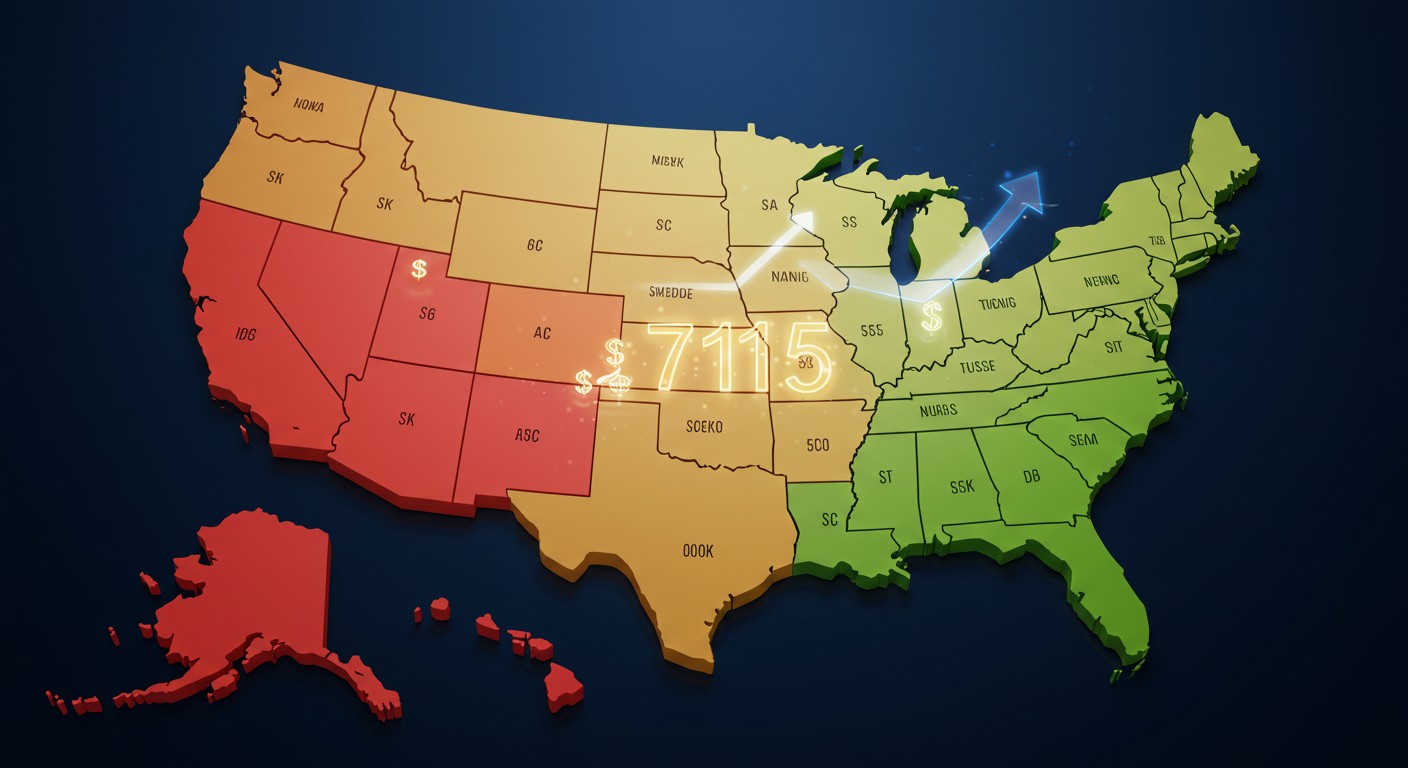

Ever wondered how your financial standing measures up against your neighbors? I’ve always been curious about how something as abstract as a credit score can shape so much of our lives—everything from getting a dream car to landing a new apartment. In 2025, the average U.S. credit score sits at 715, according to recent data, but that number hides a wild range across the country. From Mississippi’s low of 677 to Wisconsin’s impressive 739, let’s dive into what these numbers mean, why they vary, and—most importantly—how you can nudge your score higher.

Why Credit Scores Matter More Than You Think

Your credit score isn’t just a number; it’s a financial passport. It dictates whether you’ll snag that low-interest mortgage or get stuck with sky-high loan rates. A solid score can even tip the scales for job applications or rental agreements. In 2025, with economic pressures like inflation and a tighter job market, understanding where you stand is more crucial than ever. So, what’s driving these state-by-state differences, and how can you make sense of them?

A Snapshot of Credit Scores Across the U.S.

The national average credit score of 715 puts the U.S. in the “good” range, but it’s down two points from last year—a shift experts link to rising credit utilization and missed payments. States like Wisconsin (739) and New Hampshire (738) lead the pack, while Mississippi (677) and Louisiana (687) lag behind. Curious about your state? Here’s a quick look at the averages:

| State | Average Credit Score |

| Wisconsin | 739 |

| New Hampshire | 738 |

| Massachusetts | 733 |

| Mississippi | 677 |

| Louisiana | 687 |

| Alabama | 691 |

These numbers aren’t random. They often tie back to economic factors like median household income and unemployment rates. For instance, Mississippi’s median income is among the lowest at $55,980, while New Hampshire boasts a hefty $111,000. Lower incomes can mean tighter budgets, making it harder to pay off debts or avoid missed payments.

Your credit score is like a financial fingerprint—it’s unique and tells a story about your money habits.

– Financial analyst

What’s Dragging Scores Down?

Inflation has been a relentless beast in recent years, pushing many Americans to lean harder on credit cards. This spikes credit utilization—the ratio of your credit card balance to your credit limit—which accounts for 30% of your FICO score. Meanwhile, late payments, especially on student loans, are hitting scores hard. After a three-year pause on student loan repayments, delinquencies are creeping up, with nearly a third of borrowers over 90 days past due in early 2025.

I’ve seen friends struggle with this firsthand—those monthly student loan bills can feel like a punch to the gut when you’re already stretched thin. Payment history, making up 35% of your score, is the biggest factor, so even one missed payment can sting. Add in a sluggish job market, and it’s no wonder scores are slipping in some states.

The Divide Between the Haves and Have-Nots

Here’s where things get interesting—and a bit unsettling. The middle ground of credit scores (600–749) is shrinking. In 2021, 38% of Americans fell in this range, but by 2025, it’s down to 33.8%. Meanwhile, the “excellent” range (800–850) grew to 24.8%, and the “poor” range (300–549) jumped to 12.1%. It’s like the financial world is splitting into two camps: those thriving and those barely hanging on.

States with higher scores, like Vermont (740) and Minnesota (743), often have stronger economies and lower unemployment rates (3.0% and 3.1%, respectively). On the flip side, states like Mississippi and Louisiana face higher unemployment (3.9% and 4.4%) and lower incomes, which can trap residents in a cycle of debt and missed payments.

How to Boost Your Credit Score: Practical Steps

Feeling like your score could use a lift? Don’t worry—there are concrete steps you can take to turn things around. I’ve always believed that small, consistent actions can make a big difference, and credit scores are no exception. Here’s a breakdown of the most effective strategies:

- Pay on time, every time: Since payment history is the biggest chunk of your score, set up autopay or calendar reminders to avoid late payments.

- Lower your credit utilization: Aim to keep your credit card balances below 30% of your limit. Pay down high-interest cards first to save money.

- Check your credit reports: Errors are more common than you think—44% of people found mistakes in a recent study. Get free weekly reports at AnnualCreditReport.com and dispute any inaccuracies.

- Ask for a credit limit increase: This can lower your credit utilization ratio without spending a dime, as long as you don’t use the extra credit.

- Tackle high-interest debt first: Paying off costly debts reduces interest charges and frees up more of your payment to chip away at the principal.

These steps aren’t just theory—they work. A friend of mine boosted her score by 50 points in six months just by paying down her credit card and disputing an old error on her report. It’s not instant, but it’s doable.

Think of your credit score as a garden—neglect it, and weeds take over; tend to it, and it flourishes.

– Credit expert

Why Your State’s Economy Matters

Your credit score doesn’t exist in a vacuum. It’s shaped by where you live, your income, and even local job opportunities. States with high median incomes, like Massachusetts ($114,000) and New Hampshire, tend to have higher credit scores because residents can afford to pay bills on time and avoid maxing out credit cards. In contrast, lower-income states like Mississippi struggle with higher debt loads and missed payments.

Unemployment plays a role too. States with low jobless rates, like Wisconsin and Vermont, give residents more stability to manage debts. It’s no coincidence that these states top the credit score charts. If you’re in a tougher economic area, don’t lose hope—focus on what you can control, like budgeting and timely payments.

The Role of Student Loans in 2025

Student loans are a sore spot for millions, and their impact on credit scores is undeniable. After a three-year repayment pause and a 12-month grace period, missed payments are now hitting credit reports hard. In early 2025, 5.8 million borrowers were 90+ days delinquent—the highest rate ever recorded. That’s a big deal when payment history is the top factor in your score.

If you’re juggling student loans, consider income-driven repayment plans or refinancing to lower your monthly burden. Even small, consistent payments can keep your score from taking a hit. It’s not glamorous, but it’s a lifeline.

Common Credit Score Myths Debunked

Let’s clear up some confusion. I’ve heard all sorts of myths about credit scores, and they can trip you up if you’re not careful. Here are a few big ones:

- Checking your credit score hurts it: Nope! Checking your own score is a “soft inquiry” and doesn’t affect it.

- Closing old accounts boosts your score: Wrong. Closing accounts can shorten your credit history (15% of your score) and raise your utilization ratio.

- You need to carry a balance to build credit: Not true. Paying off your card in full each month shows responsibility and saves you interest.

Knowing the truth helps you make smarter moves. For example, keeping an old, unused card open (with no annual fee) can actually strengthen your score over time.

Tools to Protect and Improve Your Score

Beyond the basics, there are tools to safeguard your financial health. Credit monitoring services can alert you to suspicious activity, like unauthorized accounts, which is critical since identity theft is on the rise. Some services even offer identity theft insurance for peace of mind.

If errors or old debts are dragging you down, consider a credit repair service. These pros can dispute inaccuracies on your behalf, potentially raising your score. Just be sure to research reputable options—some charge hefty fees for little results.

A good credit score opens doors; a great one builds a foundation for your future.

– Financial planner

What’s a “Good” Credit Score, Anyway?

Credit scores range from 300 to 850. Here’s how they break down:

- Excellent (800–850): Unlocks the best rates and terms.

- Very Good (740–799): Still gets you great deals.

- Good (670–739): Qualifies for most loans, but rates may be higher.

- Fair (580–669): Limited options, higher interest.

- Poor (300–579): Tough to get approved for credit.

A score of 670–739 is considered “good” and puts you in a solid position for most financial products. Anything above 800 is golden, but even a “fair” score can improve with effort.

Looking Ahead: Building a Stronger Financial Future

Your credit score is more than a number—it’s a reflection of your financial habits and a tool to shape your future. Whether you’re in a high-scoring state like Minnesota or a lower-scoring one like Mississippi, you have the power to improve. Start with small steps: pay on time, keep your balances low, and check your reports regularly. Over time, those efforts add up.

In my experience, the most rewarding part of improving your credit is the sense of control it brings. It’s like steering your own ship through choppy waters—challenging, but empowering. Where does your state rank, and what’s your next move to boost your score?