Have you ever wondered what the world looks like when technology races ahead faster than we can keep up? The artificial intelligence (AI) revolution is no longer a distant promise—it’s here, reshaping economies, industries, and even our daily lives. In 2025, AI’s fingerprints are everywhere, from corporate boardrooms to hospital diagnostics. I’ve been diving into the latest developments, and let me tell you, the changes are both thrilling and a little unsettling. Let’s unpack three seismic shifts AI is driving right now: its deflationary impact on jobs, its insatiable hunger for commodities, and its transformative role in healthcare.

The AI Revolution: A Game-Changer for 2025

The pace of AI’s evolution is staggering. Every week seems to bring a new breakthrough, each with ripple effects across markets and society. From automating white-collar jobs to fueling demand for raw materials, AI is rewriting the rules of the game. But what does this mean for you—whether you’re an investor, a worker, or just someone trying to make sense of it all? Let’s break it down into three key areas that are shaping the future as we speak.

AI’s Deflationary Sting: Jobs Under Pressure

Picture this: a tech giant, flush with cash, announces it’s saved half a billion dollars thanks to AI. Sounds like a win, right? But there’s a catch—thousands of employees are out of a job. This is the reality at some of the biggest names in tech. One major player, heavily invested in AI, recently cut 9,000 jobs in its third round of layoffs this year, bringing the total to around 15,000. They’re not shouting it from the rooftops, but it’s hard not to connect the dots: AI is replacing human workers at an alarming rate.

This trend isn’t just about blue-collar automation anymore. White-collar jobs—think analysts, coders, even some management roles—are now in AI’s crosshairs. The economic impact is what experts call deflationary, meaning lower wages and higher unemployment could become the norm. For companies, it’s a profit bonanza—imagine raking in $70 billion in revenue with $26 billion in profit. But for workers? It’s a tougher story. I can’t help but wonder: are we ready for the social fallout of this kind of disruption?

AI’s efficiency is a double-edged sword—boosting profits while threatening livelihoods.

– Economic analyst

The political implications are just as thorny. With wealth concentrating in fewer hands—think lavish billionaire weddings sparking public outrage—AI’s role in job displacement could ignite serious unrest. It’s not hard to imagine frustrated workers pointing fingers at tech giants as the gap between the haves and have-nots widens. For investors, though, this deflationary trend signals a need to pivot toward companies leveraging AI to cut costs without sacrificing growth.

-

<-metal>AI is slashing corporate costs, boosting profit margins.

Commodities Boom: AI’s Hunger for Hard Assets

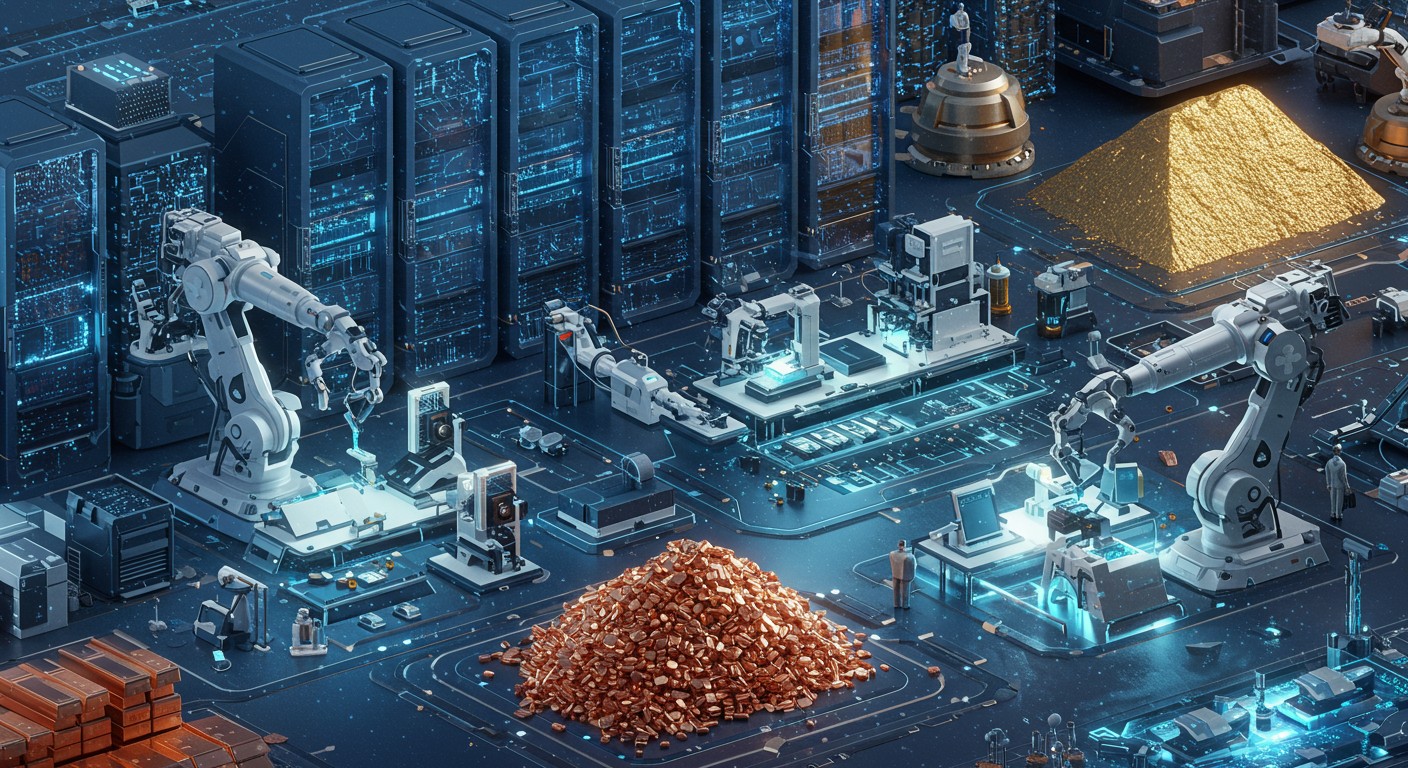

Let’s shift gears to something a bit more tangible—literally. AI isn’t just code and algorithms; it’s a beast that needs physical resources to thrive. Data centers, the backbone of AI, are gobbling up commodities like there’s no tomorrow. A single data center can demand thousands of tons of concrete, steel, and copper, not to mention lithium and silicon. This isn’t just a blip—it’s a full-on boom in hard assets.

Take silver, for example. It’s not just for jewelry or coins anymore. Silver is a key player in semiconductors, sensors, and high-power components like multi-layer ceramic capacitors used in AI chips. With the AI chip market projected to grow by over 30% annually for the next decade, silver’s demand is skyrocketing. Recently, it broke out of a 15-year pattern, with analysts eyeing a price target above $60 per ounce. That’s the kind of move that gets investors’ attention.

| Commodity | Use in AI | Market Impact |

| Silver | Semiconductors, capacitors | Breaking out to new highs |

| Copper | Wiring, data centers | All-time highs |

| Steel | Data center construction | Stocks rallying |

| Lithium | Batteries for AI systems | Growing demand |

But silver’s not alone. Copper’s hitting record highs, steel stocks are surging, and even uranium is riding the wave as AI’s energy demands push nuclear power back into the spotlight. For me, this is one of the most exciting aspects of the AI revolution—it’s not just about tech stocks. Commodity markets are waking up, and savvy investors can ride this wave by targeting undervalued players in these sectors.

Why does this matter? Because AI’s physical footprint is massive, and it’s only growing. As data centers multiply, so does the need for raw materials. It’s a rare opportunity where tech and traditional industries collide, creating a wealth of investment possibilities.

Healthcare’s New Frontier: AI-Powered Medicine

Now, let’s talk about something that hits closer to home: your health. AI is revolutionizing healthcare in ways that feel like science fiction. From drug discovery to diagnostics, the technology is proving it can outshine even the best human minds in certain tasks. I’ll admit, I was skeptical at first—can a machine really outdiagnose a doctor? The answer, increasingly, is yes.

Big players in pharmaceuticals are teaming up with tech giants to harness AI for drug development. These partnerships are slashing the time and cost of bringing new treatments to market. But the real game-changer is in diagnostics. A new open-source AI model recently hit the scene, capable of reading medical texts and images with nearly 90% accuracy. What’s wild is that it costs just a fraction of its bulkier competitors, making it accessible to hospitals and researchers worldwide.

AI’s diagnostic accuracy is reshaping how we approach patient care.

– Healthcare technology expert

This model isn’t just a tool—it’s a platform that can be customized for specific medical needs. Imagine a rural hospital using AI to diagnose complex conditions without needing a team of specialists. Or researchers tweaking the model to accelerate drug trials. The implications are enormous, not just for patients but for investors eyeing healthcare’s next big leap.

Perhaps the most exciting part? This is just the beginning. As AI continues to evolve, its role in healthcare will only deepen, creating opportunities for companies that bridge tech and medicine.

Investing in the AI Revolution: What’s Next?

So, where does this leave us? The AI revolution is a juggernaut, and it’s nowhere near slowing down. For investors, the opportunities are vast but require a keen eye. The deflationary impact on jobs means companies mastering automation will see soaring profits. The commodity boom points to undervalued players in metals and energy. And healthcare’s transformation opens doors to innovative firms at the intersection of tech and medicine.

In my experience, the best opportunities often lie where Wall Street isn’t looking. There are smaller, lesser-known companies poised to capitalize on AI’s next phase—firms that aren’t yet household names but have massive potential. The trick is knowing where to look and acting before the crowd catches on.

AI Investment Strategy: 40% Tech innovators (AI-driven firms) 30% Commodity plays (metals, energy) 30% Healthcare disruptors (AI diagnostics)

The AI revolution isn’t just about tech giants. It’s about the ripple effects—job markets shifting, commodities surging, and healthcare evolving. For those willing to dig deeper, the rewards could be substantial. What’s your next move in this brave new world?

With AI reshaping entire industries, the time to act is now. Whether you’re an investor hunting for the next big play or just curious about where the world’s headed, one thing’s clear: AI’s impact is only growing. Stay ahead of the curve, and you might just find yourself riding the wave of the future.