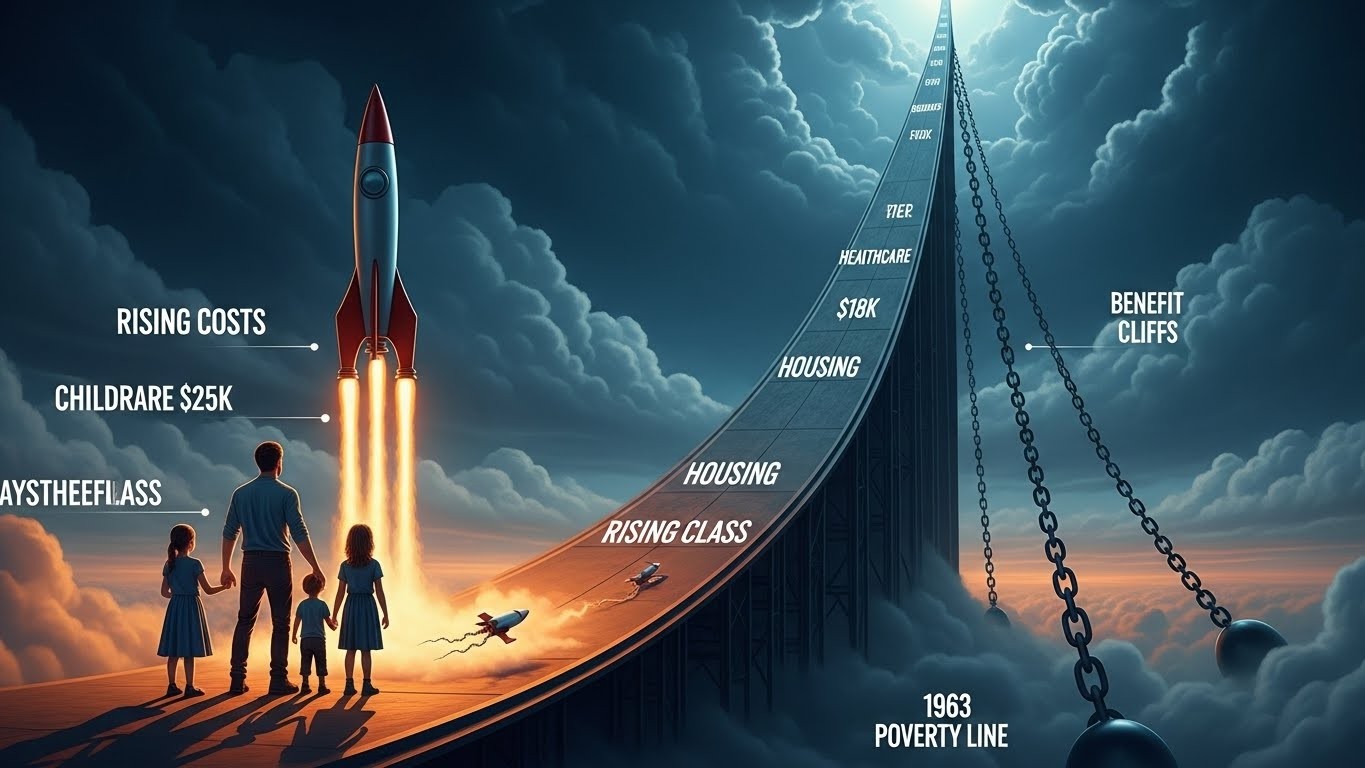

Picture this: a family of four brings home $72,000 after taxes. On paper, they’re miles above the federal poverty line. In reality, they’re rationing doctor visits, praying the car doesn’t break down, and wondering why every small raise at work seems to make life harder instead of easier.

I’ve watched friends go through exactly that. One extra promotion, a little overtime, and suddenly childcare subsidies vanish, health insurance premiums triple, and the net result is less money in the bank than before. It feels insane—because it is.

The core of the problem is shockingly simple. The official way America measures poverty is still rooted in a 1963 calculation that assumed food ate up one-third of a family’s budget. Update that math for today’s reality and you quickly realize the true “escape velocity” just to participate in modern life is somewhere between $130,000 and $160,000 for a typical family. Anything less and you’re not climbing—you’re stuck in a slow financial orbit that eventually decays.

The One Statistic That Should Terrify Every Policymaker

In 1963, the average American household spent roughly 33 cents of every dollar on food. That’s the entire foundation of the current poverty thresholds. An economist named Mollie Orshansky took the cost of a bare-bones food plan and multiplied it by three. That became the line. Congress loved the simplicity and we’ve been stuck with variations of it ever since.

Fast-forward sixty years. Food now claims 6-9% of the typical budget in developed countries. The money didn’t disappear—it migrated to housing, healthcare, childcare, transportation, and education. Those categories didn’t just inch up with general inflation; they exploded because of policy choices layered decade after decade.

Apply Orshansky’s original logic today and the poverty line for a family of four jumps from the official $31,200 (2025 figures) to something closer to $140,000. That single recalculated number exposes how broken the system has become.

What “Escape Velocity” Actually Costs in 2025

Let’s build a brutally realistic minimum participation budget for a family with two working parents and two young kids. No fancy vacations, no private schools, no daily Starbucks—just the basics required to hold jobs and raise children without constant crisis.

- Modest rent or mortgage in an average metro area (not SF or NYC): $2,200–$2,800/month

- Health insurance + out-of-pocket (employer plan): $1,200–$1,800/month

- Childcare for two preschool/school-age kids: $1,800–$2,600/month

- Transportation (two older paid-off cars + insurance + gas): $800–$1,100/month

- Food (cooked at home, minimal eating out): $900–$1,200/month

- Utilities, internet, phones: $500–$700/month

- Basic clothing, household, miscellaneous: $400–$600/month

Add it up and you’re looking at $8,000–$11,000 a month after taxes just to keep the lights on and the kids cared for while both parents work. That translates to a pre-tax household income of roughly $135,000–$165,000 depending on state taxes and exact location. And remember—this budget has zero savings, zero retirement contributions, and zero margin for emergencies.

The Cruel Mathematics of Benefit Cliffs

Here’s where things turn vicious. Most safety-net programs phase out abruptly between 130% and 250% of the federal poverty line—exactly the income range where families are trying to climb from survival to stability.

Earn one more dollar and you can lose thousands in subsidies overnight. I’ve seen effective marginal tax rates over 100%. Yes, you read that right: families literally become poorer by earning more.

Earning an extra $10,000 can trigger $20,000–$30,000 in lost benefits in some states. The system punishes the very behavior we claim to reward.

Suddenly “just work harder” isn’t motivational advice—it’s a recipe for financial disaster. Is it any wonder some families rationally decide to cap hours or turn down promotions?

How We Broke Housing, Healthcare, and Childcare

The explosion in mandatory expenses didn’t happen by accident. Layer after layer of regulation, restriction, and monetary distortion created perfect storms in exactly the sectors families can’t avoid.

Housing? Decades of zoning laws and NIMBY resistance choked supply while population grew. Result: the median home price is now eight times median income in many metro areas—worse than before the 2008 crash.

Healthcare? Certificate-of-need laws, insurance mandates, and the third-party-payer system insulated providers from normal market pressure. Costs rose 3–4 times general inflation for half a century.

Childcare? Licensing requirements, staff-to-child ratios set by lawmakers, and facilities mandates turned what should be a service industry into a heavily regulated profession with costs rivaling college tuition.

Meanwhile, wages for non-college-educated workers stagnated in real terms while these unavoidable expenses skyrocketed. The gap isn’t laziness—it’s arithmetic.

When Lottery Tickets Make More Sense Than Overtime

In a world where $100,000 income jumps are required to reach actual stability, but normal career progression delivers $5,000–$15,000 raises that trigger massive benefit losses, something perverse happens to rational thinking.

A $2 scratch-off ticket with a one-in-a-million $2 million payout starts looking mathematically defensible compared to grinding away for decades under 90% effective tax rates.

This isn’t moral failure. It’s the predictable human response to a payoff structure designed by people who never have to live under it.

The Political Trap Nobody Wants to Talk About

Raising eligibility limits to realistic modern levels would instantly make half the country eligible for benefits we can’t afford. The current welfare state is already on thin actuarial ice; extending it upward would collapse the budget within years.

But keeping the 1963 thresholds guarantees millions stay trapped, discouraged from earning more because progress equals punishment. It’s the ultimate lose-lose engineered by decades of kicking the can down the road.

Three Reforms That Could Actually Fix This

None of these are politically easy, but they attack root causes instead of symptoms:

- Replace abrupt benefit cliffs with smooth phase-outs over a realistic income band—maybe 200% to 400% of a modernized poverty measure.

- Deregulate supply in the big four cost drivers: build more housing, repeal certificate-of-need laws, loosen occupational licensing for childcare, allow more price-transparent healthcare options.

- Move toward rules-based monetary policy that stops systematically eroding purchasing power and inflating asset bubbles that price young families out of basic stability.

Each of these would do more to help working families than another dozen new subsidy programs layered on the existing broken foundation.

The tragedy isn’t that people aren’t trying hard enough. The tragedy is that we built a system using 1963 math in a 2025 economy and then act surprised when millions can’t escape the gravity well we designed.

Until we update the parameters—or better yet, remove the distortions that made the update necessary in the first place—upward mobility will remain theoretical for tens of millions of American families who are doing everything society told them to do.

The numbers don’t lie. And right now, they’re screaming.