Remember when owning just about any of the Magnificent Seven felt like printing money?

Those seven names carried the entire market on their backs for what feels like forever. You almost started feeling guilty if your portfolio didn’t have a heavy slug of them. I know I did.

Well, one of the most respected voices who spent years cheering them on just rang the bell and said it’s time to get out — or at the very least, to stop treating them like they’re the only game in town.

From “Buy Everything Mag7” to “Underweight the Group”

Ed Yardeni has been bullish on tech longer than most of us have been investing. When he talks, institutions listen. And right now he’s saying something that would have been unthinkable even twelve months ago:

“Investors should underweight the Magnificent Seven and overweight the Impressive 493.”

His reasoning boils down to three big realities that have quietly crept up while we were all hypnotized by triple-digit returns.

1. Concentration Has Reached Dot-Com Levels

Let’s start with the math that keeps veteran strategists up at night.

Information technology plus communication services — basically the Mag7’s playground — now make up roughly 45% of the entire S&P 500. That’s higher than the peak of the dot-com bubble if you strip out the energy giants of the era.

When just seven stocks can swing the whole index by whole percentage points in a single day, something feels… fragile.

Think about it this way: the Roundhill Magnificent Seven ETF (MAGS) is up 24% in 2025 alone. The broader S&P 500 is up 22.3%. That gap tells you almost everything.

Meanwhile the equal-weight S&P 500 — where Apple gets the same vote as the tiniest industrial name — is limping along with a 9.6% gain. The market has literally never been this lopsided in modern history outside of 1999-2000.

2. Valuations Are Starting to Look Silly Again

The overall S&P trades at about 22.6 times next year’s earnings. Not cheap, but not insane either.

The Nasdaq-100? 27 times. And then there’s the Mag7 themselves:

| Company | Forward P/E |

| Tesla | 212.4× |

| Apple | 33.2× |

| Amazon | 29.3× |

| Alphabet | 28.8× |

| Microsoft | 27.9× |

| Nvidia | 25.6× |

| Meta | 22.9× |

Every single one trades at a premium to the index. Some (looking at you, Tesla) trade at premiums that belong in science-fiction novels.

Even if you believe AI is the most transformative story of our lifetime — and I do — these kinds of multiples leave almost zero room for error.

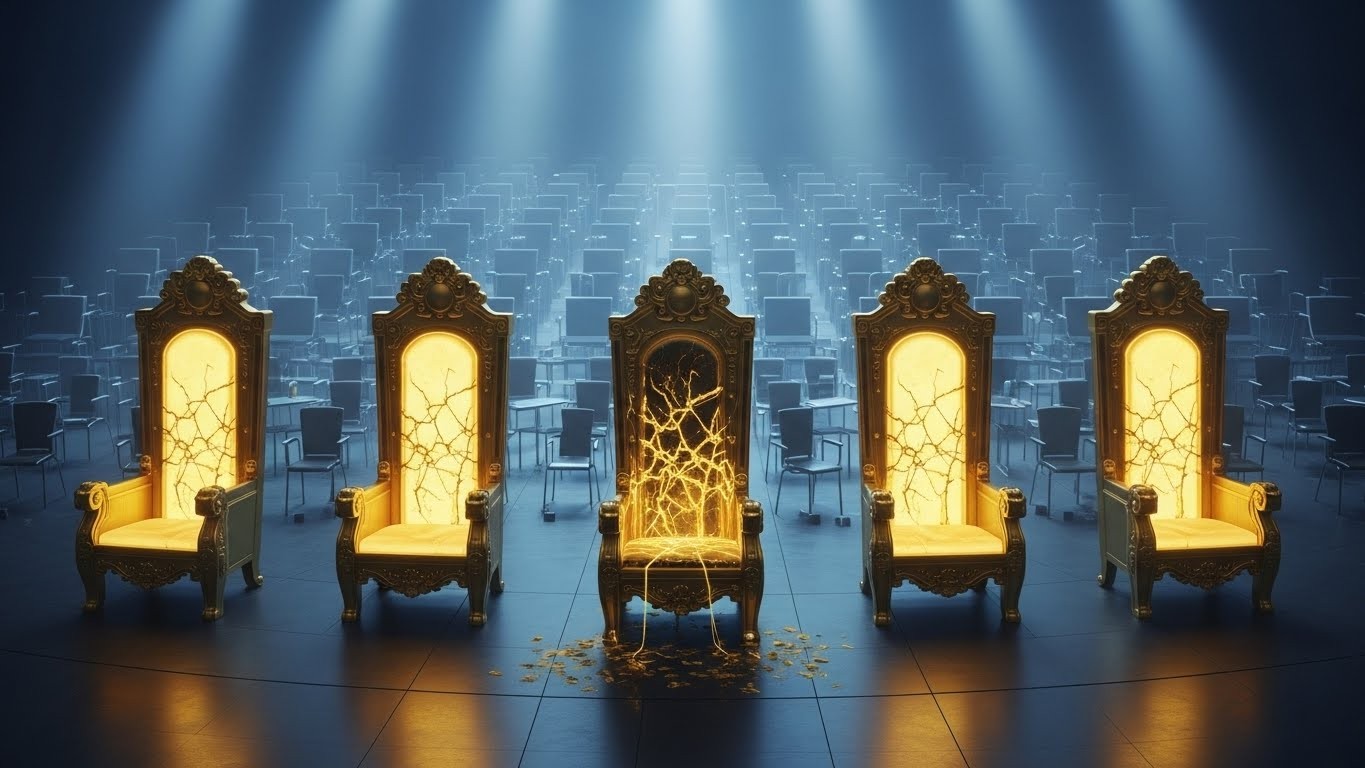

3. The Throne Room Is Getting Crowded

Here’s the part Yardeni hammered home that really stuck with me.

“It’s turning into a Game of Thrones up there.”

He’s talking about competition — not just from the usual suspects, but from literally everyone waking up to the AI gold rush.

Open-source models are getting scarily good. Cloud providers are building their own chips. Start-ups are raising billions overnight. Even companies you’ve never thought would care about AI are announcing massive initiatives.

Suddenly the moat around Nvidia isn’t quite as wide. Apple’s AI push is meeting skepticism. Tesla’s robotaxi narrative has to actually ship cars that drive themselves. Amazon has to prove it can monetize AI beyond “we spent $75 billion on capex.”

In other words, the easy money phase might be behind us.

So Where Does the Smart Money Go Next?

Yardeni’s answer is refreshingly simple: buy the sectors that actually have to benefit if the Mag7 story continues.

- Financials – trading at some of the cheapest valuations in decades while earnings grow double-digits

- Industrials – the companies building the actual factories, robots, and infrastructure AI needs

- Healthcare – still growing earnings steadily with demographic tailwinds no algorithm can disrupt

His deeper point is almost philosophical: if the Magnificent Seven are going to keep printing the kinds of returns investors expect, they’re going to have sell their products and services the other 493 companies in the index.

Productivity gains don’t happen in a vacuum. They happen when banks modernizing, manufacturers automating, hospitals digitizing records, retailers optimizing supply chains.

The Mag7 can’t eat the entire economy. At some point they become each other’s customers — and that’s when the growth math gets harder.

Does This Mean Sell Everything Tech?

Not at all.

I still think AI is the biggest investment theme of the next decade. I’m not suddenly bearish on innovation. But I am becoming more selective.

Owning the entire Mag7 basket at 1.5× the weight of the index feels like the 1999 playbook of buying every dot-com with a “.com” in its name.

Some of today’s leaders will be tomorrow’s Cisco (still huge, but never again the market driver). Others might become the next Amazon. The trick is figuring out which is which before the market does.

Timing the Rotation

Market rotations rarely happen with a neat announcement. They’re messy. They start with “this time is different” dismissals, move to “it’s just a dip,” and end with capitulation long after the easy money is gone.

We’re probably somewhere between stage one and two right now.

Small-caps and value stocks have started outperforming on a relative basis in recent weeks. Bond yields ticking higher helps financials. Defense and infrastructure spending looks sticky regardless of who sits in the White House.

None of this means the Mag7 rolls over tomorrow. But it does mean the risk/reward equation is shifting fast.

Final Thought: Diversification Is Back in Fashion

For the first time in years, spreading your bets beyond seven names doesn’t feel like performance suicide.

In fact, it might be the smartest move you make all decade.

When even the biggest bulls start talking about “Game of Thrones,” it’s probably wise to listen.

Because in that story, very few characters who sat on the Iron Throne at the beginning were still there by the end.