Imagine waking up to find your favorite car’s production line grinding to a halt because of a tiny chip caught in international drama. That’s exactly the nightmare European automakers faced recently, until a glimmer of hope emerged from Beijing over the weekend. It’s a reminder of how fragile global supply chains have become in our tech-driven world.

A Sudden Reprieve for the Auto Sector

Monday morning brought sighs of relief across trading floors in Europe. Shares of major car manufacturers climbed steadily, shaking off weeks of anxiety over potential semiconductor shortages. The catalyst? An unexpected statement from Chinese officials indicating they might grant exemptions for certain chip exports tied to a controversial company.

This development couldn’t have come at a better time. In my view, the auto industry has been walking a tightrope for months, balancing innovation with these unpredictable disruptions. One wrong move, and entire production schedules collapse like a house of cards.

What Sparked the Initial Panic?

Let’s rewind to September. The Dutch authorities made a bold and rare decision to assume control of a semiconductor firm with deep Chinese ownership ties. Their reasoning centered on national security, particularly worries that critical technology could vanish during crises.

Owned by a Shanghai-based entity, the company in question specializes in producing vast quantities of chips essential for everything from vehicles to everyday gadgets. When the Netherlands stepped in, China retaliated swiftly by halting the shipment of finished products from the firm’s facilities.

Suddenly, automakers were staring down the barrel of shortages. German brands, in particular, felt vulnerable due to their reliance on established domestic suppliers and localized manufacturing networks. Even as production shifted overseas, these connections remained vital.

The risk of unavailability in emergencies prompted decisive action to safeguard strategic interests.

– Government security analysis

It’s fascinating how one policy move can ripple through industries thousands of miles away. Have you ever considered just how interconnected our modern economy is?

Market Reactions Tell the Story

By mid-morning in London, the numbers spoke volumes. French icon Renault saw its shares bounce up around three percent. Not far behind, the Stuttgart-based luxury powerhouse Mercedes-Benz Group mirrored that gain, while the Italian-American giant behind Jeep climbed similarly.

Suppliers weren’t left out either. A French auto parts specialist advanced over three percent, and another player in the ecosystem gained nearly two. Even the Wolfsburg behemoth Volkswagen, along with its premium siblings Porsche and BMW, each tacked on more than one and a half percent.

- Renault: +3%

- Mercedes-Benz: +3%

- Stellantis: +3%

- Valeo: +3.3%

- Aumovio: +1.8%

- Volkswagen: +1.5%

- Porsche: +1.5%

- BMW: +1.5%

These aren’t just random fluctuations. They reflect investor confidence rebounding after weeks of uncertainty. In my experience following markets, such synchronized moves often signal broader sector relief.

Looking at three-month charts, you can almost pinpoint the dip when tensions escalated and the sharp recovery following the weekend announcement. It’s a classic case of news driving sentiment.

Why Automotive Chips Matter So Much

Modern vehicles aren’t just mechanical marvels anymore—they’re rolling computers. A single car can contain hundreds of semiconductors managing everything from engine performance to infotainment systems.

The firm at the controversy’s center excels in high-volume, reliable chips that aren’t always the cutting-edge variety but are absolutely crucial for mass production. Think of them as the workhorses keeping assembly lines humming.

When exports stopped, warnings poured in from industry groups about impending outages. One Japanese manufacturer even publicly announced production cuts last week, becoming the first to feel the pinch visibly.

Perhaps the most interesting aspect is how this exposes vulnerabilities in just-in-time manufacturing. Companies optimized for efficiency now face risks from geopolitical flashpoints. It’s a wake-up call, if you ask me.

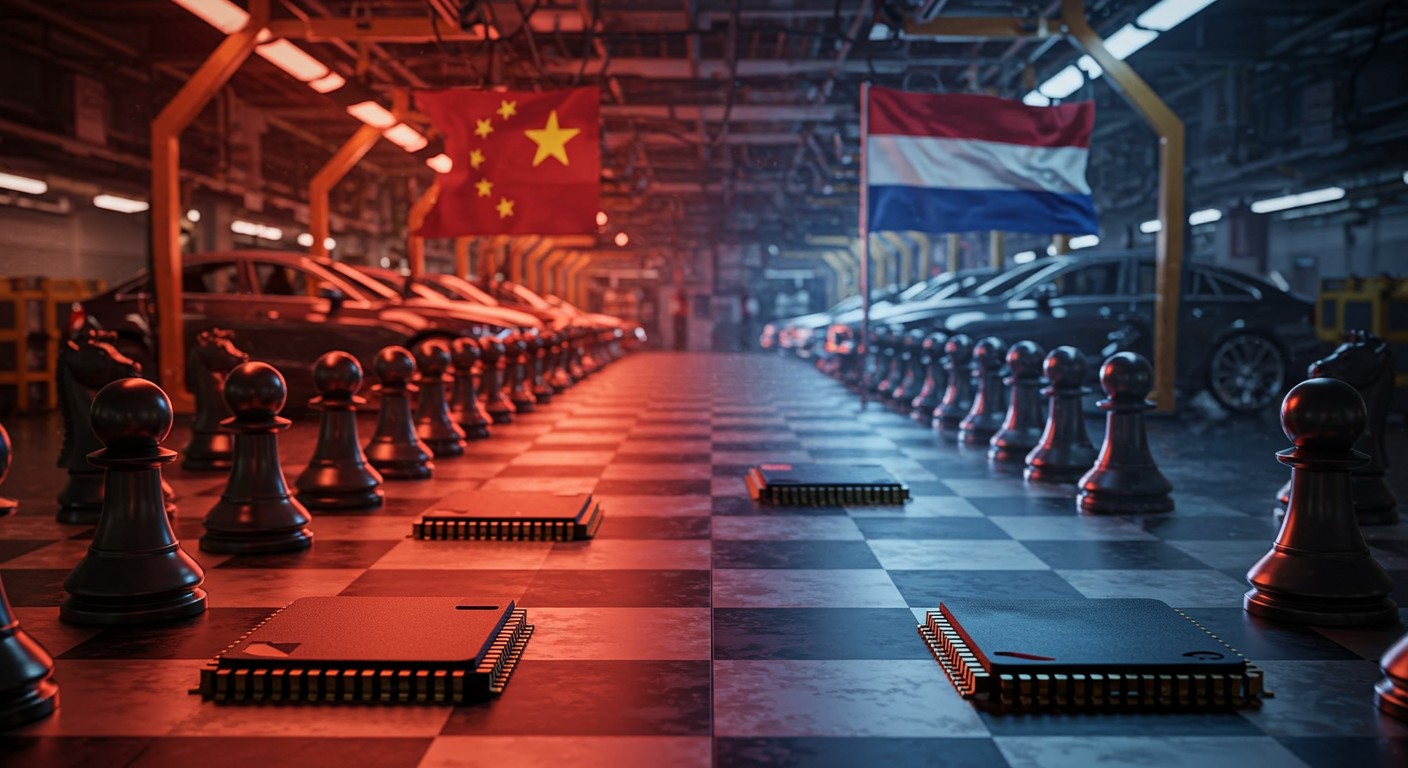

The Geopolitical Chess Game Unpacked

This isn’t happening in isolation. Broader tensions between Western nations and China over technology transfer and security have been building for years. Semiconductors sit right at the heart of this struggle.

The Dutch move reportedly followed consultations with allies concerned about supply chain dependencies. China, in turn, used export controls as leverage—a tactic we’ve seen before in other disputes.

Now, with signals of possible exemptions, there’s cautious optimism. But exemptions for whom? Under what conditions? These details will determine whether this is a full resolution or merely a band-aid.

Strategic technologies require careful balancing of economic and security priorities.

Analysts suggest any exemptions might prioritize critical industries like automotive to prevent widespread economic damage. That makes sense—disrupting car production affects jobs, consumers, and related sectors.

Broader Implications for Supply Chains

Zoom out, and this episode highlights the need for diversification. European automakers, especially those with heavy German roots, depend on intricate networks spanning continents.

Many Tier 1 suppliers—those big players delivering complex subsystems—source components globally. When one link breaks, the whole chain suffers. We’ve learned this lesson before with pandemics and natural disasters, but geopolitics adds another layer.

| Supply Chain Element | Vulnerability Level | Diversification Need |

| Semiconductor Design | Medium | High |

| Chip Fabrication | High | Critical |

| Assembly & Testing | Medium-High | High |

| Logistics & Export | Variable | Ongoing |

As the table shows, fabrication stands out as the biggest bottleneck. Concentrated in a few regions, it’s prone to disruptions whether from politics or other factors.

Companies are already responding. Investments in domestic or allied-nation production facilities are ramping up. But these take years to bear fruit, leaving short-term gaps.

Investor Takeaways from the Rally

For those watching stocks, this rally offers lessons. First, news flows matter immensely in interconnected sectors. Second, resolution of binary risks—like total export bans—can trigger sharp rebounds.

That said, caution remains warranted. Until exemptions are formalized and implemented, uncertainty lingers. Smart money might view current levels as opportunities but with hedges in place.

- Monitor official announcements closely

- Watch supplier stock correlations

- Consider broader semiconductor exposure

- Factor in currency fluctuations

- Track production resumption reports

I’ve found that combining fundamental analysis with real-time news tracking yields the best results in volatile environments like this.

Looking Ahead: Potential Scenarios

Several paths could unfold from here. In the best case, broad exemptions restore flows quickly, and stocks stabilize at higher levels. Production resumes without major delays, and the incident becomes a footnote.

Alternatively, limited or conditional exemptions might ease but not eliminate pressures. Some manufacturers could still face intermittent shortages, prompting selective output adjustments.

Worst case? Talks stall, leading to prolonged restrictions. This would force accelerated reshoring efforts amid rising costs—a painful but perhaps necessary evolution.

Whatever happens, the auto sector’s resilience will be tested. Companies with flexible sourcing and strong balance sheets should weather storms better.

Beyond immediate impacts, this saga underscores technology’s role in geopolitics. Chips aren’t just components; they’re strategic assets influencing national power.

Policymakers worldwide are grappling with these realities. Initiatives to build independent capabilities are gaining traction, from Europe to Asia and North America.

Historical Context Adds Perspective

Remember the global chip crunch of 2021-2022? Droughts, fires, and pandemic disruptions combined to cripple supplies. Automakers idled plants, and new car wait times stretched to months.

That crisis was largely environmental and logistical. Today’s challenges layer politics on top, making solutions more complex. Yet the playbook remains similar: diversify, stockpile strategically, innovate alternatives.

One silver lining? Heightened awareness drives investment. Billions are flowing into next-generation fabrication technologies and materials science.

Consumer Angle: What This Means for Car Buyers

While investors focus on stocks, everyday drivers wonder about practical effects. Will prices rise? Delays lengthen? Features get cut?

Short answer: possibly, but not dramatically if resolved soon. Modern cars already face component substitutions due to ongoing shortages in various areas.

Longer term, though, sustained disruptions could accelerate electrification timelines or push premium features into higher trims only. Adaptation is the name of the game.

Environmental Considerations in Chip Production

An often-overlooked angle: semiconductor manufacturing’s environmental footprint. Facilities consume massive energy and water, contributing to carbon emissions.

As production potentially shifts geographies, so do these impacts. Regions with cleaner grids might host more fabs, aligning with sustainability goals.

Automakers themselves push green agendas. Resolving supply issues without compromising efficiency supports broader decarbonization efforts.

Innovation Driven by Necessity

Crisis breeds creativity. Engineers are exploring chip designs using fewer critical materials or alternative architectures.

Software optimizations can sometimes compensate for hardware limitations. Over-the-air updates already enhance vehicles post-purchase; this capability could expand.

In essence, constraints force progress. We’ve seen it throughout industrial history, and semiconductors are no exception.

Global Competition Heats Up

Nations vie for leadership in this space. Massive subsidies support domestic champions, from foundries to design houses.

Europe’s own chip act aims to boost self-sufficiency. Similar programs exist elsewhere, fragmenting what was once a more unified market.

Collaboration persists in research, but commercial production increasingly nationalizes. Balance will be key to avoiding inefficient duplication.

Final Thoughts on Market Stability

As Monday’s trading session progressed, gains held firm. Volume suggested genuine buying interest rather than speculative froth.

Yet markets hate uncertainty, and details matter. Watch for concrete exemption frameworks in coming days.

Personally, I believe this incident will accelerate supply chain rethinking without causing lasting damage—if handled pragmatically. The auto sector has proven adaptable before.

One thing’s clear: in today’s world, even the smallest component can move mountains—or in this case, multibillion-dollar industries. Staying informed is more crucial than ever.

(Word count: approximately 3250)