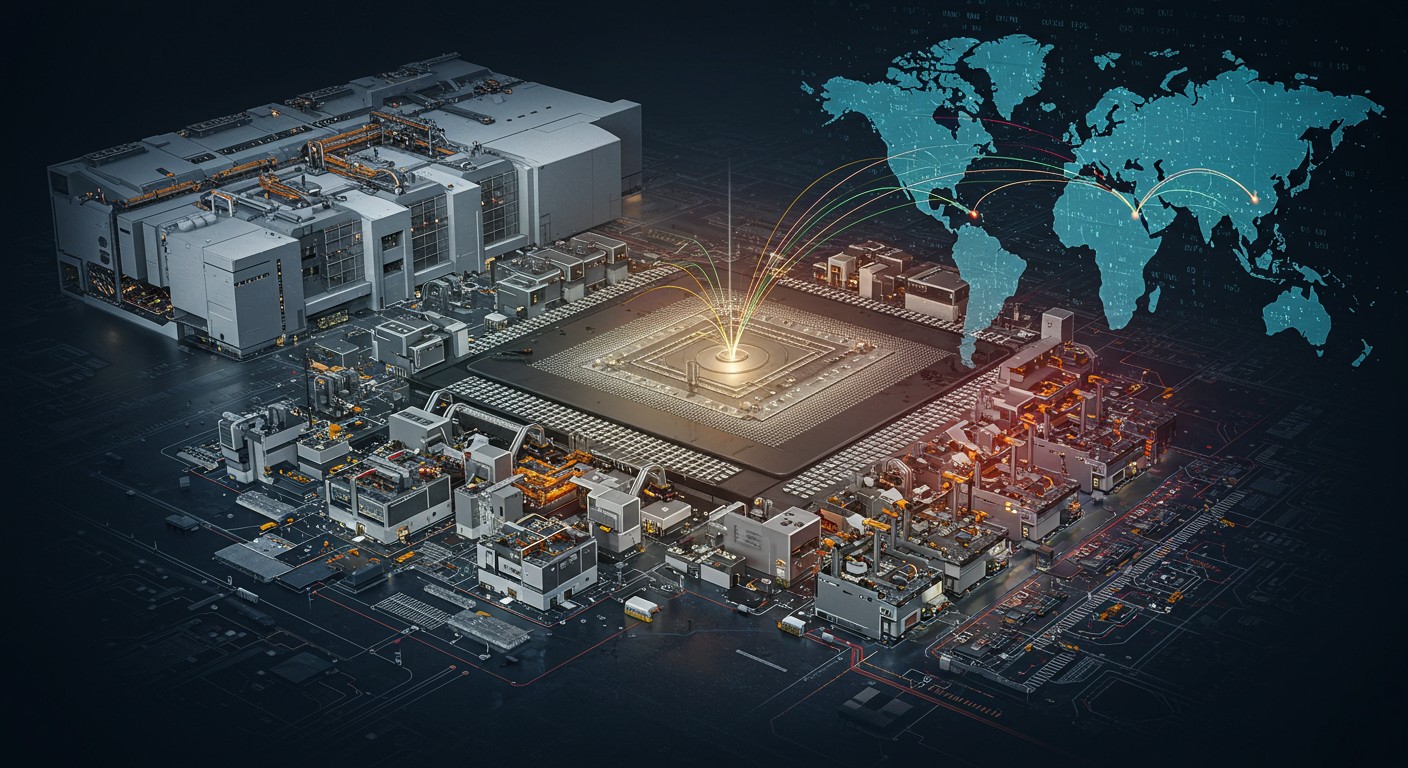

Ever wonder what powers the tech you use every day? From your smartphone to your laptop, the tiny chips inside are the unsung heroes of modern life. But here’s the kicker: most of these critical components come from a single island thousands of miles away from the U.S. I’m talking about Taiwan, the global powerhouse behind over 90% of the world’s advanced semiconductors. Recently, a bold new plan from the U.S. Commerce Department has sparked heated discussions about shifting this balance. The goal? A 50-50 split in chip production between the U.S. and Taiwan. Let’s dive into what this means, why it’s happening, and how it could reshape everything from tech to geopolitics.

Why the U.S. Wants to Reshape Chip Production

The U.S. has been a leader in innovation for decades, but when it comes to manufacturing the chips that power our devices, we’ve fallen behind. Taiwan, thanks to giants like Taiwan Semiconductor Manufacturing Company (TSMC), dominates the production of advanced semiconductors. This reliance has raised eyebrows in Washington, especially given Taiwan’s proximity to China and the geopolitical tensions that come with it. The U.S. Commerce Secretary recently outlined a plan to bring half of America’s chip production back home, a move that’s as much about economics as it is about national security.

Why does this matter? For one, having most of the world’s chips made in one place is a risky bet. A disruption in Taiwan—whether from natural disasters, political instability, or military tensions—could grind global tech to a halt. I’ve always thought it’s a bit like putting all your eggs in one basket. The U.S. wants to diversify that risk while boosting its own manufacturing muscle.

We need to make our own chips. It’s about securing our future and reducing reliance on far-off supply chains.

– U.S. Commerce Official

The 50-50 Vision: A Game-Changer?

The proposed 50-50 plan isn’t just a catchy slogan—it’s a seismic shift. The idea is simple: half of the chips used in the U.S. should be made domestically, with Taiwan handling the other half. This would still leave America reliant on Taiwan, but it’s a step toward self-sufficiency. The Commerce Secretary has set an ambitious target of reaching 40% domestic production by the end of the current presidential term, which would require a staggering $500 billion in investments.

That’s a lot of money, right? But think about it: chips are the backbone of everything from AI to electric vehicles. Investing in domestic production isn’t just about economics; it’s about ensuring the U.S. can keep innovating without being at the mercy of global supply chains. Plus, it could create thousands of high-tech jobs here at home. In my view, it’s a bold move that could pay off big time if done right.

- Economic boost: New factories mean jobs and innovation.

- Supply chain security: Less dependence on a single region.

- Geopolitical leverage: A stronger U.S. position in global tech.

Taiwan’s Role: The Silicon Shield Debate

Taiwan’s dominance in chip production has long been described as its Silicon Shield. The theory goes that Taiwan’s critical role in global tech makes it untouchable—any disruption would tank the world economy, deterring aggression from neighboring powers. But is this shield as strong as it seems? Some U.S. officials argue that relying so heavily on Taiwan puts both countries in a tricky spot.

Here’s where it gets interesting. The Commerce Secretary has suggested that a more balanced production model could actually make Taiwan safer. If the U.S. produces half the chips, Taiwan’s role remains vital, but the global fallout from any disruption would be less catastrophic. It’s a pragmatic approach, though I can’t help but wonder if it underestimates the complexities of Taiwan’s geopolitical reality.

If you’re making 95% of the chips, how do we protect you? We need a balance to keep everyone secure.

– U.S. Official

Taiwan’s chip giant, TSMC, is already on board with this shift. They’ve been building factories in the U.S. since 2020, with plans to pour in over $165 billion in investments. That’s a massive commitment, but it shows how seriously both sides are taking this plan. Still, moving production isn’t as simple as flipping a switch—it takes years to build factories, train workers, and get everything up to speed.

The Geopolitical Stakes

Let’s talk about the elephant in the room: China. Taiwan’s proximity to its powerful neighbor has always been a flashpoint. Beijing considers Taiwan part of its territory, and tensions have been simmering for years. The U.S. has reaffirmed its commitment to Taiwan’s defense, but some argue that reducing reliance on Taiwanese chips could shift the dynamics of that support. If America makes more of its own chips, does it change how it views its role in Taiwan’s security?

I’m no geopolitics expert, but it seems like a double-edged sword. On one hand, a stronger U.S. chip industry could reduce the risk of supply chain disruptions in a crisis. On the other, it might weaken the Silicon Shield that has arguably kept Taiwan safe. It’s a high-stakes balancing act, and the outcome will depend on how both sides navigate these choppy waters.

| Region | Current Chip Production Share | Proposed Share (50-50 Plan) |

| Taiwan | ~90% | 50% |

| U.S. | ~10% | 50% |

What’s Driving This Push?

The U.S. hasn’t always been this focused on bringing chip production home. For decades, it was cheaper to outsource manufacturing to Asia, where companies like TSMC and South Korea’s Samsung built cutting-edge facilities. But recent global disruptions—think pandemics, trade wars, and shipping bottlenecks—have exposed the vulnerabilities of this model. Add in the growing importance of chips for everything from AI to military tech, and it’s no surprise the U.S. is doubling down on domestic production.

Then there’s the political angle. The current administration has made it clear that it wants a more self-reliant America. Proposals like 100% tariffs on foreign semiconductors (with exemptions for companies investing in the U.S.) signal a hard pivot toward protectionism. It’s a controversial move, but it’s already pushing companies like TSMC to ramp up their U.S. investments. In my opinion, this blend of incentives and pressure could be the nudge the industry needs, though it won’t come cheap.

- Global disruptions: Pandemics and trade issues exposed supply chain risks.

- National security: Chips are critical for defense and tech innovation.

- Economic strategy: Domestic production could create jobs and boost growth.

Challenges Ahead

Shifting half of America’s chip production to the U.S. sounds great on paper, but it’s no small feat. Building advanced semiconductor factories—known as fabs—is insanely expensive and time-consuming. We’re talking billions of dollars and years of construction, not to mention the need for highly skilled workers. The U.S. has the resources, but scaling up to match Taiwan’s expertise won’t happen overnight.

Then there’s the question of cost. Chips made in the U.S. might be pricier due to higher labor and regulatory costs. Will consumers foot the bill for more expensive gadgets? And what about the global market? If the U.S. pushes too hard on tariffs, it could spark trade tensions with allies like Taiwan. It’s a delicate dance, and I’m curious to see how it plays out.

What’s Next for U.S.-Taiwan Relations?

The 50-50 plan is more than a manufacturing goal—it’s a statement about the future of U.S.-Taiwan relations. Trade negotiations are ongoing, and the outcome will likely shape tariff rates and investment flows. TSMC’s massive U.S. investments are a good start, but both sides need to keep the lines of communication open to make this work. After all, chips aren’t just a business; they’re a cornerstone of modern life.

Perhaps the most intriguing aspect is how this shift will ripple across the global stage. Will other countries follow the U.S. and push for their own chip production? Could this spark a new era of tech nationalism? Only time will tell, but one thing’s clear: the race to control the future of semiconductors is heating up, and the stakes couldn’t be higher.

This is about more than chips—it’s about shaping the future of technology and security.

– Industry Analyst

As I reflect on this, I can’t help but feel a mix of excitement and unease. The U.S. is making a bold play to reclaim its place in the chip world, but it’s a gamble that hinges on massive investments, delicate diplomacy, and a whole lot of coordination. If it works, we could see a more resilient, innovative America. If it stumbles, well, let’s just say the tech world will be watching closely.

So, what do you think? Is the 50-50 plan a stroke of genius or a risky bet? One thing’s for sure: the world of chips is about to get a whole lot more interesting.