Imagine spending months, maybe years, building a company around the idea that the hottest commodity on earth right now isn’t gold, oil, or even Bitcoin; it’s a graphics card made in California.

And then imagine discovering that people are willing to risk decades in prison just to get their hands on a few hundred of those cards.

That’s exactly what’s happening right now with Nvidia’s AI chips.

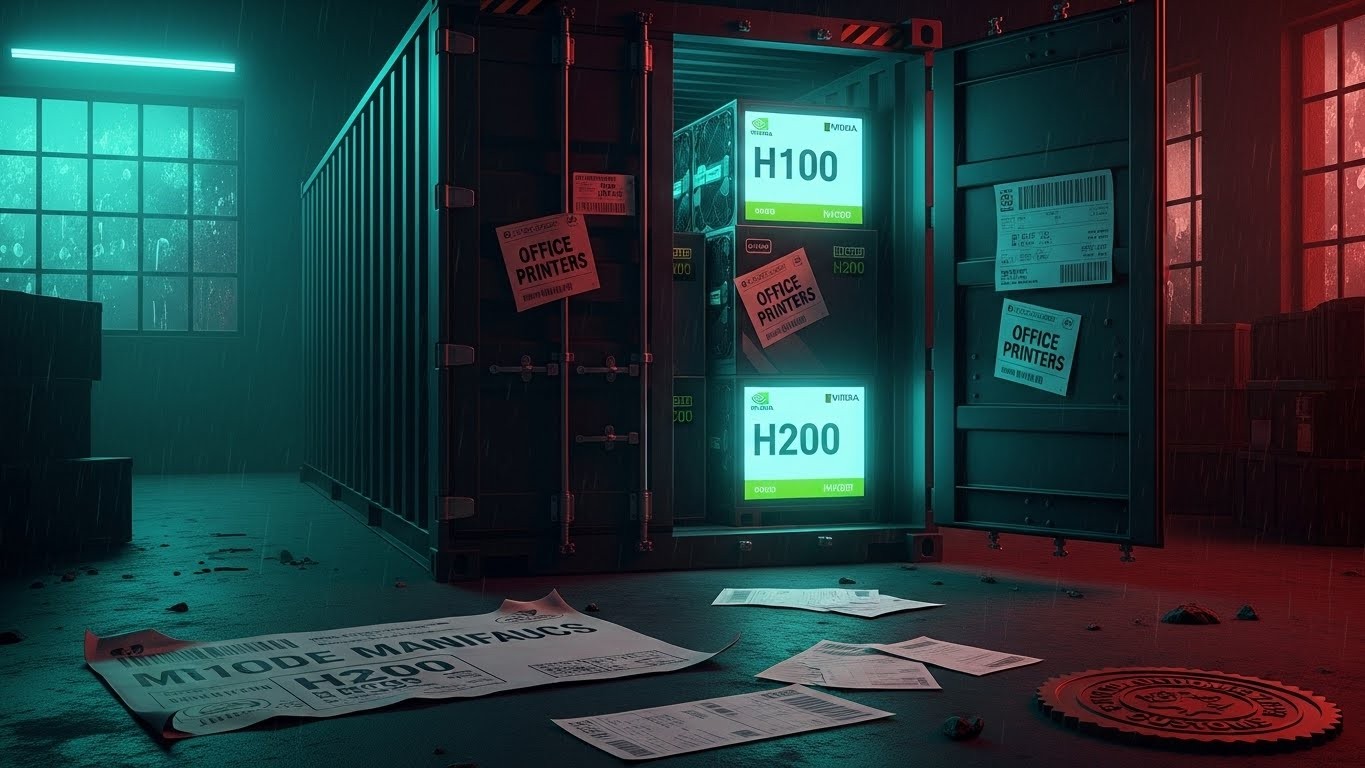

The $160 Million Black-Market Pipeline Nobody Saw Coming

Last week, federal agents quietly shut down what they’re calling one of the largest known attempts to bypass U.S. export controls on advanced technology. At the center of it all? Nvidia’s H100 and H200 GPUs – the same chips powering everything from ChatGPT to military-grade simulations.

The numbers are staggering. Between late 2024 and mid-2025, investigators say a network of shell companies, fake shipping labels, and straw buyers moved or attempted to move more than $160 million worth of restricted hardware into China and other embargoed locations.

And the craziest part? This wasn’t some shadowy criminal syndicate running the show. Some of the people involved were legitimate business owners in Texas, New York, and Canada who saw an opportunity and decided the reward was worth the risk.

How the Scheme Actually Worked

Let’s break it down, because the mechanics of this operation were disturbingly simple.

Step one: buy the GPUs legally in the United States. That part is easy – anyone with enough cash can walk into a distributor and pick up H100s or H200s, as long as they claim the chips are staying in the country or going to approved nations.

Step two: create a paper trail that looks completely normal. Invoices describing the cargo as “computer parts,” “office equipment,” or even “gaming peripherals.” Shipping manifests that list the final destination as Singapore, Thailand, or Dubai – places where controls are looser.

Step three: somewhere along the route – usually in a nondescript U.S. warehouse – workers slap new labels on the boxes, change the serial numbers in the documentation, and reroute everything to Hong Kong or mainland China.

By the time customs officials in Asia open the container, the paperwork says one thing, but the hardware inside tells a very different story.

“These weren’t low-level criminals. These were sophisticated businesspeople who understood exactly how the export control system worked – and exactly where the blind spots were.”

– Statement from federal prosecutors

The Three Men at the Center of the Storm

Three names have surfaced so far, and each story is wild in its own way.

First there’s the Texas businessman who already pleaded guilty. He ran a seemingly ordinary Houston-area tech company, but behind the scenes he was allegedly wiring tens of millions back to Chinese accounts and shipping pallets of GPUs under false pretenses. He’s looking at up to ten years when he’s sentenced early next year.

Then there’s the New York-based Chinese national accused of using “straw purchasers” – people with clean records who buy the chips on paper for U.S. companies that don’t actually exist. Classic money-laundering playbook, but applied to silicon instead of cash.

And finally, the Canadian CEO of a U.S. subsidiary of a Beijing tech giant. Authorities say he was the logistics mastermind – recruiting inspectors, creating cover stories for detained shipments, even storing extra GPUs in secret warehouses in case a container got seized.

If convicted, he could be facing twenty years.

Why These Chips Are Worth Going to Prison For

Here’s the part that keeps me up at night.

A single Nvidia H100 currently retails for around $30,000 to $40,000 on the open market. In China, where new units are essentially impossible to buy legally, the same card can fetch double or triple that on the gray market.

Do the math on a container holding 500 cards and you’re looking at profit margins that make drug traffickers blush.

- One H100 in the U.S.: ~$35,000

- Same H100 in China (gray market): $80,000–$110,000

- Profit per card: up to $75,000

- Profit on a single 500-card shipment: potentially $37.5 million

No wonder people are willing to gamble their freedom.

In my view, this is what happens when you create artificial scarcity of the single most important resource in the AI race. The demand doesn’t disappear – it just goes underground.

The Bigger Picture: A Tech Cold War Heating Up

These arrests didn’t happen in a vacuum.

Since 2022, Washington has steadily tightened the screws on China’s access to cutting-edge semiconductors. First it was the most advanced nodes, then lithography machines, and eventually even “older” AI accelerators like the H100 fell under strict licensing requirements.

The goal is clear: slow China’s progress in artificial intelligence, especially in areas with military applications.

But every restriction creates a shadow economy. And right now that shadow economy is booming.

We’ve seen similar busts involving everything from cloud computing credits to used data-center gear. Smugglers rent out illegal GPU clusters in third countries. Chinese firms buy entire server farms in Southeast Asia just to get indirect access.

It’s a global game of whack-a-mole, and the moles are winning.

The Surprise Twist Nobody Expected

Just when you thought the story couldn’t get weirder, reports surfaced this week that the White House is considering a deal that would actually allow limited sales of H200 chips to “approved” Chinese customers – on the condition that the U.S. government takes a 25% cut of the profits.

Yes, you read that right. A revenue-sharing agreement on restricted technology.

On one hand, it feels like the ultimate pragmatic compromise: acknowledge reality, bring some of the trade above board, and pocket billions in the process.

On the other, it completely undercuts the moral authority of the export control regime. How do you tell prosecutors to lock people up for smuggling when the government itself is negotiating profit splits?

Perhaps the most interesting aspect – at least to me – is what this says about where we are in the U.S.-China tech rivalry. We’re no longer in the phase of pure containment. We’re entering the phase of managed competition with financial incentives baked in.

What Happens Next

More arrests are almost certainly coming. Federal investigators have made it clear this is part of a much larger, ongoing operations.

Nvidia, for its part, says it’s cooperating fully and that secondary-market smuggling is a tiny fraction of overall volume. But the company also knows its chips have become the new oil – and everyone wants a barrel.

In the meantime, data centers in Singapore, Dubai, and even parts of Latin America are filling up with mysterious new GPU clusters. Nobody asks too many questions about where the hardware came from.

And the price of an H100 on the Chinese gray market? Still climbing.

Look, I’ve been covering tech and markets for years, and I’ve never seen anything quite like this. We’re watching the birth of a black market that could rival rare-earth minerals or sanctioned oil in size and sophistication.

The only question left is whether Washington can ever truly plug the leaks – or whether we’re just pushing the problem into darker and more creative corners.

Either way, one thing is certain: as long as AI remains the defining technology of our era, people will risk everything to get their hands on the silicon that powers it.

And that, more than any arrest or policy change, is the real story here.