Imagine this: you’re standing in front of your dream home, keys almost in hand, but the monthly payments on a traditional loan feel just a bit out of reach. Lately, with all the talk about interest rates easing up after the Federal Reserve’s recent moves, you’ve heard whispers about something called an adjustable-rate mortgage. It sounds promising—lower payments at the start, maybe enough to make homeownership happen sooner. But then doubt creeps in. What if rates climb later? I’ve chatted with enough friends and dug into this myself to know it’s not a decision to rush.

Right now, as of late 2025, the Fed has trimmed its benchmark to around 3.5% to 3.75%, and mortgage rates have dipped a touch too—30-year fixed loans hovering near 6.2% to 6.3%. Adjustable options often start even lower, which is tempting when every dollar counts. But let’s be real: this isn’t just about grabbing a deal today. It’s about sleeping easy years down the line.

In my view, these loans can be a smart play in the right circumstances, but they’re not for everyone. Perhaps the most intriguing part is how they mirror life’s uncertainties—flexible, yes, but with a side of unpredictability. If you’re pondering one, stick with me as we break it down step by step.

Navigating Adjustable-Rate Mortgages in Today’s Market

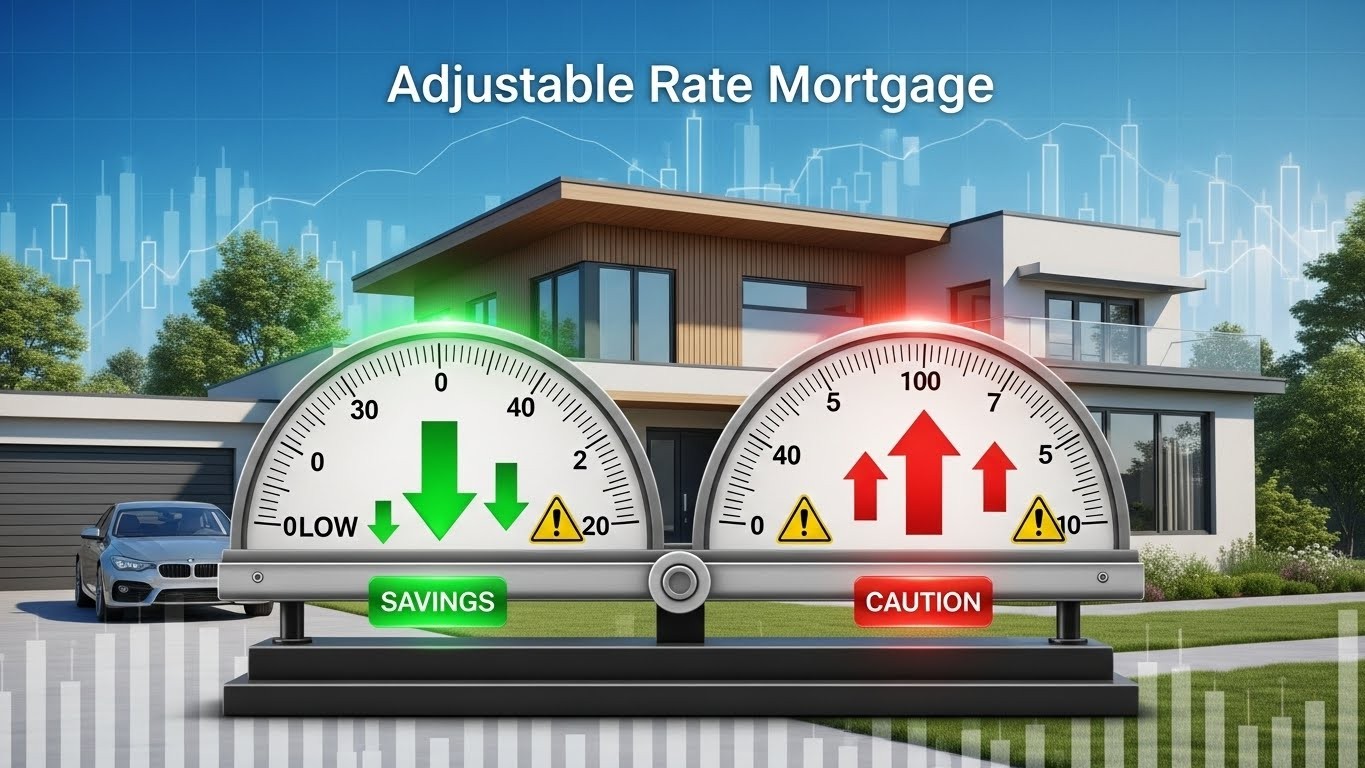

Adjustable-rate mortgages, or ARMs as they’re commonly called, have been around for decades, but they’ve gained attention lately amid shifting economic winds. Unlike their fixed-rate cousins that lock in one rate for the entire term, ARMs start with a set period of lower interest, then shift based on broader market trends.

Think of it like renting an apartment with a teaser rate for the first few years before the landlord can tweak the rent. It can work out beautifully if you move out before changes hit, or if conditions improve. But stay too long without planning, and things might get tighter.

Current data shows 30-year fixed rates around 6.2%, while popular ARM varieties—like a 5/1 or 7/6—might kick off closer to 5.5% or so, depending on the lender and your credit. That gap can translate to real savings early on, sometimes hundreds per month on a typical loan.

How These Mortgages Actually Work

At their core, ARMs blend stability and flexibility. You get an introductory phase—often 5, 7, or 10 years—where the rate stays put. After that, it adjusts at set intervals, usually every six months or annually.

The adjustment ties to an index, something reliable like the Secured Overnight Financing Rate, plus a margin the lender adds. So if the index rises, your rate likely does too. On the flip side, if markets cool, you could see payments drop without lifting a finger.

Common formats include the 7/6 ARM: fixed for seven years, then tweaks every six months. Or the 5/1: five years steady, then yearly changes. Lenders offer variations, so shopping around matters.

- Introductory period: Your low-rate honeymoon phase

- Adjustment frequency: How often changes can happen post-intro

- Index and margin: The formula driving future rates

- Caps: Built-in limits on how much rates can shift

These elements combine to create a loan that’s dynamic, for better or worse.

The Upsides That Draw People In

Let’s start positive. The biggest draw? Those initial lower rates. In a world where fixed loans linger above 6%, starting half a point or more below can free up cash for renovations, furnishings, or just breathing room in your budget.

Over the fixed period, savings add up. On a $400,000 loan, even a 0.3% difference might save thousands in interest before any adjustment.

Many borrowers find the early affordability allows them to buy sooner or in a better neighborhood than a fixed loan might permit.

Another perk: if rates fall broadly, your payment could decrease automatically—no refinance needed. And for short-term owners, like those in starter homes, you often sell before adjustments kick in.

I’ve seen cases where people planned a move in five years and pocketed serious savings without ever facing a hike. It’s rewarding when it aligns perfectly.

- Lower starting payments for immediate relief

- Potential for rates to drop later

- Ideal for planned short stays in the home

- Qualify for larger loans due to initial affordability

The Potential Downsides and Risks

Of course, there’s another side. The obvious risk is rising payments. If broader rates climb, so does yours—potentially significantly over time.

Uncertainty can stress budgets, especially for families on fixed incomes or with tight margins. No one wants surprise hikes straining finances.

Long-term holders face more exposure. Stay 15-20 years, and multiple adjustments could push costs well above what a fixed loan would have been.

Experts often note that predictability is priceless for many, making fixed rates the safer emotional choice.

Some loans carry prepayment penalties, charging fees if you refinance or sell early. Not all do, but it’s worth checking.

Crucial Rate Caps Explained

Here’s a silver lining: caps. Most ARMs include safeguards limiting changes.

Typical structure: initial adjustment cap (often 2-5%), periodic caps (usually 1-2%), and lifetime cap (commonly 5% above start).

So even in worst-case scenarios, hikes are contained. Always review these—they vary by lender.

| Cap Type | Common Limit | What It Means |

| Initial Adjustment | 2% to 5% | First change after fixed period |

| Periodic Adjustment | 1% to 2% | Each subsequent reset |

| Lifetime | 5% | Max over entire loan |

Knowing your worst-case payment is key. Run the numbers at the capped rate to ensure affordability.

When an ARM Might Fit Your Plans

Not every buyer suits an ARM, but certain situations shine.

If you’re in a starter home and expect to upgrade in 5-7 years, why pay fixed premiums longer than needed?

Job relocators, growing families, or those anticipating income boosts often benefit.

- Short-term ownership plans

- Expectation of rising income

- Comfort with potential fluctuations

- Strategy to refinance if rates drop

Conversely, if stability tops your list or you’re planning decades in one spot, fixed might feel better.

Steps to Take Before Committing

Don’t dive in blindly. Start by stress-testing scenarios.

Calculate payments at current rates, then at capped highs. Factor rising taxes, insurance too—those aren’t capped.

Shop multiple lenders; terms differ. Ask about indexes, margins, no-penalty options.

Consider future plans honestly. Life changes—jobs, kids, health. Build buffers.

Thorough preparation turns a risky choice into a calculated one.

– Mortgage advisors

Comparing to Fixed-Rate Alternatives

Fixed loans offer peace—no surprises. Payments steady, easier long-term planning.

But in high-rate environments, they cost more upfront. ARMs shine short-term.

Hybrid approaches exist too, longer fixed periods in some ARMs.

Real-Life Scenarios and Lessons

Picture a young couple buying their first place, knowing a family expansion means moving soon. They choose a 7/6 ARM, save on payments, build equity faster, then sell profitably before adjustments.

Or someone who took an ARM years ago when rates were volatile, faced hikes, but refinanced when conditions improved. Outcomes vary.

The key? Planning. Those who treat ARMs as temporary tools often thrive.

Wrapping Up: Is It Right for You?

Adjustable-rate mortgages aren’t inherently good or bad—they’re tools. Used wisely, they unlock doors otherwise closed. Rushed or mismatched, they create headaches.

In today’s market, with rates stabilizing post-cuts, they’re worth considering if your timeline aligns. But always prioritize what lets you build a home, not just own one.

Chat with lenders, crunch numbers, envision scenarios. Homeownership’s a marathon; choose the path that fits your stride.

(Word count: approximately 3520)