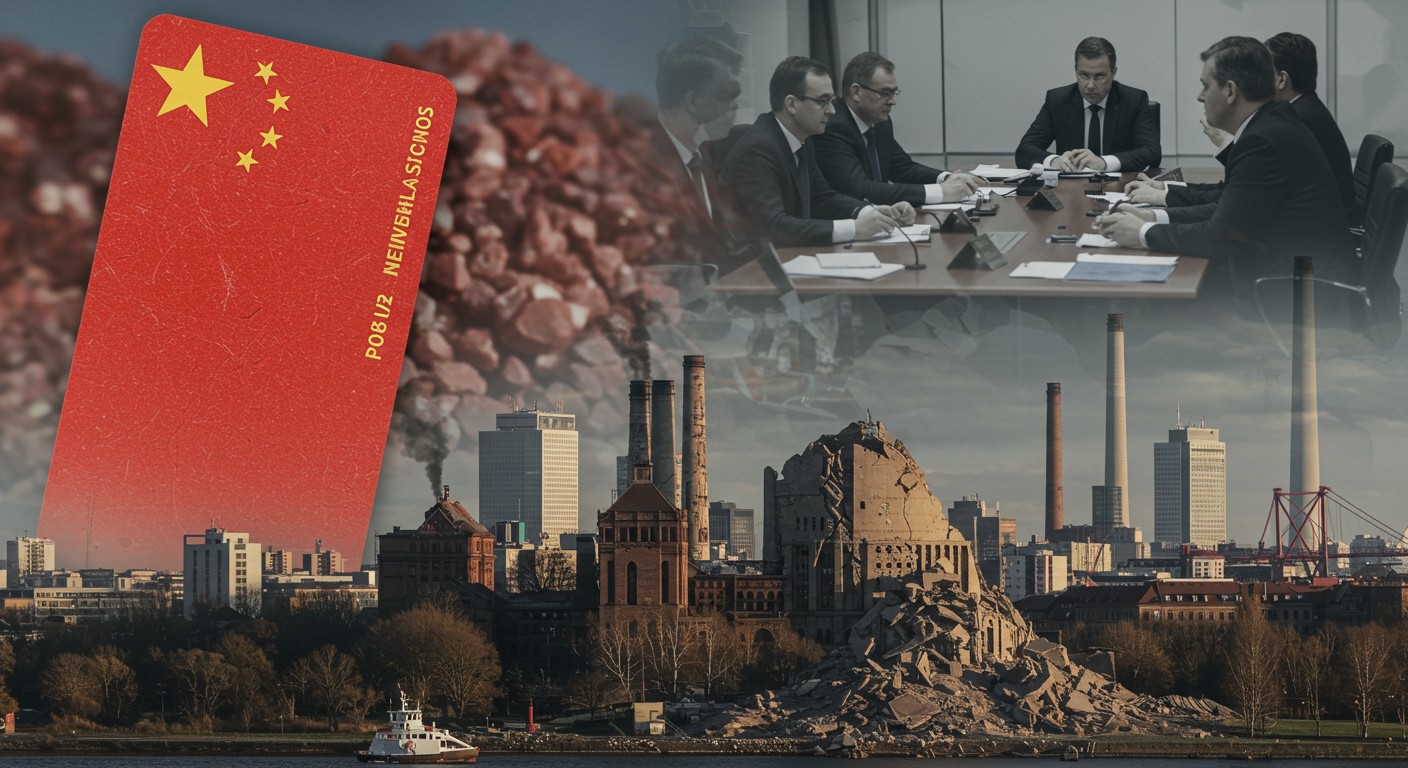

Have you ever watched a once-mighty giant stumble? It’s a humbling sight, like seeing a champion boxer take an unexpected hit. Germany, long a powerhouse of industry and diplomacy, is wobbling. Its economy is shrinking, and now, in a stinging rebuke, China has essentially told Berlin’s top diplomat to stay home. This isn’t just a diplomatic slight—it’s a signal of a shifting global order, and I can’t help but wonder: how did Germany, of all nations, end up here?

The Fall of a Titan: Germany’s Economic Woes

Germany’s economy, once the envy of Europe, is in a tailspin. Factories are slowing, exports are dipping, and the nation’s industrial backbone is creaking under pressure. The numbers paint a grim picture: Germany’s GDP contracted by 0.3% in 2024, with projections for 2025 looking even bleaker. For a country that thrived on precision engineering and global trade, this isn’t just a hiccup—it’s a full-blown crisis.

The ripple effects are undeniable. Automotive giants like Volkswagen and BMW, which employ thousands and drive significant GDP, are facing supply chain bottlenecks and rising costs. Meanwhile, energy prices, still reeling from the loss of cheap Russian gas, are squeezing manufacturers. It’s a perfect storm, and Germany’s geopolitical clout is taking a hit as a result.

Germany’s economic strength has always been its diplomatic currency. When the economy falters, the world listens less.

– Global trade analyst

China’s Red Card: A Diplomatic Disaster

Enter the latest blow: China’s decision to cancel a high-profile visit from Germany’s Foreign Minister. This wasn’t just any trip. It was meant to be a reset for strained Sino-German relations, with a delegation of heavy hitters from German industry—think automakers, robotics experts, and rare earth importers. Beijing’s message was clear: we don’t need to talk right now. Ouch.

Why does this sting so much? Because Germany desperately needs China. Rare earth elements, those obscure minerals that power everything from electric vehicles to wind turbines, are overwhelmingly controlled by China—over 90% of global refining, to be exact. A Chinese export ban, which has been floated recently, could cripple Germany’s industrial core. The cancellation of this visit feels like a warning shot.

In my view, this diplomatic snub is more than just a scheduling conflict. It’s a power play. China knows Germany is vulnerable, and it’s flexing its muscles at a moment when Berlin can least afford it.

Why China Holds the Cards

Let’s zoom out for a second. China’s economy isn’t exactly thriving either. It’s grappling with a deflationary spiral, fueled by U.S. tariffs and a property market crash that’s left ghost towns of unsold buildings. Yet, China has a trump card: its export machine. With a trade surplus nearing $1 trillion annually, Beijing can afford to play hardball.

Here’s where it gets interesting. While Chinese exports to the U.S. have plummeted by 27% due to tariffs, exports to Germany are up 10.7% this year. Europe, and Germany in particular, has become a dumping ground for China’s excess production. This isn’t just about economics—it’s about survival for Beijing. With youth unemployment hovering around 20%, China needs markets to absorb its goods, or social unrest could follow.

- China’s leverage: Near-total control over rare earth refining.

- Germany’s weakness: Heavy reliance on these materials for industry.

- Beijing’s strategy: Flooding Europe with exports to offset U.S. losses.

Could Germany have played this differently? Perhaps. Aligning more closely with the U.S. could have given Europe leverage in negotiations, but ideological stubbornness in Brussels—think green policies and regulatory overreach—has left the continent isolated.

Europe’s Missed Opportunities

Europe’s leaders, particularly in Germany, seem caught in a trap of their own making. The EU’s obsession with climate regulations and protectionist policies has alienated key allies like the U.S., which is roaring ahead with 3.8% GDP growth, deregulation, and tax cuts. Meanwhile, Europe’s energy dependence—importing 60% of its energy—has left it vulnerable, especially after cutting ties with Russian suppliers.

I’ve always found it puzzling how Europe doubles down on policies that weaken its hand. The Digital Services Act and Digital Markets Act, for instance, sound great on paper but burden businesses with red tape. Instead of cozying up to Washington for a united front against China’s dominance, Europe’s leaders are chasing ideals that don’t pay the bills.

Europe’s regulatory zeal is like rearranging deck chairs on the Titanic. It’s sinking its own competitiveness.

– Economic policy expert

What could Europe do differently? For starters, it could rethink its approach to trade and alliances. A strategic partnership with the U.S. could secure access to critical resources and counterbalance China’s dominance. But that would require swallowing some pride and admitting that the current path isn’t working.

The Rare Earth Dilemma

Let’s talk about the elephant in the room: rare earths. These minerals aren’t just a niche issue—they’re the lifeblood of modern industry. From electric car batteries to medical imaging devices, Germany’s economy grinds to a halt without them. China’s near-monopoly on refining gives it unparalleled leverage, and Beijing knows it.

Germany’s canceled delegation was supposed to address this head-on, with representatives from Siemens Healthineers and the German Robotics Association pleading for stable supplies. The fact that China didn’t even bother to meet them speaks volumes. It’s as if Beijing is saying, “You need us more than we need you.”

| Industry | Rare Earth Dependency | Impact of a Ban |

| Automotive | High (EV batteries, motors) | Production halts |

| Robotics | Medium (sensors, actuators) | Supply chain delays |

| Healthcare | High (MRI machines) | Equipment shortages |

The stakes couldn’t be higher. A full export ban would be catastrophic, and Germany’s leaders know it. Yet, their response has been tepid, caught between ideological purity and practical needs.

A Path Forward?

So, where does Germany go from here? In my opinion, the answer lies in pragmatism. Europe needs to ditch the moral posturing and focus on what keeps the lights on. That means forging stronger ties with the U.S., diversifying supply chains, and investing in alternative sources for critical materials.

- Align with the U.S.: A united front could pressure China into fairer trade practices.

- Diversify suppliers: Look to countries like Australia or Canada for rare earths.

- Reduce red tape: Scrap overly restrictive regulations to boost competitiveness.

It’s not going to be easy. Europe’s leaders will need to swallow their pride and admit that the current strategy isn’t working. But the alternative—continued decline and irrelevance—isn’t an option.

A Wake-Up Call for Europe

China’s snub is more than a diplomatic embarrassment—it’s a wake-up call. Germany, and by extension Europe, can’t afford to keep stumbling blindly. The world is changing, and clinging to outdated ideals won’t cut it. I’ve always believed that resilience comes from adaptability, and right now, Europe needs to adapt fast.

The question is: will Germany’s leaders rise to the challenge, or will they let pride and politics drag them further down? Only time will tell, but one thing’s clear—the days of taking Germany’s global influence for granted are over.

In a world of giants, only the nimble survive.

– International relations scholar

Germany’s fall from grace is a lesson for us all. Economic strength and geopolitical influence are two sides of the same coin. Lose one, and the other slips away. Let’s hope Europe’s leaders are paying attention.