Have you ever stopped to think about the unsung heroes behind the tech revolution? We’re talking about the materials that quietly power the systems we rely on daily—things like the glass fibers pulsing with data in AI-driven data centers or the sleek panels in solar arrays. One company, a titan in the glass industry, is catching the eye of investors for its surprising role in the artificial intelligence boom and beyond. It’s a fascinating story of how a seemingly traditional industry is riding the wave of cutting-edge innovation, and I’m excited to dive into why this could be a game-changer for your portfolio.

The Unexpected AI Connection in Glass

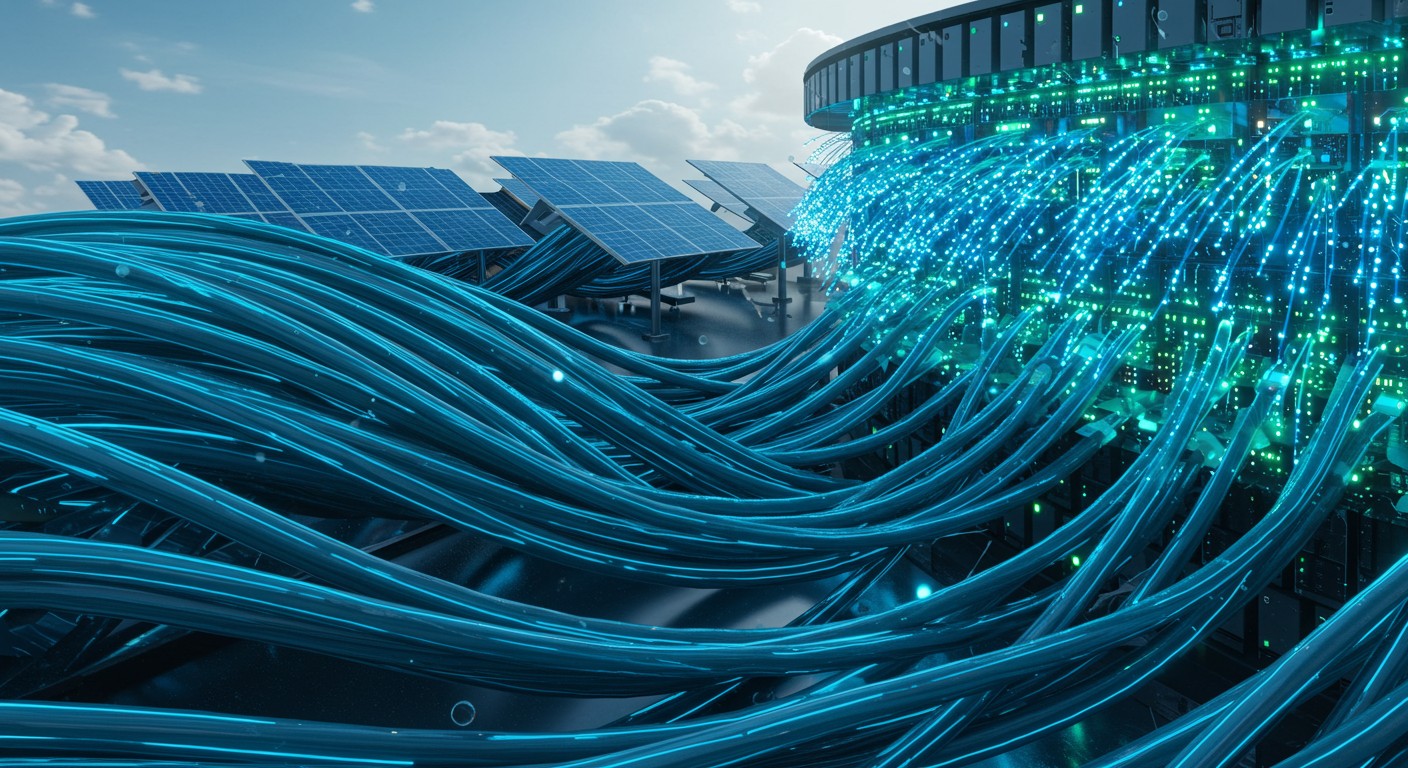

At first glance, glass might not scream “tech stock,” but dig a little deeper, and you’ll find it’s at the heart of some of today’s most transformative industries. The rise of artificial intelligence has created a massive demand for data centers—those sprawling hubs that process the vast amounts of information powering everything from chatbots to machine learning models. What’s less obvious is how much these facilities rely on fiber optics, the glass-based cables that transmit data at lightning speed.

Here’s the kicker: as AI applications grow, so does the need for more complex, high-density data centers. These modern facilities require anywhere from four to sixteen times more fiber than their predecessors. That’s not just a minor uptick—it’s a seismic shift that’s propelling companies in the glass sector into the spotlight. Analysts are buzzing about how this trend could drive sustainable growth for years to come, especially for firms leading the charge in fiber optic production.

The demand for fiber optics in AI data centers is outpacing even the most aggressive forecasts, creating a unique opportunity for glass manufacturers.

– Industry analyst

This isn’t just about keeping up with current demand. As next-generation processors roll out, the need for high-density fiber will only intensify, making glass a critical component in the AI ecosystem. For investors, this translates to a compelling case for companies positioned to capitalize on this trend.

Beyond AI: A Bright Future in Solar

While AI is the shiny new toy grabbing headlines, the glass industry’s growth story doesn’t stop there. Take the solar sector, for instance. The push for renewable energy has sparked a resurgence in U.S.-based solar production, from polysilicon to solar modules. Glass plays a starring role here, too, with specialized products used in everything from solar panels to the equipment that manufactures them.

One glass manufacturer has secured contracts for roughly 80% of the restarted solar capacity in the U.S. over the next five years. That’s a massive slice of a growing pie. With global demand for clean energy showing no signs of slowing, this positions the company as a key player in the renewable energy revolution. It’s the kind of opportunity that makes you sit up and take notice, especially when you consider the long-term potential.

- Solar polysilicon: Critical for producing high-efficiency solar cells.

- Wafers and modules: Glass components enhance durability and performance.

- Manufacturing equipment: Specialized glass is integral to cutting-edge production processes.

In my view, the solar angle is almost as exciting as the AI story. It’s a reminder that sometimes the best investments are hiding in plain sight, in industries we don’t always associate with explosive growth.

Diversified Growth: From Cars to Windows

What I find particularly compelling about this glass stock is its versatility. Beyond AI and solar, it’s making waves in industries as diverse as automotive and home construction. For example, cold form glass—a lightweight, flexible material—is revolutionizing touchscreen panels in cars. This isn’t just about aesthetics; it’s about adding functionality and value, which translates to higher revenue potential for manufacturers.

Then there’s the residential sector. Imagine triple-pane windows made with ultra-thin glass that boosts energy efficiency without adding bulk. It’s a small innovation that could have a big impact, especially as homeowners and builders prioritize sustainability. These kinds of applications show how glass isn’t just a commodity—it’s a high-tech material driving progress across multiple fronts.

Innovations like cold form glass are reshaping industries, from automotive to architecture, in ways we’re only beginning to understand.

– Technology sector analyst

Here’s a quick rundown of the diverse applications fueling growth:

- Automotive: Touchscreen panels and lightweight glass components.

- Life sciences: Specialized glass for medical devices and lab equipment.

- Residential construction: Energy-efficient windows with thin, durable glass.

This diversification is a big reason why analysts are so bullish. It’s not just about riding one trend—it’s about having multiple irons in the fire, each with significant upside.

Why Investors Are Taking Notice

Let’s talk numbers for a moment. Shares of this glass stock have already climbed 41% in 2025, and analysts see room for more. Some have raised their price targets, suggesting up to 25% upside from current levels. That’s not just optimism—it’s backed by hard data showing that demand for fiber optics and other glass products is outstripping expectations.

But what really gets me excited is the sustainability of this growth. Unlike some tech stocks that ride a single wave, this company’s exposure to AI, solar, automotive, and more creates a robust foundation. It’s the kind of stock that could deliver steady gains without the gut-wrenching volatility of pure-play tech firms.

| Sector | Growth Driver | Upside Potential |

| AI Data Centers | High-density fiber optics | High |

| Solar Energy | Polysilicon and modules | Medium-High |

| Automotive | Cold form glass | Medium |

| Residential | Energy-efficient windows | Medium |

This table sums it up nicely: multiple sectors, multiple drivers, and plenty of room to grow. It’s no wonder analysts are upgrading their ratings and investors are starting to pile in.

Is This the Right Time to Invest?

Timing is everything in investing, and right now, the stars seem to be aligning for glass stocks. The AI boom is still in its early innings, with data center spending projected to grow significantly through 2029. Meanwhile, the solar industry is gaining momentum as governments and companies double down on renewable energy. Add in the automotive and residential applications, and you’ve got a stock with exposure to some of the most exciting trends of our time.

That said, no investment is without risk. The glass industry faces competition, and global supply chains can be unpredictable. But with a diversified portfolio of applications and a strong foothold in high-growth sectors, this company seems well-positioned to weather potential storms. In my experience, stocks like this—ones that combine stability with exposure to megatrends—are rare finds.

The convergence of AI and renewable energy creates a unique moment for investors to capitalize on undervalued sectors like glass.

– Market strategist

Perhaps the most interesting aspect is how under-the-radar this opportunity still is. While everyone’s chasing the next big AI startup, companies like this one are quietly powering the infrastructure that makes it all possible. It’s a classic case of looking where others aren’t.

How to Approach This Opportunity

So, how do you play this? For starters, do your homework. Look at the company’s financials, its contracts in AI and solar, and its track record in innovation. Here are a few steps to consider:

- Research the market: Understand the demand drivers in AI and solar.

- Evaluate financials: Check revenue growth and profit margins.

- Assess risks: Consider competition and supply chain challenges.

- Diversify: Balance this stock with other tech and industrial investments.

I’ve always believed that the best investments come from spotting trends before they hit the mainstream. Glass stocks might not be the sexiest pick, but their role in AI, solar, and beyond makes them worth a serious look. Could this be the hidden gem your portfolio needs? Only time will tell, but the signs are promising.

The Bigger Picture

Stepping back, this glass stock’s story is a reminder of how interconnected our world has become. AI doesn’t just need chips and software—it needs physical infrastructure, from data centers to the cables that connect them. Solar energy isn’t just about panels; it’s about the materials that make them efficient and scalable. Even something as simple as a car’s touchscreen or a home’s windows can tie into these megatrends.

For investors, this is a chance to think beyond the obvious. While the headlines focus on tech giants, the real opportunities often lie in the companies enabling their success. Glass might not have the glamour of a new AI startup, but its role in shaping the future is undeniable.

Investment Opportunity Breakdown: 50% AI-driven fiber optic demand 30% Solar and renewable energy growth 20% Automotive and residential innovation

As we move further into 2025, I can’t help but feel optimistic about where this stock could go. It’s not just about chasing trends—it’s about finding companies with the right mix of innovation, diversification, and market timing. This glass manufacturer checks all those boxes, and then some.

Final Thoughts

Investing is as much about vision as it is about numbers. The glass industry, with its surprising ties to AI, solar, and more, offers a unique lens through which to view the future. Whether you’re a seasoned investor or just dipping your toes into the market, this is one opportunity worth exploring. It’s not every day you find a stock that bridges the gap between traditional industry and cutting-edge technology.

So, what’s your take? Are you ready to look beyond the usual suspects and bet on the materials powering tomorrow’s world? I know I’m keeping a close eye on this one.