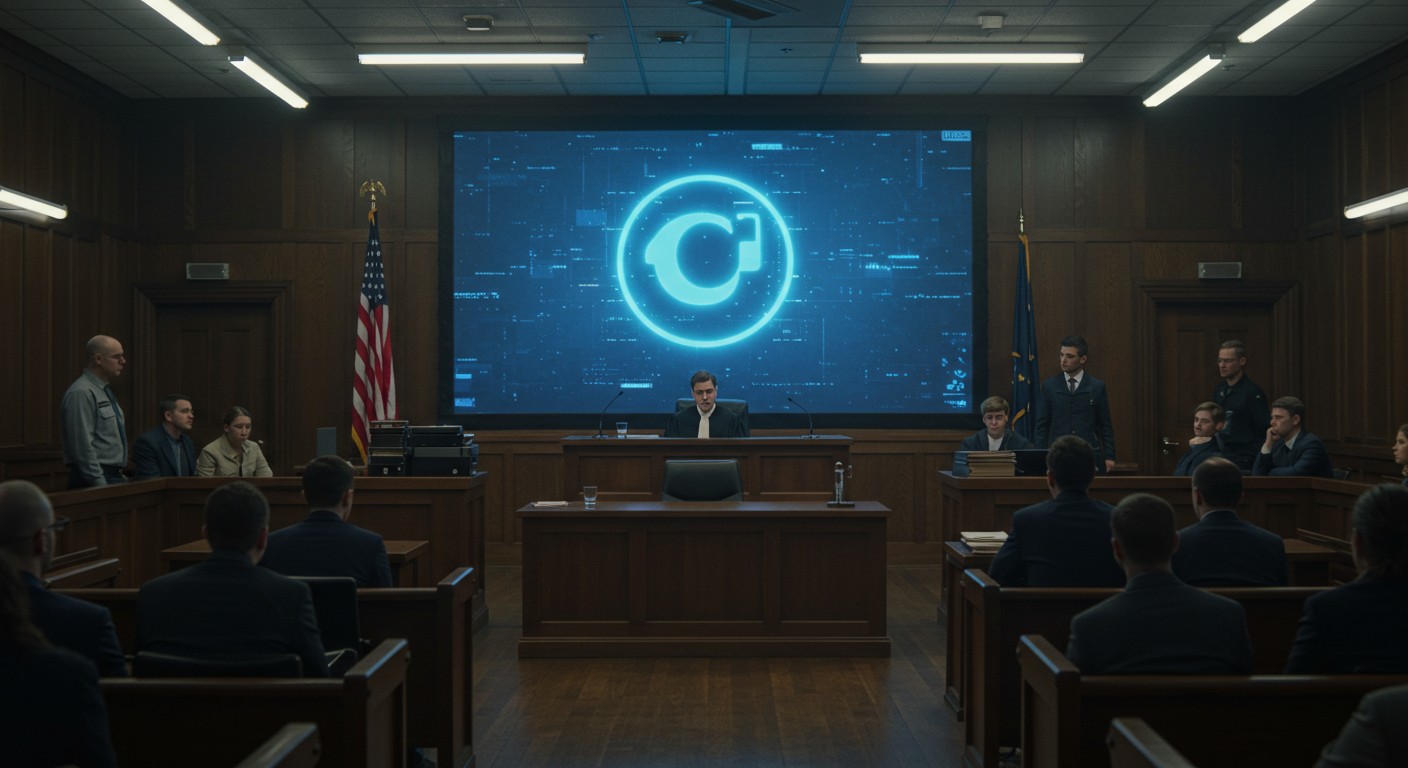

Have you ever wondered what happens when a tech giant grows so massive it seems untouchable? I’ve been mulling over this lately, especially with one of the biggest names in social media facing a courtroom showdown that could change how we connect online. The stakes are high, and the outcome could ripple through markets, investments, and even your daily scroll.

Unpacking a Landmark Case

This trial isn’t just about one company—it’s about the rules that govern big tech and how they shape our world. Regulators are zeroing in on whether certain acquisitions stifled competition, a question that could redefine what it means to dominate a market. As someone who tracks market dynamics, I find this case a fascinating mix of law, tech, and raw power.

What’s at the Heart of the Dispute?

The core issue revolves around two blockbuster deals from over a decade ago: the purchase of a photo-sharing app in 2012 and a messaging platform in 2014. Regulators argue these moves weren’t just smart business—they were calculated plays to cement market control. The accusation? By snapping up potential rivals, the company ensured no one else could challenge its throne.

Acquiring competitors can be a shortcut to dominance, but it raises red flags when it chokes innovation.

– Tech industry analyst

Back then, these deals didn’t raise many eyebrows. Regulators greenlit them without much fuss. But hindsight’s a funny thing, isn’t it? Now, with the social media landscape looking very different, authorities are asking whether those approvals were a mistake. If you’re an investor, this kind of regulatory U-turn can make you rethink long-term stability.

The Stakes: A Corporate Breakup?

Here’s where it gets wild. If the court sides with the government, the company could be forced to spin off its acquisitions. Picture a divorce, but with billions of dollars and millions of users caught in the middle. It’s not just about untangling assets—it’s about reshaping an empire that’s been built on seamless integration.

A breakup wouldn’t just hit the company’s bottom line; it could shake up the entire tech sector. Investors might see stock prices wobble, and competitors could smell opportunity. Personally, I think a forced split would be a logistical nightmare—imagine trying to carve up interconnected platforms without breaking the user experience.

- Financial impact: A split could slash valuation and spook shareholders.

- Market shift: Rivals might gain ground if the company’s grip loosens.

- User disruption: Changes to services could frustrate loyal customers.

Curious about how this might affect your portfolio? Check out our guide on managing investment risks in volatile markets.

The Defense: It’s a Competitive World

The company isn’t sitting quietly. Its defense is straightforward: the social media space is cutthroat, and they’re just one player among many. They point to a crowded field—think short-form video apps, messaging platforms, and even niche networks—as proof that competition is alive and well.

They’ve got a point. New platforms pop up constantly, each vying for your attention. But here’s my take: just because there are other players doesn’t mean the game’s fair. When one company controls multiple lanes, it’s hard for newcomers to break through. Still, the company insists that breaking it apart would hurt users more than help them.

Integration drives efficiency, and users love seamless experiences across platforms.

A Judge with the Final Say

This isn’t a jury trial, which makes things even more interesting. A single judge holds the gavel, and their ruling will carry massive weight. They’ve already shown they’re no pushover, tossing out earlier claims for being too vague. That tells me they’re digging deep into the nitty-gritty of antitrust law.

The judge’s skepticism about outdated legal frameworks is worth noting. Antitrust rules were written for railroads and oil barons, not algorithms and data. Can they stretch to fit today’s tech world? It’s a question that keeps me up at night, especially when you consider how much rides on the answer.

| Factor | Implication |

| Bench trial | Judge’s expertise shapes outcome |

| Old laws | May struggle to address tech issues |

| High stakes | Ruling could set precedent |

Why Investors Should Care

If you’re wondering whether this matters to your portfolio, the answer’s a resounding yes. A ruling against the company could tank its stock, ripple through tech indices, and even spark broader market jitters. On the flip side, a win might bolster confidence in other tech giants facing similar scrutiny.

Here’s where I get a bit opinionated: I think regulators are playing catch-up. Tech moves fast, and laws don’t. By the time a ruling drops, the market might already look different. For investors, that means staying nimble and keeping an eye on regulatory trends.

A Timeline That Tests Patience

Don’t expect a quick resolution. This trial could drag on for months, with testimony from top execs, industry rivals, and legal experts. A final decision might not land until mid-2025, and even then, appeals could stretch things further. Patience isn’t just a virtue here—it’s a necessity.

- Pretrial motions: Years of legal sparring set the stage.

- Main trial: Expect heated arguments through summer.

- Verdict: Could reshape the company—and the industry.

What’s the worst-case scenario? A drawn-out battle that leaves everyone guessing. For me, the uncertainty is the real killer—it’s like waiting for a market crash you can’t predict.

Broader Implications for Tech

This case isn’t just about one company—it’s a test for the whole tech ecosystem. If regulators win, other giants might face similar challenges. If the company prevails, it could embolden more acquisitions. Either way, the rules of the game are up for grabs.

Think about it: when was the last time a major breakup actually happened? Decades ago, a telecom giant was split into pieces, and the fallout reshaped an industry. Could we be on the cusp of something similar? I’m not holding my breath, but I’m definitely watching.

What’s Next?

As the trial unfolds, expect plenty of noise—headlines, hot takes, and market swings. For investors, the key is to stay grounded. Focus on fundamentals, diversify your holdings, and don’t get suckered by short-term panic. That’s my two cents, anyway.

In the end, this case is about more than legal jargon or corporate chess moves. It’s about power, innovation, and the future of how we connect. Whether you’re an investor, a tech nerd, or just someone who loves a good courtroom drama, this one’s worth watching.