Ever stared at your paycheck and wondered where all your money went? Taxes, right? They’re like that uninvited guest who eats half your pizza before you even get a slice. Understanding your marginal tax rate is the key to unlocking smarter financial decisions, whether you’re eyeing a big bonus or planning for retirement. Let’s dive into what this term really means, why it matters, and how you can outsmart the tax system in 2025 to keep more of your cash.

Why Your Marginal Tax Rate Is Your Financial Compass

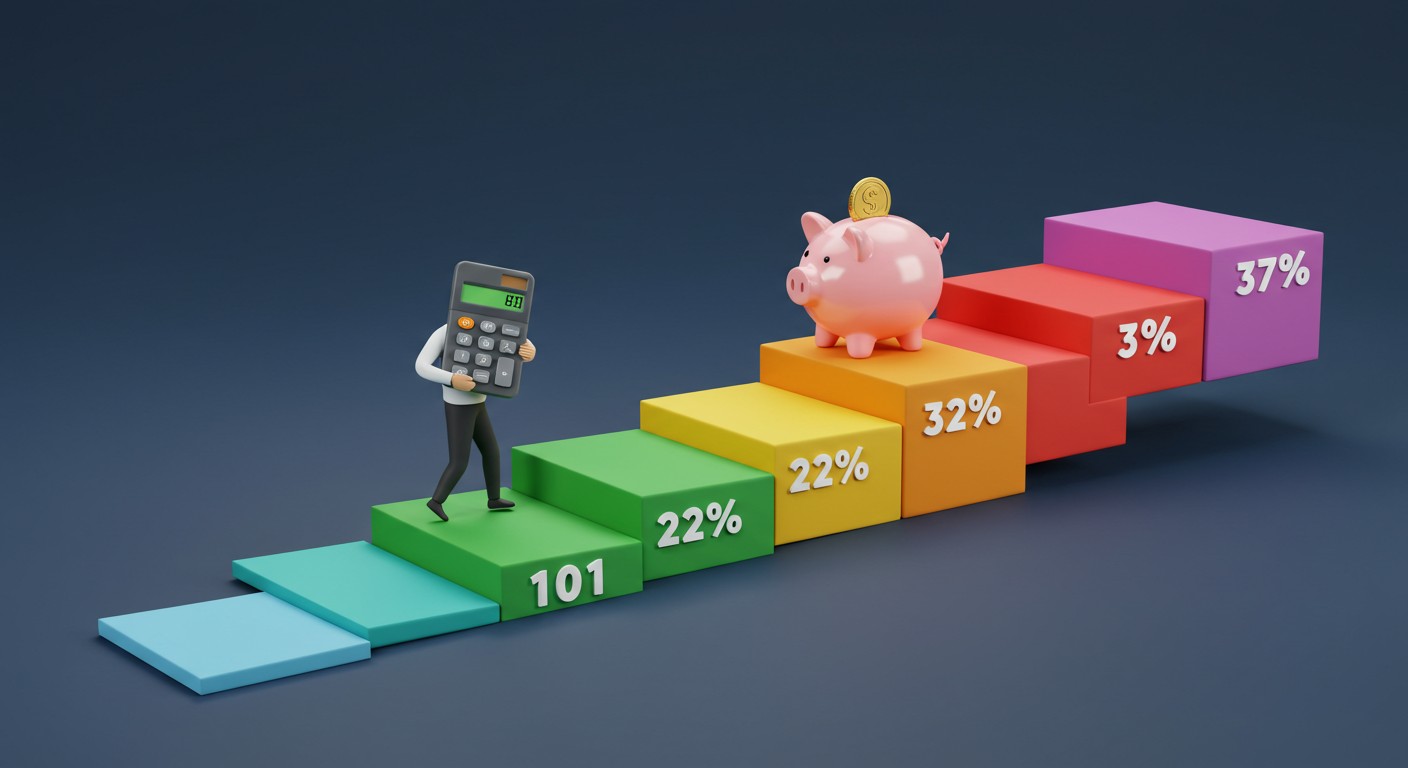

Taxes aren’t just a flat percentage slapped on your income. The U.S. uses a progressive tax system, which means your income gets sliced into layers, each taxed at a different rate. Your marginal tax rate is the percentage applied to the last dollar you earn—it’s the highest rate your income touches. Knowing this number is like having a GPS for your finances; it guides decisions about bonuses, investments, or even when to sell that old car for a profit.

Let’s break it down with a relatable example. Picture Sarah, a single filer with a taxable income of $60,000 in 2025. Her income doesn’t get taxed at one rate—it’s split across several tax brackets. The first chunk is taxed at 10%, the next at 12%, and so on. Her marginal tax rate? That’s the rate on her final dollar, which we’ll explore in detail.

How Marginal Tax Rates Actually Work

The progressive tax system is like a tiered cake—each layer has its own flavor, or in this case, tax rate. For 2025, the IRS has set specific brackets for single filers. Here’s how they stack up:

- 10%: Income up to $11,925

- 12%: Income from $11,926 to $48,475

- 22%: Income from $48,476 to $103,350

- 24%: Income from $103,351 to $197,300

- 32%: Income from $197,301 to $250,525

- 35%: Income from $250,526 to $626,350

- 37%: Income above $626,350

Let’s go back to Sarah with her $60,000 taxable income. Here’s how her taxes break down:

- First $11,925 is taxed at 10%, which is $1,192.50.

- The next $36,549 ($48,475 – $11,926) is taxed at 12%, equaling $4,385.88.

- The remaining $11,526 ($60,000 – $48,474) is taxed at 22%, which comes to $2,535.72.

Total tax? Add them up: $1,192.50 + $4,385.88 + $2,535.72 = $8,114.10. Sarah’s marginal tax rate is 22% because that’s the rate applied to her last dollar earned. But her entire income isn’t taxed at 22%—only that top slice. This distinction is crucial when planning your finances.

Understanding your marginal tax rate is like knowing the rules of a game—it helps you play smarter and keep more of your winnings.

– Financial advisor

Marginal vs. Effective Tax Rate: What’s the Difference?

While your marginal tax rate is the rate on your last dollar, your effective tax rate tells a different story. It’s the average rate you pay across all your income. To calculate it, divide your total tax liability by your taxable income and multiply by 100. For Sarah, that’s $8,114.10 ÷ $60,000 × 100 = 13.52%. So, while her marginal rate is 22%, her effective rate is only 13.52%. Pretty eye-opening, right?

The effective rate gives you a clearer picture of your overall tax burden. It’s like checking the average speed of a road trip rather than just the speed you hit on the final stretch. Knowing both rates helps you make informed decisions about extra income or deductions.

Why Knowing Your Marginal Tax Rate Matters

Your marginal tax rate isn’t just a number—it’s a tool. Let’s say you’re offered a $5,000 bonus at work. Sounds great, but how much will you actually keep? If you’re in the 22% bracket, that bonus could push you into the next bracket, say 24%, depending on your income. Knowing your marginal rate helps you predict the tax hit and plan accordingly.

Or maybe you’re thinking about selling some stock for a profit. Capital gains are taxed differently, but your marginal rate still plays a role, especially for short-term gains, which are taxed as ordinary income. By understanding where you stand, you can time your sales to minimize the tax bite.

Can Tax Credits Help?

Here’s the deal: tax credits don’t lower your marginal tax rate directly, but they can reduce your overall tax bill. For instance, the Child Tax Credit for 2025 is set at $2,200 per child, adjusted for inflation. This credit doesn’t reduce your taxable income—it directly cuts what you owe the IRS.

Let’s revisit Sarah. With her $8,114.10 tax liability, a $2,200 Child Tax Credit would drop her bill to $5,914.10. That’s a nice chunk of change back in her pocket! Credits like these are like finding a coupon for your tax bill—they don’t change the rate, but they make the final cost more bearable.

Strategies to Lower Your Marginal Tax Rate

Now, let’s get to the good stuff—how to keep more of your money. Lowering your marginal tax rate means reducing your taxable income so it falls into a lower bracket. Here are some practical strategies to make that happen:

- Max out retirement contributions: Contributing to a 401(k) or traditional IRA reduces your taxable income dollar for dollar. In 2025, you can stash up to $23,500 in a 401(k) or $7,000 in an IRA. That’s a lot of tax savings!

- Use a Health Savings Account (HSA): If you have a high-deductible health plan, you can contribute up to $4,300 to an HSA in 2025. These contributions are tax-deductible, lowering your taxable income.

- Defer income: Got a big bonus coming? Ask your employer to push it to next year, especially if you expect lower income then. This can keep you in a lower bracket.

- Charitable donations: If you’re over 70½ and taking required minimum distributions (RMDs) from an IRA, consider a Qualified Charitable Distribution (QCD). You can donate up to $108,000 directly to a charity, and it won’t count as taxable income.

These moves are like playing chess with the IRS—strategic and satisfying when you come out ahead. I’ve always found that maxing out my 401(k) feels like a double win: saving for retirement and cutting my tax bill.

Planning for Future Earnings

Your marginal tax rate isn’t just about today—it’s about tomorrow, too. Let’s say you’re up for a promotion with a hefty raise. That extra income could nudge you into a higher bracket, meaning more of your money goes to taxes. By estimating your new marginal rate, you can weigh whether the raise is worth it or if you should negotiate other perks, like more vacation time.

Or consider side hustles. That freelance gig might sound lucrative, but if it pushes you into a higher bracket, you’ll keep less than you think. Timing matters, too—deferring income or spreading it over multiple years can keep your rate lower.

Smart tax planning is about timing—knowing when to earn, when to save, and when to give.

– Tax strategist

Common Tax Traps to Avoid

It’s easy to trip up when dealing with taxes. One common mistake is misunderstanding how deductions work. Deductions lower your taxable income, not your tax rate. So, while maxing out your charitable contributions is great, it won’t change your marginal rate unless it drops you into a lower bracket.

Another trap? Ignoring state taxes. Your federal marginal rate is only part of the picture. States like California or New York have their own tax brackets, which can take a big bite out of your income. Always factor in both federal and state taxes when planning.

| Income Range | Federal Tax Rate | Potential State Tax Rate |

| $48,476–$103,350 | 22% | 5–9% (varies by state) |

| $103,351–$197,300 | 24% | 6–10% (varies by state) |

| $197,301–$250,525 | 32% | 7–11% (varies by state) |

A Few Final Thoughts

Navigating your marginal tax rate might feel like solving a puzzle, but it’s worth the effort. By understanding how your income is taxed, you can make smarter choices about earning, saving, and spending. Whether it’s maxing out your 401(k), timing a bonus, or donating to charity, every move counts. So, what’s your next step to outsmart the tax system in 2025?

Perhaps the most interesting part is how empowering it feels to take control of your taxes. I’ve always believed that knowledge is power, and in this case, it’s also money in your pocket. Start small—check your paystub, calculate your effective rate, and explore one tax-saving strategy. You might be surprised at how much you can save.