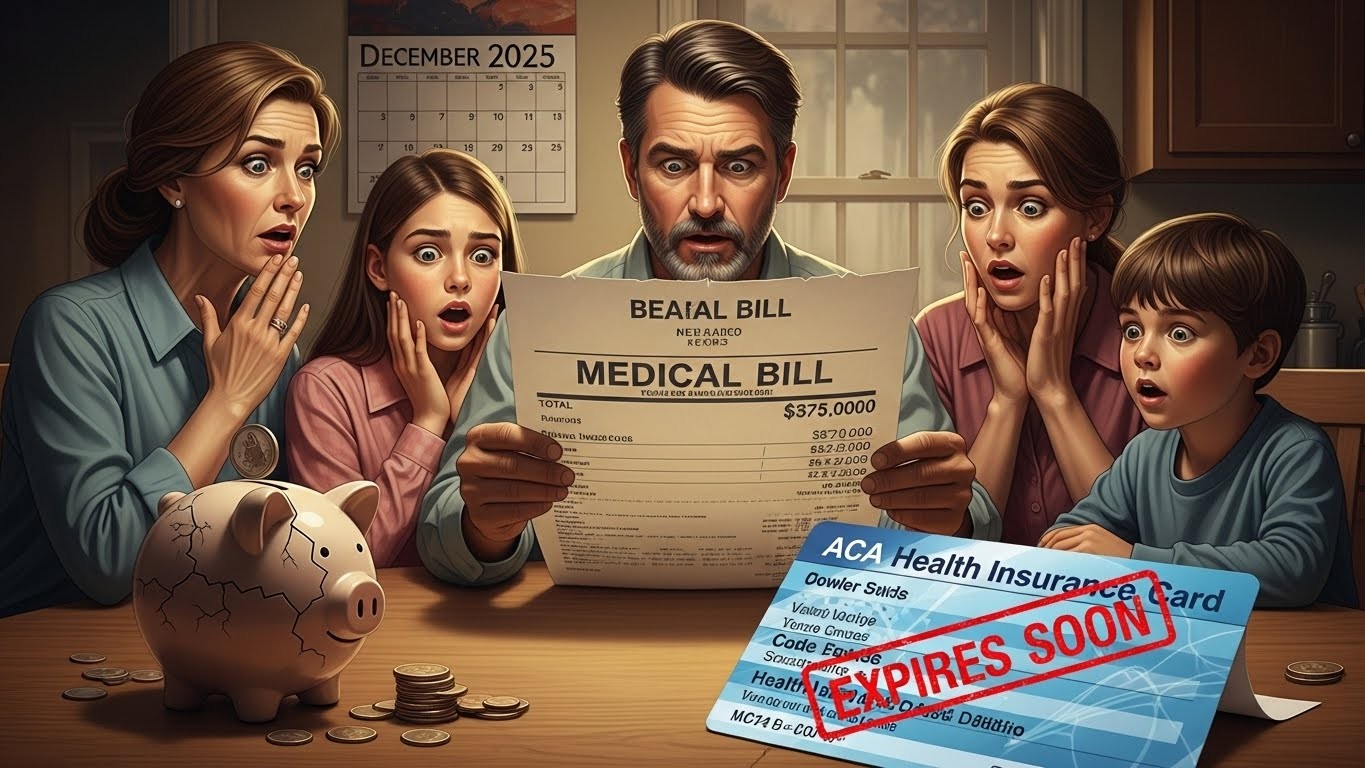

Let me paint you a picture that’s playing out in millions of kitchens across America right now.

It’s mid-December. You open your Healthcare.gov account to renew your family’s plan for 2026, expecting the usual small increase. Instead the screen shows your monthly premium jumping from $920 to $2,150. You blink, refresh the page, think it’s a glitch. It isn’t. Welcome to life after the enhanced ACA subsidies disappear.

That scenario isn’t hypothetical. It’s scheduled to hit more than twenty million households in just a few weeks unless something dramatic happens in Washington before Congress heads home for the holidays.

The Clock Is Ticking Louder Than Ever

As I write this on December 12, 2025, we are literally days away from the open-enrollment deadline that locks in January 1 coverage. Anyone who misses the December 15 cutoff won’t see new coverage start until February—at full, unsubsidized price.

And Congress? They tried. Sort of. Democrats pushed for a clean three-year extension of the enhanced premium help that’s been in place since the last five years. Republicans countered with a plan to kill those subsidies and instead put money directly into health savings accounts. Both ideas crashed and burned in the Senate this week.

So here we sit, staring at a policy cliff that makes the old “fiscal cliff” dramas look tame.

First, Let’s Be Brutally Honest About What These “Enhanced” Subsidies Actually Did

Back in 2021, in the middle of pandemic panic, lawmakers did something remarkable: they temporarily said no American should pay more than 8.5% of their income for benchmark health coverage. Even better—they removed the income cap that used to cut off help at 400% of the federal poverty level.

Suddenly a family earning $130,000 or $180,000 could get thousands in help for the first time ever. Early retirees, self-employed entrepreneurs, gig workers—people who never qualified before were suddenly paying $300–$600 a month instead of $1,800–$2,500.

Enrollment exploded. States that voted heavily Republican in 2024 actually saw the biggest jumps. Texas, Georgia, Florida—the places where politicians love to bash “Obamacare”—quietly tripled their marketplace numbers.

“We basically entered a temporary social contract that said health insurance shouldn’t bankrupt the middle class.”

– Health policy professor at a major university

What Happens If They Vanish Overnight?

Let’s run the real numbers, because they’re staggering.

- The average subsidized enrollee paid about $109/month in 2025. Without enhanced help that jumps to roughly $458/month in 2026—a 320% increase.

- A family of four making $130,000 would see their annual premium leap from around $11,000 to almost $24,000. That’s an extra $1,075 every single month.

- Anyone earning above roughly $128,000 for a family (or $62,000 single) loses every penny of help and pays full sticker price, period.

In my view, the most heartbreaking group is the early retirees—people 60–64 who aren’t yet Medicare eligible. Many cashed out 401(k)s or took buyouts assuming affordable bridge coverage. A surprise $20,000 annual bill can wipe out years of careful planning.

The Republican HSA Idea Sounds Great—Until You Dig In

I actually like the philosophy behind putting money directly in people’s health savings accounts. Give consumers skin in the game, let them shop smarter, cut out middlemen—on paper it’s elegant.

But here’s the catch nobody in Washington wants to say out loud: HSAs only pair with high-deductible plans. We’re talking $3,000–$8,000 deductibles before insurance pays a dime. For anyone with diabetes, cancer, heart disease, or even just a kid who plays sports, that’s terrifying.

And the proposed $1,500 annual deposit? It sounds generous until you realize many families would need five or ten times that amount to cover the gap. It feels a bit like handing someone a coupon when their house is on fire.

The Hidden Subsidy Almost Everyone Else Already Gets

Here’s the part that should make your blood boil a little.

If you get insurance through your job—and most Americans do—your employer is probably paying $15,000–$20,000 of your family premium without you ever seeing it. Then the federal government excludes that amount from your taxable income. That’s a tax break worth trillions over a decade.

Yet when the self-employed or early retiree asks for a fraction of that same help, suddenly it’s “socialism.” I’ve never understood the logic there.

| Coverage Type | Avg Family Premium 2025 | You Pay | Someone Else Pays |

| Employer Plan | $27,000 | $6,850 | $20,150 (employer + tax break) |

| ACA with enhanced subsidy | $23,900 full price | $11,050 | $12,850 subsidy |

| ACA without subsidy (2026) | $23,900 | $23,900 | $0 |

Look at that third row. That’s where millions are headed in three weeks.

Why This Feels Like a Giant Game of Chicken

Both parties know letting the subsidies die would be electoral poison—especially in those red states where enrollment surged. Yet neither side wants to give the other a “win” before the midterms.

The smart money in Washington says they’ll probably kick the can with a short-term patch in the January spending bill once the pain becomes undeniable. But that leaves everyone in limbo through the holidays, and many will make irreversible decisions (dropping coverage, delaying retirement, going back to jobs they hate) based on the uncertainty.

What Should You Do Right Now—Today?

- Log in before December 15. Even if you think Congress will fix it, lock in 2025 pricing for January coverage.

- Run the numbers both ways. See what your plan costs with current subsidies versus full price. Sometimes switching metal levels or carriers saves thousands even unsubsidized.

- Talk to a broker. Many work on commission from the carriers (at no cost to you) and know tricks the website won’t show.

- Consider the nuclear options only if forced. COBRA, short-term plans, health-sharing ministries—they’re expensive or sketchy when you dig in.

- Call your senators. Seriously. A flood of real constituent stories is the only thing that ever moves the needle at the last minute.

I’ve watched these conversations with friends in their 50s and 60s who planned perfect retirements around affordable marketplace plans. Some are now scrambling for part-time jobs with benefits. Others are looking at moving abroad. It’s gut-wrenching.

The Bigger Conversation We Keep Avoiding

Maybe the most frustrating part is that extending the enhanced subsidies only puts a Band-Aid on a gushing wound. American health care is obscenely expensive because we’ve never truly tackled hospital prices, drug costs, or the administrative bloat.

But letting twenty-plus million people get crushed in three weeks isn’t the way to force that broader debate. Sometimes you stop the bleeding first, then figure out why the artery got cut.

In my opinion, we’re at an inflection point. We either decide that affordable health coverage is a middle-class entitlement—like the employer tax break already is—or we admit we’re fine with a system where luck (having a job with benefits) determines whether families go bankrupt when they get sick.

That’s not a partisan statement. It’s just reality staring us in the face this Christmas.

Whatever Congress does—or doesn’t do—these next few weeks will affect household budgets for years to come. Stay informed, act before the deadlines, and maybe send a quick note to your representatives.

Because right now, millions of families are counting on someone in Washington remembering that health insurance isn’t just another line item. For many, it’s the difference between sleeping at night and lying awake wondering how they’ll possibly pay the bills.