Have you ever watched a stock climb so fast it feels like it’s defying gravity? That’s been the story of Nvidia lately, a company that’s riding the wave of artificial intelligence like no other. As someone who’s followed tech markets for years, I can’t help but marvel at how Nvidia’s chips have become the backbone of the AI revolution. But the big question now is: can this juggernaut keep soaring? Some experts believe Nvidia’s stock could jump another 40%, potentially hitting $200 per share. Let’s dive into what could make this happen and why it matters.

The Forces Behind Nvidia’s Potential Surge

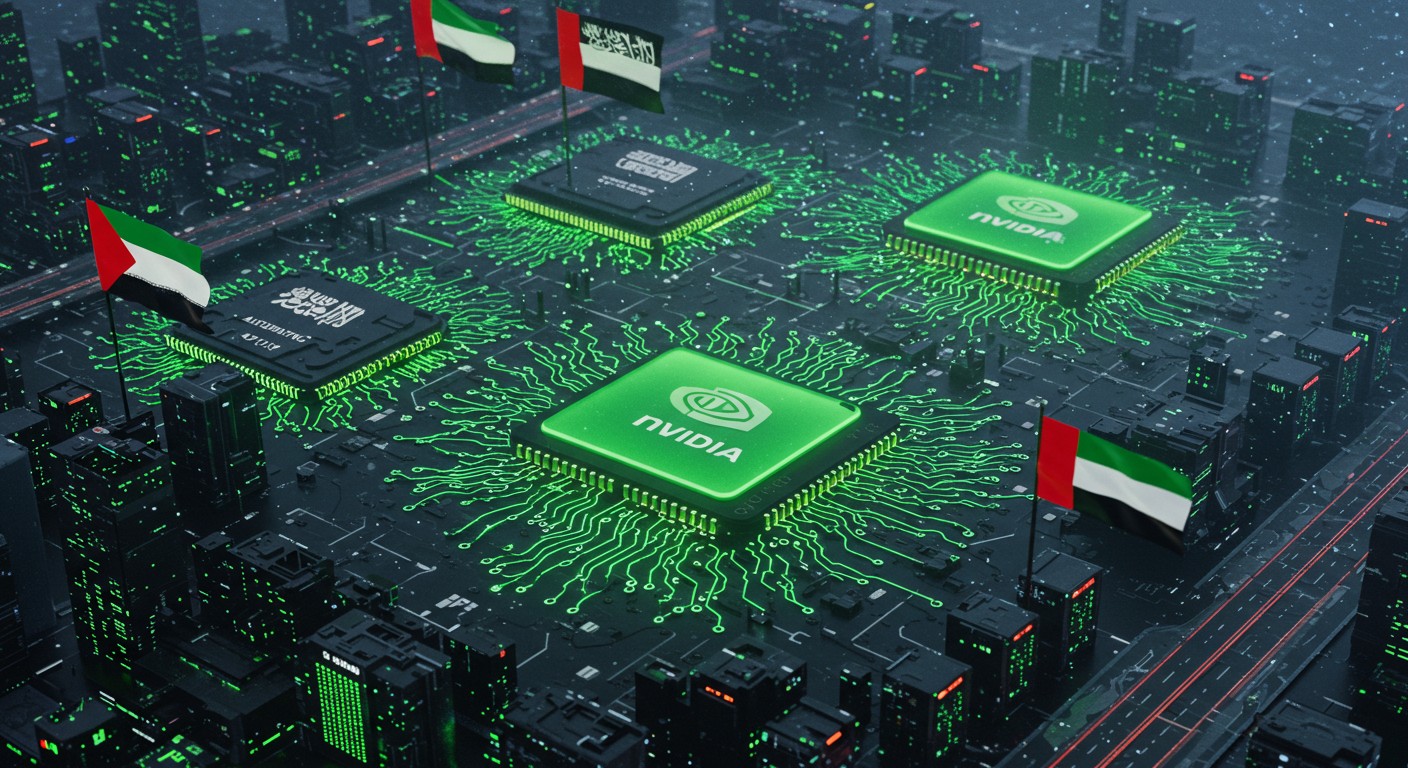

Nvidia’s meteoric rise isn’t just luck—it’s driven by its dominance in AI chip technology. The company has positioned itself as the go-to provider for everything from gaming to data centers powering generative AI. But what’s next? Two major catalysts could push the stock to new heights: sovereign AI deals and a potential reopening of the Chinese market. These aren’t just buzzwords—they’re game-changers that could redefine Nvidia’s growth trajectory.

Sovereign AI: A Global Power Play

Picture this: entire nations investing billions to build their own AI infrastructure. That’s what sovereign AI is all about—countries like Saudi Arabia and the UAE pouring resources into AI to secure their technological future. Nvidia’s at the heart of this trend, supplying the chips that power these ambitious projects. Recently, the company inked massive deals in the Middle East to provide AI chips for sprawling data centers. It’s not just about selling hardware; it’s about cementing Nvidia’s role in the global AI ecosystem.

Countries are racing to build AI infrastructure to stay competitive in the global economy.

– Tech industry analyst

Why does this matter? These deals diversify Nvidia’s revenue streams, reducing its reliance on U.S. tech giants like Microsoft or Meta. For investors, that’s a big deal. A broader customer base means more stability and growth potential. Plus, with recent policy shifts—like the scrapping of restrictive AI export rules—Nvidia’s poised to sign even more contracts. Europe’s next on the list, and if those deals come through, the stock could get a serious boost.

The China Conundrum: A High-Stakes Opportunity

Now, let’s talk about the elephant in the room: China. The world’s second-largest economy is a massive market for AI chips, but it’s been a tough nut to crack for Nvidia. Current U.S. export controls have slammed the brakes on sales, costing Nvidia billions in potential revenue. In fact, the company recently reported an $8 billion hit to its second-quarter earnings due to these restrictions. Ouch. But what if those rules were loosened?

Here’s where things get interesting. Nvidia’s CEO has been vocal about the need for a policy rethink, arguing that restricting chip exports doesn’t stop China from advancing in AI—it just pushes them toward other suppliers. If the U.S. government were to ease these controls, Nvidia could tap into a goldmine. China’s hunger for AI technology is insatiable, and Nvidia’s chips are the best in the game.

Blocking chip exports won’t halt progress—it just shifts who benefits.

– Semiconductor industry expert

Personally, I find this situation fascinating. It’s a high-stakes chess game between geopolitics and business. If Nvidia can navigate this, the payoff could be enormous. A 40% stock surge doesn’t seem so far-fetched when you consider the sheer size of the Chinese market.

Why Nvidia’s Growth Isn’t Just Hype

Let’s be real—stocks don’t just climb 40% because of wishful thinking. Nvidia’s got the fundamentals to back up the buzz. Its chips are the gold standard for AI applications, from self-driving cars to generative AI models. The company’s recent earnings showed jaw-dropping growth, and its stock has already rallied significantly from its April lows. But there’s more to the story than just numbers.

- Dominant market position: Nvidia’s GPUs are unmatched in performance.

- Diversifying revenue: Sovereign AI deals reduce dependence on a few big clients.

- Policy tailwinds: Easing export restrictions could open new markets.

These factors make Nvidia a standout, even in a crowded tech sector. But it’s not all smooth sailing—there are risks, and we’ll get to those in a bit.

The Risks: What Could Derail the Rally?

No stock is bulletproof, not even Nvidia. While the potential for a 40% surge is exciting, there are hurdles to watch. For one, the China situation is a wildcard. Geopolitical tensions could keep export controls tight, limiting Nvidia’s access to a massive market. Then there’s competition—other chipmakers aren’t sitting still, and they’re gunning for a piece of the AI pie.

| Factor | Impact | Risk Level |

| Export Controls | Limit China sales | High |

| Competition | Pressure on market share | Medium |

| Market Volatility | Affects stock price | Medium |

Despite these challenges, I’m cautiously optimistic. Nvidia’s track record shows it can adapt and innovate. The question is whether it can keep outpacing the competition while navigating a tricky global landscape.

What Investors Should Do Next

So, should you jump on the Nvidia bandwagon? It depends. If you’re already invested, holding could be wise—especially if sovereign AI deals keep rolling in. For new investors, timing is key. The stock’s already had a massive run, so waiting for a dip might make sense. Here’s a quick game plan:

- Monitor policy changes: Keep an eye on U.S.-China trade developments.

- Track sovereign AI deals: New contracts could signal more growth.

- Diversify your portfolio: Don’t bet everything on one stock, no matter how hot it is.

In my experience, chasing hype can burn you, but Nvidia’s story feels different. It’s not just a tech darling—it’s a company reshaping how the world uses AI. That’s the kind of bet that could pay off big.

The Bigger Picture: AI’s Role in the Future

Zoom out for a second. Nvidia’s rise isn’t just about one company—it’s about the AI revolution transforming industries. From healthcare to finance, AI is rewriting the rules, and Nvidia’s chips are the engine. Sovereign AI deals show that governments see this too, investing heavily to stay competitive. Even if China remains a challenge, the global demand for AI infrastructure is only growing.

AI is no longer a niche—it’s the backbone of the next industrial revolution.

– Tech strategist

Perhaps the most exciting part? We’re still in the early innings. As AI adoption accelerates, Nvidia’s poised to benefit, whether through sovereign deals or new markets. The $200 price target feels ambitious, but not impossible.

So, what’s the takeaway? Nvidia’s stock has room to run, but it’s not a sure thing. Sovereign AI and China are the keys to watch. If those dominoes fall, $200 could be just the start. For now, keep your eyes on the headlines and your portfolio diversified. The AI revolution is here—and Nvidia’s leading the charge.