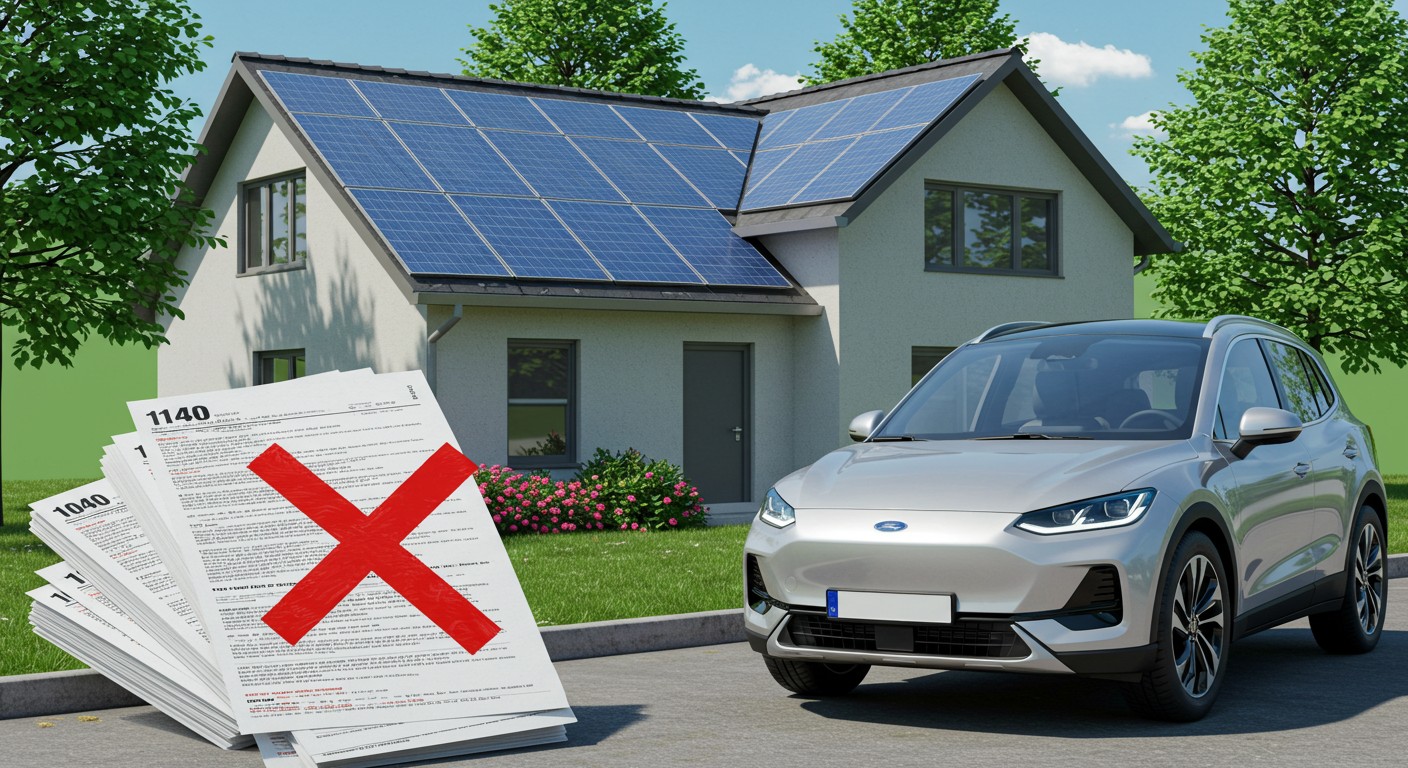

Have you ever felt the sting of missing out on a great deal just because you waited too long? I know I have—there’s nothing worse than realizing you could’ve saved thousands with just a bit of foresight. That’s exactly the vibe surrounding the clean energy tax credits right now, as new legislation looms that could pull the plug on some of the best financial incentives for going green. With Republican lawmakers pushing a massive tax overhaul, dubbed the “One Big Beautiful Bill Act,” a slew of eco-friendly tax breaks are on the chopping block, set to vanish as early as 2026. If you’ve been eyeing an electric vehicle or dreaming of solar panels for your home, now’s the time to act before these savings slip away.

Why Clean Energy Credits Are Under Fire

The clean energy tax credits, beefed up by the Inflation Reduction Act of 2022, were designed to make sustainable choices more affordable for everyday folks. Think $7,500 off a shiny new electric vehicle, $4,000 for a used one, or credits to slash the cost of energy-efficient home upgrades like solar panels or better insulation. These incentives have been a game-changer, helping families save money while cutting their carbon footprint. But here’s the kicker: Republican lawmakers in both the House and Senate are ready to sunset these credits to fund other priorities, like broad tax cuts for households and businesses. It’s a classic case of shifting funds around, and green incentives are caught in the crossfire.

The push to eliminate these credits is about redirecting federal funds, but it could leave eco-conscious consumers high and dry.

– Tax policy analyst

The House already passed its version of the bill in May, and the Senate’s version is hot on its heels, with a potential vote as soon as next week. If it passes, credits for EVs and home energy improvements could start phasing out in as little as 90 to 180 days after the law’s signed. That’s not a lot of time if you’re planning a big purchase or home project. So, what exactly are we losing, and why does it matter? Let’s break it down.

Electric Vehicle Credits: A Ticking Clock

One of the biggest hits is the electric vehicle tax credit. Right now, if you buy a qualifying new EV, you can shave up to $7,500 off your tax bill. Opt for a used EV, and you’re looking at a $4,000 credit. Even leasing an EV comes with perks, as dealers can pass along that $7,500 credit to lower your costs upfront. These incentives have made EVs more accessible, especially for middle-class families who might balk at the sticker price otherwise.

But the GOP’s plan would yank these credits away. The House bill sets a hard stop for 2026, while the Senate’s version could end some credits, like the one for used EVs, in just 90 days. That’s barely enough time to research models, test-drive a few, and make a decision. I’ve always thought EVs were a smart move—not just for the planet but for long-term savings on gas and maintenance. Losing these credits feels like a gut punch for anyone hoping to make the switch.

- New EV Credit: Up to $7,500 for qualifying vehicles.

- Used EV Credit: $4,000 for pre-owned electric cars.

- Leased EV Perk: Dealers can apply the $7,500 credit directly.

Why the rush to kill these credits? It’s all about reallocating funds. Lawmakers argue that redirecting the money to other tax cuts will boost the economy more broadly. But for consumers, this means higher costs for EVs, which could slow the shift away from gas-guzzlers. If you’re even remotely considering an EV, now might be the time to pull the trigger.

Home Energy Upgrades: Savings at Risk

It’s not just EVs taking a hit. The energy efficient home improvement credit (known as the 25C credit) and the residential clean energy credit (25D credit) are also on the line. These credits help cover the cost of projects like installing solar panels, heat pumps, or energy-efficient windows. For example, the 25C credit can knock off up to 30% of the cost of certain home upgrades, with a cap of $3,200 annually. The 25D credit is even juicier, covering 30% of the cost of big-ticket items like solar panels with no upper limit.

These credits aren’t just about saving money—they’re about making your home more comfortable and slashing your energy bills. I’ve seen friends transform their homes with solar panels and instantly regret not doing it sooner. But if the GOP bill passes, these incentives will vanish in 2026, a full seven years earlier than planned. That’s a tight window to plan and execute a major home project.

| Incentive Type | Savings Offered | Expiration Under GOP Bill |

| EV Credit (New) | Up to $7,500 | 2026 |

| EV Credit (Used) | $4,000 | 90 days post-law |

| Home Improvement (25C) | 30% up to $3,200 | 2026 |

| Residential Clean Energy (25D) | 30%, no cap | 2026 |

The loss of these credits could mean higher upfront costs for homeowners looking to go green. And let’s be real—energy bills aren’t getting any cheaper. Without these incentives, the math on projects like solar panels gets trickier, especially for folks on a budget.

What’s Driving the GOP’s Push?

So, why are Republicans so keen on ditching these credits? It’s not just about cutting green programs for the sake of it. The money saved from these credits, along with cuts to programs like Medicaid and food assistance, is earmarked for a massive package of tax cuts. Think lower taxes for businesses and individuals, which lawmakers argue will juice the economy. But here’s where I get a bit skeptical—redirecting funds from clean energy to broad tax cuts feels like trading long-term gains for short-term wins.

Cutting these credits could raise energy costs for families, which seems counterintuitive when we’re all trying to save a buck.

– Energy policy expert

Not all Republicans are on board, though. A group of 21 House GOP lawmakers recently penned a letter urging their party to keep these credits, arguing that axing them could jack up energy costs for hardworking Americans. It’s a rare moment of pushback, but with the bill already passed in the House, it’s unclear if their plea will change anything. The Senate’s version might tweak the timeline or details, but the core plan—ending these credits—seems locked in.

Why You Should Act Now

If you’re reading this and thinking, “I’ll just wait and see,” you might want to reconsider. The timeline for these credits is shrinking fast. For example, the Senate’s plan would kill the used EV credit in just 90 days after the law’s signed. New EV credits and home energy incentives get a bit more breathing room—until 2026—but that’s still only a year away. Planning a home upgrade or car purchase takes time, and waiting could mean missing out on thousands in savings.

Here’s a personal take: I’ve always believed that smart financial moves come from acting when the opportunity’s ripe. These credits are like a limited-time coupon for going green—use them now, or they’re gone. Experts agree, urging consumers to move quickly if they want to lock in these benefits.

- Research Your Options: Check which EVs or home upgrades qualify for credits.

- Plan Your Budget: Factor in the savings from credits to make projects affordable.

- Act Before Deadlines: Don’t wait for the law to pass—start now to beat the rush.

Timing is everything. If you’ve been on the fence about an EV or a home energy project, the clock’s ticking louder than ever.

The Bigger Picture: Energy Costs and You

Beyond the immediate loss of tax credits, there’s a broader impact to consider. Ending these incentives could make it harder for families to afford sustainable upgrades, which means higher energy bills over time. EVs, for instance, save drivers an average of $1,500 a year on fuel and maintenance, according to energy analysts. Solar panels can cut electricity bills by 50% or more in some cases. Without tax credits, these options become less accessible, which could slow the push toward a cleaner future.

Perhaps the most frustrating part is the ripple effect. Higher costs for green tech could discourage innovation and adoption, keeping us tethered to fossil fuels longer than necessary. I can’t help but wonder: are we prioritizing short-term tax breaks over a sustainable future? It’s a question worth chewing on.

These credits aren’t just about savings—they’re about building a future where energy is affordable and clean.

– Environmental advocate

Still, it’s not all doom and gloom. The fact that some GOP lawmakers are pushing back shows there’s still a chance to preserve these incentives, at least in part. And even if the credits vanish, the long-term benefits of going green—lower bills, cleaner air—aren’t going anywhere. The trick is acting now to maximize your savings while the credits are still around.

How to Make the Most of What’s Left

So, what’s the game plan? If you want to cash in on these credits before they’re history, you’ll need to move fast but smart. Start by researching which EVs or home upgrades qualify—not every model or project gets the full credit. Next, crunch the numbers to see how the credits fit into your budget. Finally, don’t procrastinate. With deadlines as tight as 90 days for some credits, every week counts.

Here’s a quick tip from my own experience: talk to a tax pro or energy consultant. They can help you navigate the fine print and maximize your savings. It’s a small upfront cost that could save you thousands down the line. And if you’re not sure where to start, local energy programs or EV dealerships often have resources to guide you.

Savings Checklist: - Confirm eligibility for EV or home credits - Compare costs with and without incentives - Schedule projects before 2026 deadlines

The bottom line? These tax credits are a golden opportunity to save big while doing right by the planet. But with the GOP’s bill barreling forward, that window’s closing fast. Don’t let these savings pass you by—act now, and you’ll thank yourself later.

What do you think—will you grab these credits before they’re gone, or are you holding out for a policy shift? Either way, the time to decide is now.