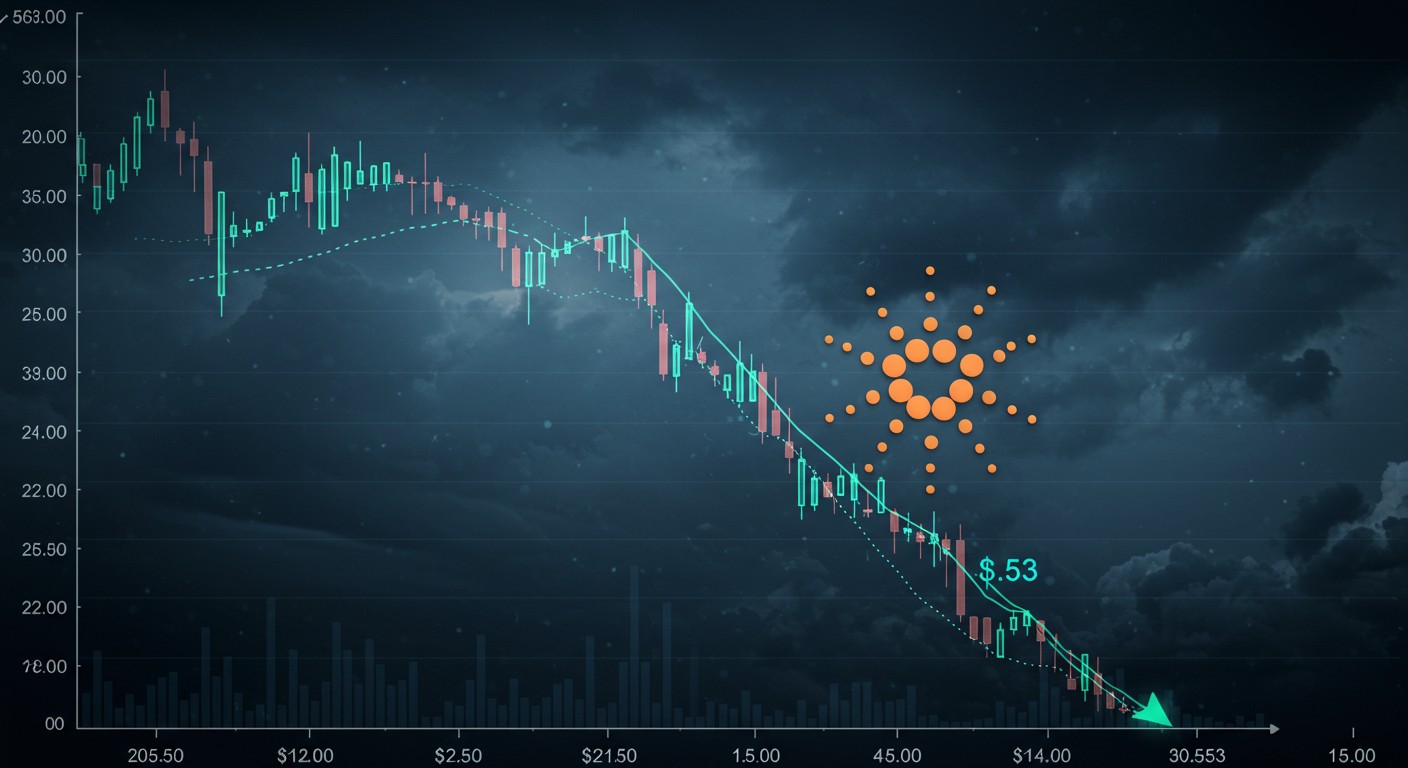

Have you ever watched a cryptocurrency chart and felt like you’re staring at a rollercoaster about to take a sharp dive? That’s exactly the vibe Cardano (ADA) is giving off right now. After a fleeting rebound that barely made a dent, the price is teetering on the edge, with traders eyeing the critical $0.53 support level. Let’s unpack what’s happening with ADA, why this low-volume bounce is raising red flags, and what it could mean for investors and traders alike.

Why Cardano’s Price Is Struggling

The crypto market is a wild place, full of hope, hype, and harsh reality checks. Cardano, one of the most promising altcoins, has been stuck in a rough patch lately. Its recent attempt to climb back from a dip didn’t exactly inspire confidence. The price tried to rally but lacked the bullish conviction needed to break through key resistance levels, leaving traders with more questions than answers.

According to market analysts, the issue boils down to one word: volume. When a price bounces without strong trading volume, it’s like a car running on fumes—it might move forward for a bit, but it’s not going far. For Cardano, this weak bounce signals that buyers aren’t fully committed, and that’s a problem when bearish momentum is still calling the shots.

The Rejection at Value Area Low

Let’s get into the nitty-gritty of Cardano’s price action. The value area low, a technical term for a price zone where trading activity has historically clustered, acted as a brick wall for ADA’s recent recovery attempt. The price hit this level, got rejected, and promptly retreated. It’s like Cardano knocked on the door of a bullish breakout but was told, “Not today.”

Price rejections at key levels like the value area low often signal that sellers are still in control.

– Crypto market analyst

This rejection isn’t just a one-off event. It confirms a broader bearish market structure, where lower highs and lower lows dominate the chart. For traders, this is a clear sign that the path of least resistance is still downward, at least for now. The lack of follow-through buying after the bounce only adds fuel to the bearish fire.

Why Volume Matters So Much

Volume is the lifeblood of any price movement. Think of it as the crowd at a concert: a huge, energized audience can make the show unforgettable, but a half-empty venue? Not so much. In Cardano’s case, the recent price bounce came with weak volume, meaning there weren’t enough buyers to push the price past resistance and sustain a rally.

- Lack of conviction: Low volume suggests traders are hesitant, possibly waiting for clearer signals.

- Bearish dominance: Without strong buying pressure, sellers continue to dictate the market.

- Corrective moves: The rebound was likely a temporary correction, not a trend reversal.

In my experience, watching volume is like checking the pulse of a market. When it’s weak, you know something’s off. For Cardano, this lack of volume is a warning sign that the price could be headed for another test of lower levels.

The $0.53 Support Level: Make or Break

All eyes are on the $0.53 high-timeframe support. This level has held up during past consolidations, acting as a floor where buyers have stepped in to defend the price. But here’s the kicker: if this level breaks, it could open the door to deeper losses. On the flip side, if it holds, we might see Cardano settle into a range-bound pattern, bouncing between $0.53 and higher resistance around $0.76.

| Price Level | Significance | Potential Outcome |

| $0.53 Support | Historical base for price recovery | Holds: Range-bound trading; Breaks: Deeper decline |

| $0.76 Resistance | Key barrier for bullish momentum | Breakout could signal recovery |

| Value Area Low | Recent rejection point | Continued resistance strengthens bearish bias |

Personally, I find this $0.53 level fascinating. It’s like a line in the sand for Cardano’s price. If buyers show up here with conviction, we could see a solid base form. But if they don’t, things could get ugly fast.

What’s Driving the Bearish Sentiment?

So, why is Cardano struggling to find its footing? A few factors are at play. First, the broader crypto market has been a mixed bag, with some coins like Solana and Bitcoin showing strength while others, like ADA, lag behind. This uneven performance can sap confidence from altcoin investors. Second, the lack of major catalysts—like new protocol upgrades or partnerships—has left Cardano in a bit of a narrative drought.

Recent market data paints a clear picture:

- Market Cap: Cardano’s market cap sits at $24.4 billion, respectable but not enough to shield it from volatility.

- 24-Hour Volume: At $1.3 billion, trading activity is decent but not enough to drive a sustained rally.

- Price Movement: A 4.97% drop over the past week underscores the bearish pressure.

Perhaps the most interesting aspect is how Cardano’s price action mirrors broader market uncertainty. Investors seem to be holding their breath, waiting for a spark to ignite the next move.

Can Cardano Bounce Back?

Here’s where things get tricky. Cardano isn’t doomed—far from it. Its fundamentals, like its focus on scalability and sustainability, still make it a favorite among long-term investors. But in the short term, the charts aren’t exactly screaming “buy now.” If the $0.53 support holds, we could see ADA carve out a trading range, giving traders a chance to accumulate at lower levels.

Patience is key in markets like this. Strong support levels often create opportunities for those who wait.

– Veteran crypto trader

If buying pressure picks up, a push toward $0.76 could be in the cards. But without a significant increase in volume, any rally might be short-lived. For now, traders should keep their eyes peeled for signs of stronger bullish momentum.

Strategies for Traders and Investors

Navigating a market like this requires a game plan. Whether you’re a day trader or a long-term investor, here are some practical strategies to consider:

- Watch the $0.53 level: Set alerts for price action around this key support. A bounce could signal a buying opportunity, while a break might call for caution.

- Monitor volume: Look for spikes in trading volume to gauge whether a move is sustainable.

- Stay patient: Range-bound markets reward those who wait for clear signals rather than chasing weak bounces.

I’ve found that in choppy markets, patience often pays off more than impulsive trades. Cardano’s current setup suggests we’re in for more sideways action unless something big shakes things up.

What’s Next for Cardano?

Looking ahead, Cardano’s price action will likely hinge on two things: the $0.53 support and broader market sentiment. If Bitcoin and other major coins continue to climb, it could lift altcoins like ADA along with them. But if the market turns sour, that $0.53 level will be tested hard.

For now, the charts suggest a range-bound scenario is the most likely outcome. Traders can look for opportunities to buy at support and sell at resistance, while long-term investors might see this as a chance to accumulate at lower prices. Either way, staying informed and nimble is key.

Cardano Price Outlook: Short-term: Test of $0.53 support Mid-term: Potential range between $0.53 and $0.76 Long-term: Watch for volume spikes and market catalysts

Cardano’s journey is far from over, but it’s at a crossroads. Will it hold the line and set the stage for a recovery, or will it succumb to bearish pressure? Only time—and the charts—will tell.

So, what’s your take? Are you betting on Cardano to bounce back, or are you bracing for more downside? The crypto market is never boring, and ADA’s next move could be a wild one.