Picture this: it’s early 2026, you’re gathering the usual pile of tax documents, and instead of the normal “you owe” surprise, the software spits out a refund that actually makes you do a double-take. One thousand, maybe two thousand dollars extra. Not a stimulus check, not a random bonus—just money that was always yours but was being over-withheld every payday.

That scenario isn’t wishful thinking anymore. Senior administration officials, including the new Treasury Secretary, have gone on record saying exactly that could happen for tens of millions of working households next year. The reason? A sweeping new tax package passed mid-2025 that dramatically changes how payroll withholding works—and most employees haven’t adjusted yet.

The One Big Beautiful Bill Act: The Quiet Game-Changer

Buried in the fine print of the legislation—let’s call it the OBBB Act for short—are provisions that eliminate federal income tax on overtime pay and tipped income, raise standard deductions, and tweak withholding tables across the board. Lawmakers celebrated the passage in July, but here’s the part nobody shouted from the rooftdoors: the IRS didn’t force employers to update W-4 withholding immediately.

Most companies simply kept deducting taxes the old way through the rest of 2025. Result? Workers have inadvertently been overpaying Uncle Sam for months. Come April 2026, all that overpayment flows back as one-time refunds—potentially the largest refund season in years.

“I think we’re going to see $100–$150 billion of refunds, which could be between $1,000–$2,000 per household.”

– Treasury Secretary Scott Bessent, December 2025

Why the Refunds Are So Large This Time

Let’s break it down like we’re talking over coffee. Three major changes converged at once:

- No federal tax on overtime hours – Think nurses, truck drivers, factory workers pulling extra shifts.

- No federal tax on tips – Servers, bartenders, delivery drivers, hair stylists—basically anyone who lives on gratuities.

- Higher standard deductions and bracket adjustments – Even salaried workers with no tips or OT see lower effective rates.

Because paychecks didn’t reflect these cuts for the second half of 2025, the difference piles up. A server making $45,000 in wages plus $25,000 in tips could easily be looking at $1,800–$2,200 back. Someone with consistent overtime might see even more.

What Happens After the Big Refund?

Here’s the part I find fascinating. That monster refund in early 2026 is basically a one-time event. Once HR departments (or you, if you submit a new W-4) update withholding to match the new law, you stop overpaying each paycheck. Suddenly your net pay jumps—maybe $80–$150 every two weeks—without a raise from your boss.

In my experience covering personal finance, people feel these “found money” moments differently. A fat refund feels like a bonus (hello, new TV or vacation). Smaller but consistent paycheck bumps tend to disappear into daily life—groceries, gas, the electric bill. Both are real money, but the psychological impact varies wildly.

Who Benefits the Most?

Not every household sees the same windfall. Here’s a rough breakdown:

| Household Type | Estimated 2026 Refund Range |

| Single server or bartender | $1,200 – $2,600 |

| Dual-income with one OT worker | $1,500 – $3,000 |

| Family with tipped + salaried income | $2,000 – $4,000+ |

| Salaried only, no tips/OT | $400 – $1,200 |

Numbers are obviously estimates—your mileage depends on income, state taxes, deductions—but the pattern is clear: the harder you hustle with overtime or tips, the bigger the payback.

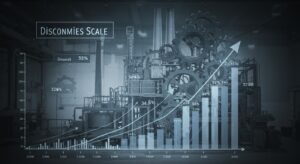

The Bigger Economic Picture

Put $100–$150 billion back into consumers’ pockets in the first quarter, and economists start salivating. Retail gets a shot in the arm right when seasonal layoffs usually hit. Car dealers could see a surge. Credit-card balances might finally start dropping instead of the endless climb we’ve watched for years.

Critics, of course, point out that tariffs funding some of these cuts could raise prices on imported goods. Fair point. But for the households getting the refunds, the money is real and immediate. Whether the net effect on inflation is positive or negative will be debated for years—personally, I suspect the stimulus effect outweighs the price-pressure effect in the short run.

What Should You Do Right Now?

Honestly? Not much—yet. You can’t force your employer to adjust withholding mid-year for most of these changes (the IRS guidance is still rolling out). But come January, grab the new 2026 W-4 form and run the numbers. The goal is simple: get your withholding as close to perfect as possible so you’re not lending the government your money interest-free all year.

- Mark your calendar for the IRS withholding estimator update (expected late December 2025).

- Pull last paystub of 2025 and compare take-home once the changes hit.

- Consider directing part of the bigger paycheck straight into retirement accounts—Roth contributions never looked so painless.

I’ve always believed the best tax strategy is owing a little or getting a tiny refund, not giving the government a zero-interest loan. Next year gives millions of us a rare do-over.

Final Thoughts

Whether you love or hate the politics behind the OBBB Act, the mechanics are hard to argue with: lower effective tax rates on the exact kinds of income that working-class and middle-class families rely on. For once, tax season might actually feel good.

Come next April, when your accountant (or TurboTax) asks the usual “any big changes this year?” you’ll have a great story to tell. And maybe a much happier bank balance to go with it.

Disclosure: All estimates are based on public statements from administration officials and general tax principles. Individual results will vary. Consult a qualified tax professional for personal advice.