Have you ever wondered what keeps a nation’s defense system humming behind the scenes? It’s not just tanks or jets—it’s the raw materials that make them possible. Recently, a lesser-known company made headlines by securing a game-changing $10 million contract with the U.S. Department of Defense, spotlighting a critical yet often overlooked piece of the national security puzzle: critical minerals. This deal isn’t just about numbers; it’s a bold step toward reducing America’s reliance on foreign supply chains and strengthening its industrial backbone.

Why Critical Minerals Are the Unsung Heroes of Defense

When you think of national defense, minerals might not be the first thing that comes to mind. But materials like antimony are the unsung heroes powering everything from munitions to high-tech batteries. The recent $10 million deal for antimony delivery to the U.S. Defense Logistics Agency underscores just how vital these resources are. This contract, part of an indefinite delivery, indefinite quantity agreement, signals a broader push to secure domestic sources for strategic materials.

Antimony, a silvery metalloid, isn’t exactly a household name. Yet, it’s indispensable in military-grade compounds, flame retardants, and even advanced electronics. With global supply chains often dominated by foreign players, ensuring a steady domestic flow of such minerals is a matter of national security. In my view, this move feels like a wake-up call—a reminder that self-reliance starts with the raw materials we often take for granted.

A Landmark Deal for U.S. Antimony

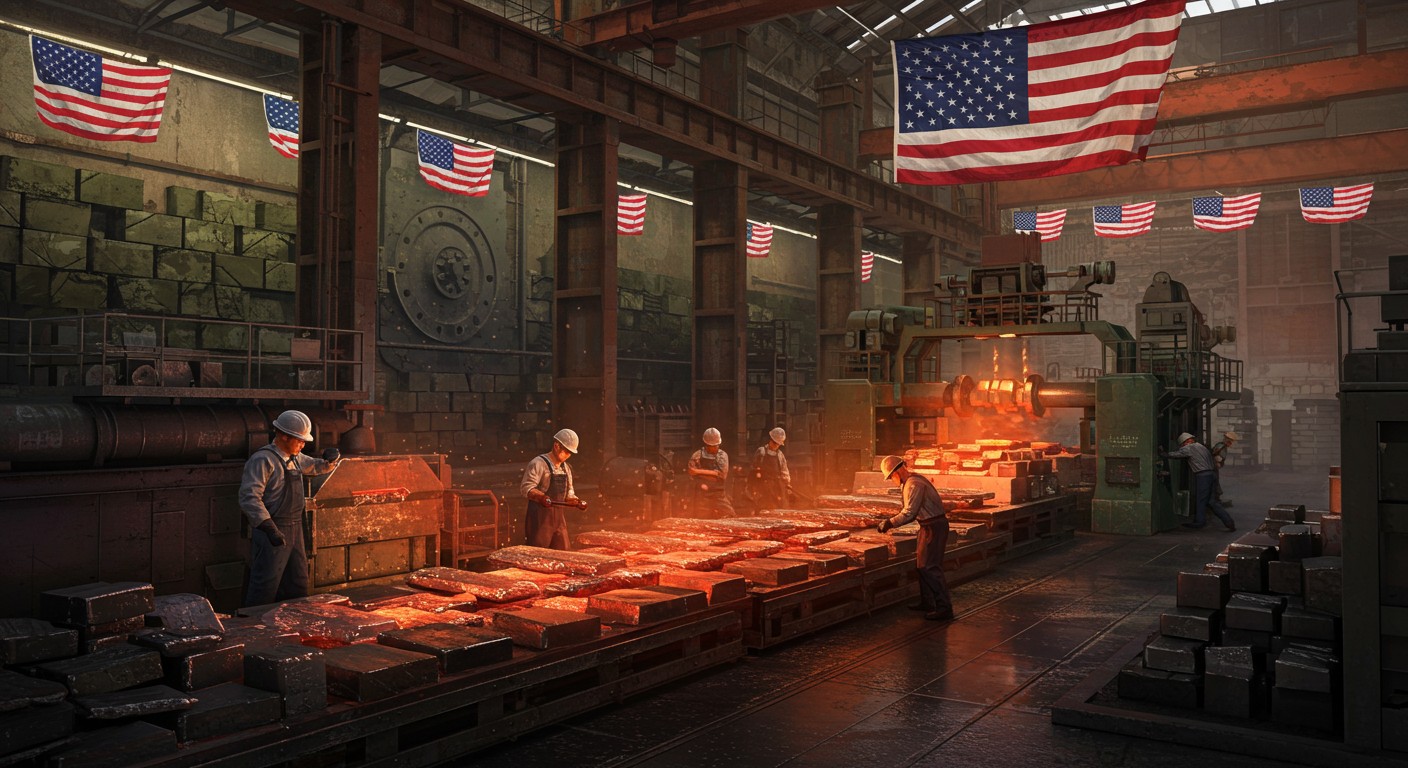

The company at the heart of this deal is one of the few players in North America with the capacity to process antimony domestically. Their $10 million order involves delivering 315,000 pounds of antimony metal ingots to replenish the National Defense Stockpile. This isn’t just a one-off transaction—it’s part of a long-term partnership with the Department of Defense, reflecting months of negotiations that ramped up in late 2024.

Our team is proud to contribute to the nation’s defense readiness by supplying critical minerals from our domestic facilities.

– Company leadership

What makes this deal even more intriguing? The company’s CEO recently showed confidence by purchasing over $600,000 worth of stock, a move that sent shares climbing more than 10%. It’s a signal that insiders see a bright future, and I can’t help but think they’re onto something big. After all, with only two antimony smelters in North America, this company is uniquely positioned to meet growing demand.

Why Antimony Matters More Than You Think

Antimony isn’t just another mineral—it’s a linchpin in modern defense and industry. Here’s a quick breakdown of why it’s so critical:

- Munitions: Antimony is used in ammunition primers and tracer rounds, essential for military operations.

- Batteries: It’s a key component in advanced energy storage systems, powering everything from drones to electric vehicles.

- Flame Retardants: Antimony compounds are vital for safety in textiles and electronics.

- Military-Grade Alloys: It strengthens materials used in high-performance defense applications.

With such a wide range of uses, it’s no wonder defense officials have flagged antimony as a vulnerability in the U.S. industrial base. Relying on foreign suppliers—particularly from regions with complex geopolitical dynamics—poses risks that the U.S. can no longer afford to ignore. This contract is a clear signal that the government is taking action to address that gap.

A Broader Push for Supply Chain Resilience

This antimony deal is part of a larger movement to bolster America’s supply chain resilience. Recent policy efforts, particularly under the Trump administration, have prioritized securing domestic access to critical minerals. Executive actions and funding initiatives have poured billions into sectors like semiconductors and rare earths, with companies like Intel and MP Materials reaping the benefits. The antimony contract fits right into this strategy, aiming to reduce dependence on foreign sources for materials that keep the nation secure.

Why does this matter? Because global supply chains are fragile. A single disruption—whether from trade disputes, natural disasters, or geopolitical tensions—can choke off access to essential resources. By investing in domestic production, the U.S. is hedging against those risks. In my experience, these kinds of initiatives often ripple beyond their immediate impact, sparking innovation and job creation in unexpected ways.

What’s Next for the Critical Minerals Sector?

The antimony deal is just the tip of the iceberg. Industry insiders expect more announcements soon, particularly around nuclear fuel and uranium, as the U.S. continues to shore up its domestic capabilities. The company behind this contract is forecasting robust growth, with projected revenues of $40-50 million in 2025 and a bold $100 million target for 2026. Analysts seem to agree, with estimates closely aligning with these figures.

| Year | Projected Revenue | Analyst Estimates |

| 2025 | $40M–$50M | $45.2M |

| 2026 | $100M | $100.6M |

These numbers suggest confidence in the sector’s growth, but they also raise a question: can domestic production scale fast enough to meet demand? The answer depends on continued investment, innovation, and policy support. For now, this company’s ability to deliver antimony from its own facilities positions it as a leader in the race to secure America’s mineral future.

The Bigger Picture: Why This Matters to Investors

For investors, this deal is a signal to pay attention to the critical minerals space. The combination of government backing, insider confidence, and rising demand for strategic materials makes companies like this one worth watching. Here’s why this sector is heating up:

- Government Support: Federal initiatives are funneling billions into domestic production, creating opportunities for companies in the space.

- Geopolitical Shifts: Reducing reliance on foreign minerals is a priority, driving demand for U.S.-based suppliers.

- Market Growth: The global push for clean energy and defense modernization is boosting demand for minerals like antimony.

Perhaps the most exciting part? This isn’t just about one company or one mineral. The broader trend toward mineral independence is reshaping industries, from defense to clean energy. Investors who positioned themselves early in this space are already seeing double-digit gains, and the momentum shows no signs of slowing.

The shift toward domestic critical minerals is a game-changer for both national security and economic growth.

– Industry analyst

Challenges and Opportunities Ahead

Of course, scaling domestic production isn’t without challenges. Mining and processing critical minerals require significant investment, regulatory approvals, and skilled labor. Environmental concerns also loom large, as sustainable practices become a priority for both policymakers and consumers. Yet, these challenges are also opportunities for innovation—think advanced extraction techniques or eco-friendly processing methods.

In my opinion, the companies that can balance efficiency, sustainability, and scalability will come out on top. The antimony deal is a proof of concept, showing that domestic players can meet the moment. But it’s up to the industry to keep pushing forward, and I’m optimistic about what’s to come.

Final Thoughts: A Step Toward Self-Reliance

The $10 million antimony contract is more than a business deal—it’s a statement. It signals a commitment to strengthening America’s defense and industrial capabilities while reducing reliance on foreign supply chains. For those of us watching from the sidelines, it’s a reminder that the smallest components—like a humble mineral—can play an outsized role in shaping the future.

As the U.S. continues to prioritize strategic resources, companies in this space will likely see growing opportunities. Whether you’re an investor, a policymaker, or just someone curious about the forces shaping our world, this is a story worth following. What’s the next mineral to take center stage? Only time will tell, but for now, antimony is stealing the spotlight.