Why January’s Housing Slump Matters More Than You Think

Let’s be honest—when sales of previously owned homes drop sharply like this, it’s not just a blip on the radar. The numbers show a seasonally adjusted annual rate of just 3.91 million units, down 8.4% from December and 4.4% lower than the same month a year earlier. That’s the weakest pace we’ve seen in over two years. I’ve watched these reports for years, and this kind of sudden slowdown often signals that affordability is still squeezing families harder than many headlines admit.

Buyers aren’t vanishing into thin air. They’re out there, scrolling listings late at night, crunching numbers on affordability calculators, and then… hesitating. The combination of elevated prices and rates that, while lower than peak levels, still feel punishing creates a real psychological barrier. It’s like standing at the edge of a pool on a chilly day—you know the water might be fine, but jumping in feels daunting.

Breaking Down the Sales Drop: What Really Happened

The decline wasn’t limited to one corner of the country. Sales fell across every major region, with the South and West seeing the steepest month-to-month drops. Why? Part of it could be seasonal—harsh weather in many areas made house hunting miserable. But dig a little deeper, and you see structural issues that don’t melt away with spring.

Contracts signed in late fall or early winter often close in January, and mortgage rates hovered without much movement before easing slightly. Yet even with that small relief, the momentum fizzled. Prospective buyers, as industry pros put it, are struggling. Not just with math, but with the emotional weight of committing to such a massive expense in uncertain times.

Affordability conditions are improving… However, supply has not kept pace and remains quite low.

– Chief economist, major real estate association

That quote captures the frustration perfectly. Wages have been rising faster than home prices lately, and rates are down from a year ago. In theory, that should unlock demand. In practice? Not so much yet.

Home Prices: Still Climbing Despite the Slowdown

Here’s the twist that keeps sellers smiling and buyers frowning: prices didn’t budge downward. The median sales price hit $396,800 in January—the highest ever for that month—and eked out a 0.9% gain year over year. How does that happen when sales tank? Simple: supply remains tight.

Inventory dipped from December but stayed up 3.4% compared to last January. At the end of the month, there were about 1.22 million homes available—a 3.7-month supply at current sales pace. Balanced markets usually sit around six months, so we’re still firmly in seller territory. Homeowners, many sitting on serious equity gains (think $130,000+ in wealth buildup since early 2020 for the average owner), feel no rush to list.

- Prices stay elevated because sellers hold the cards

- Buyers face competition on desirable properties

- First-time buyers inch up slightly to 31% of sales (from 28% last year)

- Higher-end homes (over $1 million) actually saw gains year over year

- Lower-priced segment (under $250,000) took the biggest hit

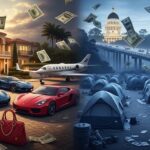

That last point hits hard. The entry-level market is practically frozen in many areas, pushing younger or first-time buyers toward rentals or waiting it out. In my view, this growing divide between luxury and starter homes is one of the more concerning trends right now.

The Affordability Puzzle: Progress, But Not Enough

It’s easy to look at the sales drop and think everything’s broken. But zoom out, and there’s some light. The Housing Affordability Index recently showed the best conditions since early 2022. Wage growth outpacing price increases helps, and mortgage rates dipping below last year’s levels gives a bit of breathing room.

Still, “improving” doesn’t mean “easy.” Many families run the numbers and realize monthly payments would eat too much of their budget. Add in property taxes, insurance, maintenance—it’s a lot. Perhaps the most interesting aspect is how consumer confidence plays into this. When people feel uneasy about the broader economy, big purchases like homes get delayed, even if the data suggests conditions are getting better.

I’ve spoken with folks in various markets, and the sentiment is clear: people want to buy, but they need to feel secure. Job stability, inflation trends, rate forecasts—all factor in. Right now, that security feels just out of reach for too many.

Regional Differences: Not Every Market Feels the Same Pain

The national numbers mask big variations. The South, long a hotspot for growth, saw sharp declines. The West, with its sky-high prices, struggled too. Meanwhile, some Midwest areas held steadier, though no region escaped the monthly drop.

Homes are lingering longer on the market—46 days on average versus 41 last January. That’s not drastic, but it’s a sign that buyers have a little more leverage to negotiate, especially if listings sit. In competitive pockets, though, well-priced homes still fly off the shelf.

| Region | Sales Trend (Month-to-Month) | Key Note |

| Northeast | Decline | High prices persist |

| Midwest | Decline | More moderate impacts |

| South | Steepest drop | Weather and demand shift |

| West | Significant decline | Inventory constraints |

This table simplifies things, but it shows the uneven playing field. Buyers in one area might find opportunities while others face frustration.

What This Means for Buyers Right Now

If you’re in the market, this slowdown could be your window. Less frenzy means more time to think, negotiate, and perhaps snag concessions like closing cost help or repairs. But don’t wait forever—spring traditionally brings more listings and competition.

For sellers, the message is clear: price realistically. Overpricing in this environment leads to longer days on market and eventual reductions. The equity cushion many have is real, but buyers are pickier when options feel limited.

- Check local inventory trends—national stats don’t tell your story

- Run fresh affordability numbers with current rates

- Consider timing: spring could bring relief or renewed bidding wars

- Talk to local pros for neighborhood-specific insights

- Focus on long-term fit over short-term market noise

These steps sound basic, but they matter. Too many people get paralyzed by headlines and miss opportunities.

Looking Ahead: Can the Market Rebound in 2026?

January’s numbers were disappointing, no question. But context matters. Weather played a role, and affordability has genuinely improved in recent months. If rates stabilize or dip further, and more sellers list (perhaps lured by lower borrowing costs), we could see a pickup as the year progresses.

That said, challenges remain. Supply needs to grow meaningfully to ease price pressure. Builders face their own hurdles, and many homeowners are locked into low-rate mortgages, reluctant to move. The market feels stuck in a delicate balance—better than the worst of recent years, but far from booming.

In my experience following these cycles, patience pays off. Buyers who stay engaged, even through tough months, often find the right home when conditions shift. Sellers who adapt pricing and presentation tend to come out ahead.

The housing market rarely moves in straight lines. January reminded us of that. But beneath the disappointing sales figure lies a story of gradual improvement mixed with persistent hurdles. Whether you’re buying, selling, or just watching, staying informed and realistic is the best approach. The next few months will tell us a lot about whether this dip was a pause or a warning sign.