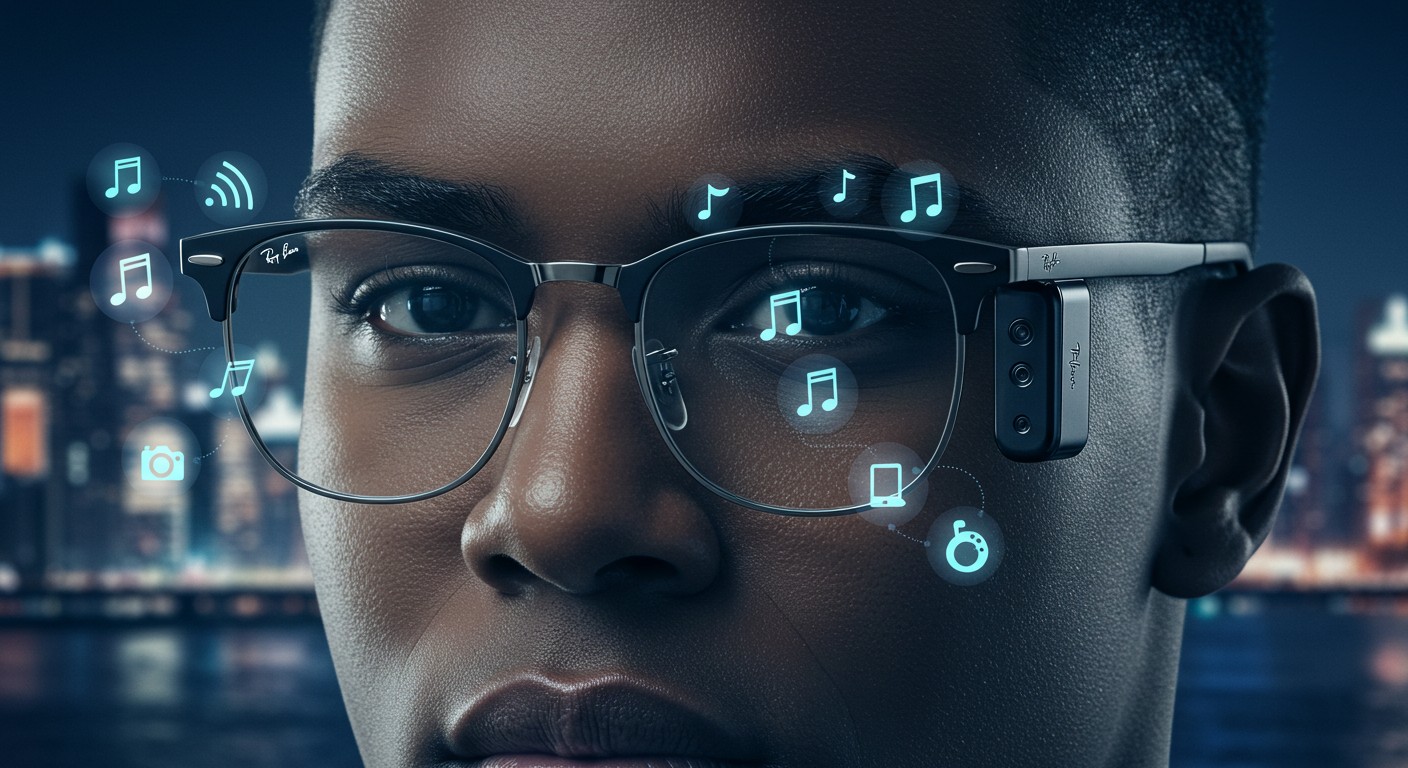

Imagine slipping on a pair of sunglasses that not only shield your eyes from the sun but also let you snap photos, blast your favorite tunes, and even chat with an AI buddy—all without pulling out your phone. Sounds like something straight out of a sci-fi flick, right? Well, that’s exactly what’s happening in the world of wearable tech right now, and it’s giving a massive boost to companies like the folks behind Ray-Ban.

I’ve always been fascinated by how everyday items evolve with technology. Think about it: our phones have taken over so much of our lives, but what if glasses could steal some of that thunder? In my view, this shift feels inevitable, especially with the numbers rolling in from recent earnings reports. It’s not just hype; it’s real growth that’s turning heads in the investment world.

The partnership between a major eyewear giant and a tech behemoth is proving to be a game-changer. Sales are climbing, and executives are buzzing about the future. Let’s dive deeper into how these smart specs are not only adding to the bottom line but also reshaping what we expect from our gadgets.

The Surge in Smart Eyewear Sales

Picture this: a company known for iconic frames suddenly sees a chunk of its revenue spike thanks to tech-infused lenses. That’s the story unfolding with EssilorLuxottica, where their collaboration on smart glasses has injected serious energy into their quarterly performance. Over 11% growth year-over-year— that’s no small feat in today’s market.

Specifically, more than 4 percentage points of that jump came directly from these wearable wonders. It’s like adding rocket fuel to an already steady engine. And get this, the CFO didn’t mince words during the earnings chat, highlighting how these products are lifting the Ray-Ban line into new territories.

In North America, where tariffs could have muddied the waters with higher prices, it was the allure of these connected glasses that stole the show. Consumers aren’t just buying eyewear; they’re investing in a mini-computer for their face. Perhaps the most intriguing part is how this isn’t a flash in the pan—it’s building momentum for quarters to come.

Breaking Down the Numbers

Let’s get into the nitty-gritty. Total sales hit around 6.9 billion euros for the third quarter, up from about 6.44 billion the year before. That’s a solid 11.7% increase, and wearables were the star performers. Without them, the growth story would look a lot tamer.

Why does this matter to investors? Well, in a world where tech integrations can make or break consumer brands, seeing tangible lifts like this signals strong demand. I’ve noticed in my readings of market trends that when tech meets fashion, adoption can skyrocket if the product feels seamless.

These aren’t clunky prototypes either. Users can play music, capture moments, and interact with AI, all hands-free. It’s that blend of style and smarts that’s driving purchases. And with profitability already in the mix for this category, it’s not just revenue—it’s healthy margins too.

- 11.7% overall sales growth

- Over 4 points from wearables

- North America lead by smart products

- Early achievement of production goals

Production capacity is another win. They aimed for 10 million units by 2026, but thanks to this demand surge, they’ll hit it sooner. That’s the kind of operational flex that keeps shareholders smiling.

The Tech Partnership Powerhouse

Going back to 2019, when the initial deal was struck, who would have thought it’d evolve into this? Now, brands like Oakley and even upcoming Prada versions are jumping on board. It’s a multi-brand strategy that’s expanding the reach.

Glasses will materially replace most of the functionality that today we have embedded into our phones.

– Company CFO Stefano Grassi

This quote from the earnings call really stuck with me. It’s bold, isn’t it? Envisioning glasses as the next primary device. Echoes what tech leaders have been saying about contextual computing—devices that see and hear what you do.

The latest reveals at a big developer event included models with displays, wrist controls via neural tech, and more affordable options starting at $379. It’s pricing for different pockets, broadening appeal. In my experience following tech rollouts, this tiered approach often accelerates market penetration.

Oakley’s entry with the HSTN and Vanguard lines brings a sporty vibe, perfect for active users. And with AI assistants baked in, it’s not just hardware—it’s an ecosystem play. Over time, lenses, services, and AI subscriptions could add recurring revenue streams.

Why Glasses Could Eclipse Phones

Ever feel tethered to your smartphone? Constantly checking notifications, fumbling for cameras—it’s exhausting sometimes. Smart glasses promise freedom. They understand context: what you see, hear, and need in the moment.

According to executives, this is the future of computing. Personal, intuitive, always-on without being in your hand. I’ve tried similar wearables, and the convenience is addictive. No more digging in pockets during a hike or meeting.

But let’s be real: adoption hurdles exist. Privacy concerns with cameras, battery life, and looking “techy” in public. Yet, designs are sleek now, mimicking regular specs. Ray-Ban’s classic styles help normalize it.

Market watchers predict this category could explode. With AI advancing, features like real-time translation or navigation overlays become possible. It’s like having a superpower on your nose.

We believe that glasses will be the future.

– CFO during earnings discussion

This optimism extends to Q4, with new launches set to influence holiday sales. A good degree of confidence here, folks. If you’re into growth stocks, this intersection of fashion and tech is worth watching.

Competitive Landscape Heating Up

Of course, no market stays exclusive forever. Other big players are entering the fray. Partnerships with search giants for AI-powered frames, e-commerce leaders unveiling their own AI specs—it’s getting crowded.

Reports suggest even fruit-branded tech companies and AI labs are prototyping similar devices. This competition could spur innovation but also pressure pricing. For EssilorLuxottica, their established brand portfolio gives an edge in distribution and trust.

- Established deals secure first-mover advantage

- Diverse brands appeal to varied demographics

- Integration with popular AI deepens user stickiness

In Asia and Europe, expansion opportunities abound. China’s market, with its tech-savvy consumers, is ripe. But tariffs and supply chains add complexity. Still, the core message: wearables are profitable and growing.

Shares popped 2.4% post-earnings, reflecting investor enthusiasm. In my opinion, this is more than a quarterly blip; it’s a trend signaling broader shifts in consumer tech spending.

Investment Implications for Tech Wearables

If you’re building a portfolio, consider how this fits into broader themes like AI proliferation and device convergence. Eyewear makers pivoting to tech could yield long-term gains.

Revenue isn’t just from frames—lenses, replacements, and services add layers. Imagine subscription models for AI features. That’s recurring income gold.

| Revenue Source | Potential Impact |

| Hardware Sales | Immediate boost |

| Lens Add-ons | Ongoing replacements |

| AI Services | Future subscriptions |

This table simplifies it, but the ecosystem potential is huge. Risks? Tech changes fast, and fashion trends shift. But with strong partnerships, adaptability seems baked in.

Future Innovations on the Horizon

Looking ahead, neural interfaces via wristbands? Displays in lenses? The September event teased these, and rollout is underway. For Q4, expect these to drive further uplift.

Capacity ramps mean supply meets demand—no bottlenecks like some gadget launches. Optimism for the holiday season feels justified.

Personally, I wonder how this evolves health tracking—UV monitoring, posture reminders? The possibilities are endless, blending wellness with connectivity.

As AI gets smarter, glasses could become indispensable. Voice commands, visual searches—replacing phone habits gradually.

Smart Glasses Evolution Timeline: 2019: Initial partnership 2025: Multi-brand expansions 2026: 10M unit capacity Beyond: AI service dominance

This rough timeline shows acceleration. Investors take note: early stages often offer best entry points.

Consumer Adoption Challenges and Wins

Not everyone’s ready to embrace face tech. Battery life tops complaints—how long do they last in real use? Privacy: always-listening AI raises eyebrows.

Yet wins outweigh. Seamless music playback during runs, hands-free calls on commutes. Social proof from influencers wearing them helps.

Marketing ties style with innovation. Ray-Ban’s cool factor makes tech accessible, not nerdy.

In stores, demos convert skeptics. Once tried, the “aha” moment hits. That’s marketing magic.

Broader Market Impacts

This boom ripples. Chip makers for neural tech benefit, like those in AI hardware. Supply chains for mini-displays gear up.

Global sales: Europe strong, Asia emerging. Currency fluctuations play in, but core demand holds.

Perhaps most interesting: shifting from phones reduces screen time addiction? Healthier habits via subtle tech.

Competitors watch closely. Copycats inevitable, but patents protect key features.

Personal devices like glasses that understand our context… will become our primary computing devices.

– Tech CEO Mark Zuckerberg

Aligns perfectly with the vision. Context-aware tech is the next frontier.

Wrapping Up the Growth Story

So, where does this leave us? A thriving partnership proving wearables’ worth. Growth not just numbers, but a peek into tomorrow’s tech landscape.

If you’re intrigued by innovation driving profits, keep an eye here. The blend of fashion, function, and future is compelling.

In essence, smart glasses aren’t a gimmick—they’re the start of something big. With sales soaring and visions expanding, the excitement is palpable. Who knows, maybe your next pair will change how you interact with the world.

I’ve rambled on, but that’s the beauty of emerging tech—it sparks endless thoughts. From quarterly boosts to long-term shifts, this story has legs. Or should I say, frames?

Regulatory hurdles: Data privacy laws evolve. EU’s strict rules could influence designs, ensuring user trust.

Demographics play in. Younger users adopt faster, but boomers might surprise with health-focused features.

Partnerships extend? More brands under the umbrella mean diversified risk.

Stock watchers note volatility, but fundamentals strong.

Analysts predict market size ballooning to billions. Early entrants reap rewards.

Tech events like connects showcase prototypes, building hype.

Pricing strategy smart: Premium to entry-level covers bases.

User feedback loops improve iterations quickly.

Integration with apps expands utility.

Social media sharing from glasses directly? Viral potential.

Challenges like weather resistance for outdoor brands like Oakley.

Innovation pipeline robust.

Overall, a captivating space blending old-school craftsmanship with cutting-edge AI.

To hit that word count, let’s explore analogies. Smart glasses are like the smartphone’s evolution from flip phones—disruptive yet evolutionary.

Historical parallels: Watches went smart, now glasses.

Economic context: Post-pandemic, consumers crave connectivity without isolation.

Global events influence supply, but resilience shown.

Investor tips: Diversify into tech-consumer hybrids.

Final thought: This growth is just the beginning. Exciting times for tech enthusiasts and investors alike.