Have you ever stopped to think about what powers the tech revolution sweeping the globe? It’s not just code or algorithms—it’s the raw materials and energy that make it all possible. The rise of artificial intelligence (AI) isn’t just transforming how we interact with devices; it’s reshaping entire industries, from manufacturing to energy production. I’ve been fascinated by this shift for a while, and the more I dig into it, the clearer it becomes: we’re on the cusp of a massive boom in hard assets. This isn’t just about flashy tech stocks; it’s about the metals, minerals, and power sources that will fuel the next phase of innovation.

The Physical AI Revolution: A Game-Changer

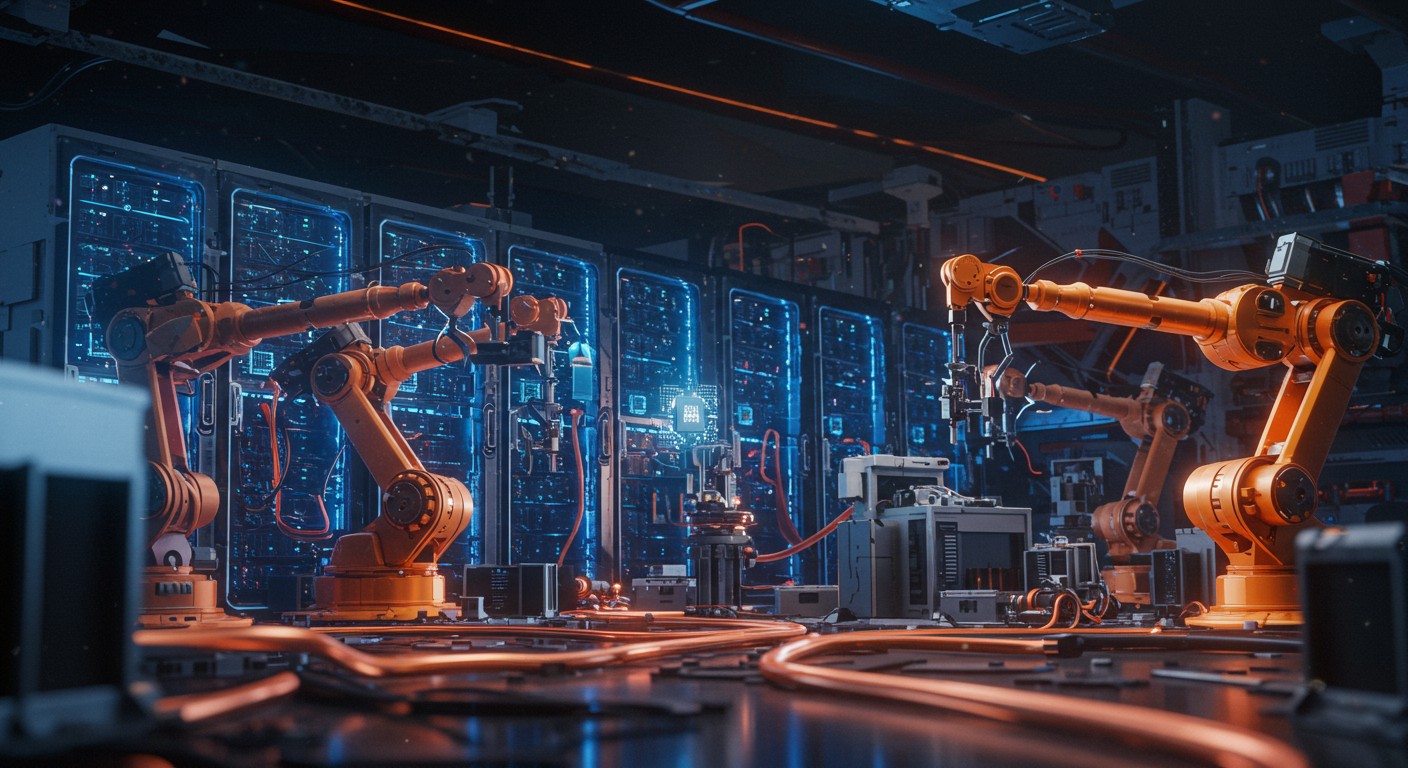

The AI story is entering a bold new chapter, one I like to call physical AI. This is where the digital brain meets the physical world—think robots, self-driving cars, and smart appliances that don’t just think but act. It’s one thing to have an algorithm crunching numbers in the cloud, but it’s another to see that intelligence embedded in machines that move, build, and interact with the world around us. This shift is happening fast, and it’s creating ripple effects that most investors haven’t fully grasped yet.

Why does this matter? Because physical AI isn’t just a software story—it’s a hardware and resource story. Every robot, every autonomous vehicle, every smart factory requires a staggering amount of materials and energy. From copper wiring to steel frames to the electricity that powers it all, the demand for hard assets is about to skyrocket. Let’s dive into what’s driving this trend and why it’s a golden opportunity for savvy investors.

From Code to Concrete: The Rise of Physical AI

Physical AI is where the rubber meets the road—quite literally in some cases. Companies are no longer just building smarter software; they’re embedding it into tangible objects. Take autonomous vehicles, for instance. These aren’t just cars with fancy dashboards; they’re rolling supercomputers packed with sensors, processors, and wiring. Each one needs metals like copper and aluminum, not to mention a constant supply of energy to keep it running.

Then there’s robotics. Factories are increasingly relying on AI-powered robots to handle everything from assembly lines to logistics. These machines aren’t just a few lines of code—they’re complex systems requiring steel, copper, and rare earth metals. I recently read about a robotics company that’s already using advanced AI to make its machines “think” about their environment in real time. That kind of innovation doesn’t just need programmers; it needs raw materials, and lots of them.

The next phase of AI isn’t just about smarter algorithms—it’s about building the physical infrastructure to bring those algorithms to life.

– Industry analyst

This isn’t just hype. Major players are already moving in this direction. Companies are rolling out self-driving taxis that navigate crowded cities without human input. Others are developing AI models that understand the physical world well enough to predict how objects move even when they’re out of sight. This is next-level stuff, and it’s going to redefine what we think of as “technology.”

The Energy Hunger of AI

Here’s where things get really interesting—and a bit mind-boggling. AI doesn’t just need materials; it needs energy, and lots of it. Data centers, the backbone of AI, are already gobbling up electricity at an unprecedented rate. According to energy experts, AI-related technologies could drive a 160% surge in global electricity demand by 2030. That’s not a typo—160%! And that’s just for data centers, not even counting the power needed for physical AI applications like robotics or smart grids.

Think about it: every time you interact with an AI-powered device, it’s pulling power from somewhere. A single data center can consume as much electricity as a small city. Now imagine thousands of these centers springing up worldwide, all humming with the energy needed to train and run AI models. It’s no wonder some companies are turning to nuclear energy to meet this demand. Nuclear is reliable, scalable, and increasingly seen as a go-to solution for powering the AI revolution.

But it’s not just about keeping the lights on. The energy demands of AI are pushing innovation in how we generate and store power. From advanced batteries to next-gen nuclear reactors, the race is on to fuel this tech boom. For investors, this opens up a whole new world of opportunities beyond traditional tech stocks.

The Commodity Boom Nobody’s Talking About

Let’s talk about the unsung heroes of the AI revolution: commodities. You can’t build a robot without steel, wire it without copper, or power it without energy. The numbers here are staggering. A single AI data center can require up to 10,000 metric tons of copper for cabling and equipment. A single AI-powered robot might need 50 to 100 pounds of copper, and experts predict millions of these robots will hit the market by 2030. Do the math—that’s a colossal demand spike.

Copper’s just the start. Aluminum, tin, steel, silver, and rare earth metals are all critical to building the hardware that powers physical AI. Some analysts estimate that AI could boost copper demand by 15-20% annually through the end of the decade. That’s not a blip; it’s a structural shift in the commodity markets. And it’s not just metals—energy commodities like uranium are also seeing renewed interest as AI companies look for reliable power sources.

| Commodity | AI Application | Estimated Demand Growth |

| Copper | Data centers, robotics | 15-20% annually |

| Aluminum | Vehicle frames, electronics | 10-15% annually |

| Uranium | Nuclear-powered data centers | 5-10% annually |

Here’s my take: most investors are so focused on the shiny tech side of AI that they’re missing the bigger picture. The real money might not be in the next hot startup but in the companies mining copper, producing steel, or generating power. These aren’t sexy investments, but they’re the backbone of this revolution.

Why Investors Should Care

So, why should you, as an investor, care about this? Because the AI boom isn’t just about coding geniuses in Silicon Valley—it’s about the supply chains that make it all possible. The markets are already starting to catch on. Commodity indices are showing bullish patterns, and uranium stocks are quietly climbing as nuclear energy gains traction. This isn’t a short-term trend; it’s a multi-year, potentially multi-trillion-dollar shift in capital allocation.

Smart investors are already positioning themselves to ride this wave. They’re looking beyond the usual suspects—tech giants and chipmakers—and diving into the hard asset space. Mining companies, energy producers, and even niche players in the commodity supply chain are starting to see increased interest. The best part? Many of these opportunities are still flying under Wall Street’s radar.

- Diversify your portfolio: Don’t just bet on tech—consider commodity ETFs or mining stocks.

- Think long-term: The AI boom will drive demand for years, not months.

- Explore energy plays: Nuclear and renewable energy companies could be big winners.

Personally, I find the commodity angle fascinating because it’s so overlooked. Everyone’s chasing the next big AI stock, but the companies supplying the raw materials are quietly building wealth. It’s like investing in the pickaxes during the gold rush—sometimes the real money is in the tools, not the treasure.

How to Position Yourself for the Boom

So, how do you get in on this? First, you need to think beyond the obvious. Sure, tech stocks are exciting, but the hard asset play is where the real upside lies. Start by researching companies involved in copper mining, aluminum production, or uranium extraction. These aren’t household names, but they’re critical to the AI ecosystem.

Next, consider the energy angle. Nuclear energy is making a comeback, and companies in this space could see significant growth as AI’s energy demands soar. Renewable energy is another area to watch—solar and wind are great, but don’t sleep on the potential of next-gen nuclear solutions.

The smart money is already moving into commodities and energy. The question is: are you paying attention?

– Financial strategist

Finally, don’t be afraid to dig into niche opportunities. There are smaller companies out there—ones Wall Street hasn’t caught onto yet—that are poised to benefit from the AI-driven demand for materials and energy. These are the kinds of plays that can turn a modest investment into something substantial.

The Bigger Picture: A Transformative Opportunity

Here’s the thing: the AI revolution isn’t just about technology—it’s about reshaping the global economy. The demand for hard assets and energy is going to create winners and losers across industries. The companies that supply the raw materials and power for this boom will be just as critical as the ones writing the code. And for investors, that means a once-in-a-generation opportunity to get in early.

I’ll be honest: I didn’t fully grasp the scale of this trend until I started digging into the numbers. The sheer volume of copper, steel, and energy needed to sustain this revolution is mind-blowing. It’s not just about building a few robots; it’s about retooling entire industries to support a new era of innovation. And that’s where the real wealth will be created.

So, what’s your next move? Are you going to chase the same tech stocks everyone else is buying, or are you going to look at the bigger picture? The AI boom is coming, and it’s bringing a hard asset revolution with it. Get ahead of the curve, and you could be looking at some serious returns.

In my experience, the best investments are the ones nobody’s talking about yet. The AI-driven demand for commodities and energy is still flying under the radar, but it won’t stay that way for long. Whether you’re a seasoned investor or just starting out, now’s the time to start paying attention to this transformative trend. The question is: are you ready to capitalize on it?