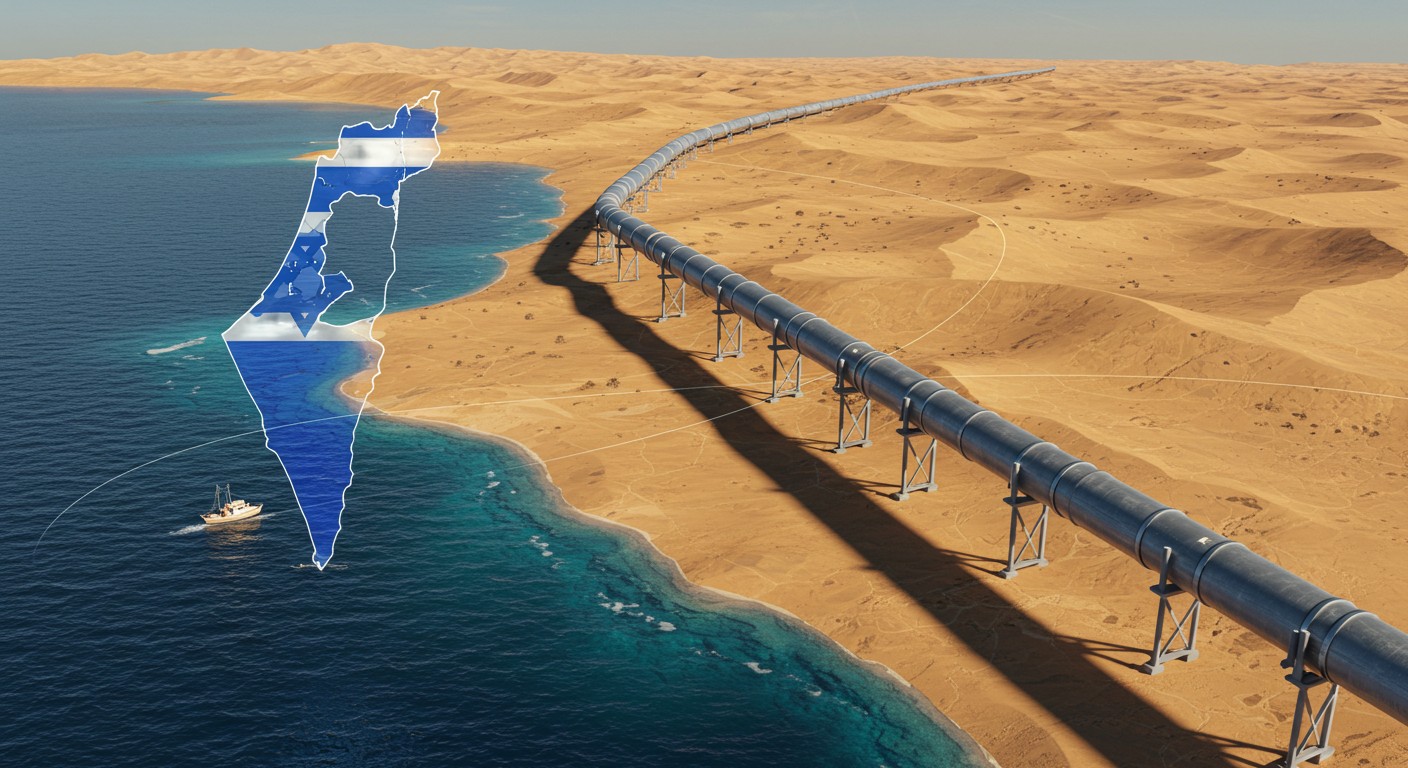

Have you ever wondered how a single pipeline could shift the balance of power in a region? In the heart of the Middle East, where tensions often dominate headlines, a new deal is quietly reshaping the energy landscape. A major agreement between a leading U.S. energy company and Israel’s state-owned pipeline operator is set to build a natural gas pipeline connecting Israel’s massive Leviathan Gas Field to Egypt. This isn’t just about energy—it’s about economics, geopolitics, and the delicate dance of international relations. Let’s unpack this ambitious project and explore why it matters.

A Pipeline to Power: The Big Picture

The Middle East has long been a hotspot for energy resources, but this new pipeline deal is a game-changer. Spanning hundreds of miles and costing over half a billion dollars, it promises to deliver 600 million cubic feet of natural gas per day from Israel to Egypt. For a country grappling with an energy crisis, this could be a lifeline. Egypt’s domestic gas production has been declining, and the nation has leaned heavily on costly imported liquefied natural gas (LNG). This pipeline, expected to be operational in three years, could ease that burden and strengthen ties between two unlikely partners.

But there’s more to this story than pipes and gas. The project sits at the intersection of economic ambition and geopolitical complexity. I’ve always found it fascinating how energy deals can either bridge divides or spark conflicts. This one? It’s walking a tightrope. Let’s dive into the details.

Why Egypt Needs This Pipeline

Egypt’s energy situation is, frankly, a bit of a mess. Once a gas exporter, the country has become a net importer since 2022. Mature fields like Zohr are depleting faster than new discoveries can keep up. Add to that a surge in domestic electricity demand and past financial hiccups—like currency shortages and unpaid debts to foreign companies—and you’ve got a recipe for an energy crisis. Last year, Egypt imported nearly a billion cubic feet of gas daily from Israel, a number that’s been climbing steadily.

Egypt’s reliance on imported gas is a stark reminder of how quickly energy fortunes can shift.

– Energy market analyst

The new pipeline, dubbed Nitzana, will boost Israel’s export capacity to Egypt to over 2.2 billion cubic feet per day. That’s a massive leap. For Egypt, it means less dependence on expensive LNG imports, which currently cost billions annually. For businesses and households, it could mean fewer power outages and more affordable energy. But here’s the kicker: this deal isn’t just about economics. It’s a strategic move to deepen ties between Israel and Egypt, two nations with a complex history.

The Leviathan Gas Field: A Mediterranean Giant

At the heart of this deal is the Leviathan Gas Field, a behemoth discovered in 2010 off Israel’s coast. Spanning 330 square kilometers and holding an estimated 22.9 trillion cubic feet of recoverable gas, it’s one of the largest natural gas reserves in the Mediterranean. Operated by a consortium led by Israel’s NewMed Energy, with significant stakes held by a U.S. energy giant and Ratio Energies, Leviathan is already supplying gas to Israel, Egypt, and Jordan through a network of subsea wells and pipelines.

- Location: 130 km off Haifa, Israel

- Production: Facilitated by four subsea wells and an offshore platform

- Output: Gas processed offshore and piped to Israel’s national grid

- Markets: Serving Israel, Egypt, and Jordan

The field’s expansion, known as Phase 1B, is another piece of this puzzle. Plans include new drilling, subsea systems, and possibly a floating liquefied natural gas (FLNG) facility. The final investment decision is slated for late 2025, but security concerns and market demand have delayed progress. In my view, the fact that this expansion is even being considered amid regional tensions speaks volumes about the confidence in Leviathan’s potential.

Geopolitical Risks: A Delicate Balance

Here’s where things get tricky. The Middle East is never short on drama, and this pipeline deal is no exception. Recent escalations, including military orders in Gaza and bold statements from Israeli leadership about a “Greater Israel,” have raised eyebrows. Some reports suggest the Israeli government is holding off on fully greenlighting the deal until certain conditions are met. That’s a reminder that energy projects in this region are never just about energy—they’re about power, influence, and survival.

Then there’s the broader East Mediterranean chessboard. The same U.S. company behind the Nitzana pipeline is also bidding for exploration rights off Crete, in waters contested by Greece, Turkey, and Libya. These maritime disputes, rooted in competing claims over Exclusive Economic Zones (EEZs), add another layer of complexity. Greece sees its partnership with the U.S. firm as a way to assert sovereignty, while Turkey and Libya push back, citing a 2019 agreement that ignores Greece’s claims. It’s a high-stakes game, and energy is at the center.

Energy deals in the Mediterranean are as much about diplomacy as they are about resources.

– Geopolitical strategist

Perhaps the most intriguing aspect is how these tensions could affect the pipeline’s future. Will it strengthen Israel-Egypt relations, or will it become a flashpoint if regional conflicts escalate? I’d wager it’s a bit of both—energy has a way of forcing uneasy alliances.

Economic Impacts: Beyond the Pipeline

The economic ripple effects of this project are massive. For Egypt, the pipeline means energy security and cost savings. Importing gas via pipeline is far cheaper than LNG, which requires specialized terminals and ships. For Israel, it’s a chance to cement its role as a regional energy hub. The Leviathan field already supplies Jordan and Israel’s domestic market, and boosting exports to Egypt could bring in billions in revenue.

| Country | Benefit | Challenge |

| Egypt | Reduced LNG imports, energy stability | Geopolitical dependence |

| Israel | Increased export revenue, regional influence | Security risks |

| U.S. Company | Expanded market presence | Navigating disputes |

For the U.S. energy company involved, this is a bold move to expand its footprint in a volatile region. Partnering with Greece for offshore exploration and pushing forward with Leviathan’s expansion shows a willingness to take calculated risks. But as someone who’s followed global markets for years, I can’t help but wonder: is the payoff worth the potential fallout?

What’s Next for the Region?

The Nitzana pipeline is just one piece of a larger puzzle. The Leviathan expansion, if approved, could double the field’s output. Meanwhile, exploration off Crete could unlock new reserves, though it risks escalating tensions with Turkey and Libya. These projects are interconnected, not just by geography but by the delicate balance of power in the region.

- Pipeline Completion: Expected in three years, boosting Egypt’s energy supply.

- Leviathan Expansion: Final decision in Q4 2025, potentially adding an FLNG facility.

- Crete Exploration: Bidding underway, with results that could reshape maritime boundaries.

What strikes me most is the ambition behind these moves. In a region where stability is never guaranteed, betting big on energy infrastructure is a bold play. It’s a reminder that even in the face of conflict, the pursuit of resources—and the wealth they bring—never stops.

A Personal Take: Why This Matters

I’ve always believed that energy is the backbone of modern economies, but it’s also a catalyst for change. This pipeline deal isn’t just about gas—it’s about the potential to reshape alliances, stabilize economies, and maybe even ease tensions in a volatile region. But it’s not without risks. Geopolitical flare-ups could derail progress, and the stakes are high for all involved.

So, what’s the takeaway? This project is a microcosm of the challenges and opportunities in global energy markets. It’s a story of ambition, risk, and the relentless drive to secure resources. As the pipeline takes shape, I’ll be watching closely—not just for the gas it’ll carry, but for the ripple effects it’ll have across the Middle East and beyond.

Energy deals like this one don’t just power homes—they power economies, influence politics, and shape the future. What do you think: will this pipeline be a bridge to cooperation or a spark for conflict? The answer, like the region itself, is anything but simple.