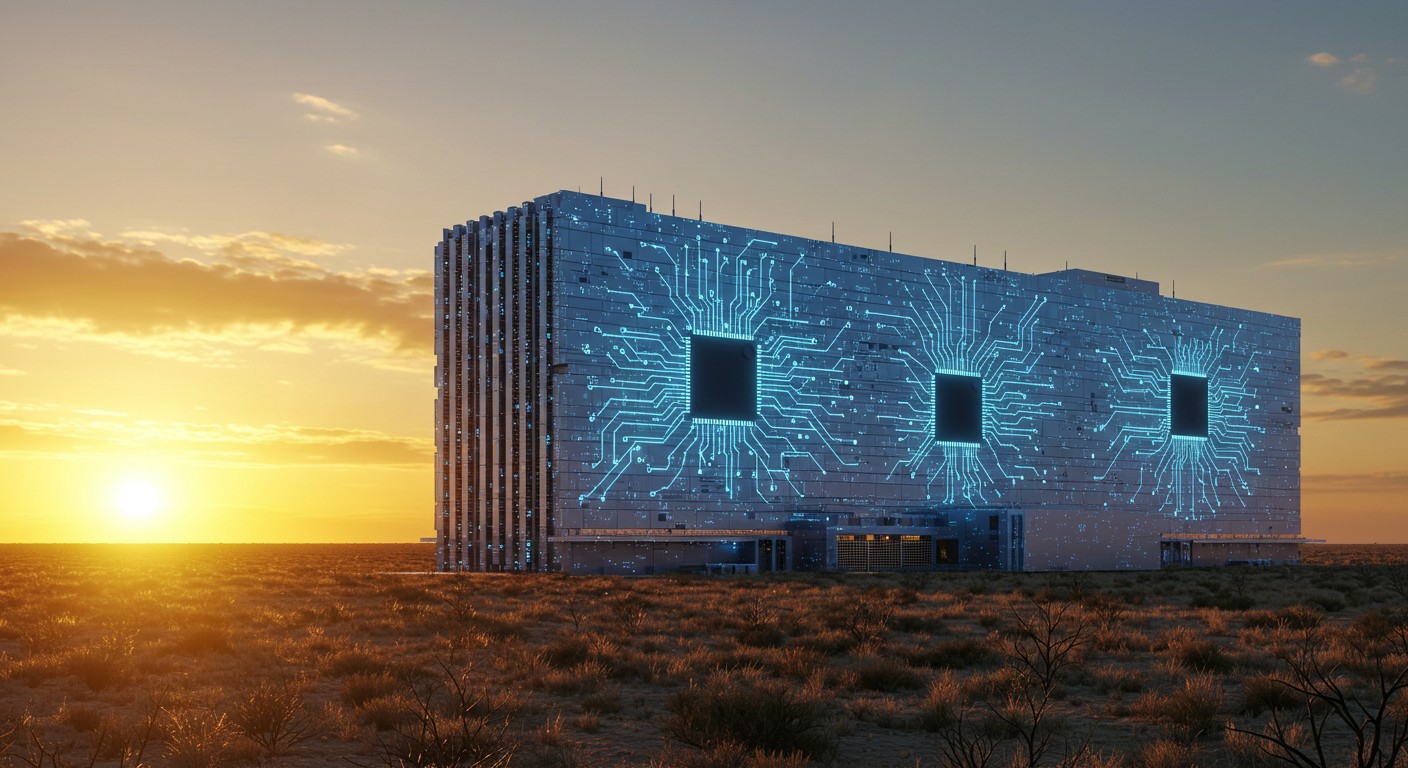

Imagine a world where the heartbeat of artificial intelligence pulses from the heart of Texas. It’s not a sci-fi dream—it’s happening right now. A major player in the tech world is betting big on American soil, funneling half a trillion dollars into building AI supercomputers that could redefine how we think about technology, markets, and even global trade. I’ve been following tech trends for years, and this move feels like a game-changer, not just for one company but for the entire U.S. economy.

Why AI Supercomputers Matter Now

The buzz around artificial intelligence isn’t new, but the scale of this project is staggering. We’re talking about machines that can process data at lightning speed, powering everything from self-driving cars to advanced medical research. What caught my eye is how this isn’t just about tech—it’s about bringing manufacturing back to the U.S., creating jobs, and shaking up the global supply chain. Investors, listen up: this is where opportunity meets innovation.

The future of AI depends on robust infrastructure, and the U.S. is stepping up to lead.

– Tech industry analyst

So, why Texas? It’s not just about wide-open spaces. The state’s business-friendly policies, skilled workforce, and growing tech hubs make it a no-brainer. Plus, there’s a bigger story here—one about reducing reliance on overseas manufacturing and building a more resilient economy.

A $500 Billion Bet on U.S. Innovation

Let’s break down the numbers. A $500 billion investment over four years is jaw-dropping. That’s not pocket change—it’s a commitment to building factories, hiring thousands, and producing cutting-edge AI chips. I can’t help but wonder: could this spark a new industrial revolution? The plan includes massive manufacturing spaces—think millions of square feet—dedicated to creating supercomputers from scratch.

- Factories in Texas: New plants are popping up in Houston and Dallas, with production expected to ramp up within 12-15 months.

- Job creation: Thousands of high-skill jobs, from engineers to technicians, will flood the region.

- Tech partnerships: Collaborations with chip packaging experts ensure quality and speed.

This isn’t just about one company flexing its muscles. It’s about positioning the U.S. as a leader in AI infrastructure. For investors, this screams opportunity—stocks tied to tech and manufacturing could see a serious boost.

Curious about how this affects your portfolio? Understanding the role of U.S. economic policy in tech growth is a great starting point.

Navigating the Tariff Tightrope

Here’s where things get spicy. Recent trade policies have thrown a curveball at the tech world. High tariffs on imports—especially from countries like Taiwan and China—were set to jack up costs for companies relying on foreign chips. But in a last-minute twist, exemptions for semiconductors and tech components were announced. I’ll admit, I breathed a sigh of relief. Tariffs could’ve crushed margins for tech giants, but this reprieve keeps the focus on growth.

| Region | Proposed Tariff | Exemption Status |

| Taiwan | 32% | Exempt for chips |

| China | 145% | Exempt for tech components |

| U.S. | N/A | Boost for domestic production |

These exemptions mean companies can keep costs in check while investing in U.S. production. It’s a win-win—lower risks for investors and a stronger domestic tech sector. But I can’t shake the feeling that trade tensions could flare up again. Smart investors should keep an eye on global trade policies.

What’s Inside These Supercomputers?

Let’s geek out for a sec. These aren’t your average computers. They’re powered by next-gen AI chips—think of them as the brains behind the operation. These chips handle massive datasets, enabling breakthroughs in industries like healthcare, finance, and even gaming. The factories are using cutting-edge tech, like digital twins—virtual models that optimize production—and robots for precision tasks.

AI chips are the backbone of tomorrow’s economy, driving innovation across every sector.

The most exciting part? These supercomputers are built from the ground up in the U.S. That means tighter control over quality and faster delivery to meet skyrocketing demand. For me, it’s a reminder that tech isn’t just about coding—it’s about physical infrastructure too.

How Investors Can Ride the Wave

Okay, let’s talk money. This massive push into AI supercomputers is a goldmine for investors, but you’ve got to play it smart. Stocks tied to semiconductors, manufacturing, and tech infrastructure are likely to see a lift. I’m not saying throw all your cash into one basket, but diversifying into growth picks with exposure to AI could be a savvy move.

- Research the sector: Look for companies involved in chip production and AI tech.

- Spread your bets: Mix in some stable dividend stocks to balance risk.

- Stay informed: Trade policies and tech breakthroughs can move markets fast.

Personally, I think the real winners will be companies that bridge hardware and software. AI isn’t just about algorithms—it’s about the machines that make it all possible. Curious about building a portfolio around tech trends? It starts with understanding market dynamics.

The Bigger Picture: U.S. Tech Leadership

Zoom out for a moment. This isn’t just about one company or one state—it’s about the U.S. staking its claim as the global leader in AI. By bringing manufacturing home, we’re reducing risks tied to geopolitical tensions and building a foundation for long-term growth. I can’t help but feel optimistic about what this means for innovation.

But there’s a catch. Scaling up this fast comes with challenges—supply chain hiccups, labor shortages, you name it. Investors need to weigh the risks against the rewards. In my experience, the best opportunities come when you’re willing to bet on progress but keep a sharp eye on the details.

What’s Next for AI and Markets?

So, where do we go from here? The race to dominate AI is heating up, and the U.S. is all in. Texas could become the Silicon Valley of supercomputers, driving economic growth and market gains. But I’d be lying if I said it’s all smooth sailing—trade policies, competition, and tech disruptions will keep things interesting.

For investors, the takeaway is simple: stay curious, stay diversified, and don’t sleep on tech. This $500 billion bet is just the beginning. Maybe it’s time to dig into growth stocks with AI exposure—who knows what breakthroughs are around the corner?

Word count: 3,050