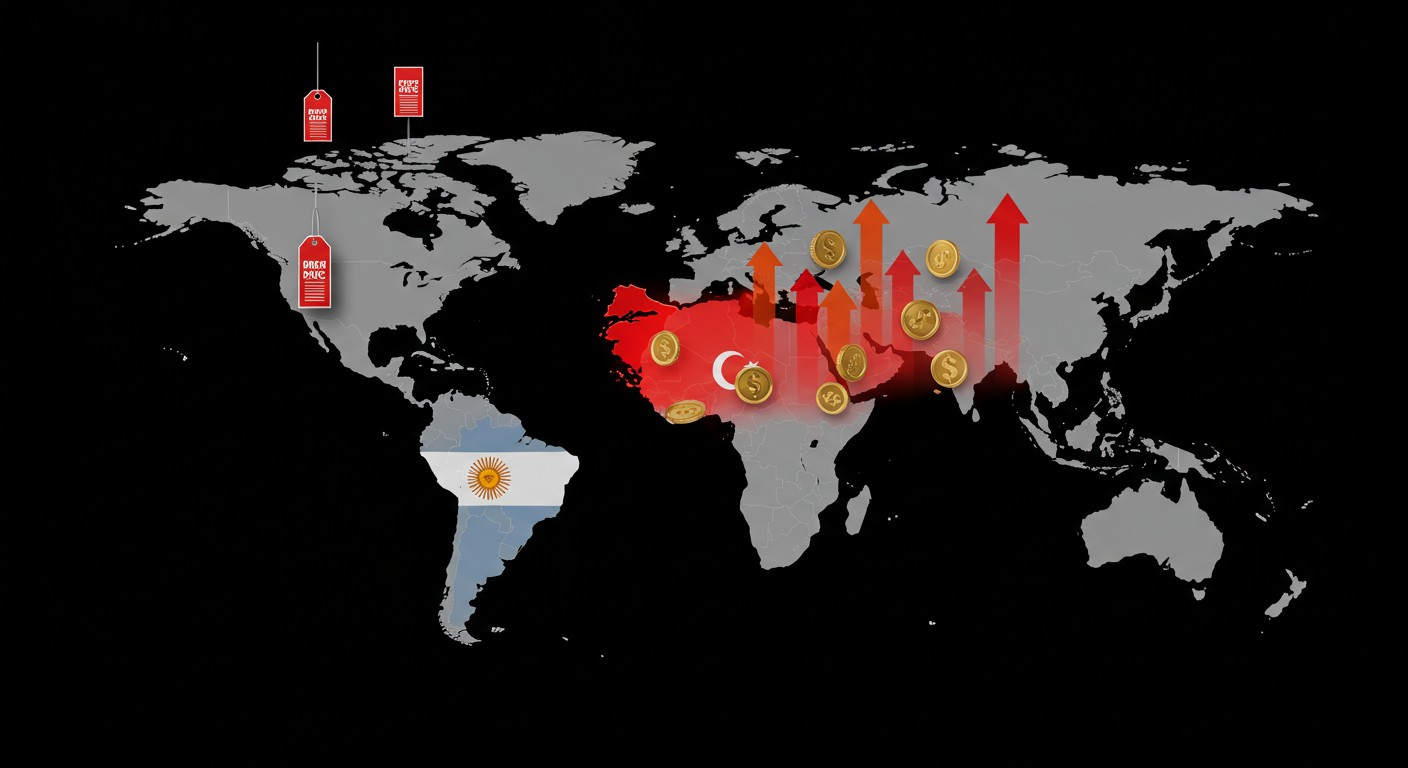

Ever wondered why some countries can’t seem to tame skyrocketing prices while others are practically begging people to spend? It’s a wild ride out there in the global economy, and the latest snapshot of G20 inflation rates paints a vivid picture. From Argentina’s jaw-dropping 33.6% annual inflation to China’s dip into deflation at -0.4%, the disparities are stark. Let’s dive into what’s driving these extremes and what it means for the world in 2025.

The Global Inflation Landscape in 2025

The world’s largest economies are grappling with wildly different challenges. Some are wrestling with runaway price growth, while others face the eerie quiet of declining consumer demand. This uneven terrain isn’t just numbers on a spreadsheet—it’s shaping lives, businesses, and governments. Let’s break down the key players and what’s at stake.

Argentina: A Flicker of Hope Amid Persistent Inflation

Argentina’s inflation rate of 33.6% makes it the G20’s undisputed heavyweight in price surges. But here’s a twist: August 2025 marked the lowest monthly increase since 2022, with prices creeping up by just 1.9%. Is this a sign that the country’s economic storm might be calming? I’m cautiously optimistic, but history tells us not to get too comfortable.

Years of economic mismanagement, tight currency controls, and a weakening peso have left deep scars. The cost of everyday goods—think bread, fuel, rent—keeps climbing, squeezing households. Recent financial support from the U.S. offers a lifeline, but without bold reforms, it’s like putting a bandage on a broken leg. Structural challenges, like rebuilding trust in the peso, remain daunting.

Argentina’s economy is a tightrope walk—stabilizing inflation requires more than temporary aid.

– Global economic analyst

What’s next for Argentina? The government needs to balance short-term relief with long-term fixes. Easier said than done, but if they can keep monthly inflation low, there’s hope for a softer landing.

Türkiye: Lira Woes and Policy Missteps

Türkiye’s not far behind, with inflation clocking in at 33%. Food, energy, and housing costs are hitting families hard. The central bank’s choice to cut interest rates—yep, you read that right—has raised eyebrows. Most economists would argue that tightening policy is the way to cool inflation, but Türkiye’s playing a different game.

The Turkish lira’s slide is a big culprit. A weaker currency means imports, from oil to electronics, cost more. August’s price hikes were steeper than expected, shaking confidence in the central bank’s strategy. If I were a betting person, I’d say Türkiye’s in for a bumpy ride unless policymakers pivot fast.

- Food prices: Soaring, making daily necessities a luxury for many.

- Energy costs: Rising, driven by global markets and a weak lira.

- Housing: Rents and home prices are climbing, squeezing budgets.

Can Türkiye turn it around? A stronger lira and tighter monetary policy could help, but political will is key. For now, families are left navigating a tough economic reality.

China: Deflation’s Quiet Threat

While Argentina and Türkiye are fighting inflation fires, China’s dealing with a different beast: deflation. At -0.4% year-over-year in August, consumer prices are falling. Sounds great, right? Cheaper stuff! But hold on—deflation often signals weak demand, and that’s a red flag for the world’s second-largest economy.

China’s facing a perfect storm: a shrinking workforce, declining birth rates, and an aging population. Add a struggling real estate sector—once a massive driver of growth, accounting for up to 30% of GDP—and you’ve got a recipe for economic stagnation. Falling home prices and developer defaults aren’t just numbers; they’re eroding confidence among consumers and investors.

Deflation is a silent killer—it saps growth and chills spending.

– Economic researcher

Perhaps the most worrying part? China’s long relied on investment-driven growth, but that model’s showing cracks. Shifting to a consumption-driven economy sounds nice on paper, but it’s a massive undertaking. Without big policy moves, deflation could linger, dragging down global trade.

The Rest of the G20: A Mixed Bag

Beyond the outliers, the G20’s inflation picture is varied. The U.S. hit 2.9% in August, its highest since January, but still manageable. Japan’s at 2.7%, and the Euro Zone’s hovering at 2.0%, both close to central bank targets. Meanwhile, Canada (1.9%) and South Korea (1.7%) are keeping things cool.

| Country | Inflation Rate (YoY %) |

| Argentina | 33.6% |

| Türkiye | 33.0% |

| United States | 2.9% |

| Japan | 2.7% |

| Euro Zone | 2.0% |

| Canada | 1.9% |

| South Korea | 1.7% |

| China | -0.4% |

This spread shows how diverse the global economic landscape is. Some countries are tiptoeing toward stability, while others are stuck in extremes. It’s like watching a global chess game where every player’s got a different strategy.

What’s Driving These Trends?

Inflation and deflation don’t just happen—they’re driven by a mix of policy, market forces, and structural shifts. Let’s break it down:

- Currency Dynamics: Weak currencies like Argentina’s peso and Türkiye’s lira jack up import costs, fueling inflation.

- Monetary Policy: Türkiye’s rate cuts defy conventional wisdom, while other central banks are more cautious.

- Demographic Shifts: China’s aging population and shrinking workforce are curbing spending, pushing deflation.

- Sectoral Crises: China’s real estate slump is a major drag, while global energy prices hit countries like Türkiye hard.

These factors aren’t isolated—they ripple across borders. A weak lira affects global trade, just as China’s deflation could cool demand for exports. It’s a connected world, and no economy operates in a vacuum.

What’s the Global Outlook?

Looking ahead, the global economy’s at a crossroads. Argentina and Türkiye need bold reforms to tame inflation without crushing growth. China’s got to spark domestic demand to escape deflation’s grip. Meanwhile, countries like the U.S. and Japan are walking a tightrope, aiming to keep inflation in check without tipping into recession.

In my view, the most fascinating part is how interconnected these challenges are. A policy misstep in one country can send shockwaves globally. For instance, if China’s deflation deepens, it could drag down commodity prices, hitting exporters hard. On the flip side, stable inflation in places like Canada offers a glimmer of hope.

The global economy is like a puzzle—every piece affects the whole picture.

– Financial strategist

So, what can we expect in 2026? More volatility, for sure, but also opportunities for countries that play their cards right. Keep an eye on central banks—they’ll be the ones steering the ship.

Why This Matters to You

You might be thinking, “Inflation in Argentina? Deflation in China? How’s that my problem?” Fair question. But whether you’re saving for a house, investing in stocks, or just buying groceries, global economic trends hit your wallet. Rising import costs in Türkiye could mean pricier goods worldwide. China’s deflation might cool global markets, affecting your investments.

Here’s a quick takeaway list to keep you grounded:

- Watch global trends: Inflation and deflation affect everything from gas prices to your savings.

- Stay informed: Economic shifts in one country can ripple to yours.

- Plan smart: Diversify investments to hedge against volatility.

The world’s economy is a complex beast, but understanding these dynamics gives you an edge. Whether you’re a casual observer or a savvy investor, these trends shape the future we’re all living in.

Final Thoughts

The G20 inflation snapshot for 2025 is a reminder of how diverse and interconnected our world is. Argentina and Türkiye are battling price surges, while China’s grappling with the opposite. Each country’s story offers lessons—and warnings—for the rest of us. As we move toward 2026, the question isn’t just how these economies will fare, but how their challenges will shape the global landscape. Stay curious, and keep your eyes on the numbers.