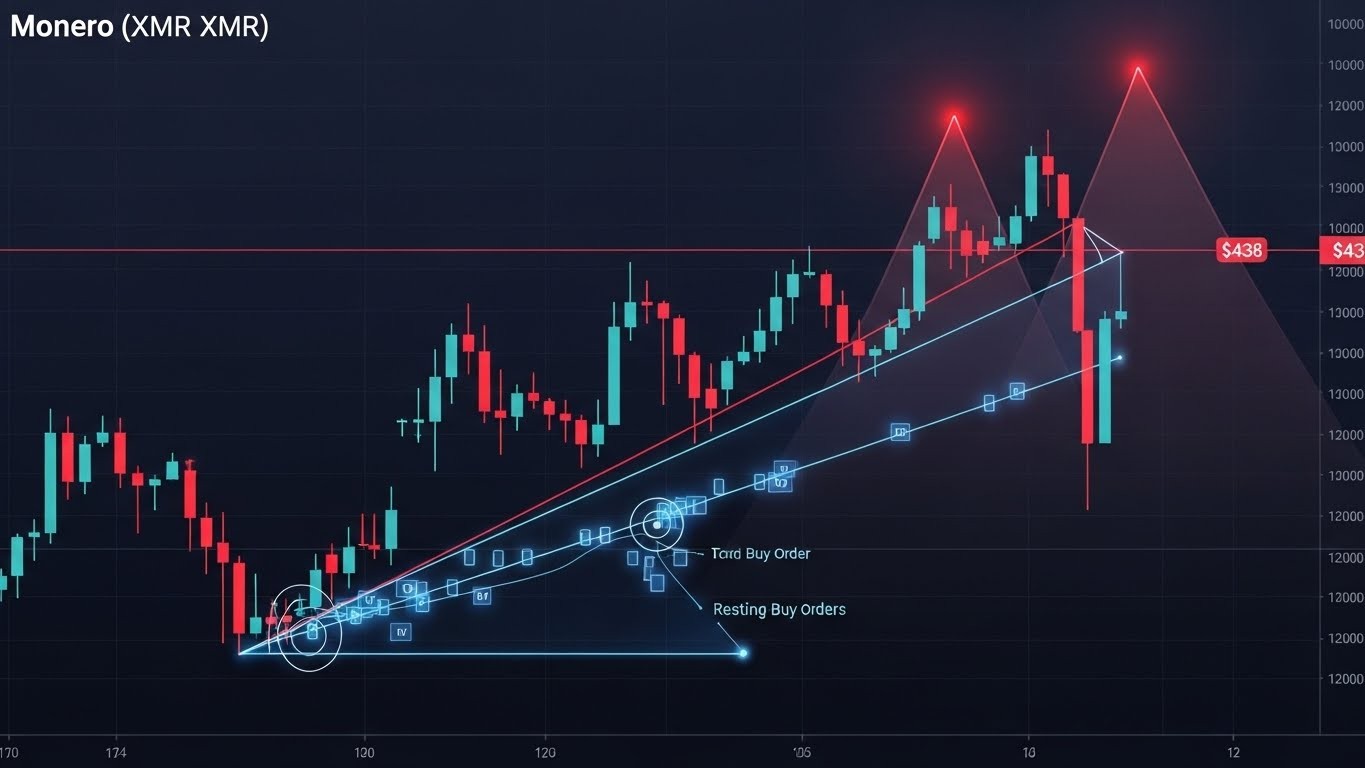

Have you ever watched a coin run straight up, touch a round number everyone is talking about, and then… just roll over? That’s exactly what happened to Monero this week. After teasing the $438 level twice, XMR printed what looks like a textbook double top and has since broken down hard. The bears aren’t just knocking on the door anymore – they’ve kicked it down.

I’ve been following privacy coins for years, and these moments always feel heavier than your average altcoin correction. When Monero starts bleeding, it usually means something deeper is shifting in market sentiment. Let’s break down what’s actually happening on the charts and why the path of least resistance suddenly points south.

The Double Top That Nobody Wanted to See

Double tops are one of those patterns that make technical traders sit up straight. They’re simple, they’re brutal, and when they form at major historical resistance like $438 for Monero, they tend to mean business.

Think about it: the first peak hits $438 and gets rejected. Bulls shake it off – normal profit-taking, right? They regroup, push again, and… same exact level, same exact rejection. That’s not coincidence. That’s distribution. Smart money saw the wall, took profits, and left retail holding the bag at the top.

In my experience, when you combine a double top with decreasing volume on the second push (which is exactly what we saw), the reversal probability shoots through the roof. This wasn’t some random wick – it was a deliberate ceiling.

The Rising Wedge That Sealed the Deal

If the double top was the warning shot, the rising wedge breakdown was the confirmation kill.

After failing at $438 the second time, Monero didn’t just drop – it consolidated in a beautiful but deadly rising wedge. Higher lows, lower highs, shrinking volume… all the classic signs that bulls were losing steam while bears patiently waited for their moment.

When that lower trendline finally cracked, the move was swift and merciless. We’ve now seen follow-through selling that confirms the pattern isn’t just theoretical anymore. This is real bearish momentum.

Rising wedges in uptrends resolve downward roughly 70% of the time. When they form after a double top at major resistance, that probability feels closer to 90% in crypto markets.

Where the Real Support Actually Lives

Now comes the part most traders hate: there’s almost nothing between current price and the next major demand zone.

Looking at the higher timeframe, the $319-$313 region stands out for multiple reasons:

- Previous all-time high resistance from 2021 that flipped to support

- High-volume node from the last major accumulation phase

- The 0.618 Fibonacci retracement of the entire move up from the bear market lows

- Round psychological level that tends to attract resting liquidity

Markets love clean sweeps to liquidity. Right now, there’s a massive pool of stop losses above $420-$430 and almost no real bids until we hit that lower zone. Guess where price wants to go?

The Privacy Coin Rotation Nobody’s Talking About

Here’s something I’ve noticed over multiple cycles: privacy coins don’t move in isolation. When Bitcoin dominates, privacy becomes less of a priority. When regulation heats up or exchanges start delisting, suddenly everyone remembers why Monero exists.

Right now? We’re in full risk-on mode. Bitcoin is making new highs, altcoins are pumping, and privacy just isn’t the hot narrative. Capital rotates to whatever’s working, and right now that’s not XMR.

Interestingly, some newer privacy projects have been absorbing flow that might have gone to Monero six months ago. The sector isn’t dead – it’s just rotating. And Monero, being the old guard, tends to suffer most during these periods.

Volume Profile Tells the Same Story

One of my favorite tools for confirming structural changes is volume profile. What does it show for Monero right now?

The point of control (highest volume node) from the recent rally sits right around $340. Price is currently trading below this level, which is classically bearish. The next high-volume node below? You guessed it – that $313-319 area we’ve been discussing.

| Level | Type | Significance |

| $438 | Double Top Resistance | Failed breakout zone |

| $400-$410 | Minor support | Likely to break |

| $340 | Point of Control | Current price below = bearish |

| $319-$313 | Major demand zone | Next realistic target |

What Would Actually Invalidate This Setup

To be fair, no setup is ever 100%. For the bears to lose control here, we’d need to see:

- A strong close back above $436 (ideally on expanding volume)

- Rejection of lower prices and higher low formation

- Break and retest of the wedge as support

- Significant increase in privacy narrative strength

Until any of those things happen? The structure remains clearly bearish. I’ve learned the hard way that fighting clean technical breakdowns rarely ends well.

The Bigger Picture for Privacy Coins

Stepping back, this move in Monero says more about market cycles than about the coin itself. Privacy coins have always been counter-cyclical – they shine when everything else looks risky, and they fade when greed takes over.

Right now we’re in the greed phase. Bitcoin dominance is climbing, regulatory pressure feels distant, and traders want maximum upside with minimum friction. Monero, with its slower transactions and regulatory target on its back, just doesn’t fit the current meta.

That doesn’t mean it’s dead. It means it’s on sale for the next time the market remembers why privacy actually matters.

Look, I’ve been wrong before. Maybe this is the deepest shakeout since 2022 and Monero rips straight through $500 while I’m writing this. But the charts don’t lie, and right now they’re screaming one thing: caution.

The double top at $438, the rising wedge breakdown, the volume profile, the lack of support until $313… everything lines up for continuation lower. Sometimes the cleanest setups are the scariest because there’s literally no narrative to fight them.

If you’re holding Monero, this might be the time to tighten those stops or consider taking some profits. If you’re looking to buy, that $313-319 zone looks like the place where real accumulation could begin again.

Either way, respect the pattern. The market has a way of humiliating anyone who thinks “this time is different” when the exact same setup printed six months ago.

Stay safe out there.