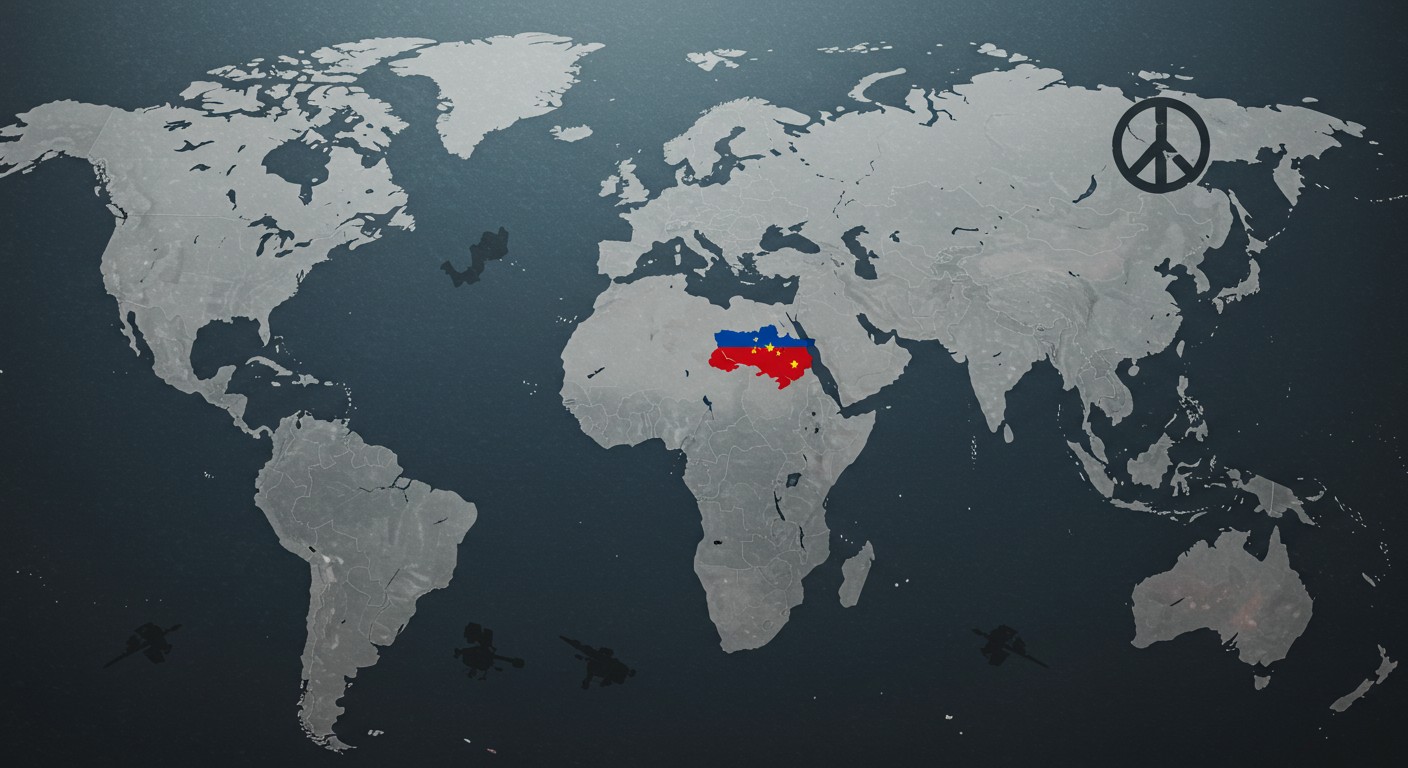

Ever wonder how a single rumor can ripple through global markets like a stone skipped across a pond? A few months ago, I was sipping coffee, scrolling through headlines, when one stopped me cold: whispers of Chinese soldiers fighting in Ukraine. The claim felt like a spark in a dry forest—potentially explosive. If true, it could reshape geopolitics and jolt investors worldwide. But is there any substance behind the noise, or is it just another headline designed to stir the pot?

Unpacking the Ukraine-China Soldier Claims

The story broke when a high-profile figure in Kiev claimed that two individuals, allegedly Chinese nationals, were captured in Ukraine’s Donetsk region, supposedly fighting alongside Russian forces. The accusation didn’t stop there—reports suggested over 150 Chinese citizens might be involved. My first thought? That’s a bold statement. In a world where information travels faster than fact-checking, I knew we had to dig deeper.

Rumors of foreign fighters in conflicts aren’t new, but they carry weight when they involve global powers.

– Geopolitical analyst

Here’s the catch: no independent group has verified these claims. Videos and documents surfaced, but they’re about as conclusive as a blurry photo of Bigfoot. Are these fighters really from China? And if so, are they state-backed soldiers or just mercenaries chasing a paycheck? Let’s break it down.

What’s the Evidence—Or Lack Thereof?

The evidence so far is thin. Kiev’s claims hinge on a couple of captives and some paperwork listing names and passport numbers. Sounds convincing at first, right? But without third-party confirmation, it’s hard to separate fact from propaganda. I’ve seen markets swing on less, so skepticism feels warranted.

- Captured Individuals: Two alleged Chinese nationals, but no public access to verify their identities.

- Documents: Lists of names and passports exist, yet remain unverified by neutral parties.

- Intelligence Reports: Suggestions of 150+ Chinese fighters, but based on unconfirmed sources.

Now, Russia’s home to thousands of ethnic Chinese, and China’s massive population means a few citizens could end up anywhere—even a warzone—without Beijing’s blessing. Former intelligence experts have floated the idea that these could be freelancers, not state-sponsored troops. That’s a key distinction, and one investors should keep in mind.

Mercenaries or Military? The Bigger Picture

Mercenaries aren’t exactly a new phenomenon. Conflicts like Ukraine’s have drawn fighters from all corners—think Colombians, Canadians, even Nepalese. Both sides have welcomed foreign muscle since day one. If a handful of Chinese citizens joined the fray, it wouldn’t automatically mean Beijing’s pulling strings. But the optics? They’re messy.

| Country | Reported Fighters | Side |

| Canada | Over 1,000 | Ukraine |

| Poland | Nearly 3,000 | Ukraine |

| Nepal | Unknown | Russia |

| China | 150+ (Alleged) | Russia |

Here’s where it gets tricky: even if these fighters are mercenaries, the narrative could still sting. Accusations like these fuel mistrust, and in a world already on edge, that’s no small thing. For me, the real question isn’t just whether Chinese boots are on the ground—it’s how the story itself could shift the chessboard.

Why This Matters to Investors

Geopolitical rumors don’t just make headlines—they move markets. When whispers of Chinese involvement hit, I couldn’t help but think of the trade war simmering between Washington and Beijing. If this story gains traction, it could pour fuel on that fire. Sanctions, tariffs, or even tighter export controls could follow, hitting everything from tech stocks to commodity prices.

Markets hate uncertainty, and geopolitical noise is uncertainty on steroids.

Let’s talk specifics. If tensions escalate:

- Tech Sector: Companies reliant on Chinese manufacturing could face supply chain headaches.

- Commodities: Energy and metals markets might spike if sanctions disrupt trade.

- Emerging Markets: Investor confidence in Asia could take a hit, dragging down regional indices.

I’ve always believed that smart investors don’t just react—they anticipate. Keeping an eye on how this narrative unfolds could give you a leg up, whether you’re holding growth stocks or hedging with safe-haven assets.

The Peace Process at Risk

Beyond markets, there’s a bigger worry: peace. Ukraine’s conflict has been a grinding stalemate, and any hope of talks hinges on trust—or at least the absence of outright hostility. Throwing China into the mix as a supposed player risks derailing fragile negotiations. Why? Because it paints a picture of a broader, scarier conflict.

Picture this: diplomats finally sit down to hash out a ceasefire, only for accusations of Chinese involvement to dominate the room. Suddenly, it’s not just about Ukraine and Russia—it’s a proxy war with global stakes. That’s the kind of scenario that keeps me up at night, and it’s not just me. Recent analysis suggests peace talks are already on thin ice.

Every new player in a conflict makes the path to peace exponentially harder.

– Diplomatic strategist

If I had to bet, I’d say the bigger danger isn’t Chinese soldiers—it’s the megaphone amplifying the claim. Provocative statements from Kiev could push Washington to act tough, which might spook markets even more than the rumor itself.

China’s Stance and Credibility

Beijing’s response has been predictable: a flat denial. They’ve called the claims baseless and reiterated that their citizens are urged to avoid conflict zones. Fair enough, but in geopolitics, perception often trumps reality. If the world starts seeing China as a silent backer of Russia, it could lose face as a neutral player.

Why does this matter? Because China’s been positioning itself as a potential mediator in global disputes. If these accusations stick, that role could crumble, affecting everything from trade deals to its influence in emerging markets. For investors, that’s a signal to watch diplomatic moves as closely as earnings reports.

How Should Investors Respond?

So, what’s the play here? First, don’t panic. Rumors like this often fade as quickly as they flare up. But they’re also a reminder that geopolitical risk is part of the game. Here’s how I’d approach it:

- Stay Diversified: Don’t let one headline dictate your portfolio. Spread your bets across asset classes.

- Monitor Trade Tensions: Keep tabs on U.S.-China relations, especially if sanctions talks heat up.

- Lean on Safe Havens: Gold or bonds can cushion the blow if markets get jittery.

Personally, I’ve found that staying calm and sticking to a plan beats chasing every rumor. That said, there’s no harm in tweaking your strategy if the noise gets louder.

The Broader Implications

Zoom out, and this story isn’t just about Ukraine or China—it’s about a world where information is a weapon. A single claim, true or not, can shift alliances, crash markets, or stall peace talks. That’s the reality investors face today. It’s less about what’s happening and more about what people believe is happening.

Maybe the most interesting aspect is how interconnected everything’s become. A rumor in Donetsk can hit your tech stocks in New York or your commodity bets in London. It’s like a spiderweb—one tug, and the whole thing vibrates.

In today’s markets, perception is as powerful as reality.

As I wrap this up, I can’t shake the feeling that we’re only seeing the tip of the iceberg. Whether Chinese soldiers are in Ukraine or not, the story’s already doing its damage—stirring doubt, spiking tensions, and keeping investors on edge. My advice? Keep your eyes open, your portfolio balanced, and your emotions in check. That’s the only way to navigate a world this noisy.

What do you think—could this rumor really change the game, or is it just another storm in a teacup? Either way, it’s worth watching closely.