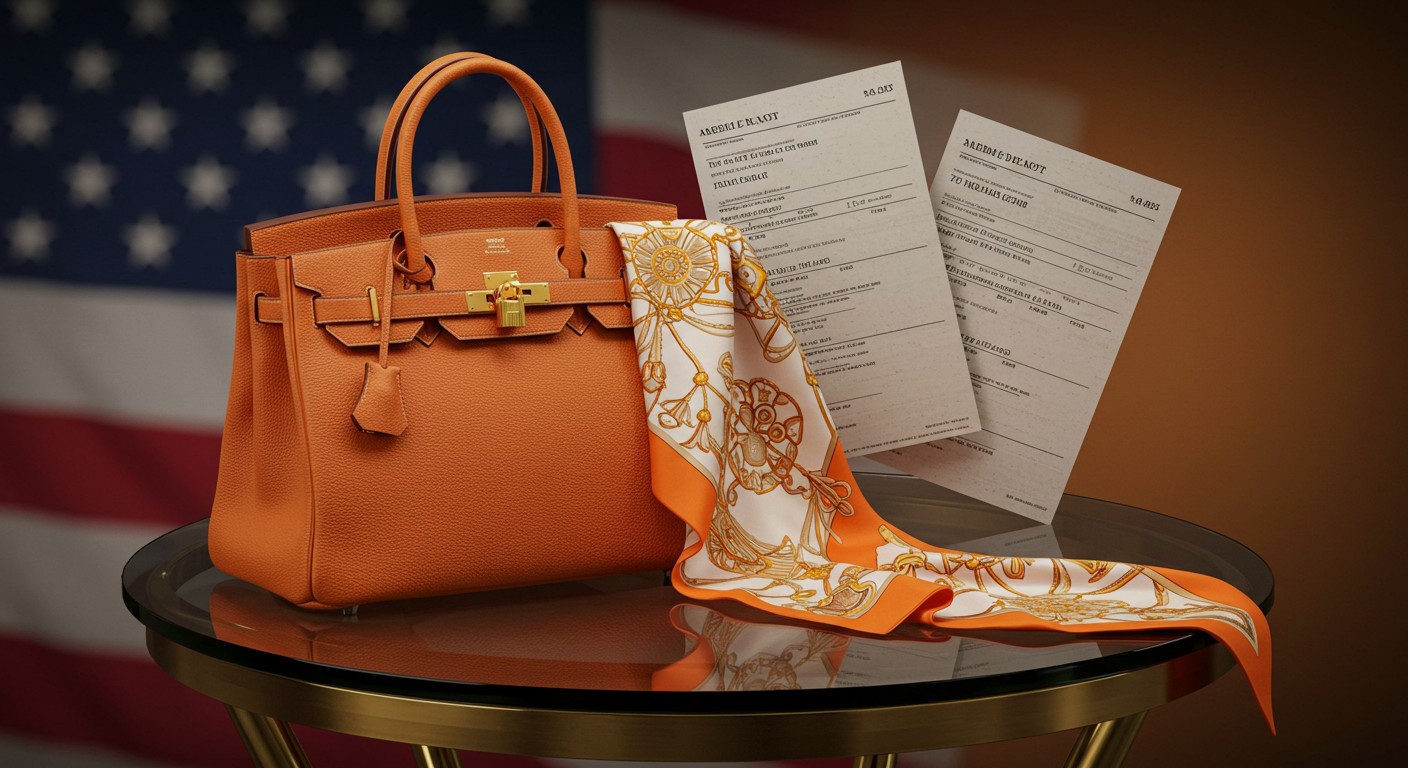

Have you ever wondered what happens when global politics crashes into the world of high-end fashion? Picture this: you’re eyeing that iconic Hermès Birkin bag, a symbol of status and craftsmanship, only to find out its price just spiked—again. This isn’t just inflation at play; it’s the ripple effect of new U.S. tariffs reshaping the luxury market. As someone who’s tracked market trends for years, I find it fascinating how policy decisions can send shockwaves through even the most exclusive corners of commerce. Let’s unpack how luxury giants are navigating these changes and what it means for investors and consumers alike.

Why Luxury Prices Are Climbing in the U.S.

The luxury sector, known for its resilience, is facing a new challenge: tariffs. Starting May 1, U.S. consumers will see higher prices on high-end goods like handbags and scarves. This move comes as brands aim to offset a universal 10% tariff introduced by the White House in early April 2025. Unlike other markets, where prices remain steady, the U.S. is ground zero for these increases. It’s a classic case of passing costs down the line, but the stakes are higher when your clientele expects nothing less than perfection.

Tariffs are like uninvited guests at a lavish dinner party—they disrupt the vibe and force everyone to adjust.

– Financial analyst

What’s driving this? The tariffs are part of a broader policy shift, impacting everything from electronics to apparel. For luxury brands, the strategy is clear: protect profit margins by raising prices. But here’s the kicker—unlike everyday retailers, luxury firms can often get away with this because their customers are less price-sensitive. Still, it’s a gamble. Will loyal buyers stomach the hike, or could this spark a shift in spending habits?

Hermès Takes the Lead

One major player in this saga is a French luxury house renowned for its Birkin and Kelly bags. The company recently announced it will adjust U.S. prices to “fully offset” the 10% tariff’s impact. This isn’t a blanket global increase—only American shoppers will feel the pinch. According to financial experts, this targeted approach reflects a deep understanding of regional market dynamics. It’s a bold move, especially for a brand that just claimed the title of the world’s largest luxury firm by market capitalization.

- Targeted pricing: Price hikes limited to the U.S. market.

- Brand strength: Leveraging exclusivity to maintain demand.

- Market leadership: Overtaking rivals in valuation despite challenges.

In my view, this strategy is a masterclass in brand management. By isolating price increases to one region, the company avoids alienating global customers while reinforcing its premium positioning. But it’s not without risks. If U.S. sales dip, the ripple effects could hit the company’s bottom line.

The Bigger Picture: Tariffs and Consumer Spending

Tariffs don’t just affect luxury goods—they’re a sledgehammer to consumer budgets. From cars to clothing, prices are creeping up across the board. For luxury brands, the impact is less about volume and more about perception. A $10,000 handbag might still sell, but if buyers start questioning the value, brand loyalty could waver. Recent market analysis suggests that while high-net-worth individuals are less affected, middle-tier luxury shoppers might cut back.

| Sector | Tariff Impact | Consumer Reaction |

| Luxury Goods | 10% price hike | Stable demand, some hesitation |

| Electronics | 5-15% increase | Reduced purchases |

| Apparel | 8-12% rise | Shift to budget brands |

Here’s where it gets tricky. If broader economic conditions—like a potential recession—dampen consumer confidence, even luxury brands could face headwinds. I’ve seen cycles like this before, and they often force companies to get creative. Could we see more limited-edition releases or loyalty programs to keep buyers hooked? Only time will tell.

How Luxury Stacks Up Against Other Sectors

Compared to mass-market retailers, luxury brands have a unique advantage: their customers aren’t pinching pennies. A 10% price hike on a $500 scarf might sting, but it’s not a dealbreaker for the target audience. Contrast this with, say, a budget clothing chain, where a similar increase could drive shoppers to competitors. Financial experts note that luxury’s pricing power stems from its brand equity—a moat that’s hard to breach.

Luxury thrives on exclusivity, not affordability. Tariffs test that balance.

That said, no sector is immune to macroeconomic shifts. If tariffs escalate—say, to the 20% level some European firms fear—the calculus changes. For now, luxury giants are banking on their ability to pass costs onto consumers without losing their allure. It’s a high-stakes bet, but history shows they often come out on top.

Performance Check: Luxury Sales in Q1 2025

First-quarter results offer a glimpse into how luxury brands are faring. One leading firm reported 11% sales growth in the Americas, which made up nearly 17% of its revenue. Globally, revenue grew 7% on a constant currency basis—solid, but slower than the 17.6% surge in Q4 2024. Analysts called the performance “respectable,” noting that weaker sales in watches and perfumes dragged down overall growth.

- Americas strength: 11% sales growth, driven by U.S. demand.

- Global slowdown: 7% growth, below expectations of 8-9%.

- Category challenges: Watches and perfumes underperformed.

These numbers tell a story of resilience but also vulnerability. The Americas remain a bright spot, but the slowdown elsewhere raises questions. Are tariffs already casting a shadow, or is this just a natural ebb in the luxury cycle? I lean toward the latter, but investors should keep a close eye on upcoming quarters.

Investor Takeaways: Navigating the Luxury Market

For investors, the luxury sector remains a compelling but complex play. Companies with strong brand moats—like the one leading the market cap race—are well-positioned to weather tariff storms. Their ability to raise prices without losing customers is a testament to their market power. But there are risks to consider, especially if global economic growth falters.

Here’s my take: luxury stocks can be a hedge against inflation, but they’re not bulletproof. If consumer spending tightens, even high-end brands could see sales soften. Diversifying across sectors—say, pairing luxury with defensive stocks like utilities—might be a smart move. And don’t sleep on smaller luxury players; they could offer growth potential at a lower valuation.

What’s Next for Luxury?

As tariffs reshape the landscape, luxury brands face a pivotal moment. Will they double down on exclusivity, or pivot to capture a broader audience? Some might explore new markets—like Asia, where demand for high-end goods is booming. Others could lean into digital channels, offering virtual try-ons or exclusive online drops to keep buyers engaged.

The future of luxury lies in adapting without compromising prestige.

– Market strategist

Perhaps the most interesting aspect is how this plays out for investors. Luxury stocks have long been a darling of portfolios, but tariffs introduce new variables. I’d wager that brands with global reach and loyal followings will come out ahead, but it’s worth watching how they balance growth with profitability.

Final Thoughts: A Market in Flux

The luxury market is at a crossroads. Tariffs are forcing brands to rethink pricing, while consumers grapple with higher costs across the board. For investors, this is both a challenge and an opportunity. By focusing on companies with strong fundamentals and pricing power, you can navigate this turbulence with confidence. As for that Birkin bag? It might cost a bit more, but its allure remains untarnished—for now.

So, what’s your take? Are luxury brands overplaying their hand, or is this just another bump in the road for a sector built on exclusivity? One thing’s for sure: the intersection of policy and luxury is a space worth watching.