Ever wonder how a single policy tweak can send ripples through global markets? I’ve been mulling over how fast things move when trade rules shift, and lately, one tech giant’s hustle caught my eye. With a temporary pause on certain tariffs, the race is on to rethink where and how our favorite gadgets are made. It’s not just about phones—it’s about the chess game of global production, and it’s fascinating.

Why Tech Giants Are Scrambling

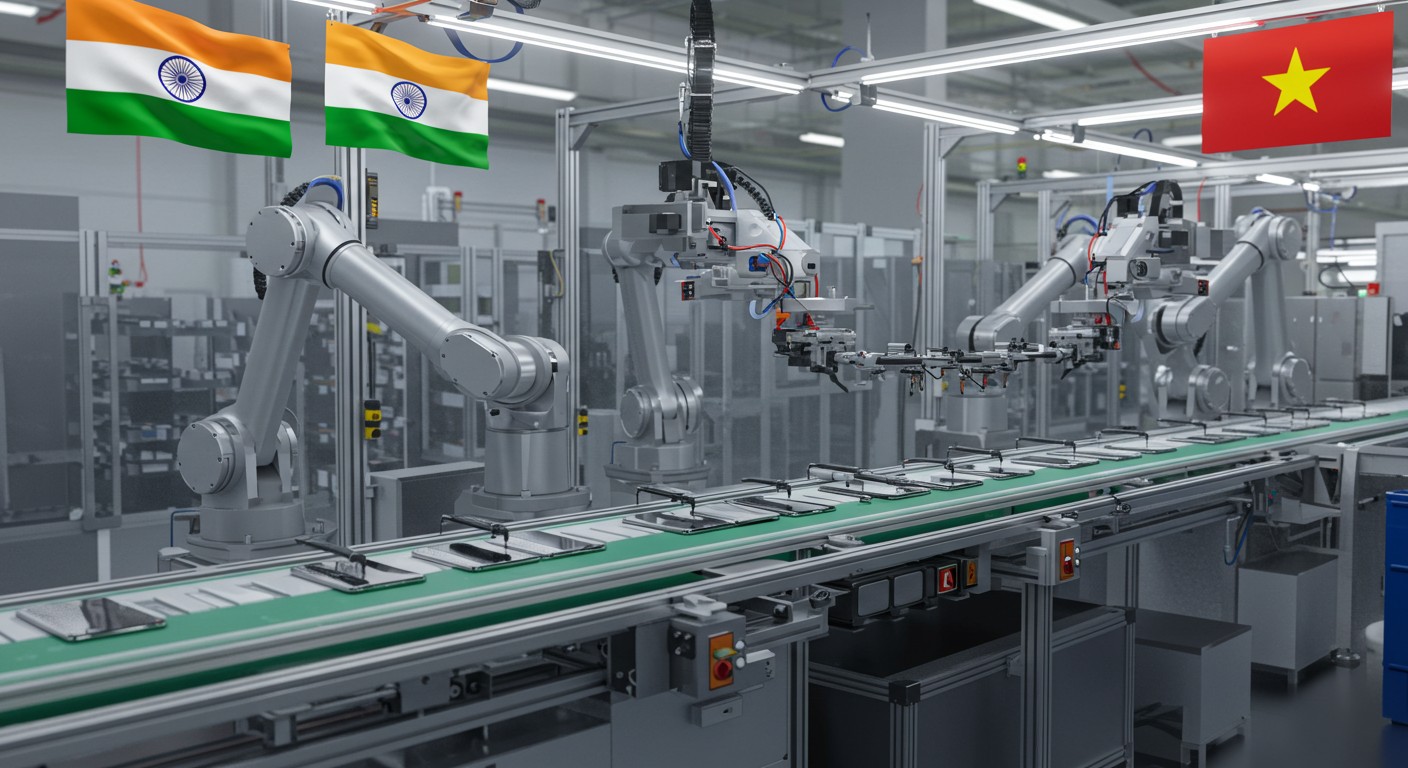

The world of tech manufacturing is rarely calm, but recent trade developments have kicked things into overdrive. A 90-day tariff pause on select goods has given companies a narrow window to pivot. For one major player, this means cranking up smartphone, tablet, and laptop output in places like India and Vietnam. It’s a calculated move to dodge higher costs down the line, and honestly, it’s impressive to watch unfold.

A Surge in Indian Factories

India’s been making waves as a manufacturing hub, and now it’s in the spotlight. Suppliers have been told to boost iPhone production by millions of units this year alone. Factories are already running at full tilt, so squeezing in more isn’t a walk in the park. To make it happen, there’s been a push to snap up new equipment, which could mean a big leap in output if things go smoothly.

Ramping up production in a new region isn’t just about flipping a switch—it’s a logistical marathon.

– Supply chain expert

I can’t help but think this is a turning point. India’s not just a backup plan; it’s becoming a cornerstone for tech giants looking to diversify. The goal? Produce over 50 million smartphones annually, with a chunk earmarked for the U.S. market. That’s no small feat, and it’s got me wondering how this will shake up global trade flows.

Vietnam Steps Up

Meanwhile, Vietnam’s carving out its own slice of the pie. Instructions are clear: most laptops and tablets for American consumers need to roll off Vietnamese assembly lines. It’s a bold shift, and suppliers are hustling to move components like printed circuit boards to Southeast Asia. The urgency here feels almost palpable—like everyone knows the clock’s ticking.

- Key products: Smartphones, laptops, tablets.

- New hubs: Vietnam and India lead the charge.

- Goal: Reduce reliance on traditional manufacturing bases.

What strikes me is the sheer scale of coordination. Moving parts and pieces across borders isn’t cheap, and air freight costs are no joke. Yet, the push to diversify seems worth it when you consider the risks of staying put. It’s a high-stakes game, and I’m curious to see who comes out ahead.

Navigating Tariff Twists

The tariff pause isn’t a free pass—it’s a breather. While some goods like chips and phones dodged the initial hit, trade officials have hinted at semiconductor tariffs looming on the horizon. This uncertainty is pushing companies to act fast, and it’s not just one brand. Other tech heavyweights are also leaning on Southeast Asia to keep their supply chains humming.

According to trade analysts, this is part of a broader trend called friendshoring—shifting production to allied nations. It’s a term I’ve been hearing more lately, and it makes sense. Why bet everything on one country when you can spread the risk? For investors, this shift could mean new opportunities in emerging markets, but it’s not without challenges.

| Region | Key Products | Challenges |

| India | Smartphones | Factory capacity limits |

| Vietnam | Laptops, Tablets | Component logistics |

| Thailand | Circuit Boards | Production scaling |

Looking at this, I can’t shake the feeling that we’re watching a global supply chain overhaul in real time. It’s messy, sure, but there’s something exciting about it—like the world’s figuring out a new way to operate.

The China Factor

Let’s talk about the elephant in the room: China’s still a massive player, but its role is shrinking. Suppliers are being nudged to ship components out of China to support these new hubs. It’s not a full exit—far from it—but the trend is clear. Diversification is the name of the game, and it’s happening at breakneck speed.

An executive I read about summed it up nicely: it’s like scooping up every bit of inventory and sprinting to safer ground. Air freight’s being used heavily, which isn’t cheap, and guess who’s footing the bill? Suppliers, not the tech giants. That’s a tough pill to swallow, but it shows how serious this shift is.

Diversifying supply chains is no longer optional—it’s survival.

I’ve always thought flexibility is key in business, but this takes it to another level. Companies that can pivot like this might just come out stronger, while those stuck in old ways could struggle. It’s a reminder that adaptability isn’t just a buzzword—it’s a lifeline.

What’s in It for Investors?

Now, let’s get to the juicy part: what does this mean for your portfolio? Tech stocks are always a hot topic, and these supply chain shifts could shake things up. Companies that nail this transition might see cost efficiencies or even stronger market positions. On the flip side, those slow to adapt could face headwinds.

Emerging markets like India and Vietnam are worth watching too. As production ramps up, local economies could get a boost, potentially creating opportunities in global trade investments. I’m no crystal ball gazer, but I’d keep an eye on firms tied to these regions.

- Tech giants: Look for companies diversifying their supply chains.

- Emerging markets: Consider funds focused on Southeast Asia.

- Logistics: Freight and shipping firms could see a spike.

One thing I’ve learned? Markets love clarity, and right now, there’s still a lot of fog. Tariffs could come back, policies might shift again—it’s anyone’s guess. That’s why I lean toward diversified portfolios to weather these storms.

The Bigger Picture

Stepping back, this isn’t just about one company or one policy. It’s about how global trade is evolving. The push for reshoring and friendshoring isn’t new, but it’s gaining steam. Countries like Thailand are stepping up for component production, and others might follow.

According to trade experts, these shifts could reshape global supply chains for decades. That’s a big deal, and it’s got me thinking about long-term plays. Maybe it’s time to dig deeper into markets that are quietly positioning themselves as new hubs.

Perhaps the most interesting aspect is how this all ties back to resilience. Companies, markets, even investors—we’re all learning to roll with the punches. And in a world that’s anything but predictable, that’s a skill worth honing.

So, what’s next? I don’t have all the answers, but I’m betting these shifts will keep markets buzzing for a while. Whether you’re eyeing tech stocks or curious about emerging economies, there’s no shortage of angles to explore. One thing’s for sure: the global chessboard just got a lot more interesting.