Have you ever wondered what powers the tech giants reshaping our world? Not just the flashy chips or sleek devices, but the unsung heroes behind the scenes? I’m talking about companies like Corning, a 174-year-old glassmaker that’s quietly becoming a linchpin in the tech revolution. With its stock hitting 25-year highs in 2025, it’s hard to ignore the buzz. Partnered with juggernauts like Nvidia and Apple, Corning’s role in data centers and specialty glass is sparking investor excitement. Let’s dive into why this company might just be the next big thing in tech investing.

The Hidden Powerhouse in Tech’s Engine Room

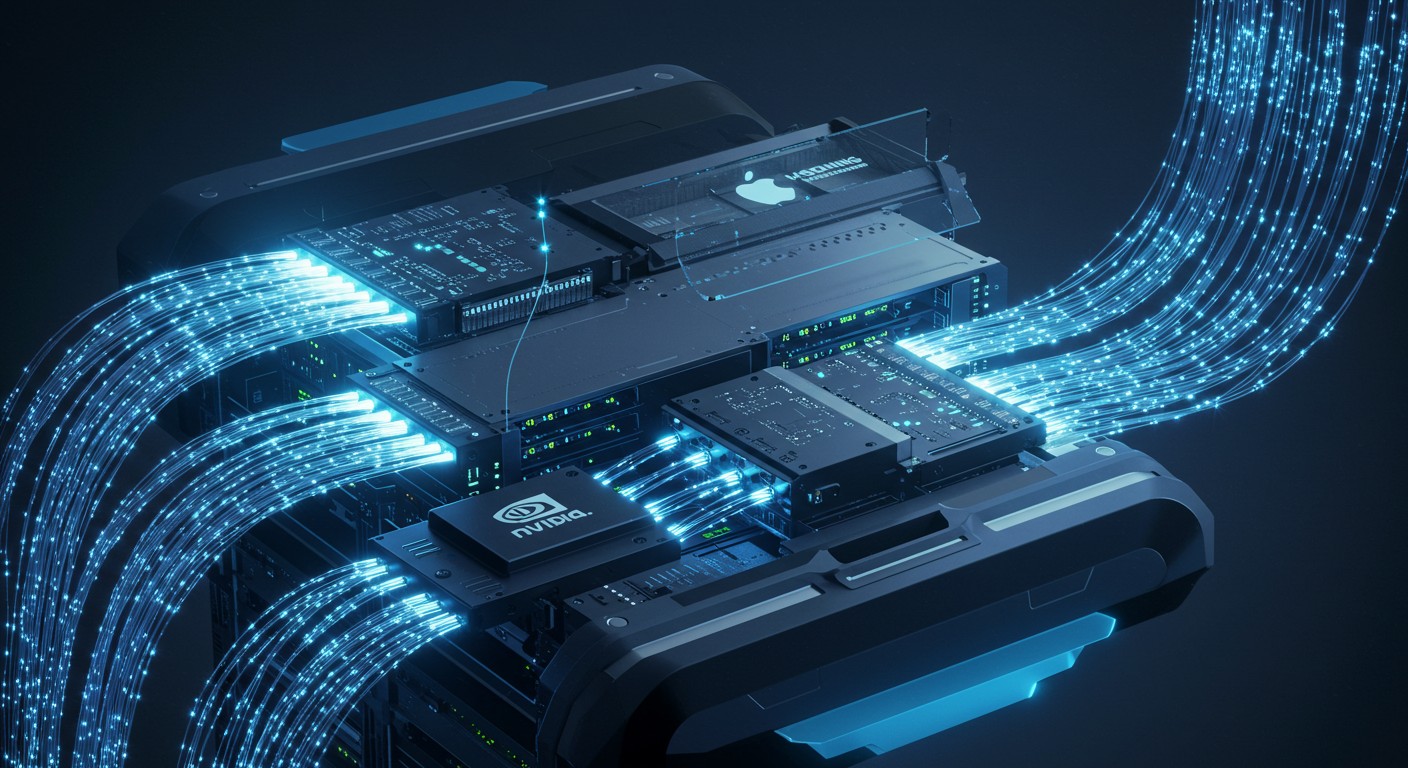

Corning isn’t a name that screams “tech superstar” at first glance. Founded in the 19th century, it’s been around longer than most of the gadgets we use daily. But don’t let its age fool you—this company is anything but stuck in the past. From crafting glass for smartphone screens to engineering the fiber optic cables that keep data centers humming, Corning’s fingerprints are all over the tech we rely on. What’s got investors so excited? It’s the company’s knack for aligning itself with the biggest players in the industry, capitalizing on the AI boom and the relentless push for innovation.

Fueling the AI Revolution

Artificial intelligence is the talk of the town, and for good reason. Companies are pouring billions into building data centers capable of handling the massive computational demands of AI workloads. But here’s the kicker: none of this happens without the right infrastructure. That’s where Corning steps in. Their specialized fiber optic cabling is designed to support the high-speed, high-capacity needs of modern data centers. And when it comes to powering the chips driving AI? Corning’s got a direct line to one of the biggest names in the game.

Corning’s cabling is the backbone of the data centers fueling the AI revolution.

– Tech industry analyst

Partnering with a leading AI chipmaker, Corning ensures that its products are at the heart of the systems driving the future. These cables aren’t just wires—they’re the arteries of the digital age, moving data at lightning speed to keep AI systems running smoothly. With demand for AI infrastructure showing no signs of slowing, Corning’s positioned to ride this wave for years to come.

A Deepened Bond with Apple

If AI is one piece of the puzzle, consumer tech is another. Corning’s long-standing partnership with Apple is a perfect example of how this company stays ahead of the curve. You’ve probably held their work in your hand without even realizing it—Corning’s specialty glass is used in every iPhone and Apple Watch. In 2025, Apple announced a $2.5 billion investment to expand its collaboration with Corning, focusing on boosting U.S.-based manufacturing.

This isn’t just about making shiny screens. It’s about a strategic push to bring more production stateside, aligning with broader trends in tech and geopolitics. As one executive put it, Corning’s Kentucky facility is set to triple production to meet Apple’s needs for its latest devices. That’s a massive vote of confidence in Corning’s ability to deliver cutting-edge materials at scale.

Every iPhone and Apple Watch sold globally will feature glass from our expanded U.S. facility.

– Corning executive

Why Investors Are Taking Notice

Let’s talk numbers for a second. Corning’s stock has surged 60% year-to-date in 2025, leaving the S&P 500’s modest 12% gain in the dust. Compare that to Apple’s 7% dip or even Nvidia’s impressive 32% climb, and you start to see why investors are buzzing. In my opinion, what makes Corning stand out is its ability to fly under the radar while powering some of the biggest tech trends. It’s not the flashy AI chipmaker or the consumer-facing giant—it’s the company making their success possible.

- Diversified portfolio: From smartphone glass to data center cabling, Corning’s products span multiple industries.

- Strategic partnerships: Aligning with tech titans ensures long-term growth potential.

- AI-driven demand: The explosion of data centers is a goldmine for Corning’s specialized offerings.

But here’s a question: why aren’t more people talking about Corning? Maybe it’s because investors are too busy chasing the “obvious” plays like chipmakers or cloud providers. In my experience, the best opportunities often come from companies like this—ones that quietly enable the giants.

Beyond Tech: Corning’s Broader Impact

Corning’s reach extends far beyond smartphones and data centers. Their materials are used in emission control systems for vehicles, helping reduce environmental impact. They also supply glass for research labs, enabling breakthroughs in science and medicine. It’s the kind of versatility that makes you wonder: is there anything this company can’t do?

Perhaps the most interesting aspect is how Corning balances innovation with sustainability. Their products don’t just power tech—they contribute to a cleaner, more efficient world. For investors, this adds another layer of appeal: a company that’s not only profitable but also aligned with global trends toward sustainability.

What’s Next for Corning?

Looking ahead, Corning’s trajectory seems poised for continued growth. The AI infrastructure boom shows no signs of slowing, and with tech giants doubling down on data centers, Corning’s cabling and glass solutions will remain in high demand. Meanwhile, their deepened partnership with Apple ensures a steady revenue stream from the consumer tech side.

| Sector | Corning’s Role | Growth Potential |

| Data Centers | Fiber optic cabling | High |

| Consumer Tech | Specialty glass for devices | Medium-High |

| Automotive | Emission control systems | Medium |

Of course, no investment is without risk. The tech sector can be volatile, and Corning’s reliance on a few key partners could be a double-edged sword. But with a track record spanning nearly two centuries, this isn’t a company that’s likely to crumble under pressure.

Should You Invest?

So, is Corning the next big bet for your portfolio? If you’re looking for a company that’s deeply embedded in the tech ecosystem without the hype of a headline-grabbing stock, it’s worth a closer look. The numbers speak for themselves—60% growth in a year isn’t something to sneeze at. But more than that, it’s the company’s ability to evolve and adapt that makes it so compelling.

In my view, the real magic lies in Corning’s quiet dominance. They’re not trying to steal the spotlight—they’re just making sure the spotlight works. Whether it’s the glass on your phone or the cables powering the cloud, Corning’s got a hand in it all. And with the tech world only getting hungrier for innovation, this could be one stock that’s just getting started.

The best investments are often the ones nobody’s talking about yet.

– Seasoned investor

Before you jump in, do your homework. Look at Corning’s financials, track their partnerships, and weigh the risks. But if you’re betting on the future of tech—and who isn’t?—this glassmaker might just be the dark horse you’ve been waiting for.