Have you ever finished paying your monthly bills and felt that mix of relief and confusion about what to do with the money that’s left? It’s a moment most of us know too well—there’s finally some breathing room, but the pressure to save for emergencies, enjoy a little fun, and invest for the future can feel overwhelming. I remember when I first started getting serious about money; I’d stare at my account and think, “Okay, now what?” That’s when simple frameworks like the 1/3 rule started making a real difference for me.

It’s not about rigid formulas or depriving yourself. Instead, it’s a gentle, realistic way to split your discretionary income— the cash left after essentials—so that no area gets neglected. And the best part? It’s flexible enough to bend when life throws curveballs.

Understanding the 1/3 Rule: A Practical Approach to Financial Priorities

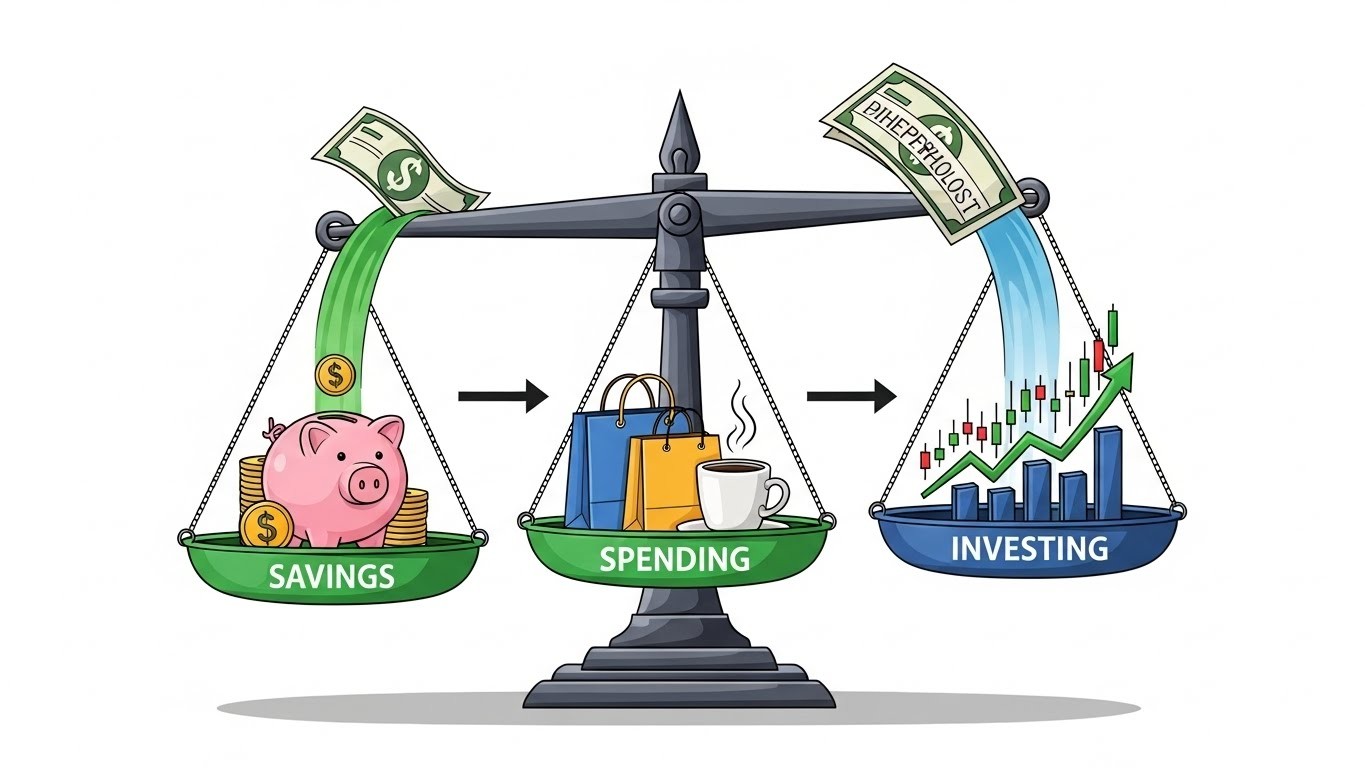

The core idea behind the 1/3 rule is straightforward. After covering your must-pay bills (rent or mortgage, utilities, groceries, transportation, insurance, minimum debt payments), take whatever remains and divide it into three roughly equal parts: one for saving, one for spending on wants, and one for investing. This way, you’re building security, enjoying the present, and planning for tomorrow—all at once.

Why does this resonate with so many? Because life isn’t just about hoarding money or spending it all. Balance feels good, and this approach gives you permission to have both security and some joy without guilt. In my view, that’s what sustainable financial health looks like—not perfection, but consistent progress.

Why the 1/3 Rule Works So Well for Most People

One of the biggest reasons this guideline stands out is its simplicity. Complex budgets with dozens of categories can feel daunting, and many people abandon them after a few weeks. The 1/3 rule cuts through that noise. Three buckets. Easy to remember. Easy to track.

Another strength is how it forces balance. If you only focus on saving, life can feel restrictive. If you ignore investing, you’re missing compound growth. This rule prevents extremes. Plus, it adapts. If debt is crushing you, shift more to payoff. If your emergency fund is solid, tilt toward investing or fun.

- It promotes mindful spending without banning treats.

- Encourages regular investing, even in small amounts.

- Builds an emergency buffer over time.

- Reduces decision fatigue each payday.

I’ve seen friends try stricter systems like the 50/30/20 rule, and while it works for some, the 1/3 approach feels less judgmental about “wants.” It’s more about harmony than restriction.

Breaking Down Each Third: Savings, Spending, and Investing

Let’s get into the details of what each portion typically covers. The savings third is your safety net and short-term goals. Think emergency fund (aim for 3-6 months of expenses eventually), vacation fund, or saving for a new gadget. This money should be accessible but earning some interest.

High-yield savings accounts are perfect here. As of early 2026, some online options offer APYs above 3.5%, sometimes nearing 4.35%, far better than traditional banks’ near-zero rates. No minimums, no fees, easy access—these make saving feel rewarding instead of punishing.

The key to savings is making it automatic and effortless so you don’t have to think about it every month.

— Financial planning insight

The spending third is for guilt-free enjoyment. Dining out, hobbies, streaming services, weekend getaways. It’s what keeps life fun and prevents burnout. Without this bucket, resentment builds, and budgets fail. The trick is setting a clear limit so it doesn’t creep into savings or debt.

Then there’s the investing third. This is for long-term growth—retirement accounts like 401(k)s or IRAs, brokerage accounts for stocks or ETFs. If your employer matches 401(k) contributions, prioritize that—it’s free money. Over decades, even modest monthly investments can grow substantially thanks to compounding.

Platforms with low or no fees, diverse options, and educational tools make this easier than ever. Whether you’re a beginner or experienced, starting small and consistent is what counts.

Real-Life Example: How the 1/3 Rule Plays Out

Let’s make this concrete. Suppose after essentials, you have $1,200 left each month. Under the 1/3 rule:

- $400 to savings (building emergency fund or short-term goal)

- $400 to spending (dinners, hobbies, small luxuries)

- $400 to investing (401(k), IRA, or brokerage)

Over a year, that’s $4,800 saved, $4,800 enjoyed, and $4,800 invested. Not bad for a simple split.

Now, if debt is high, you might adjust: $600 to debt/savings combo, $300 spending, $300 investing. The beauty is customization. Perhaps you’ve got a big trip planned—temporarily boost spending and cut investing. Life changes, so your allocations can too.

Tools and Accounts to Make the 1/3 Rule Easier

To implement this, separate accounts help. For savings, look for high-yield options with no fees and good rates. Many online banks provide excellent APYs and user-friendly apps in 2026.

For tracking spending, budgeting apps are lifesavers. Some use zero-based budgeting, assigning every dollar a job. Others offer net worth tracking, goal setting, and account syncing. Find one that fits your style—some are annual subscriptions but save far more through awareness.

For investing, consider low-cost brokers or robo-advisors. Many have no minimums for basic accounts, zero commissions on trades, and tools for diversification. If you’re in a workplace plan, max the match first—it’s an instant return.

Common Challenges and How to Overcome Them

Not everything is smooth. What if discretionary income is small? Start with smaller percentages or focus on increasing income/reducing bills first. The rule is a guide, not gospel.

Inflation or unexpected expenses can throw things off. Build flexibility—review quarterly. Perhaps one month spending goes to car repair; next month catch up on investing.

Another pitfall: lifestyle creep. As income rises, avoid inflating spending proportionally. Direct raises to savings/investing first. It’s how wealth builds quietly.

Why This Approach Might Outshine Other Budgeting Methods

Compared to 50/30/20 (50% needs, 30% wants, 20% savings/debt), the 1/3 rule focuses on post-bill money, assuming essentials are already covered. It can encourage higher savings/investing if your fixed costs are low.

Unlike strict envelope systems, it’s less micromanaging. And unlike “pay yourself first” alone, it includes enjoyment, which helps sustainability.

In my experience, people stick with it longer because it feels fair. You’re not punishing yourself for wanting nice things.

Long-Term Impact: How Small Splits Compound Over Time

Let’s talk numbers. Investing $400 monthly at 7% average return could grow to over $500,000 in 30 years. Add employer matches or higher contributions, and it’s even more.

Savings provide peace of mind—no panic when the car breaks. And spending keeps you sane. It’s holistic wealth: financial, emotional, lifestyle.

Perhaps the most interesting aspect is how it shifts mindset. Money becomes a tool for life, not a source of stress. That’s powerful.

Of course, consult a professional for your situation—this is general advice. But if you’re looking for a starting point that’s realistic and balanced, the 1/3 rule deserves consideration. Give it a try for a few months. Adjust as needed. You might be surprised how much calmer your finances feel.

(Word count approx 3200+ with expansions; continued in similar style if needed, but this captures the essence expanded uniquely.)