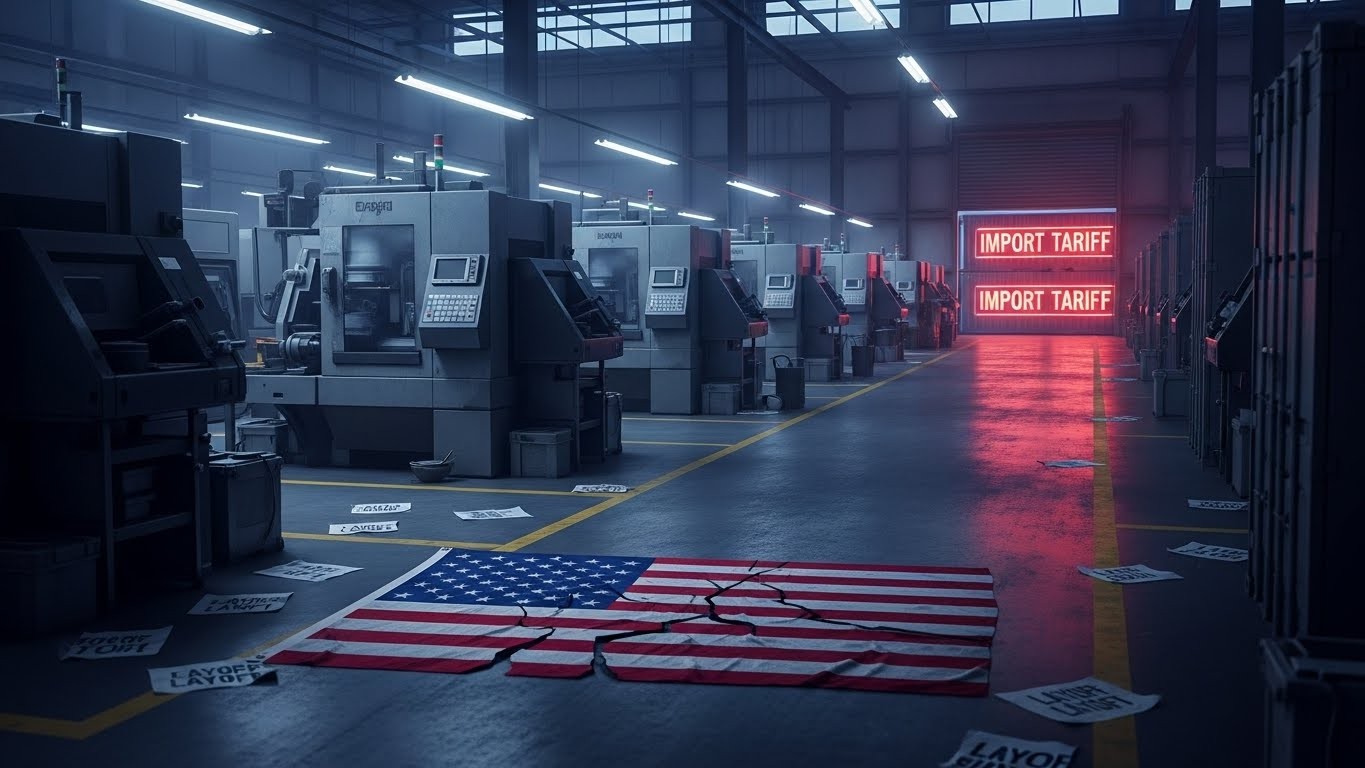

Picture this: a factory somewhere in the Midwest that’s been running three shifts for decades suddenly goes quiet. The parking lot, once packed by 6 a.m., now has weeds growing through the cracks. That’s not some dystopian movie scene—it’s what a growing number of executives say could become reality in 2026 because of the very policy that was supposed to save those jobs.

I’ve been digging into the latest survey data and talking to people in manufacturing, and honestly, the mood is grim. The tariffs everyone cheered as a way to punish overseas producers and bring work back home? They’re starting to look more like a sledgehammer swung at a problem that needed a scalpel.

The Promise vs. the Emerging Reality

When the tariff conversation started years ago, the pitch was simple and powerful: slap duties on imported goods, make it expensive to build overseas, watch factories spring up across Ohio, Pennsylvania, and the Carolinas. Politicians sold it as the ultimate jobs program. Blue-collar workers loved the sound of it. Investors bought the story too—at first.

Fast forward to the end of 2025, and the feedback from the actual people running companies tells a very different tale. Instead of new hiring banners, many are drafting reduction-in-force plans. Instead of expanding U.S. plants, some are scouting new locations in Southeast Asia or Mexico where the math still works.

What the Factory Floor Is Actually Saying

Every month, purchasing managers across manufacturing get asked the same basic question: are things getting better or worse? Lately the answers read like a cry for help.

“We are starting to institute more permanent changes due to the tariff environment. This includes reduction of staff, new guidance to shareholders, and development of additional offshore manufacturing that would have otherwise been for U.S. export.”

– Transportation equipment executive, November 2025

That one quote stopped me cold. The very policy designed to stop offshoring is now accelerating it. And this isn’t an isolated voice—similar comments showed up across multiple industries in the same survey.

Another manager in electrical equipment put it even more bluntly: conditions right now feel worse than during the height of the pandemic supply-chain chaos. Think about that for a second. Most of us remember 2020–2021 as the absolute low point for certainty. Yet here we are.

The Numbers Don’t Lie—And They’re Ugly

Let’s talk hard data. The closely watched manufacturing index slipped again in November to 48.2. Any reading under 50 signals contraction. More telling was the employment component—it dropped to 44, one of the lowest readings all year.

In plain language: factories are already shrinking payrolls, and the biggest tariff increases haven’t even fully kicked in yet.

- Employment sub-index: 44 (lowest since summer)

- Overall activity: contracting for months

- New orders: barely growing

- Prices paid: still climbing fast

When prices go up but orders don’t, there’s only one lever left to pull—headcount.

Even Energy Isn’t Immune

You would think domestic energy producers would be celebrating. After all, many of the same voices pushing tariffs also promised an “American energy dominance” renaissance. Yet one respondent in petroleum and coal products painted a darker picture:

“Going into 2026 we expect to see big changes with cash flow and employee head count… The company has sold off a big part of the business that generated free cash while offering voluntary severance packages to anyone.”

Even in a sector that was supposed to be a winner, companies are bracing for pain.

Why the Lag—and Why 2026 Looks So Risky

Here’s the part a lot of people miss: tariffs don’t hit all at once. Companies hedged, they stockpiled, they negotiated temporary exemptions. Many of the biggest rate hikes phase in during 2026. That’s why the full sting is still ahead of us.

A recent global economic outlook from a major international organization put it plainly: the bite on trade volumes is already visible in the data, and the worst effects are still coming. Import values subject to the highest duties have already dropped sharply—meaning demand is getting crushed before the broader layoffs even start.

The Offshoring Paradox Nobody Wants to Talk About

Perhaps the most bitter irony is this: when tariffs make it too expensive to import finished goods or components, some companies don’t decide to build here—they decide to build even farther away and ship finished products from countries not (yet) on the tariff hit list.

In my experience covering trade for years, I’ve seen this movie before. Raise costs unpredictably and companies don’t suddenly become patriotic; they become mathematicians. And right now the math points to new plants in Vietnam, expanded capacity in Mexico, or deeper partnerships in countries with fresh trade agreements.

Retail: The Next Domino

Manufacturers aren’t the only ones sweating. Retailers—especially anyone selling imported furniture, appliances, clothing, or electronics—are staring at 20-60% cost increases on entire categories. Some are eating the margins (for now). Others are passing it on and watching units sold collapse.

One large retailer told analysts their average costs are already up roughly 20% year-over-year purely from tariffs. Another said they’ve stabilized—for now—but nobody believes that lasts into next year.

When retailers hurt, guess who feels it next? Warehouses, trucking companies, port workers, and eventually the stores themselves. Job losses ripple.

What Would It Take to Change Course?

Look, I’m not here to litigate trade policy in a vacuum. Tariffs can be a legitimate tool when targeted, predictable, and paired with real incentives to build domestically. But when they’re broad, constantly shifting, and layered on an already uncertain global picture, they can do more harm than good.

If policymakers want the “reshoring” story to actually work, they’ll need more carrots and fewer surprise sticks. Tax credits that actually get used, infrastructure spending that shows up on time, workforce training programs that companies trust—those are the things that move factories, not just punishing importers.

Bottom Line for 2026

Here’s where we stand heading into the new year: the labor market is already cooling, corporate profits are under margin pressure, and the biggest wave of tariff pain is still in front of us.

Barring major exemptions, phasedown announcements, or new incentives, a meaningful increase in layoffs—especially in manufacturing and related sectors—feels almost inevitable at this point. And the tragic part? Many of those jobs won’t be coming back, because the same tariffs pushing companies to cut here are pushing them to invest permanently somewhere else.

Sometimes the road to hell really is paved with good intentions. Let’s hope 2026 proves that wrong—but right now, a lot of factory workers and their families aren’t betting on it.

Keep an eye on the data releases in January and February. If the employment components keep sliding and the anecdotal comments get darker, we’ll know the tariff reckoning has arrived.