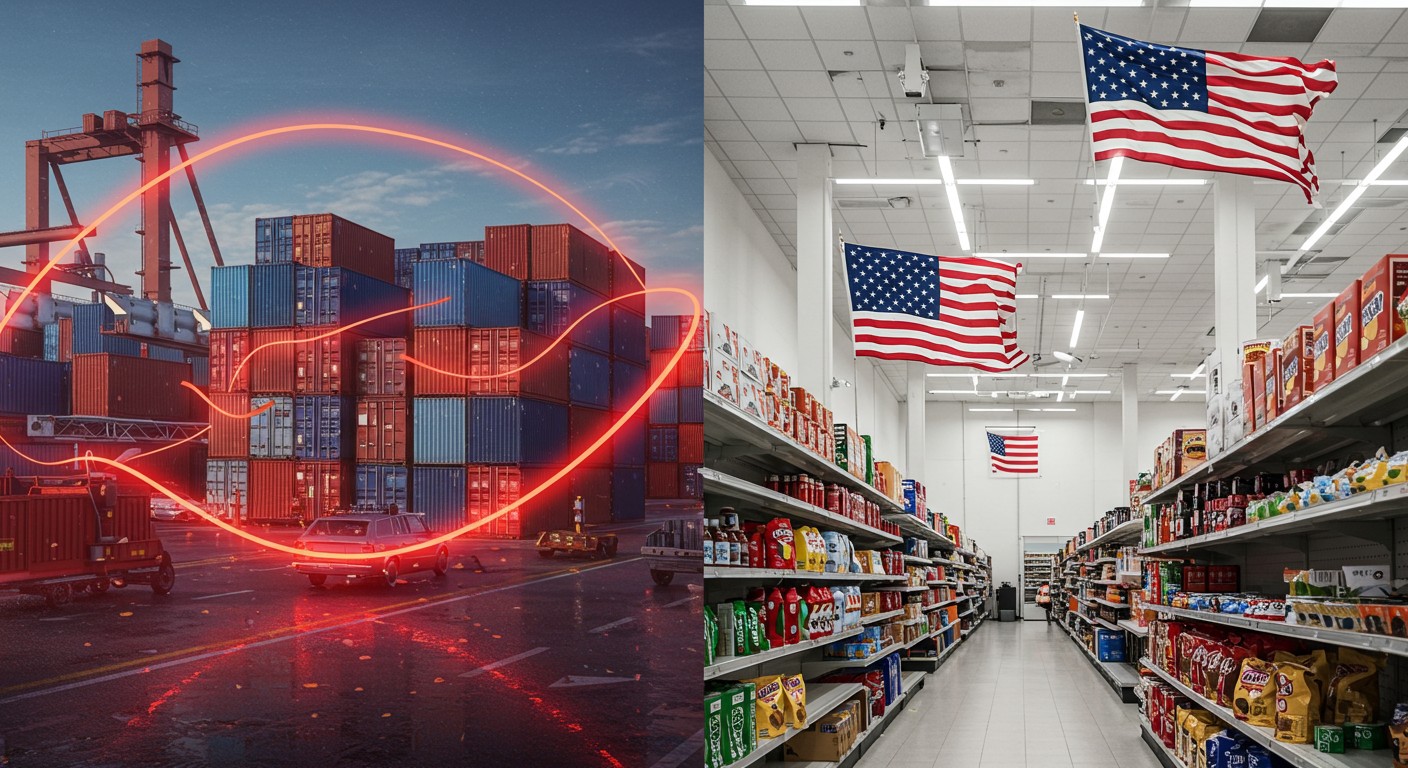

Have you ever wondered what happens when the gears of global trade grind to a halt? Picture this: it’s November, and you’re strolling through your favorite store, expecting festive displays brimming with holiday goodies. Instead, you find sparse shelves, with only a few lonely decorations in sight. This scenario isn’t far-fetched—it’s a real risk as U.S.-China tariff disputes ripple through supply chains, threatening the holiday season. The intricate dance between Chinese factories and U.S. retailers is facing unprecedented challenges, and the stakes couldn’t be higher.

The Tariff Tangle: A Global Trade Dilemma

The recent escalation of U.S. tariffs on Chinese imports has sent shockwaves through the global economy. With tariffs jumping from 34% to a staggering 145% in early April, businesses on both sides of the Pacific are scrambling to adapt. This isn’t just about numbers—it’s about the toys, electronics, and decorations that define the holiday season. The uncertainty has forced many U.S. retailers to pause orders, leaving Chinese factories in a state of limbo. But as the clock ticks toward Black Friday and Christmas, some are cautiously restarting production, hoping to avoid the dreaded sight of empty shelves.

“If production doesn’t ramp up soon, retailers risk missing the holiday rush entirely.”

– Supply chain consultant

In my view, this situation highlights a critical truth: global trade is a delicate ecosystem. One policy shift can disrupt everything from factory floors in Guangdong to shopping malls in Ohio. Let’s dive into how this tariff turmoil is reshaping the landscape.

Why Holiday Retail Hangs in the Balance

The holiday season is retail’s Super Bowl, accounting for a massive chunk of annual sales. But getting those festive goods from Chinese factories to U.S. stores is a logistical marathon. For instance, electronic products need to ship by early September to clear customs and hit shelves post-Thanksgiving. That’s a tight window, especially when tariffs throw a wrench into the works. Factories need six months to manufacture, test, and package products, meaning preparations should’ve started in March. With orders halted in April, the timeline is dangerously compressed.

Retailers are caught in a bind. Stockpiling inventory last year helped, but those reserves are dwindling. According to industry data, China’s exports to the U.S. surged 9.1% in March, but recent weeks have seen a sharp drop in cargo ships crossing the Pacific. Cancelled shipments have spiked, and new export orders from Chinese factories hit their lowest point since late 2022. The result? A potential holiday season with fewer gifts under the tree.

- Inventory shortages: Retailers risk empty shelves if orders don’t resume soon.

- Compressed timelines: Late production could miss critical holiday sales windows.

- Rising costs: Rushing orders may drive up production and shipping expenses.

It’s a nerve-wracking game of chicken. Retailers are betting on tariff relief, but waiting too long could spell disaster. I can’t help but wonder: how many businesses will roll the dice and lose?

The Supply Chain Ripple Effect

Tariffs don’t just affect factories—they disrupt entire supply chains. Imagine a factory making Christmas ornaments. If orders stop, the glass supplier, the paint manufacturer, and even the raw material providers feel the pinch. Restarting these chains isn’t like flipping a switch; it takes time and coordination. Some experts estimate that even if tariffs ease, it could take months to fully restore production cycles.

“A halted supply chain is like a stalled engine—it doesn’t just restart on demand.”

– Manufacturing expert

Here’s where it gets tricky: 36% of U.S. imports from China rely on mainland suppliers with no easy alternatives. Rerouting goods through other countries sounds clever, but it’s a logistical nightmare. New routes mean new costs, new delays, and new risks. For businesses, it’s a question of whether to absorb tariff costs, pass them to consumers, or gamble on empty shelves. None of these options are particularly festive, are they?

Hedging Bets: How Businesses Are Adapting

Despite the uncertainty, some companies are taking action. Retail giants like Walmart and Target have reportedly greenlit production in key Chinese manufacturing hubs like Yiwu and Dongguan. Smaller players are placing cautious orders, hoping tariffs will drop by the time goods reach U.S. ports. It’s a calculated risk—nobody wants to be the Grinch who cancels Christmas.

Take the toy industry, for example. Wholesalers are urging clients to lock in orders by mid-May to secure non-tariffed pricing. This strategy aims to beat potential price hikes while ensuring products arrive by late July. But there’s a catch: if everyone rushes to backfill orders, factories could get overwhelmed, and air shipping costs could skyrocket. It’s a high-stakes balancing act.

| Industry | Adaptation Strategy | Risk Level |

| Electronics | Early September shipping | High |

| Toys | Mid-May order deadlines | Medium |

| Decorations | Partial order resumption | Low-Medium |

Personally, I find this adaptability inspiring. Businesses are navigating uncharted waters with creativity and grit, but the pressure is immense. Will they pull it off, or will tariffs steal the holiday spotlight?

The Consumer Impact: What It Means for You

Let’s bring this home: how do tariffs affect the average shopper? If supply chains falter, you might face higher prices or limited product choices. That shiny new gadget or perfect Christmas gift could cost more—or not be available at all. Retailers may try to absorb some costs, but don’t be surprised if holiday budgets take a hit.

Then there’s the phenomenon of Christmas creep, where holiday merchandise hits stores earlier each year. Tariffs could disrupt this trend, forcing retailers to scramble for last-minute stock. For consumers, it’s a reminder to shop early and stay flexible. After all, nobody wants to be stuck giftless on December 24th.

- Shop early: Beat potential shortages by starting your holiday shopping in October.

- Compare prices: Look for deals to offset potential tariff-driven price hikes.

- Stay informed: Keep an eye on trade news for updates on tariff relief.

It’s a bit unsettling to think that global trade policies could dictate your holiday haul, isn’t it? Yet, this is the reality of our interconnected world.

Looking Ahead: Can Trade Talks Save the Day?

There’s a glimmer of hope on the horizon. Recent reports suggest both the U.S. and China are exploring tariff exemptions to ease economic strain. For instance, certain U.S. goods like semiconductors and aerospace equipment have received exemptions, while the U.S. has rolled back tariffs on electronics like smartphones. These moves signal a willingness to negotiate, but time is running out.

“Trade negotiations are a marathon, not a sprint, but the holiday clock is ticking.”

– Economic analyst

If a breakthrough happens, expect a mad dash to backfill orders. But as one manufacturing CEO pointed out, rushing production for large volumes is no easy feat. Factories could face bottlenecks, and shipping costs could soar. For now, businesses and consumers alike are holding their breath, hoping for a resolution that keeps the holiday spirit alive.

In my opinion, the real lesson here is resilience. The global trade system is under strain, but it’s also adaptable. Whether through clever workarounds or diplomatic breakthroughs, I believe we’ll find a way to keep the holiday magic intact—though it might take some serious hustle.

As we navigate this tariff-driven uncertainty, one thing is clear: global trade is a complex web that touches every aspect of our lives, from the gifts we give to the prices we pay. The U.S.-China tariff saga is a stark reminder of how interconnected our world is—and how fragile that connection can be. So, next time you’re browsing holiday deals, spare a thought for the factories, ships, and retailers working overtime to make it happen. And maybe, just maybe, start your shopping a little earlier this year.