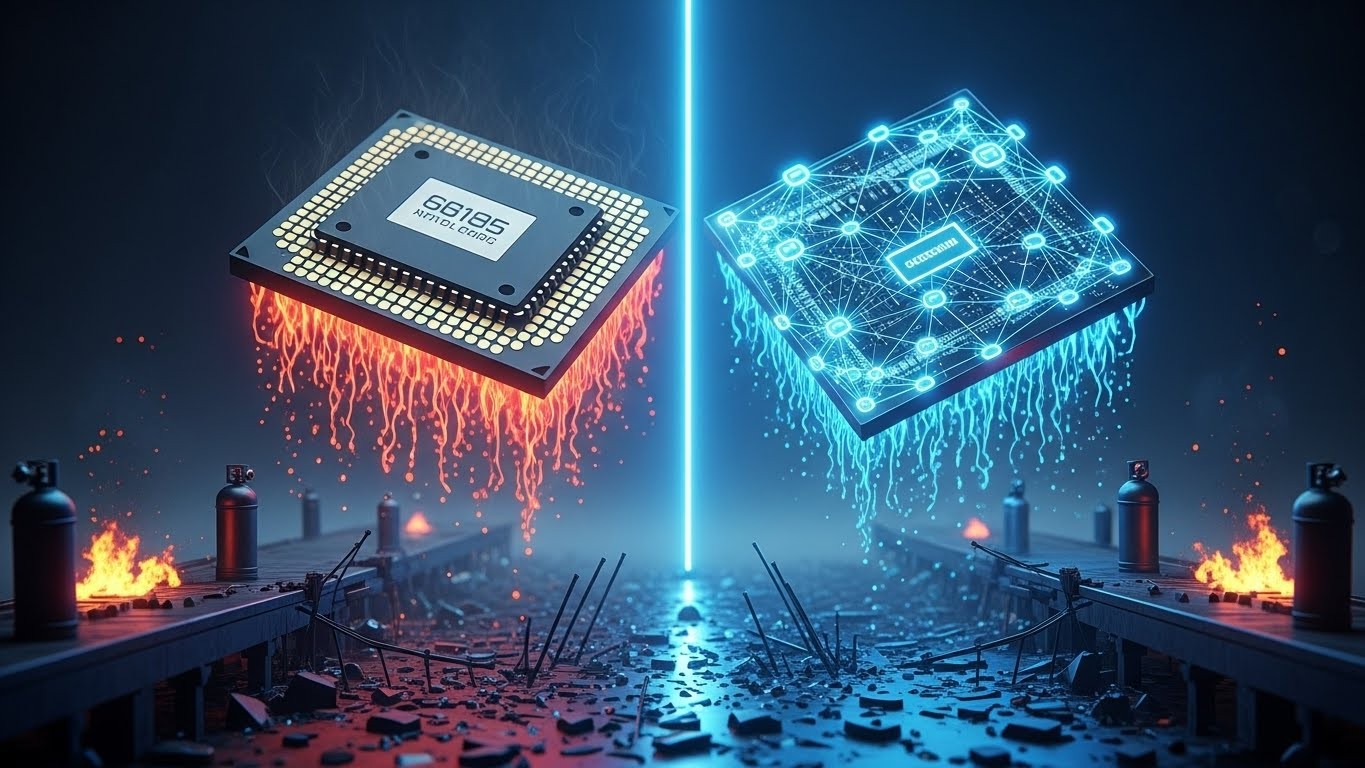

Remember when computer engineers thought the path to infinite speed was just cranking up the clock speed on a single chip? They pushed silicon until it literally melted. Then someone realized the future wasn’t a hotter processor — it was dozens, hundreds, thousands of specialized cores working together. I can’t shake the feeling that Web3 is living through the exact same delusion right now.

Every bull run we get a new savior chain promising millions of transactions per second. The pitch is always the same: bigger blocks, faster consensus, sub-cent fees. And every time real users show up, the experience still somehow feels like dial-up internet. Why? Because we’re trying to settle every apple, orange, and banana individually at the checkout instead of just paying the total at the end.

The 1984 Processor Trap in Modern Blockchains

In the 1980s the industry hit what we now call the power wall. A single core couldn’t get any faster without cooking itself. The breakthrough wasn’t a magical new transistor — it was parallelism and specialization. Yet here we are in 2025 still treating layer-1 and most layer-2 blockchains like they’re that lonely overheating core expected to do everything.

Blockchains were designed for final settlement, not high-frequency clearing. That distinction matters more than any TPS number ever will.

Settlement vs Clearing — The Difference Nobody Talks About

When you pay at a grocery store, the cashier doesn’t phone Visa for every item you scan. All the little transactions get netted out behind the scenes and only the final balance hits the payment rail. Traditional finance figured this out decades ago. Banks clear millions of trades between themselves every day and settle the net position overnight through the central bank.

Crypto? We proudly settle every meme-coin swap, every NFT mint, every DeFi yield claim directly on chain in real time. It’s like insisting the Fed supervise every pack of gum you buy. Noble in theory, insane in practice.

We built the most trustless settlement layer in history… then tried to run the entire economy on top of it without any clearing mechanism. It’s financial masochism.

The Three Headaches That Actually Stop Mass Adoption

Forget abstract debates about decentralization. Real people abandon wallets for three painfully concrete reasons:

- They see a $8 gas fee to move $20 and close the tab.

- They discover their USDC lives on Polygon but the cool new game is on Arbitrum and the bridge just got hacked again.

- They try a “simple” yield farm that requires approving tokens on four different chains and give up halfway.

Those aren’t growing pains. Those are architectural failures.

Gas Fees Aren’t a Feature — They’re Friction

Even the cheapest L2 still charges something for every action. That tiny fee is devastating psychologically. Traditional apps are free at point of use; Web3 apps feel like slot machines that occasionally bite you.

Zero-gas interactions aren’t a nice-to-have. They’re table stakes for anything beyond speculative trading.

Liquidity Fragmentation Is Quietly Killing Us

We now have hundreds of chains, each with its own isolated pools. Moving assets between them means trusting bridges that have lost billions — $2.17 billion in the first half of 2025 alone, if anyone is still counting.

Bridges aren’t a bug; they’re a symptom of solving the wrong problem. Unifying liquidity shouldn’t require wrapping tokens in ever more complex IOUs guarded by multisigs.

Developer Experience Is the Hidden Bottleneck

Want to build a cross-chain app today? Good luck juggling ten different SDKs, monitoring bridge statuses, and explaining to users why their funds are “in transit” for twelve hours. Most teams spend 80% of their time on plumbing and 20% on product. That ratio is backwards and everyone knows it.

So What Actually Works?

We need to stop treating the base layer like it has to be the operating system, the application server, and the database all at once. The real scaling leap comes from specialization.

Think of the blockchain as the central bank — slow, expensive, and absurdly secure. Then build a trustless clearing layer on top that handles the firehose of day-to-day activity and only touches the settlement layer when it absolutely must.

This isn’t another rollup. Rollups still inherit most of the base layer’s constraints. We’re talking about a true Layer 3 clearing network — peer-to-peer, non-custodial, and capable of netting millions of interactions before anyone pays a single wei of real gas.

How a Modern Clearing Layer Changes Everything

- Gasless for users — the clearing network sponsors or nets out fees; only net positions hit L1/L2.

- Unified liquidity — trade any asset on any chain without bridges because the clearing layer speaks every dialect natively.

- Instant finality for users — even if settlement is asynchronous, the economic effect is immediate and guaranteed.

- Developer paradise — write once, deploy everywhere. One API, one balance sheet, zero bridge monitoring.

In practice it looks a lot like the correspondent banking model, but fully decentralized. Participants run clearing nodes, stake collateral, provide liquidity, and earn fees — exactly like market makers do today, except now the rails are permissionless.

Lessons From History We Keep Ignoring

Computing escaped the single-core trap through parallelism and specialization. The internet scaled by pushing intelligence to the edge and keeping the core dumb and simple. Even Visa doesn’t try to process every authorization on a global monolithic ledger — it clears regionally and settles nightly.

Every industry that achieved hyper-scale did it by adding layers of abstraction, not by making the base layer faster.

Web3 is the only one still trying to defy that pattern.

What 2026 Could Look Like

Imagine opening a wallet and seeing one balance — not 15 versions of USDC scattered across chains. You click “swap” and it just happens, instantly, for free. Behind the scenes a clearing network routed the order, matched it with counterparty liquidity, and only when some threshold is crossed does a batched settlement hit Ethereum or Solana or whichever base layer you prefer.

The base layers keep doing what they’re good at: being boring, expensive, and unbreakable. Everything else moves upstack where speed and cost actually make sense.

I’ve been in this space since 2016 and I honestly believe this architectural shift is the single biggest unlock left. Faster consensus mechanisms are nice. Parallel execution engines are clever. But they’re still just shaving milliseconds off a fundamentally broken model.

Real mass adoption won’t come from another “Ethereum killer.” It will come when normal people stop noticing there’s a blockchain underneath at all.

And the only way that happens is if we finally admit the 1984 processor era of Web3 is over — and start building the multi-core, specialized future we should have started five years ago.

The chains themselves aren’t the bottleneck anymore. Our obsession with making them do everything is.

Time to let them settle down and do what they were always meant to do — while we build the clearing fabric the world actually needs on top.