Have you ever wondered what keeps those massive AI brains humming around the clock? It’s not just code and chips—it’s an insane amount of electricity, the kind that could light up small countries. Lately, I’ve been fascinated by how the tech world’s hunger for power is shaking up corners of the market you wouldn’t expect, like big oil stepping into the spotlight in a whole new way.

The Great Energy Divide in Markets

Over the last couple of years, something odd has been happening in the investment world. Power-related stocks—think utilities, natural gas producers, even uranium miners—have been on a tear, hitting highs not seen in ages. Meanwhile, traditional oil explorers and refiners? They’ve been treading water, or worse, as crude prices dip to uncomfortable lows. It’s like the market is betting everything on electrons but forgetting about hydrocarbons altogether.

In my view, this split makes sense on the surface. AI and data centers are gobbling up energy at a ridiculous pace, and renewables alone can’t keep up with the reliability demands. But here’s where it gets interesting: one of the biggest names in oil is quietly positioning itself to bridge that gap, and it could rewrite the rules for energy stocks.

Why AI Needs Uninterruptible Power

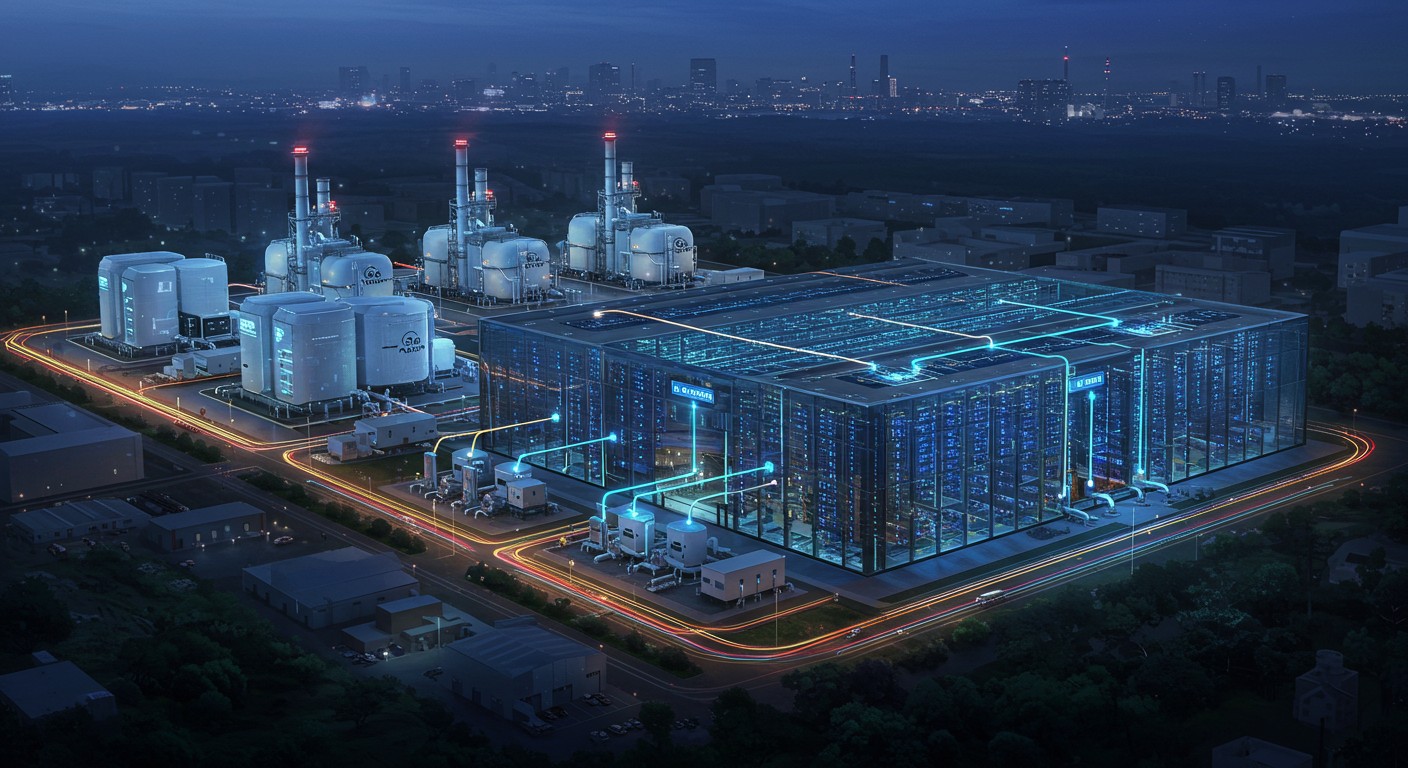

Let’s paint a picture. A single large data center can suck down as much power as a mid-sized city. Multiply that by the thousands being built for cloud computing, machine learning training, and all the generative AI tools we’re obsessed with. Blackouts? Not an option. Downtime costs millions per minute.

Tech companies have chased wind and solar hard, offsetting emissions with credits. That’s great for PR, but physics doesn’t care about certificates— you need dispatchable power, the kind you can ramp up instantly. Natural gas fits that bill perfectly, which is why some are already signing deals for gas-fired plants near their facilities.

The desire for low-emission facilities is real among these big players, and in the short to medium term, we’re likely the best shot at making it happen.

– Industry executive

Perhaps the most intriguing part is how this the old guard of energy is adapting. They’re not just pumping fuel; they’re bundling it with tech to clean up the exhaust.

Carbon Capture: From Buzzword to Business Model

Carbon capture and storage—CCS for short—used to sound like sci-fi or greenwashing. Capture CO2 from smokestacks, pipe it underground, store it forever. Skeptics abound, but the tech has matured quietly in oil fields for enhanced recovery.

Now, imagine applying that at scale to gas plants feeding data centers. Aim for 90% capture rates. That’s not pie-in-the-sky; it’s engineering that’s been proven in pilots. The key? Location, infrastructure, and know-how—all things a supermajor brings to the table.

- Existing pipeline networks for CO2 transport

- Geological expertise in suitable storage sites

- Decades of handling high-pressure gases safely

- Relationships with utilities and regulators

I’ve always thought the real winners in energy transitions aren’t the pure-play renewables; they’re the incumbents who pivot smartly. This feels like one of those moments.

The Talks Heating Up Behind Closed Doors

Word is, discussions are far along. Power providers want cleaner output without ditching reliable fuel. Tech giants need to hit aggressive net-zero targets while scaling infinitely. Enter the oil major with a proposal: let us handle the emissions, you handle the algorithms.

It’s not charity. This is a revenue stream—selling decarbonized gas, capturing carbon for fees, maybe even monetizing credits. For data center operators, it checks the sustainability box without betting the farm on unproven tech.

One example making waves: a major social platform inked a deal in the South for gas-powered supply to a new campus. No capture yet, but it’s the thin edge of the wedge. Add CCS, and suddenly natural gas looks green enough for boardroom presentations.

Nuclear and Renewables: Friends or Foes?

Don’t get me wrong—nuclear is having its moment too. Small modular reactors, billions in investments, restarts of old plants. It’s baseload heaven. But timelines? Years, if not decades, for widespread deployment at scale.

Renewables with batteries help, but storage costs skyrocket for 24/7 needs. Gas with capture? It deploys now, using brownfield sites and existing grids. In my experience following energy markets, pragmatism often trumps purity when deadlines loom.

| Power Source | Availability | Emission Profile | Scalability Timeline |

| Renewables + Storage | Intermittent | Low | Medium |

| Nuclear (SMRs) | Baseload | Very Low | Long |

| Gas + CCS | Dispatchable | Low (90% capture) | Short |

That table simplifies it, but you get the idea. No silver bullet, but a portfolio approach where gas bridges the gap.

What This Means for Oil Stocks

Remember that market disconnect I mentioned? If a supermajor cracks the code on AI-adjacent revenue, it could spark a re-rating. Not just volume sales, but premium pricing for “clean” molecules. Investors love growth narratives, and this ties directly to the hottest sector on earth.

Of course, risks abound. CCS isn’t cheap—billions in capex. Regulatory hurdles for storage sites. Public perception if something leaks. But the upside? Tapping a demand curve that’s vertical while oil demand plateaus in transport.

I’ve found that the best investments hide in plain sight, where old industries meet new megatrends. Energy for AI might be the sleeper story of the decade.

Broader Implications for Tech and Energy

Zoom out, and this is bigger than one company. It signals a thaw in the culture wars between big tech and big oil. Both need each other more than they’d admit publicly. Tech needs power security; energy needs growth markets beyond EVs and plastics.

- Tech funds infrastructure via long-term PPAs

- Energy deploys capital and expertise

- Governments ease permitting for strategic projects

- Everyone claims climate wins

Win-win-win, if executed well. Or a house of cards if costs balloon or tech pivots again.

Challenges on the Road Ahead

Let’s be real—nothing this ambitious is smooth sailing. Capture rates at 90% sound impressive, but real-world plants deal with variability. Gas prices fluctuate. What if hydrogen or geothermal suddenly scales?

Then there’s the ESG crowd. Some will never accept fossil fuels, capture or not. Others will see it as pragmatic progress. In my opinion, perfection is the enemy of progress here; we need solutions that work today while better ones mature.

We’ve got the sites secured, the pipes in place, and the technical chops to make this real.

Confidence like that doesn’t come from thin air. It’s backed by balance sheets that dwarf most tech firms’ capex budgets.

How Investors Can Think About This

If you’re portfolio-heavy in tech, consider the energy underbelly. If you’re in oils, watch for partnerships announcements—these could be catalysts. Diversified utilities with gas exposure might benefit indirectly.

Personally, I like plays that benefit from multiple futures. Gas with CCS works whether AI explodes or moderates, whether nuclear delays or accelerates. It’s optionality baked in.

At the end of the day, the AI revolution isn’t just about smarter software; it’s about who powers it sustainably and profitably. The fact that a century-old oil giant is leading the charge on low-emission data center fuel? That’s the kind of plot twist markets love. Keep an eye on this space—it’s just getting started.

Whether you’re a tech enthusiast, energy investor, or just curious about where the world is headed, this convergence matters. It might not make headlines daily, but it’s reshaping trillions in capital flows. And in a world obsessed with net zero, finding common ground between silicon and hydrocarbons could be the pragmatic path forward we’ve all been waiting for.

One thing’s clear: the energy for tomorrow’s intelligence won’t come from one source. It’ll come from unlikely alliances, proven tech repurposed boldly, and a willingness to meet in the middle. If this deal-making bears fruit, we might look back at 2025 as the year oil officially entered the AI trade—not as a relic, but as a reinvented partner.

Now, imagine the boardrooms where these conversations happen. Engineers sketching capture layouts next to data architects planning server farms. It’s not the future we romanticized, but it might be the one that actually works. And for investors patient enough to connect the dots, the rewards could be substantial.

I’ve spent years watching energy markets gyrate with geopolitics and ideology. This feels different—demand-driven, technology-enabled, and strangely collaborative. Maybe, just maybe, the great energy divide is starting to heal, one data center at a time.