Ever wondered just how much the US car market means to the world’s biggest automakers? I’ve been digging into this lately, and let me tell you, the numbers are eye-opening. With talk of tariffs swirling and trade policies shifting, it’s a pivotal moment to understand how much foreign car giants depend on American buyers—and what they’re doing to navigate these choppy waters.

The US: A Goldmine for Global Automakers

The United States isn’t just another market for carmakers—it’s a powerhouse. For many foreign automakers, American consumers are a linchpin, driving a hefty chunk of their global revenue. But how reliant are they, really? Let’s break it down with some hard data and see what’s at stake.

How Much Revenue Comes from the US?

Foreign automakers lean on the US market more than you might think. Recent analysis shows that for some Japanese giants, the US accounts for over 30% of their global sales. South Korean and German brands aren’t far behind, with the US often representing a quarter or more of their revenue streams. Why? Americans love their cars—SUVs, trucks, hybrids, you name it—and they’ve got the purchasing power to back it up.

The US is the world’s second-largest auto market, and its appetite for vehicles fuels global production.

– Industry expert

Take a major Japanese brand, for instance. In 2023, their US sales skyrocketed by over 30%, thanks to a surge in demand for hybrid models. That’s not just a blip—it’s a lifeline. German luxury brands, too, rely on American buyers to keep their margins fat. The US isn’t just a market; it’s a make-or-break territory for these companies.

The Tariff Threat: A Game-Changer?

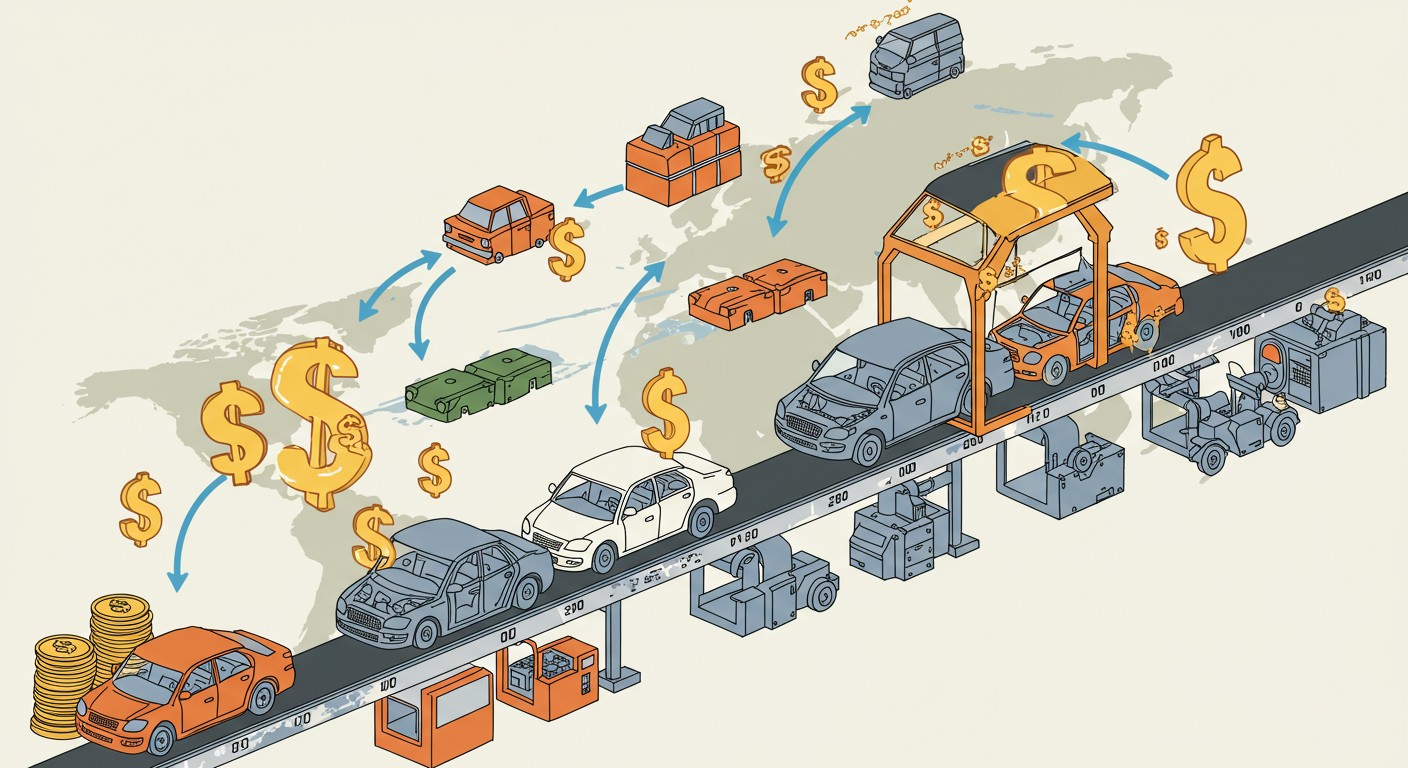

Now, let’s talk about the elephant in the room: tariffs. There’s been buzz about slapping hefty taxes on imported vehicles, and that’s got automakers sweating. The logic behind these tariffs is simple—push companies to build cars in the US rather than ship them from overseas. Sounds straightforward, right? But it’s not that easy.

Moving production to the US isn’t like flipping a switch. It’s a multi-year, multi-billion-dollar gamble. One industry insider put it bluntly: setting up a new factory takes at least three years. That’s assuming everything goes smoothly, which, let’s be honest, it rarely does. Plus, automakers rely on a tangled web of global suppliers for parts—think semiconductors from Asia, steel from Europe, and batteries from who-knows-where. Tariffs could jack up costs, squeeze margins, and force some tough choices.

- Higher prices: Tariffs could make imported cars pricier for consumers.

- Production shifts: Some automakers might build US plants to dodge tariffs.

- Supply chain chaos: Global networks could face disruptions.

Where Are These Cars Coming From?

Let’s zoom out and look at where the US gets its vehicles. In 2024, nearly half of new cars sold here were assembled abroad. That’s a big deal. The top countries shipping cars to the US are a mix of neighbors and far-off players, each with their own strengths.

| Country | Import Value (2024) |

| Mexico | $78.5B |

| Japan | $39.7B |

| South Korea | $36.6B |

| Canada | $31.2B |

| Germany | $24.8B |

Mexico’s at the top, thanks to its proximity and trade agreements. Japan and South Korea dominate with reliable sedans and EVs, while Germany’s all about luxury. Canada’s no slouch either, churning out trucks and SUVs. These numbers show just how globalized the auto industry is—and why tariffs could send shockwaves worldwide.

How Automakers Are Fighting Back

Foreign automakers aren’t sitting ducks—they’re already making moves. I’ve noticed a pattern: those who’ve invested heavily in the US seem better positioned to weather the storm. Take one Japanese brand that’s pouring over $1 billion into its Ohio factories. They’re retooling to produce gas, hybrid, and electric vehicles on the same line. Smart, right?

Then there’s the battery game. EVs are the future, and automakers know it. That same company’s teaming up with a major energy firm to build a $4.4 billion battery plant in Ohio. It’s a bold bet on America’s EV boom—and a hedge against tariffs. Other brands are following suit, doubling down on US production to stay competitive.

Investing in US manufacturing isn’t just about tariffs—it’s about securing a foothold in the world’s most lucrative market.

– Automotive analyst

The Risks of Over-Reliance

Here’s where it gets tricky. Depending too much on one market—like the US—can backfire. If tariffs hit hard, or if American demand dips, automakers could be in hot water. I’ve seen this before in other industries: put all your eggs in one basket, and you’re asking for trouble. Diversifying markets is easier said than done, though. Europe’s saturated, China’s a tough nut to crack, and emerging markets aren’t ready to pick up the slack.

That said, some automakers are playing the long game. They’re eyeing Southeast Asia and Latin America for growth, but those markets won’t replace the US overnight. For now, it’s all about balancing act—keep American buyers happy while exploring new horizons.

- US focus: Prioritize American production and marketing.

- Global outreach: Test waters in emerging markets.

- Innovation: Invest in EVs and autonomous tech to stay ahead.

What Does This Mean for Investors?

If you’re an investor, this is more than just auto industry gossip—it’s a chance to spot opportunities. Automakers with strong US operations could be safer bets if tariffs kick in. Look for companies investing in American plants or EV tech. On the flip side, those heavily reliant on imports might face headwinds. It’s all about risk management, something every smart investor keeps top of mind.

According to recent analysis by Investopedia, diversification across industries and regions remains key to weathering trade disruptions. That’s solid advice. Personally, I’d keep an eye on supply chain stocks too—tariffs could shake up logistics and component makers in ways we’re not fully seeing yet.

The Bigger Picture: Global Trade at a Crossroads

Zoom out, and this isn’t just about cars—it’s about the future of global trade. Tariffs, supply chains, and manufacturing are all pieces of a bigger puzzle. The auto industry’s a great lens because it’s so interconnected. What happens here could ripple into tech, energy, even agriculture. Perhaps the most fascinating part is how it forces us to rethink globalization itself.

Will we see a shift toward regional production? Maybe. Could automakers double down on automation to cut costs? Quite possibly. One thing’s for sure: the companies that adapt fastest will come out on top. And for investors, consumers, and policymakers, staying informed is half the battle.

Trade policies shape industries, but adaptability shapes winners.

Wrapping It Up: What’s Next?

The US auto market is a juggernaut, and foreign automakers know it. They’re hooked on American buyers, but with tariffs looming, the road ahead’s got some curves. From billion-dollar factory upgrades to bold EV bets, these companies are scrambling to stay in the game. For me, the real question is: can they pivot fast enough?

Whether you’re an investor eyeing opportunities or just curious about the car industry’s future, one thing’s clear: change is coming. Keep an eye on the Financial Times for broader market trends—it’s a great way to stay ahead. What do you think—will tariffs reshape the auto world, or is this just another bump in the road?