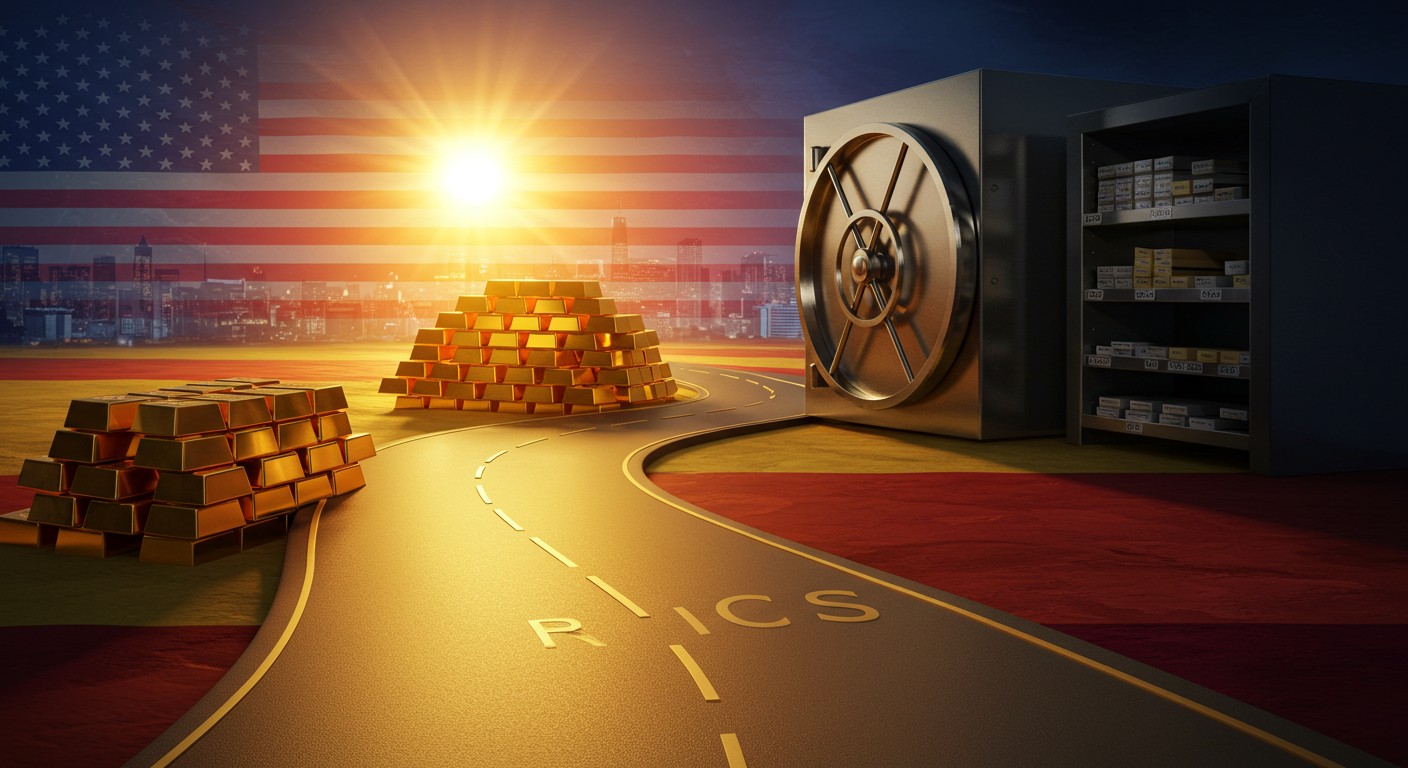

Have you ever wondered what happens when the world’s financial giants start playing a new game with old rules? Picture this: a global chessboard where gold, not paper, becomes the king. I’ve been diving deep into the shifts shaking up the financial world, and let me tell you, the moves being made by BRICS nations are nothing short of seismic. The push toward Basel III compliance is rewriting the rules, and it’s not just about banking regulations—it’s about who holds the real wealth.

Why Basel III Is a Game-Changer for Gold

The global financial system is like a house of cards, delicately balanced on trust and promises. Basel III, a set of international banking reforms, is shaking that foundation by demanding banks back their bets with real, tangible assets—think physical gold, not just digital entries. This isn’t just a technical tweak; it’s a fundamental shift that’s exposing cracks in the system, especially for Western banks drowning in derivative losses.

BRICS nations—Brazil, Russia, India, China, and South Africa—are leading the charge, quietly but aggressively stockpiling gold. Why? Because they see the writing on the wall: paper-based wealth is losing its grip, and physical assets are making a comeback. It’s like watching a slow-motion revolution unfold, and I can’t help but feel a mix of awe and unease at the scale of it all.

BRICS and the Gold Rush: A Strategic Play

Let’s break it down. BRICS countries, especially China, aren’t just buying gold for kicks—they’re building a fortress. Recent data suggests China’s gold reserves have surged, with estimates pointing to over 2,000 tons added in the last decade alone. This isn’t a coincidence; it’s a calculated move to challenge the dominance of the US dollar and expose weaknesses in Western financial systems.

Gold is the ultimate hedge against a system built on promises. BRICS knows this and is acting fast.

– Financial strategist

Their strategy is clear: use Basel III to force banks to hold physical gold, not just paper claims. This puts pressure on Western bullion banks, which have long relied on unallocated gold—essentially, gold they promise but don’t physically possess. It’s like selling a house you don’t own, and now the buyers are knocking.

- China’s gold purchases outpace global supply, tightening markets.

- Russia and India follow suit, diversifying away from dollar-based assets.

- Physical delivery demands expose banks’ over-leveraged positions.

I find it fascinating how BRICS is turning a regulatory shift into a geopolitical weapon. It’s not just about economics—it’s about power. And the US? It’s facing growing calls to audit its own gold reserves, which some whisper might not be as robust as claimed. Could this be the moment the curtain gets pulled back?

The Squeeze on Bullion Banks

Bullion banks are in a bind, and it’s not hard to see why. For years, they’ve played a high-stakes game, selling paper gold—contracts that promise gold without delivering the shiny stuff. Basel III is changing that, demanding physical delivery to back up these claims. The result? A supply crunch that’s sending ripples through the market.

June markets are already showing signs of tightness, with physical gold and silver in short supply. Banks are scrambling to cover their positions, but the math isn’t adding up. Some estimates suggest that for every ounce of physical gold, there are 100 ounces of paper claims. That’s a house of cards waiting to collapse.

| Asset | Paper Claims | Physical Availability |

| Gold | 100:1 | Limited |

| Silver | 50:1 | Declining |

It’s like watching a high-wire act where the safety net’s been removed. Banks are caught between rising demand and dwindling supply, and the pressure is only growing. In my view, this could be the spark that lights up a massive price revaluation for both gold and silver.

Silver: The Dark Horse in the Race

While gold gets all the headlines, silver might just steal the show. Why? It’s not just a precious metal—it’s an industrial powerhouse, used in everything from solar panels to electronics. As physical demand spikes, silver’s supply constraints are even tighter than gold’s, setting the stage for a potential breakout.

Here’s where it gets interesting: silver’s price has been suppressed for years by the same paper games plaguing gold. But with Basel III forcing physical delivery, those games Hawkins are starting to crumble. I’ve always thought silver’s potential is underappreciated, and the current market dynamics suggest it’s ready to shine.

- Silver’s industrial demand is surging, driven by green energy trends.

- Paper contracts are losing influence as physical delivery takes over.

- Market tightness in June could push silver prices to new highs.

Perhaps the most exciting part is silver’s dual role as both a safe-haven asset and an industrial necessity. It’s like the Swiss Army knife of metals—versatile and ready for action. If BRICS keeps pushing for physical delivery, silver could outpace gold in percentage gains over the next few years.

The US Gold Reserve Question

Across the Atlantic, the US is facing its own reckoning. Calls for a full audit of its gold reserves are growing louder, fueled by skepticism about whether the reported 8,133 tons are actually there. It’s a bold question: what if the vaults aren’t as full as we’ve been told? The last full audit was decades ago, and whispers of re-hypothecation—lending out gold that’s already promised elsewhere—are raising eyebrows.

An audit could either restore confidence or expose a financial scandal of historic proportions.

– Economic analyst

The implications are massive. If the US can’t back its claims with physical gold, the dollar’s credibility could take a hit, accelerating the shift toward BRICS-led systems. It’s like a high-stakes poker game where someone might call the bluff. Personally, I’d love to see the cards on the table—wouldn’t you?

What’s Next for Investors?

So, where does this leave you? The financial world is at a crossroads, and Basel III is the signpost. For investors, the message is clear: physical assets are king. Gold and silver aren’t just shiny metals; they’re insurance against a system that’s showing its age.

Here’s a quick game plan:

- Diversify into physical metals: Consider holding gold and silver in secure vaults.

- Watch BRICS moves: Their gold strategy could drive prices higher.

- Stay informed: Market tightness in June could signal the start of a bigger trend.

In my experience, markets don’t shift overnight, but the signs are there. The bullish coiling pattern in gold and silver prices suggests a breakout is coming. It’s like a spring being compressed—when it releases, the move could be explosive.

The Bigger Picture: A New Financial Era?

Stepping back, this isn’t just about gold or silver—it’s about trust. The push for Basel III by BRICS nations is a signal that the old ways of doing things are under scrutiny. Paper promises are losing their luster, and physical assets are stepping into the spotlight. It’s like the world’s waking up from a long dream of infinite credit.

What’s most intriguing to me is how this could reshape global wealth. If BRICS succeeds in forcing a physical gold standard, the balance of power shifts eastward. The US, Europe, and their banks will have to adapt or risk being left behind. It’s a bold new world, and I’m both nervous and excited to see where it leads.

The future of wealth isn’t in digits on a screen—it’s in what you can hold in your hand.

As we move forward, keep an eye on the markets. The gold revaluation isn’t just a financial event; it’s a signal of deeper changes. Maybe it’s time to rethink what wealth really means. After all, in a world of paper promises, there’s something reassuring about the weight of gold in your hand, isn’t there?