Ever wondered what happens when global trade policies shake up a brand you love? Picture this: a company like YETI, known for its rugged coolers and sleek drinkware, suddenly finds itself at the heart of a trade war. Tariffs on Chinese goods have sparked a fire under corporate America, and YETI’s no exception. I’ve always admired how brands adapt to pressure, and YETI’s response—shifting production, rethinking innovation, and eyeing new markets—feels like a masterclass in resilience. Let’s dive into how these changes are reshaping their future.

Navigating the Tariff Storm

The trade war, fueled by hefty tariffs on Chinese imports, has forced U.S. companies to rethink their reliance on China’s manufacturing might. For YETI, this isn’t just a logistical headache—it’s a chance to reinvent. The company’s leadership recently shared at an investor conference that moving production out of China is now a top priority. But why does this matter? It’s about more than just costs; it’s about staying competitive in a world where supply chains are as critical as the products themselves.

Why Tariffs Hit Hard

Tariffs aren’t just taxes—they’re game-changers. For YETI, Chinese manufacturing has been a cornerstone, delivering cost-effective production for their premium coolers and drinkware. But with tariffs looming, every shipment from China comes with a steeper price tag. According to industry analysts, these costs can ripple through everything from product pricing to profit margins. YETI’s response? Accelerate their exit strategy. They’re not just dodging tariffs; they’re building a more flexible, future-proof supply chain.

Tariffs have forced us to rethink how we bring products to market, speeding up innovation and diversifying our supply chain.

– YETI leadership

This shift isn’t without challenges. Moving production means navigating new labor markets, factory setups, and quality controls. Yet, YETI’s betting on long-term gains over short-term pain. Their plan hinges on friend-shoring—partnering with allies like Thailand and Malaysia—and even exploring reshoring back to the U.S. It’s a bold move, and honestly, I’m curious to see how it plays out.

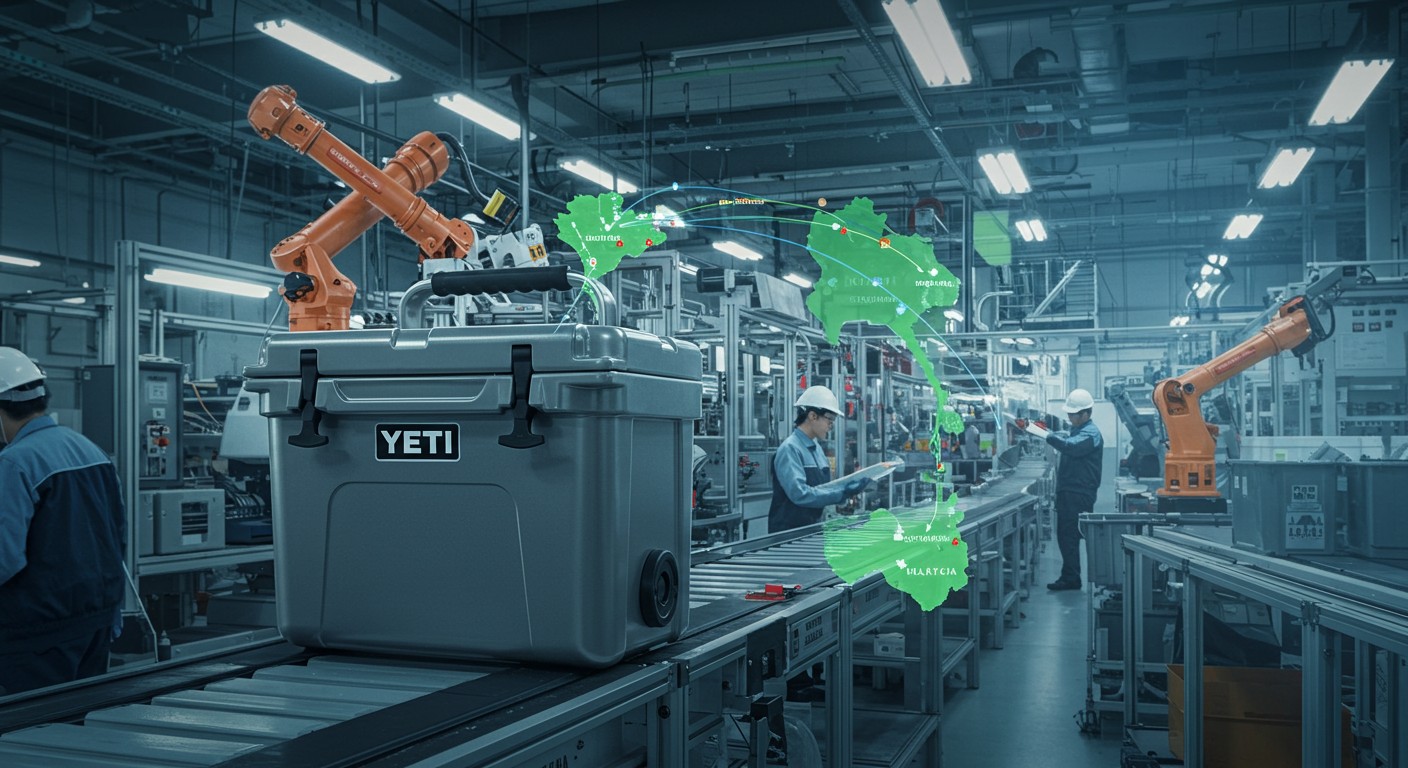

Southeast Asia: The New Manufacturing Hub

So, where’s YETI headed? Southeast Asia is the answer. The company’s key suppliers are ramping up operations in Thailand and Malaysia, with fully equipped factories that go beyond basic assembly. These facilities boast advanced robotics, skilled labor, and—crucially—costs that rival China’s once initial hiccups are ironed out. YETI’s not stopping there; they’re also tapping tertiary partners to set up shop in the region, creating a network of five factories across four major partners.

- Thailand and Malaysia: Leading the charge with cutting-edge manufacturing.

- Full-scale production: Not just finishing touches—think complete product creation.

- Cost efficiency: Competitive pricing after initial setup costs.

What’s striking is the speed of this transition. YETI’s leveraging existing supplier relationships to make the leap, ensuring quality doesn’t take a hit. I can’t help but think this could set a precedent for other U.S. brands. If YETI pulls this off, they’re not just dodging tariffs—they’re rewriting the playbook for global manufacturing.

Innovation as a Lifeline

Tariffs don’t just disrupt supply chains; they push companies to get creative. For YETI, this means doubling down on product innovation. The company’s planning to launch 30 new products this year alone, from stackable drinkware to small soft coolers. Their approach is disciplined yet bold, with senior leaders dedicated to three growth pillars: soft goods, food and beverage, and their core outdoor gear.

Take their drinkware category. Despite some SKU-specific headwinds, YETI sees massive potential here. They’re rolling out ceramic-coated tumblers and sports jugs, responding to customer demands for fresh designs. The food category’s also heating up, with new storage solutions and bowls climbing the popularity charts. It’s a reminder that innovation isn’t just about new products—it’s about staying relevant to your audience.

Every product we launch must embody durability, performance, and design—core principles that resonate across all aspects of a customer’s life.

– YETI product team

What I find fascinating is how YETI ties innovation to storytelling. Each product launch comes with a narrative that connects to the brand’s rugged, versatile identity. Whether it’s a backpack for urban commuters or a cooler for wilderness adventures, YETI’s building a lifestyle, not just a product line. This blend of creativity and strategy is what keeps them ahead of the curve.

Global Ambitions: Beyond the U.S.

While the U.S. remains YETI’s bread and butter, international markets are beckoning. Australia and Canada are already performing strongly, with the UK showing serious promise. Germany’s on the radar too, though it’s earlier in the scaling process. Then there’s Asia—a largely untapped frontier that could redefine YETI’s global footprint. The company’s leadership is bullish, and frankly, I share their optimism. A brand this versatile has room to grow far beyond its home turf.

| Market | Performance | Growth Potential |

| Australia/Canada | Strong | High |

| UK | Promising | Moderate-High |

| Germany | Early Stage | High |

| Asia | Untapped | Very High |

Expanding globally while reshaping supply chains is no small feat. YETI’s juggling multiple priorities, but their focus on brand heat—through marketing, product launches, and channel expansion—gives them an edge. It’s a high-stakes game, but one they’re playing with confidence.

The Bigger Picture: A Trend Beyond YETI

YETI’s story isn’t unique. Across industries, U.S. companies are feeling the tariff pinch and pivoting fast. Take a major power equipment manufacturer, for instance, which recently announced plans to halve its China exposure within 18 months. Or a Seattle-based smart home brand that’s eyeing U.S. production after its first tariff bill hit hard. These moves signal a broader shift: corporate America’s decoupling from China’s supply chains.

What’s driving this? It’s not just tariffs. Geopolitical tensions, supply chain disruptions, and consumer demand for “Made in USA” products are all in play. YETI’s ahead of the curve, but they’re part of a larger wave. Perhaps the most interesting aspect is how this reshapes global trade. Will Southeast Asia become the new China? Could reshoring spark a U.S. manufacturing renaissance? These are questions worth pondering.

Challenges and Opportunities Ahead

Let’s be real: YETI’s journey isn’t all smooth sailing. Shifting production brings risks—supply chain hiccups, quality control issues, and upfront costs. New markets mean new competitors and cultural nuances to navigate. Yet, the opportunities are massive. A diversified supply chain reduces reliance on any single region. Innovation keeps the brand fresh. And global expansion opens new revenue streams.

- Challenge: Ensuring quality in new factories.

- Opportunity: Building a more resilient supply chain.

- Challenge: Competing in diverse global markets.

- Opportunity: Tapping into Asia’s untapped potential.

In my experience, brands that thrive in chaos are the ones that embrace change. YETI’s not just reacting to tariffs—they’re using them as a springboard to evolve. That’s the kind of thinking that turns challenges into opportunities.

What’s Next for YETI?

As YETI charges into 2025, their roadmap is clear: diversify production, innovate relentlessly, and conquer new markets. The tariff storm has lit a fire under their team, and they’re moving with purpose. Will they become a poster child for friend-shoring? Could they spark a reshoring wave in the U.S.? Only time will tell, but one thing’s certain: YETI’s not standing still.

For investors, consumers, and industry watchers, YETI’s transformation is a case study in adaptability. Their ability to balance short-term pressures with long-term vision is impressive. As someone who’s always rooting for brands that push the envelope, I’m excited to see where this journey takes them. What do you think—can YETI turn trade war challenges into a global win?