is a paradox—a decentralized dream where trust is supposed to come from code, not people, yet human greed keeps muddying the waters. Stories of insider dumping—where project founders or early investors sell off massive token holdings to retail investors—have sparked outrage. It’s like buying a ticket to a concert only to find out the band sold out the best seats to their buddies before you even had a chance. This kind of behavior erodes confidence and leaves everyday investors holding the bag.

Take, for example, the whispers around certain blockchain projects. Critics argue that some platforms operate like multi-level marketing schemes, relying on new investors to prop up prices while insiders cash out. It’s a cycle that sounds eerily familiar to anyone who’s ever been pitched a “get-rich-quick” scheme. But how do you spot these red flags before your wallet takes a hit?

Red Flags: Spotting the Warning Signs

The first step to staying safe is knowing what to look for. Crypto scams don’t always come with neon signs screaming “fraud!”—they’re often subtle, dressed up in slick marketing or fake partnerships. Here’s a breakdown of some telltale signs that a project might not have your best interests at heart.

- Unrealistic promises: If a project guarantees sky-high returns or claims to be “the future of finance” without clear evidence, run the other way.

- Insider selling: Large token dumps by founders or early investors can tank prices, leaving retail investors in the dust.

- Fake partnerships: Announcements of big-name collaborations that turn out to be exaggerated or outright false are a classic bait-and-switch.

- Lack of transparency: If the team behind a project is anonymous or vague about their roadmap, it’s a red flag.

- Community neglect: Projects that don’t invest in educating or supporting their community often prioritize profits over people.

I’ve seen friends get burned by projects that looked legit on the surface but crumbled under scrutiny. It’s heartbreaking, but it’s also a reminder: always dig deeper than the hype.

Trust in crypto is fragile—once broken, it’s hard to rebuild.

– Blockchain analyst

The Exit Liquidity Trap

One term that’s been thrown around a lot lately is exit liquidity. It’s a fancy way of saying that new investors are essentially funding the payouts of early adopters or insiders. Imagine a pyramid where the folks at the top cash out while those at the bottom are left scrambling. Some critics argue that certain crypto projects thrive on this model, luring in new buyers with promises of growth while the big players quietly sell off their holdings.

This isn’t just speculation—it’s backed by on-chain data. Large wallet movements to exchanges often signal that insiders are preparing to sell, which can lead to price crashes. For example, recent reports highlighted a project where millions in tokens were moved to exchanges, sparking a 10% price drop in hours. It’s a gut punch for retail investors who thought they were in for the long haul.

| Crypto Behavior | Impact on Investors | Risk Level |

| Insider Token Dumps | Price Volatility | High |

| Fake Partnership Claims | Misled Investment | Medium-High |

| Lack of Community Support | Loss of Trust | Medium |

The takeaway? Always check wallet activity on platforms like Etherscan or Solscan before diving into a project. It’s like checking the weather before a hike—better to know the storm’s coming.

The Role of Community in Crypto

A strong community can make or break a crypto project. When developers engage with their users—through AMAs, educational content, or transparent updates—it builds trust. But when a project treats its community like an afterthought, it’s a sign they’re more interested in profits than progress. Some projects, critics say, fail to fund public goods like open-source tools or educational resources, leaving their communities vulnerable to scams.

In my experience, the best projects are those that treat their community like partners, not pawns. Take Ethereum’s developer ecosystem—it’s a hive of activity, with grants and resources flowing to support innovation. Compare that to projects that stay silent unless they’re hyping a token sale. The difference is night and day.

A community that’s informed and engaged is a project’s greatest asset.

– Crypto educator

Protecting Yourself: Practical Steps

So, how do you navigate this minefield without losing your shirt? It’s not about avoiding crypto altogether—there’s real potential here—but about being smart. Here’s a step-by-step guide to staying safe:

- Do your own research (DYOR): Don’t trust hype. Check whitepapers, team credentials, and on-chain activity.

- Use trusted wallets: Hardware wallets or reputable software wallets reduce the risk of hacks.

- Beware of FOMO: If a project’s price is spiking and everyone’s talking about it, that’s often the worst time to buy.

- Follow the money: Use blockchain explorers to track large wallet movements.

- Join communities: Engage with other investors on forums or social platforms to share insights.

These steps aren’t foolproof, but they’re a solid foundation. I’ve learned the hard way that skipping even one can lead to regret. A friend once lost thousands to a flashy project that promised “revolutionary” tech—turns out, it was all smoke and mirrors.

The Bigger Picture: Trust in Blockchain

The crypto space is still young, and growing pains are real. Every bull run brings new scams, but it also brings innovation. The challenge is separating the signal from the noise. Blockchain’s promise of decentralization is powerful, but it doesn’t mean blind trust. It means verifying everything—code, teams, and intentions.

Perhaps the most interesting aspect is how these controversies shape the future. Each scandal pushes the industry toward better practices—more transparency, stronger regulations, and smarter investors. But it’s a slow process, and until then, you’re your own best defense.

Crypto Safety Checklist: 1. Verify team credentials 2. Check token distribution 3. Monitor wallet activity 4. Avoid hype-driven decisions

The crypto world is a bit like dating—exciting, full of potential, but you’ve got to keep your guard up until trust is earned. By staying informed and skeptical, you can navigate the chaos and come out ahead.

Why Education Matters

One thing that keeps popping up in crypto controversies is the lack of education. Many investors jump in without understanding smart contracts, tokenomics, or even basic wallet security. It’s like diving into the deep end without learning to swim. Projects that prioritize community education—through tutorials, webinars, or open-source tools—tend to build stronger, more resilient ecosystems.

Take a moment to ask yourself: how much do you really know about the projects you’ve invested in? If the answer’s “not much,” it’s time to hit the books—or at least some reputable crypto blogs. Knowledge is your shield in this wild west of finance.

Looking Ahead: A Safer Crypto Future

Despite the scams and mistrust, there’s hope for crypto’s future. New tools are emerging to help investors—like decentralized identity systems to verify teams or AI-driven scam detection. Plus, regulators are starting to crack down on shady practices, which could clean up the space. But none of this replaces your own due diligence.

In my view, the crypto market is like a teenager—rebellious, messy, but full of potential. It’ll mature, but not without a few bruises along the way. The key is to stay curious, stay skeptical, and never bet more than you can afford to lose.

The only way to win in crypto is to outsmart the scammers.

– Veteran crypto trader

So, next time you’re eyeing a shiny new token, take a breath. Check the team, the tokenomics, and the community. Trust is hard-won in crypto, but with the right tools and mindset, you can navigate this jungle and maybe even come out on top.